Readers Question: Whose is to blame for the continued UK recession?

With the banking crisis and economic recession, politics seems to be currently dominated by a ‘blame’ game – trying to work out whose fault it is. Unsurprisingly, the coalition have tried to shift blame on to Euro crisis and banks. Others have blamed the governments own spending cuts.

Possible Suspects for continued recession

- Euro-crisis – uncertainty and recession in Eurozone affecting UK exports and investment levels in UK

- Bank Lending – Banks reluctance to lend to firms is stifling investment and economic recovery.

- Government spending cuts – Cuts in government spending have led to a fall in demand and also a subsequent fall in consumer spending.

- Global downturn. The UK is being affected by global economic slowdown. (though other parts of the world are still posting positive economic growth)

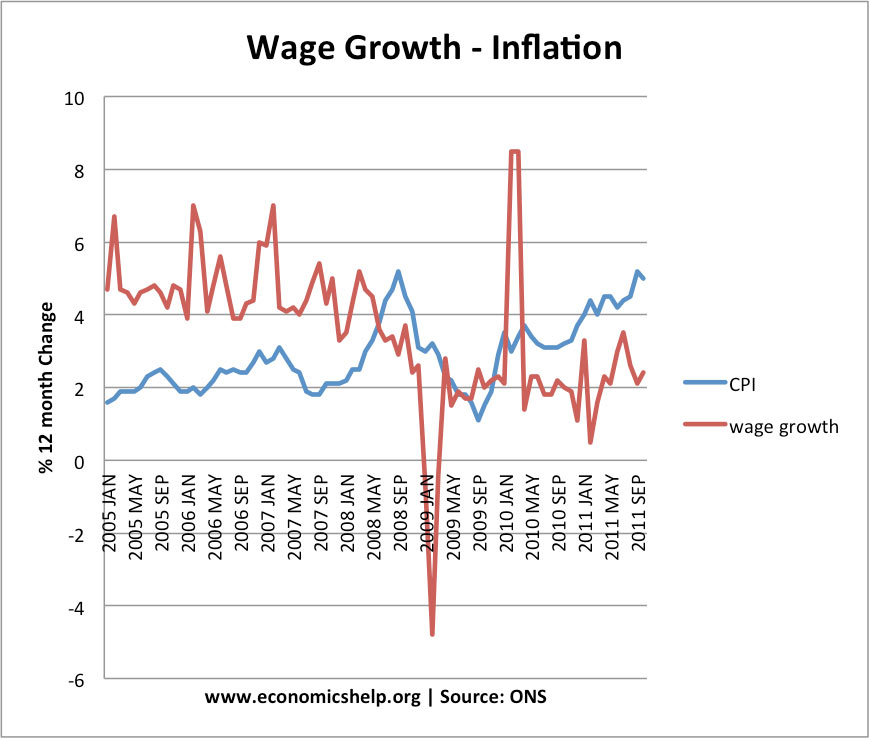

- Reduced real wages. Combination of real wage cuts and higher commodity inflation has squeezed disposable incomes in past few years.

- Weakness of housing market

- low levels of UK consumer spending

- Government spending under Labour

Euro Crisis.

The chancellor, George Osborne has sought to put considerable blame on the Euro crisis for holding back UK recovery. Osborne recenlty said:

“Our recovery – already facing powerful headwinds from high oil prices and the debt burden left behind by the boom years – is being killed off by the crisis on our doorstep,” Eurozone crisis killing off recovery

Source: ONS

If we look at exports to the Eurzone, there is some evidence of a recent decline in 2012. Though there has always been an element of volatility in the past two years, there is no clear downward pattern. The economic slowdown is most pronounced in peripheral countries, such as Spain and Italy. Others like Germany and France have been able to post positive economic growth.

The Eurozone is definitely important for exports and wider UK economic confidence. However, looking at the trend in exports to Europe, there is no clear pattern that falling exports to our main trading partner is leading factor in causing a recession.

Bank Lending

The Business secretary, Vince Cable, recently argued that banks reluctance to lend was a big factor in holding back the UK economy. Cable said:

“The banking culture is anti-business, it doesn’t focus on the long term. It is throttling the recovery of British industry because companies cannot get loans to expand their business.” (Cable, Banks throttling recovery)

Cable suggests the lack of competition and short-termism leads to a reluctance to lend long term. Since the credit crunch, bank lending has fallen significantly and now many banks are increasing their cash reserves, trying to improve their liquidity. This fall in bank lending back in 2008, was a cause of the initial slide into recession. This lack of bank lending has partly been addressed by the most recent form of Quantitative Easing which also sought to encourage more direct bank lending rather than just buy government bonds.

It is true bank lending is low. However, the continued low levels of bank lending may be a reflection of the fundamental lack of demand in the economy. With poor growth prospects, firms are not looking to expand and invest. Making banks lend more, will not necessarily change this fundamental lack of demand in the economy.

Government Spending Cuts

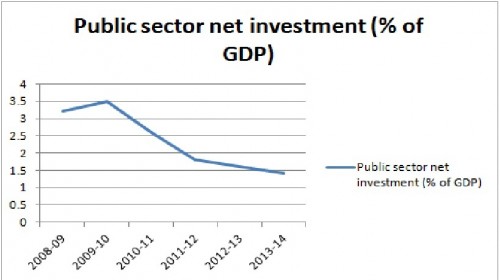

Government spending cuts in 2011 and 2012 have played a significant role in reducing aggregate demand. Bank of England member Adam Posen has recently said that government spending cuts have had a big multiplier effect in reducing consumer spending further than might be expected. Adam Posen on spending cuts

Source ONS | NTV

This graph shows extent of government spending cuts on key public sector net investment. At a time of rising savings and falling private sector spending, this has had a been a big drag on economic growth.

see also: negative impact of austerity on economy and debt.

Consumer Confidence

Consumer confidence has fallen to a record low in recent months. This is a reflection of many factors. – falling real wages, negative outlook from Europe, fears over house prices, uncertainty over unemployment, high inflation. There is no single factor leading to a decline in consumer confidence, but clearly this has had a major impact on holding back economic recovery.

Real Wages

Real wages in the UK have been sluggish since the start of the credit crisis. The fall in real wages has continued into 2012.

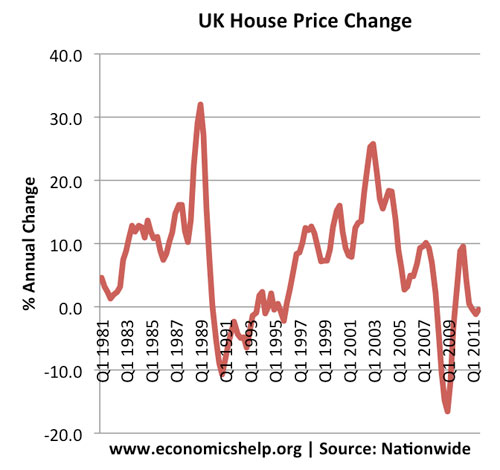

House Prices

UK house prices stabilised after the initial 2008/09 fall. However, although house prices have been broadly flat, there are still reasonable fears over further falls in UK house prices. This leads to a negative wealth effect and reduces consumer confidence even further.

Conclusion

It’s not surprising to hear the coalition blaming external factors, such as the Eurozone and also blaming bank lending. It is equally unsurprising to hear Labour reject these excuses, pointing to the government’s own austerity measures.

In practice, the continued double dip recession is a combination of factors, which have all contributed to disappointing economic growth. However, of all the factors mentioned above, cuts in government spending are one of the most significant factors. Real spending cuts of £6.5bn have led to lower demand and lower employment. They have also played an important role in depressing consumer confidence as the public expect more cuts to come. Some argue spending cuts have been relatively minor. But, compared to past trends of rising real government spending, this cut in spending at this particular economic situation have definitely held back economic growth.

Related

Re the popular claim, repeated by Adam Posen, that there have been government spending “cuts”, John Redwood claims there have been no cuts, even after allowing for inflation. Redwood has set out his research in several blog posts, but this is just one:

http://johnredwoodsdiary.com/2010/08/12/the-cuts/

So someone is talking nonsense. And if I had to bet, I’d guess it’s Adam Posen. Reason is that I was at a conference a few months ago where Posen made the bizarre claim that excessive house price increases were the major cause of all crashes. Well that clearly was not the case with the 1929 crash: excessive share prices were the cause of that particular crash.

I also think this article is talking nonsense to a degree Ralph.

Depending on whose figures you use, household final consumption as a % GDP accounts for around 65 – 70%. If output = consumption + investment + Goverment expenditure + net exports in economics 101 then consumption clearly dwarfs Government expenditure. With some of the most indebted households in the developed world, real wages falling and confidence low (with many fearing we have yet to see the worst of this crisis due to unresolved Eurozone problems) it is no wonder consumption has fallen, and at 65% of the economy, this will provide a huge drag on growth, more so that Government cutbacks.

Many companies are sat on huge amounts of cash but aren’t investing this as again, they fear an unravelling of the Eurozone. As rational economic agents they are hoarding their cash until a more settled picture emerges before investing. So no growth there either. Net exports constitute a small component of the UK economy but 50% go to the EU and there is low demand in Europe so again, this will have a drag effect on growth. And if Government did spend more, they may be able to “stimulate” the economy in some way but at what cost? We have already seen the Greek, Portuguese and Irish dominos fall with Spain and Italy next, precisely because of deficit and debt fears. We have alarming deficit and debt figures and unfortunately we are no different to other nations in this position – Britannia no longer rules the waves. So you may get so positive impact on output in the short term but at the cost of higher interest rates and an increased liklihood of speculative market attacks on gilts. And at some stage the stimulus must be withdrawn, so if the underlying picture hasn’t resolved by the time this is stimulus is withdrawn then growth will come crashing down again but with a bigger deficit and debt problem to contend with. The US is and will continue to suffer with this problem – they have added around $4 trillion – that is trillion – over his 4 years. It is unsustainable and at some point they are in major trouble.

In short, Osborne is right on this one. The Eurozone debacle plays a big part in our current economic travails, and it is insane to suggest you can solve a debt and deficit crisis with more debt and deficit! Government should actually be cutting deeper and with the savings used to aggressively cut taxes to increase disposable income / reduce household debt and thus trigger a rebound in consumption, whilst further reducing business taxes to encourage those businesses here to spend and those not here to relocate. This will lay the foundations for real, sustainable growth, not more unsustainable Government credit card growth.

https://www.economicshelp.org/blog/5284/economics/how-much-has-government-spending-been-cut/

https://www.economicshelp.org/blog/5289/economics/impact-of-a-fall-in-public-sector-investment/

Posen is close to being right. The major cause of all financial crises are unsustainable levels of private sector debt (inexplicably absent from this list!). Unsustainable debt due to excessive speculation. Since the abolition of slavery (i.e. lending cannot be secured on property rights to a human being) lending tends to be secured on next safest asset, land. N.B. the credit could be spent on anything, shares, tulips etc, the tendency however is for the security on the balance sheet become inflated too. Nearly all financial crises correlate with land (hence house) price bubbles whereby the productive economy (actually making and distributing actual things and services) cannot support the speculative valuations placed upon the underlying assets.

You’re right about level of debt being a major structural weakness in the economy. It should be on there.

There is absolutely no future in apportioning blame.Let’s leave that to our party political politicians.It appears that lots of mistakes have been made in the past,it also appears that we do not learn from those mistakes but continue to repeat them.The “Welfare State” is out of control and needs to be reduced to an economically manageable size.To do this in a humane way will take a generation,assuming of course we have the politicians with the courage and the mandate to do it.We also have to re-balance the economy giving manufacturing a more prominent role.It’s not blame we want ,it’s a well thought out longterm plan that rectifies the organic and structural problems that bare wrecking our society.

“Some argue spending cuts have been relatively minor. But, compared to past trends of rising real government spending, this cut in spending at this particular economic situation have definitely held back economic growth.”

Sooo, compared to past trends of rising government spending there have been “cuts”? Can I take your definition of “cuts” to mean a non-increase in spending?

Hmm…to me an non-increase is not a cut. Usually a cut would imply a decrease in spending.

Potentially misleading don’t you think?

No. Because spending has been cut 1.5% in 2011-12. https://www.economicshelp.org/blog/5284/economics/how-much-has-government-spending-been-cut/

The welfare concerns are drop in ocean, every Bank and Bankers over last decade should be stripped of assets and jailed that will more than cover the odd Guy on the Dole, every Politician should hold up hands for stealing from the people stripped of assets and jailed hope this is micro/social enough for you makes sense to the Man on the street