Readers Question: How does manipulating the LIBOR rate upwards improve the profits of the trading division of a bank?

The London Interbank Offered Rate (LIBOR) is the average interest rate estimated by leading London banks for the cost involved in borrowing from other banks.

The banks themselves set their own LIBOR rate.

- Some banks set mortgage interest rates and bank loans depending on the LIBOR rate. This is because LIBOR reflects the banks lending costs. If LIBOR increases, then some mortgage rates / loans will automatically go up.

Link between LIBOR and Base Rate

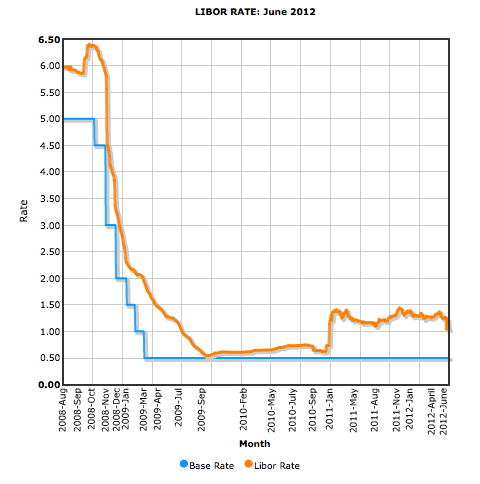

Traditionally the Libor rate closely follows the Bank of England’s base rate. This is because if it is cheaper to borrow from the Bank of England, it should be cheaper to borrow from other banks.

Credit Crunch and LIBOR

At the start of the credit crunch, there was an increased divergence between the base rate and libor. When base rates were cut to 5% at the end of 2007, the LIBOR rate increased to 6%.

In October 2008, the LIBOR Rate again shot up to 6.25% reflecting banks uncertainty due to the Lehman crisis.

The LIBOR reached a record low of 0.54% in September 2009. The LIBOR has since crept upwards to 0.9% on prospects of a possible recovery (and possible increase in base rates – though this still looks unlikely)

How Banks can Make Higher Profits

Banks set their own LIBOR rate. In theory, this rate setting is done to reflect actual borrowing costs, and is supposed to be calculated programmatic ally to reflectborrowing costs. But, in the case of Barclays, traders influenced the other department in Barclays responsible for setting the LIBOR rate. Thus, LIBOR was being set in a way which made derivatives and loans more profitable.

As the Economist reports

Asked to fudge the numbers by a competitor bank, Barclays acquiesced. The grateful reaction: “Dude. I owe you big time! Come over one day after work and I’m opening a bottle of Bollinger.” [Libor]

If the LIBOR rate is artificially increased, then they can charge a higher interest rate on mortgage and other loans. Therefore, this can increase their profitability.

Barclays were fined for being involved in activity such as:

One trader stated in an email to a submitter: “We have another big fixing tom[orrow] and with the market move I was hoping we could set [certain] Libors as high as possible.” US CFTC

To give an idea of the scale of money involved: A messages revealed that for each basis point (0.01%) that LIBOR was moved, those involved could net “about a couple of million dollars”.

Insider Knowledge

Another issue is the links between banks and traders. LIBOR is influential in derivatives trading. If traders have inside knowledge about the future movement of LIBOR, they can profit from even minor swings in the LIBOR rate