In the UK, the basic rate of income tax is 20%. It is the rate than most taxpayers will pay.

It is important to note that this is a marginal tax rate and so is only paid on income above the tax threshold.

In the UK, the tax threshold is £10,600 for 2013/14

Therefore, if you earn £12,000, you will only pay the basic rate of 20% on only the income above the tax threshold – in this case, £1,400. Meaning you will pay just £280 tax on a salary of £12,000. Giving an average tax rate of 2.3%

However, in addition to the basic rate of tax, National insurance contributions are also charged. This is another type of income tax, ostensibly to be used for the social security budget, but in practice is used like income tax. There have been proposals to merge the two.

The UK income tax system is designed to be progressive – meaning as income rises, you pay a higher percentage of your income in tax.

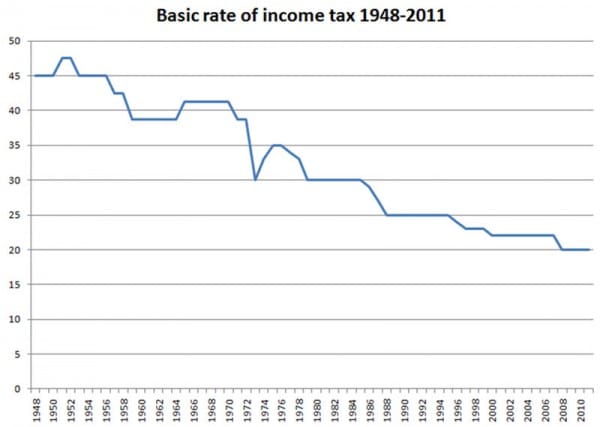

History of the basic rate of Income-tax

Income Tax was introduced in 1799 by William Pitt the Younger to pay for the Napoleonic Wars, initially it was 2d in the pound for incomes over £60.

In recent years, mid-1980s, the basic rate reached 33%

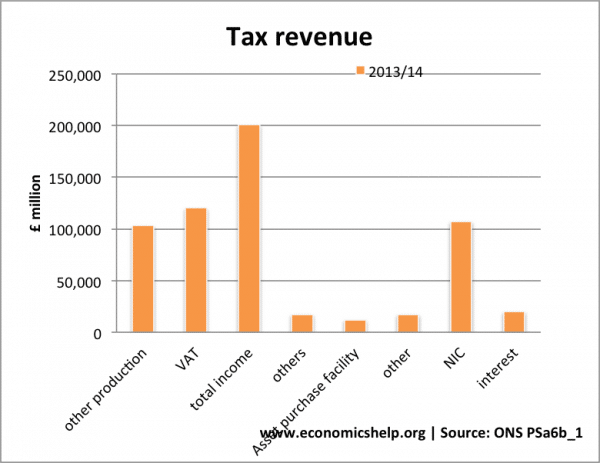

Revenue gained from income tax

Related