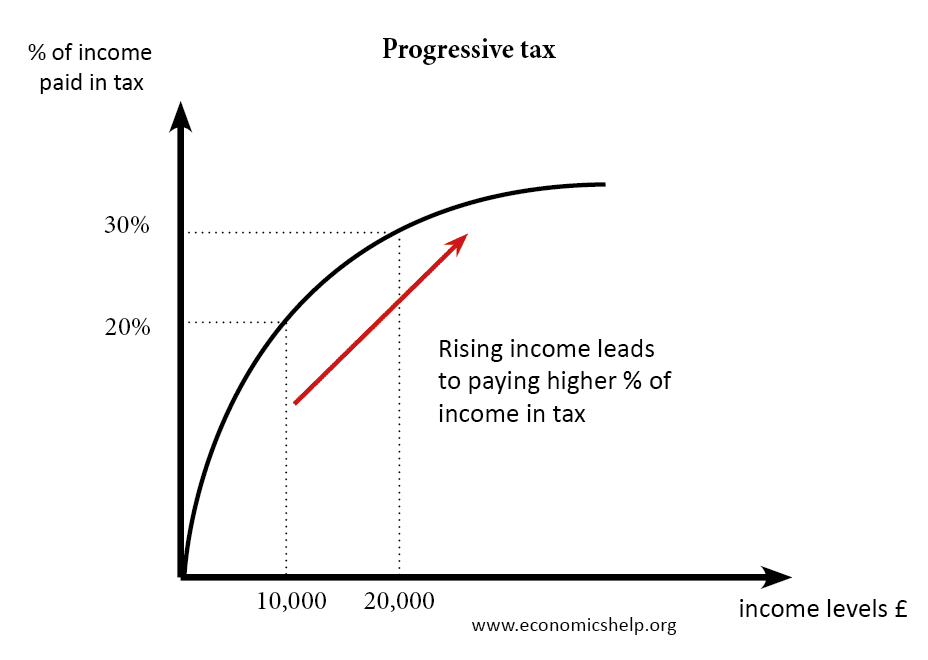

A progressive tax takes a higher percentage of tax from people with higher incomes. It means that the more a person earns, the higher his average rate of tax will be.

- In this case, the person earning £10,000 is paying 20% of their income in tax (total tax of £2,000)

- The person earning £20,000 is paying 30% of their income in tax (total tax of £ 6,000)

The aim of a progressive tax is:

- To help reduce inequality – taking lower average levels of tax from low wage earners, and taking more from higher wage earners.

- Recognition of the diminishing marginal utility of income.

- To increase the incentive for people to take low paid jobs, e.g. move off benefits into work. If low-income work has a low incidence of the tax, it encourages people to enter the labour force and take a job.

Marginal tax rates

Progressive taxes make use of marginal tax rates. Income is taxed on the extra income earned, e.g. higher rate of income tax is charged at 40% on income above £36,000

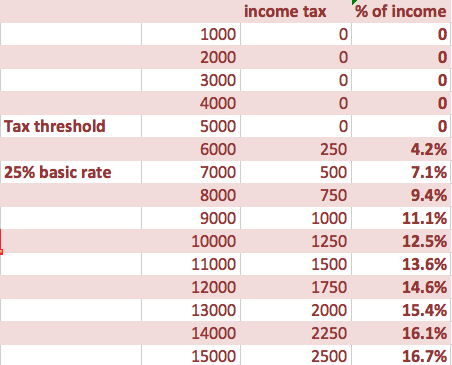

Example of Progressive tax

Income tax threshold of £5,000 – means you don’t pay any income tax on first £5,000

Then marginal income is taxed at 25%. It means someone earning £6,000 pays £250 or 4.2% of their income in tax

Someone earning £15,000 pays £2,500 or 16.7% of income in tax

Example of progressive tax in the UK

UK income tax rates

- Income tax threshold (0%) – £10,000

- Basic rate 20% – £10,000 to £31,865

- Higher rate 40% – £31,866 to £150,000

- Additional rate 45% – income over £150,000

Example of different average tax rates

1. Income £12,000

You pay tax at 20% on the income above threshold (£12,000 – £10,000) = £400

Average tax rate = 3.3%

2. Income is £40,000.

- You pay 0% on your Personal Allowance of £10,000.

- You pay 20% on the income from £10,000 to £31,866 (21,866) = £4,372.20

- You pay 40% on income between £31,866 to £40,000 – £8,134 = £3,253

- Total tax – £7,625

- average tax rate 19%

3. Income is £250,000

- You pay 0% on your Personal Allowance of £10,000.

- You pay 20% on the income from £10,000 to £31,866 (21,866) = £4,372.20

- You pay 40% on income between £31,866 to £150,000 – £118,134 = £47,253.6

- You pay 45% on income between £150,000 and £250,000 = £45,000

- total tax = £94,372

- average tax rate = 37.7%

As income increases, you not only pay more tax, but your average tax rate increases.

Other types of progressive taxes

Capital gains and stamp duty. You could argue taxes like capital gains and stamp duty are progressive. Only people on high incomes will be buying expensive houses. In the UK, rates of stamp duty are also quite progressive.

Is VAT progressive?

VAT has an element of progressivity. People with higher incomes will spend more and therefore pay more VAT. VAT is also excluded from essential items like food. Though people on high incomes tend to save more, so as a proportion of income, VAT payments may be less than low-income people

The opposite of a progressive tax is a regressive tax – a tax which takes a higher percentage of income from low-income earners. (e.g. poll tax)

Other justifications for progressive taxes

- The diminishing marginal utility of money. As income increases, the marginal utility of money goes down. For someone on £10,000 a year every £1 is important for meeting living costs. But if your income goes up from £250,000 to £300,000 there is a limited increase in living standards.

- Positional externalities. It is argued by some economists that people with high incomes often end up spending money on positional goods, such as larger houses and more expensive cars, expensive art. Non-essential goods. Where there is competition to have prestige. Progressive taxes enable money to be spent on public services like health and education.

- Happiness. Some people with high salaries may enjoy making a bigger contribution to society.

Criticisms of progressive taxes

If taxes are too progressive, then people may face a disincentive for getting a better-paid job. e.g. a top rate marginal income tax rate of 80% may encourage people to go and work elsewhere.

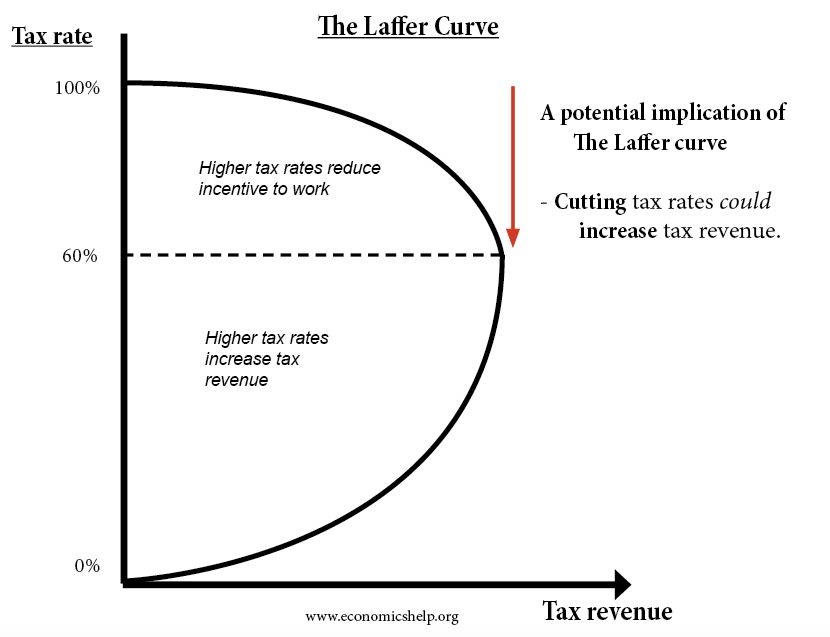

Laffer curve

Laffer curve analysis suggests that if marginal income tax increases too much, it may reduce the incentive to work.

Related

Progressive taxation in a developing economy is fair and workable

Completely agree. I think Margaret Thatcher blamed high taxes for the very high annual increases in salary for those at the top of the tree.

Well the higher rates of taxes disappeared and the rich now continue to enjoy annual increases – what is the excuse now?

Two quick questions:

Why is Income Tax always considered in isolation from National Insurance?

&

Why only three or four bands of tax (forgetting for a moment the complications introduced by a separate National Insurance system!) Why not start at 5% with a larger number of bands increasing by 5% each time?

Progressive tax is the most effective way of reducing poverty and inequality.

One thing the article omits is that progressive taxation helps dampen inflation. Prices rise when there is an abundance of money, as, for example, what is happening in California’s Silicon Valley. Fast rising high tech incomes coupled with low taxation of those incomes is causing causing costs for food, transportation and especially housing to skyrocket as high tech workers outbid everyone else for those necessities. That would be less of a problem if more progressive taxation dampened high techies’ to do that.

It is fairer and more inclusive

The calculation ommits the fact that, once earning in excess of £100,000 in the UK, you lose £1 of your tax free allowance for every £2 excess earnt

At the point of earning £250,000 you will have lost all of that allowance. Your first 31,866 (at these rates) will all be taxed at 20%. This makes the average rate

Higher

A progressive tax is fair and equitable

I think taxes should be cut for each child you have in your care