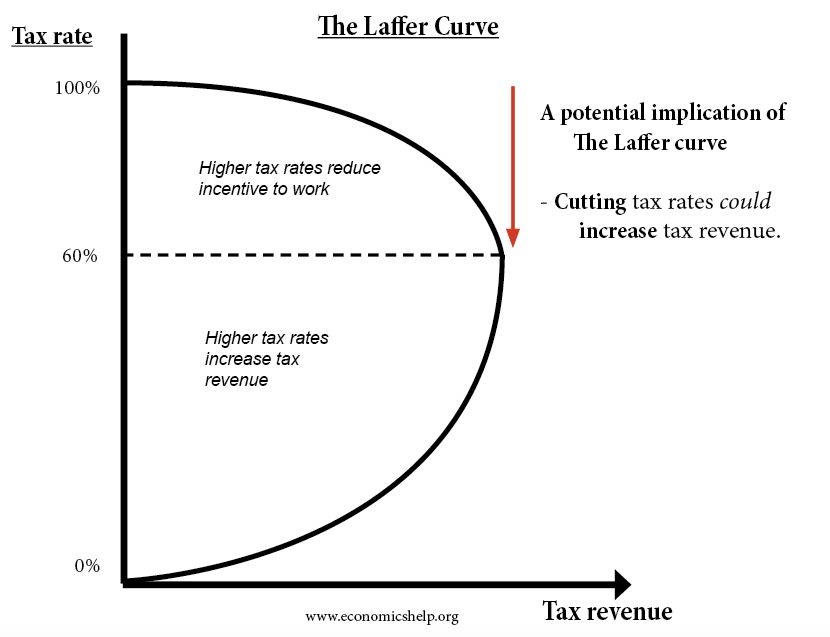

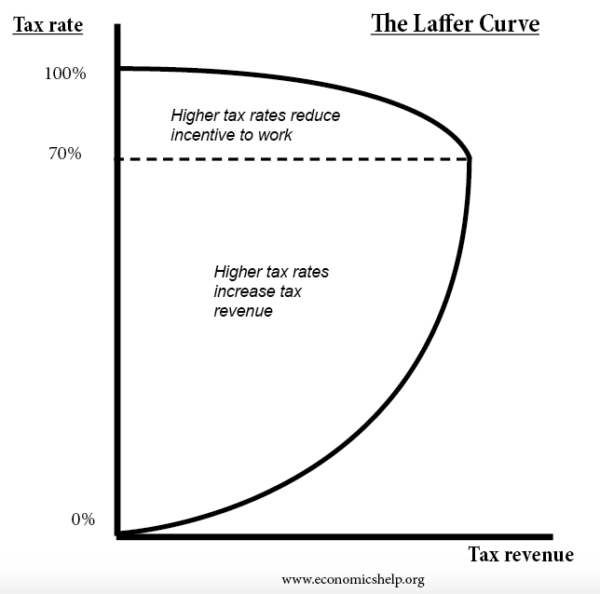

The Laffer Curve states that if tax rates are increased above a certain level, then tax revenues can actually fall because higher tax rates discourage people from working.

Equally, the Laffer Curve states that cutting taxes could, in theory, lead to higher tax revenues.

- It starts from the premise that if tax rates are 0% – then the government gets zero revenue.

- Equally, if tax rates are 100% – then the government would also get zero revenue – because there is no point in working.

- If tax rates are very high, and then they are cut, it can create an incentive for business to expand and people to work longer. This boost to economic growth will lead to higher tax revenues – higher income tax, corporation tax and VAT.

- The importance of the theory is that it provides an economic justification for the politically popular policy of cutting tax rates.

- As Andrew Mellon said in 1924 – 74% of nothing is nothing. Mellon pushed for the top rate of tax to be reduced from 73% to an eventual 24% (He also personally benefitted as he was one of richest men in America).

- However, economists disagree on the level at which higher tax rates actually cause disincentives to work.

The Laffer curve became important in the 1980s because it appeared to give an economic justification to cutting income tax rates. For politicians, such as Ronald Reagan, the Laffer Curve analysis is attractive – it appears to give the best of both worlds.

- Lower tax rates which are politically popular.

- Increased tax revenues and lower budget deficits.

Economic analysis behind tax increases

In reality, it is more complicated. Higher tax rates do not necessarily cause people to work fewer hours. Firstly, there are two main factors that influence a workers decision to work more or less.

- Substitution effect – If higher tax leads to lower wages then work becomes relatively less attractive than leisure. The substitution effect of higher tax is that workers will want to work less.

- Income effect – However, if higher tax leads to lower wages, then a worker may feel the need to work longer hours to maintain his target level of income. Therefore, the income effect means that higher tax may mean some workers feel the need to work longer.

Therefore, there are two competing effects – it depends which effect is stronger.

In addition, in the real world, workers may be tied to contracts, if tax rates go up, many workers may not have the luxury of deciding to work less.

What is the optimal level of taxation for maximising revenue?

One study of economists [1] suggests that a marginal income tax rate of 70% is considered a level at which the Laffer curve effect may start to occur. In other words, if income tax rates are 80% and they are cut to 70% – the incentive effect may increase total tax revenue.

However, this suggests that if you have a higher rate of income tax of 50%, then cutting tax rates will not of themselves lead to an increase in working hours and tax revenue.

Tax cuts in reality – evaluation

It can be difficult to measure the impact of tax cuts because several factors will influence total tax revenue.

- For example, if during a tax cut – there is strong economic growth and real incomes are rising, then this factor will lead to higher tax revenue. If the economy is in a recession or a period of falling real incomes, then tax revenues, will ceteris paribus, be falling.

- To measure whether the Laffer curve is having an effect, we need to examine whether the tax rates have an impact on labour supply, and levels of entrepreneurship.

- In recent years, the UK cut corporation tax rate from 20% to 19% – this led to higher company tax. But is this because of greater incentives to invest or a reflection of the fact, company profit is taking a bigger share of GDP? (profit/wage share of GDP)

- The effect will be complicated by time lags. In the short term, changes in tax rates will have little impact because people are stuck to contracts. However, in the long-term, changes in tax rates can encourage people to enter labour force and encourage people to set up own business. In the very long-term, it may influence where people choose to live and work. For example, when France announced higher income tax rates of over 70%, some French workers threatened to move abroad and take advantage of lower income tax rates.

- In an era of globalisation, there is greater tax competition because it is easier for multinationals to move operations to other countries. For example, Ireland cut corporation tax and benefitted from inward investment from the likes of Google and Microsoft.

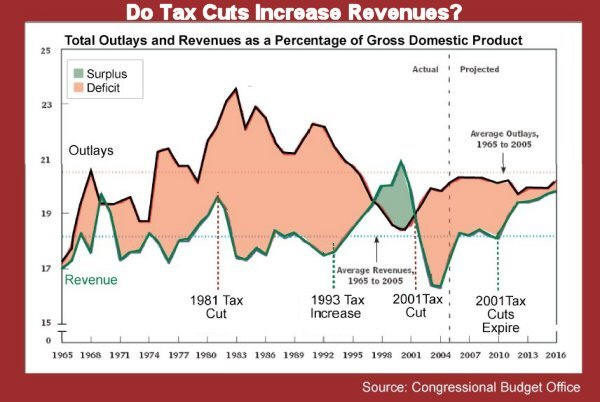

Do tax cuts reduce the deficit?

This evidence from US CBO suggests tax cuts lead to higher deficit. Tax increases reduce the deficit. (link)

Conclusion

There is sound reasoning behind the Laffer Curve – at some point, higher tax rates will lead to lower tax revenues. However, the big question is what level will this be? If the peak tax rate is 70%, then the Laffer curve will not affect most western economies – as income tax rates are mostly significantly lower than 70%. For example, recent US tax cuts from 35% will have little effect on incentives.

History of Laffer curve

The Laffer curve is named after the economist Arthur Laffer. In 1974, he tried to illustrate this concept to officials Dick Cheney and Donald Rumsfeld from the Ford administration. Legend states that he drew the concept on a napkin (though he doesn’t remember this incident). The term was coined by Jude Wanniski who was also at the meeting. Laffer has since stated he was not the first person to suggest this concept pointing out a 14th-century philosopher -Ibn Khaldun, who wrote in his work The Muqaddimah:

“It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments.”

Related

Reference

[1] Fullerton, Don (2008). “Laffer curve”. In Durlauf, Steven N.; Blume, Lawrence E. The New Palgrave Dictionary of Economics (2nd ed.). p. 839.

For anyone interested, here’s the Laffer curve stated mathematically:

I = total taxable income

T = tax rate

R= Tax revenue

n (constant)=taxable income if the tax rate was 0%

IT=R

I =-T + n (gradient is negative for all the reasons stated above, eg: people avoiding tax)

R = TI = T(-T+n) = -T^2 + nT

Help me understand laffers curve well,,, good job,, thank u,,,

From my life experience, 90 year, I can see that something important has been left out of this analysis. We need a tax and regulatory system that will encourage entrepreneurs to start small businesses. These are the key to our economic growth. People who start small businesses have an innate desire to create an interesting business that will feed themselves and their families. They are seeking much more than work. This psychological stance is what is missing from the analysis of the Laffer Curve. The small businessman needs a low tax environment in order to survive. With a low tax environment, thousands of folks will take the risks inherent in starting a small business. Often, the founders go without a salary for about 5 years while they learn how to make the business work. A high percentage fail, but many try again.

The odds for success decrease as taxes go higher. Why? Regulations rise as taxes rise and an accountant needs to be hired to do the taxes. Since the business cannot afford this, it shuts down. In the early years of a new, small business it is that simple.

I am 90 years old. Born during the Great Depression into a lower economic class family. My father was 30 years old in 1930, with two children to support. He was a milkman with an 8th grade education. Even though he earned just $50/week, he saved some money and twice started businesses that failed. 15 years after the first try, he finally, slowly succeeded. After 5 years, he started hiring people. His little business, office supplies, eventually supported six families. That is job creation! Multiply that man’s experience by thousands and you have a description of capitalism, American style. IT REQUIRES A LOW TAX, LOW REGULATION ECONOMIC ENVIRONMENT.

This analysis of the Laffer curve is woefully incomplete as it is focused only on income tax and the effect of taxes on a worker, it does not cover entrepreneurs or investments. It does not consider capital gains taxes for instance. I, and thousands like me, are reluctant to sell property assets because of the punitive rates of CGT. For years I have wanted to dispose of a property purchased in 2000. But with the removal of ‘taper relief’ I am faced with paying tax on twenty years of property inflation so the tax demand would be punitive and out of all proportion to the real gain. So I continue to hand onto the property and the Treasure continues to get nothing.

Laffer was very obviously right in principle. Although the principle can be heavily distorted if you cherry pick which taxes to include.