The invisible hand is a concept that – even without any observable intervention – free markets will determine an equilibrium in the supply and demand for goods.

The invisible hand means that by following their self-interest – consumers and firms can create an efficient allocation of resources for the whole of society.

How does the invisible hand work?

Suppose, a firm was charging a very high price for bread – £4 a loaf. This creates an incentive for another baker to sell at a lower price, say £2. Consumers will then switch from the high-cost bread to the low cost bread. This competitive pressure means that the price will fall – until there is an equilibrium between supply and demand. We don’t need a government to set an equilibrium price – the market price will automatically occur from all the actions of firms and supplies.

How does invisible hand deal with shortages?

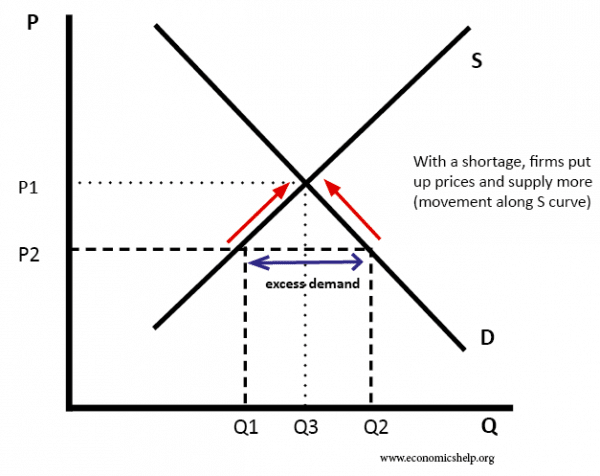

Suppose, a good was in short supply. At the current price, demand was greater than supply – leading to queues.

In this case, firms have an incentive to increase the price and/or firms have an incentive to increase supply – invest in production. The net effect, is that prices will rise until equilibrium is reached and the shortage is overcome.

Therefore, over time, prices and supply will adjust until the market returns to equilibrium.

Invisible hand – Adam Smith

In the Wealth of Nations (1783) Adam Smith mentioned the term ‘invisible hand’ on two occasions. The book is an important explanation of how free markets can operate.

Every individual… neither intends to promote the public interest, nor knows how much he is promoting it… he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.

The Wealth Of Nations, Book IV, Chapter II, p. 456, para. 9.

Smith is saying that individuals consider their selfish aims – businessman to make profit; consumers to purchase cheap goods. However, by seeking to make profit, firms end up helping to create a more efficient economy that leads to equilibrium the market for goods.

Adam Smith also mentions the concept of ‘invisible hand’ in another work “The Theory of Moral Sentiments.”

The rich…are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and thus without intending it, without knowing it, advance the interest of the society…

The Theory of Moral Sentiments (1776) Part IV, Chapter 1.

This is a different interpretation. It suggests that those with wealth, will be led by some invisible force to redistribute their wealth – either through charity or paying workers higher wages.

In the nineteenth century, Karl Mark argued capitalist inequality would lead to revolution, but as capitalists become more wealthy – this started to trickle down to workers. In the period 1850-1990, there was a rise in real wages for most workers in the western world. Higher real wages also benefited capitalists as they could sell more goods.

Short video on the invisible hand

Implications of the invisible hand

- For most goods and services, there is no need for government regulation and price controls. The ‘invisible hand’ of market forces will ensure the optimal price and output.

- Agents pursuing self-interest can contribute towards societies well-being – even if they don’t mean to.

- If owners of capital increase in wealth – there can be a trickle-down effect to benefit everyone in society.

- Private business will follow their profit motive to find the most efficient use of investment funds.

- Free trade is beneficial. Free trade enables firms to specialise in goods where they have a comparative advantage.

Limitations of the invisible hand

“The reason that the invisible hand often seems invisible is that it is often not there.”

Joseph Stiglitz

Monopoly Power Adam Smith himself was aware of how firms with monopoly power could cause prices to be pushed above the equilibrium. Without sufficient competitive pressure, firms could become stagnant, inefficient and exploit customers through higher prices.

Externalities. The invisible hand can lead to an efficient outcome – if there are no external costs/benefits. But, if there are significant externalities – e.g. pollution costs, then the free market can lead to over-production of goods with these external costs.

The tragedy of the commons. This is a situation where people pursuing self-interest can lead to depletion of natural resources, e.g. over-fishing in the sea. The tragedy of the commons

Irrational behaviour. The theory of the invisible hand and free-markets suggests consumers and firms are rational. However, in industries, such as finance we can see individuals can get carried away with irrational exuberance. This can lead to booms in asset prices – and prices distorted from economic realities. See: Criticisms of efficient market hypothesis

Time lags and immobilities. If an industry closes down, then the invisible hand may push the unemployed to move and get a job in another industry. However, in reality, there are occupational and geographical immobilities, therefore, resources (labour and capital) can become unemployed for a long time)

Limitations of selfish actions. The invisible hand could be used to justify selfish actions. But, to some, this is the wrong approach. You could argue the motivation is important and individuals should be aware of the actions on the rest of society – rather than gaining justification to be just selfish.

Related

Tejvan Pettinger, thank you for this post. Its very inspiring.

Adam Smith’s Wealth of Nations is in the public domain and can be downloaded from Project Gutenberg and searched. The printed book can cost you $15 and take a lot of effort to search. Has Smith’s “Invisible Hand” been used as a propaganda tool for decades since most people would never read WoN?

Smith used the word ‘invisible’ six times but only once as “invisible hand”. It is really curious that we hear about the ‘invisible hand’ so much.

Smith used the word ‘education’ EIGHTY TIMES. We are not told about that. Search for “and account” and you will find multiple instances of “read, write, and account”, not “read, write and arithmetic”. Double entry accounting was more than 300 years old when Smith wrote Wealth of Nations, but 50% of Brits were illiterate and public schools did not exist in 1776.

The United States could have made accounting/finance mandatory in the schools since Sputnik. Wouldn’t that have helped everyone best serve their own self interest? But we do not hear the people who propagandize us about the “invisible hand” advocating mandatory accounting because that might make their invisible rip-offs more difficult.

Adam Smith never used the word ‘depreciation’. He mentioned paper money being depreciated one time. Marx wrote about ‘depreciation’ a number of times in Das Kapital, sometimes regarding the depreciation of machines.

Consumers did not buy automobiles and air conditioners and televisions before 1885.

Marx died in 1883.

But it’s OK! Our brilliant economists do not talk about the depreciation of under engineered consumer trash today either. Every time you buy a replacement the purchase is added to GDP. What about NDP? Oh sorry, you never heard an economist explain NDP. That’s OK too, they only depreciate the Capital Goods and ignore the depreciation of consumer junk anyway.

Wealth of Nations has probably been in the public domain for a very long time but cheap computing did not make it available in Project Gutenberg until 3/17/2001. Milton Friedman died in 2006. Was Friedman giving us the straight dope on economics or treating us like dopes for decades?