The current US administration is proposing tax cuts which ‘The Committee for a Responsible Federal Budget’, estimates it will include $5.8 trillion of total tax cuts over the decade and a net cost of $2.2 trillion through 2027.

The problem with these tax cuts

- It is unclear how these tax cuts will be financed. An ageing population is putting upward pressure on government spending.

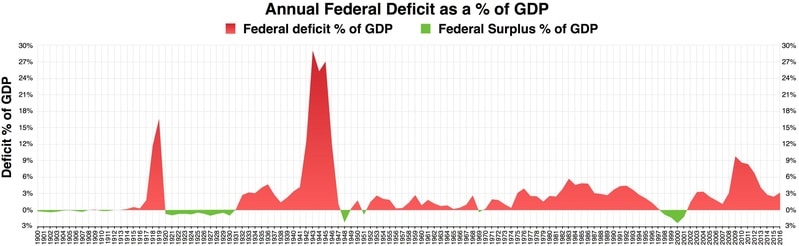

- Will increase the deficit and national debt at a time when the economy is growing – it is the stage of the economic cycle when the deficit and debt should be reduced.

- With marginal tax rates already low, it will offer little if any supply-side incentive to boost economic growth. For example, corporation tax will be cut, but companies already have very large cash reserves. The tax cuts are unlikely to lead to more investment as companies are already cash rich (cash reserves of companies)

- There will be little if any boost in aggregate demand and economic growth. With the US economy growing close to its long-run trend rate, the Federal Reserve is likely to offset any expansionary fiscal effect with higher interest rates. Tax cuts which lead to higher interest rates will be an example of crowding out.

- Exacerbate inequality. In recent decades there has been a growing gap between rich and poor in the US. Although all will benefit from these tax cuts, it is the richest who will benefit disproportionately most. With tax cuts for middle classes expiring first (not index-linked). According to some estimates, 79% of tax cuts goes to top 1% according to Tax Policy Centre

- The average tax bill for all income groups would decline by $1,600, or 2.1 percent, in 2018. The biggest decrease would go to those with incomes above $730,000, who would see their after-tax incomes rise by an average of 8.5 percent, or about $129,000. (NY Times)

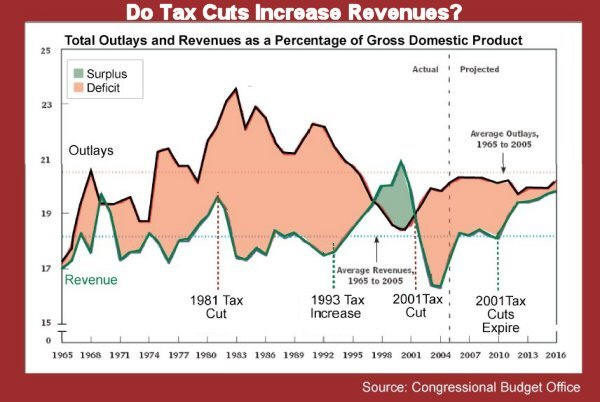

Tax cuts historically lead to a large deficit.

1993 tax increases didn’t prevent the strong economic growth of the 1990s.

Borrowing and the economic climate

Economics help.org started in Nov. 2006. For much of the past decade, it has been an unusual economic climate in that there has often been a good case for advocating government borrowing. There are many articles stating that western economies like the US and Europe would be advised to increase government borrowing – due to their below trend economic growth.

However, the economic cycle is finally starting to change and with reasonable growth in the US – now is the time for countries to reduce deficits further and start aiming to reduce debt to GDP.

Basic Keynesian economics provides a good argument for government borrowing in recession, but equally, it provides strong argument to run a balanced budget during periods of economic growth.

When the economy is growing strongly, it is damaging to cut taxes and lead to higher borrowing.

US economy

Since the recovery of 2009, the US economy has been growing strongly at 2- 2.5% a year, at the end of June 2017, annualised growth was 3.1% (growth)

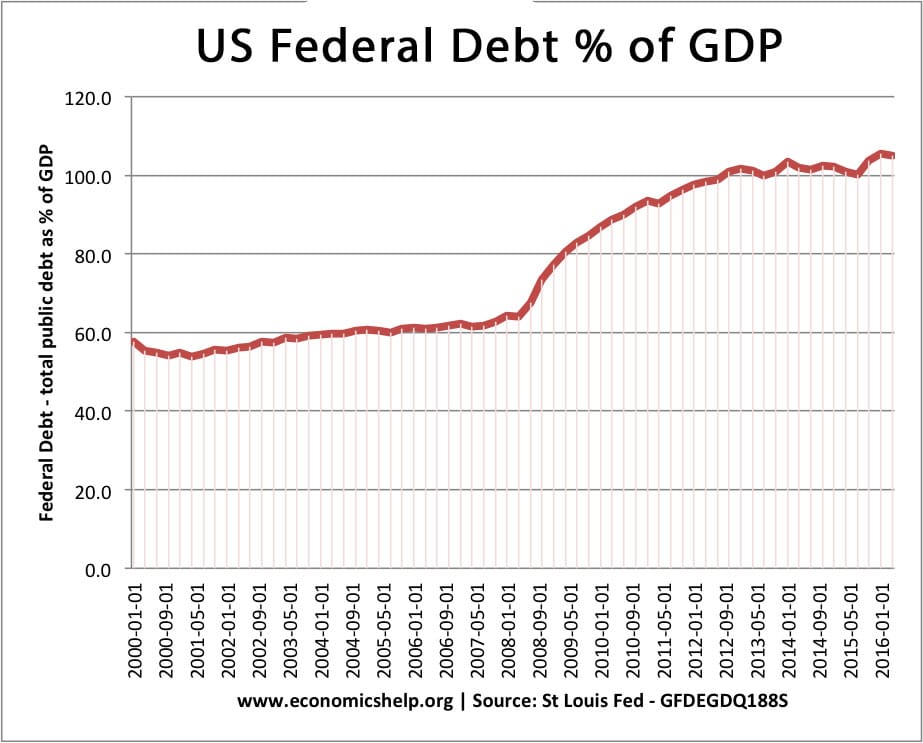

US debt % of GDP

Since 2008, the federal debt has increased from 60% of GDP to 100% of GDP. This debt has been manageable. There has been strong demand for US bonds and US bond yields have remained at record lows.

However, now is the time, when the government should aim to reduce debt to GDP back towards 60%.

One reason is that during the next recession, a government may need to pursue expansionary fiscal policy. If debt rises higher – then the government will have less room for manoeuvre during the next crisis.

Annual deficit.

Related