Automation and AI have been called the fourth industrial revolution. Robots replacing the jobs of human labour will increase efficiency and enables higher economic growth But, others are concerned that rapid automation can create unequal outcomes, with some losing their job and struggling to gain new forms of employment. A robot tax would, in theory, make the winners from automation pay towards compensating the ‘losers’ of automation.

However, critics of a robot tax argue that it will stifle innovation and encourage firms to move production to countries without a robot tax. Therefore, badly implemented, a robot tax has potential to make everyone lose out.

Arguments for a tax on robots

1. Shares the benefits of growth. Automation increases productivity, output and national income. Firms and some highly skilled workers will do very well. It enables higher profits and higher salaries for those workers who program robots or work on marketing.

2. Rise in inequality. In recent decades we have seen a rise in inequality. Corporate profitability has risen while real median wages have been stagnant. It reflects the fact the recent proceeds of automation and economic growth have not been shared equally. High-income earners have seen rapid growth in wages, but there is a new class of temporary, contract work, which is generally low paid with uncertain hours. A robot tax is a way to try and redistribute income from those benefiting from automation to those who are losing out. For example, an increasing number of economists have suggested a universal basic income to give minimum income guarantee to those left behind by recent trends in economic growth.

3. This time is different. Many argue technology shifts employment patterns, but new jobs are always created. However, there have been arguments automation may not create new jobs like in the past. The reason is that robots will be able to replace even skilled routine jobs like tax drivers and medical professionals who perform routine scans and checks.

Arguments against a tax on robots

1. A tax could discourage productivity gains. Automation is an important aspect of improving manufacturing productivity and retaining international competitiveness. If firms don’t automate and use the latest technology, they will get left behind and could go out of business. Then everyone in the firm will lose job – not just those replaced by robots.

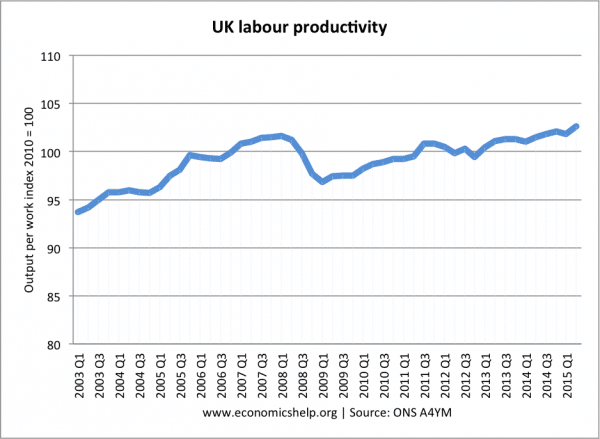

Stagnant UK labour productivity – is it related to poor take up of automation?

The UK has had very poor productivity growth for the past 10 years. It also has one of the lowest rates of robot take-up rates. According to the RSA – the UK has just 33 robot units for every 10,000 employees, compared with 93 in the US and 213 in Japan. If UK doesn’t invest and improve productivity, then real wages will remain stagnant. The best way to see wage growth is to encourage higher productivity levels. If a tax is placed on firms who invest in robots, it could discourage investment and UK productivity will suffer.

2. What is a robot? It becomes hard to evaluate where should taxes fall. If supermarkets introduce self-checkout machines is this a robot? What if a new company sets up a 3D printing machine, do you place a tax on new firm for creating employment?

3. Luddite Fallacy. The Luddite fallacy is the mistaken belief that new technology will destroy jobs. The past 300 years have shown new technology merely shifts employment patterns. Some will lose manufacturing jobs, but new jobs will be created in the service sector. Robots have an emotional appeal because of fears robots with AI will take over. But, the logic of new technology destroying jobs is same as when weavers smashed looms in the Nineteenth Century. The Economist notes that in the 1960s, President John F. Kennedy declared that the major domestic challenge was “maintain full employment at a time when automation…is replacing men” – in other words fears over automation are persistent and nothing new.

4. Potentially less pollution. Automation could help protect the environment, e.g. local 3d printing rather than importing from China reduces pollution of transport. When we tax goods like petrol and carbon it is because they have high external costs of pollution. But, the externalities argument is weak with regard to robots.

5. Lower costs enable new services. When the bank ATM was introduced, people feared automatic cash dispensers would cause bank tellers to lose their jobs. But, by lowering costs, banks have been able to open more urban branches. James Bessen, an economist at the Boston University School noted the number of bank tellers fell from 20 per branch in 1988 to 13 in 2004 but, in the same period, the number of urban bank branches rose by 43% creating more employment. (source Economist) However, a British citizen may feel it is going the other way, with banks closing record numbers of branches – because automated technology and online banking is shifting more jobs to online call centres. (Reuters, (2017) “British banks set to close record 762 branches this year”)

Evaluation

There is a strong case for government intervention to help those who are losing out from the pace of economic and technological change. New technology and the free market can create higher productivity, but it is no guarantee everyone will share from the proceeds. If society becomes increasingly unequal with winners and losers – there are costs beyond economics.

However, a simplistic robot tax could be counter-productive. If it is placed on companies who use more automation it could cause a fall in investment and encourage firms to shift production to other countries.

A better option may be not to tax robots per se, but find ways to fund education, training and basic income from general taxation.

Related