Labour productivity measures the output per worker in a period of time. Labour productivity is an important factor in determining the long-run trend rate of economic growth; tax revenues, inflation and real wages.

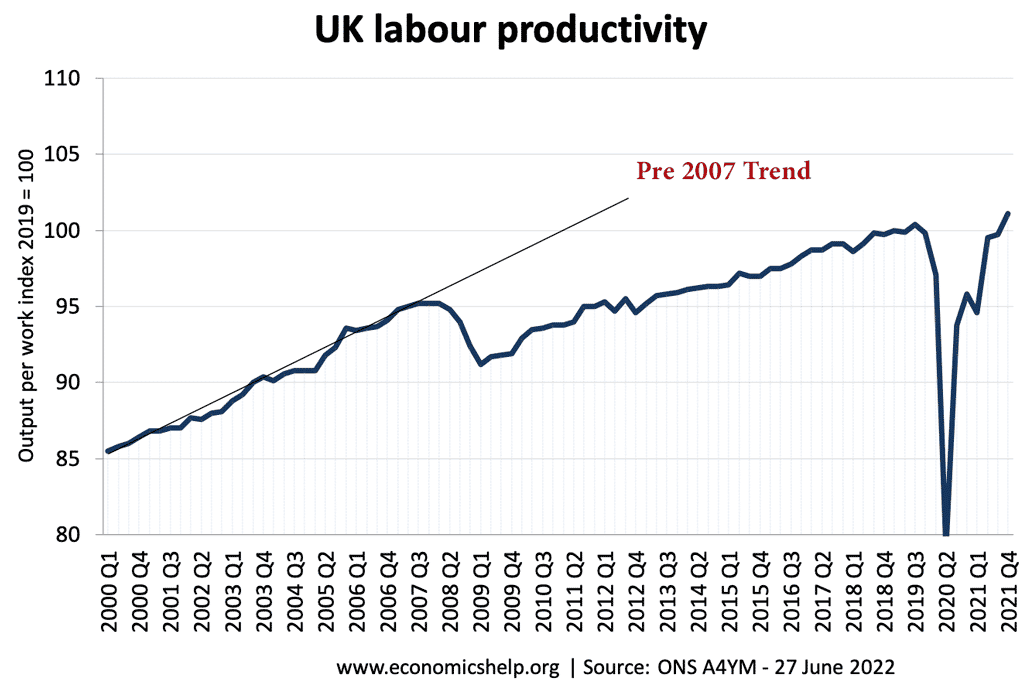

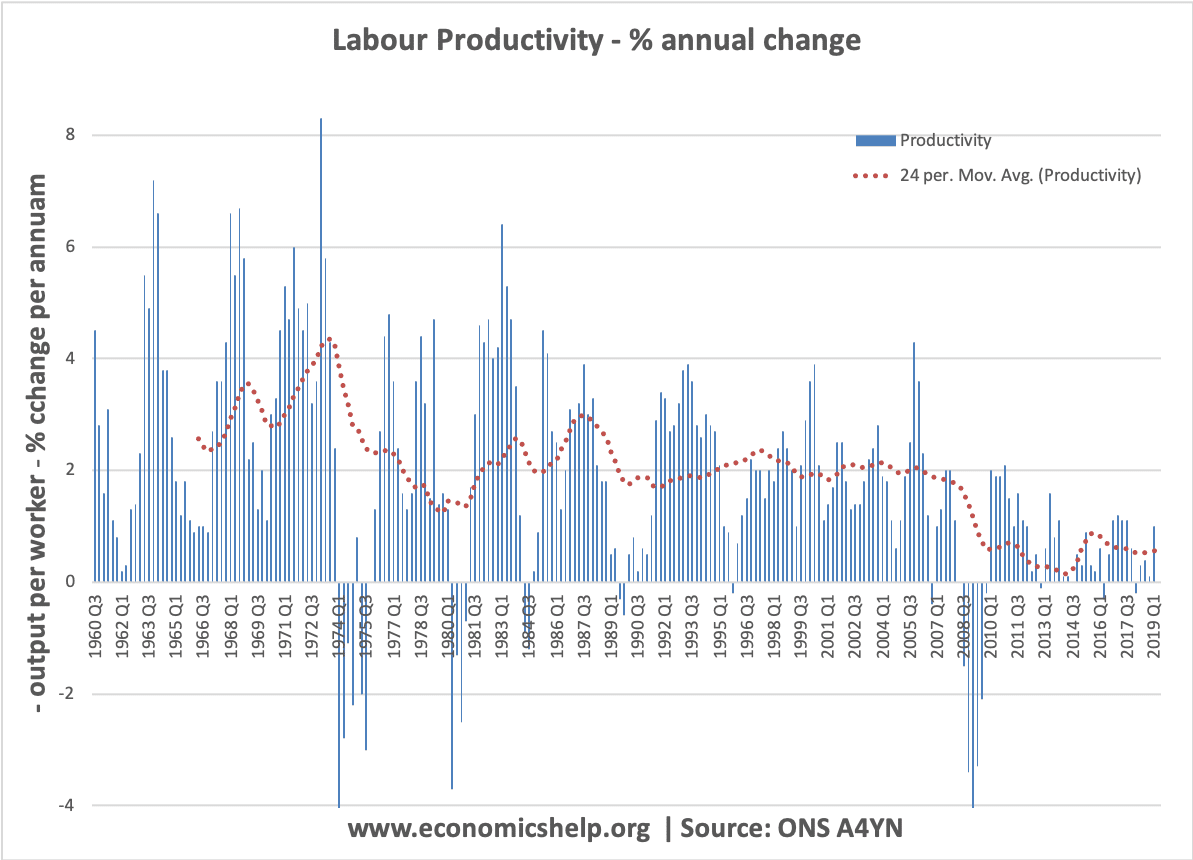

Since the start of the great recession in early 2008, UK labour productivity growth has remained very low – well below the historical average. (The ONS estimates 20% below its pre-crisis trend) In Dec 2019, the Royal Statistical Society (RSS) stated that the statistic that best “capture the spirit of some of the biggest issues of the last 10 years” is the annual productivity growth of 0.3% (compared to 2% pre-financial crisis)

Reasons for this ‘productivity puzzle’ include – more flexible labour markets, stagnant real wages, lack of investment, increase in part-time/temporary work, and international trends in technological development.

Recent UK Labour Productivity

ONS Labour productivity – A4YN – Productivity index PRDY

Since the 2007 crisis, UK labour productivity has stagnated – falling well below its pre-crisis trend. This has had a serious impact on real earnings growth, prospects for future economic growth and tax revenues.

Annual growth in Productivity

In the post-war period, UK labour productivity growth was averaging roughly 2-3% a year. However, since the start of the recession in 2008, UK labour productivity has increased by only 5% in the space of 13 years.

Unlike previous recessions, UK labour productivity growth has not bounced back when the recession ended. Productivity growth has struggled to remain positive.

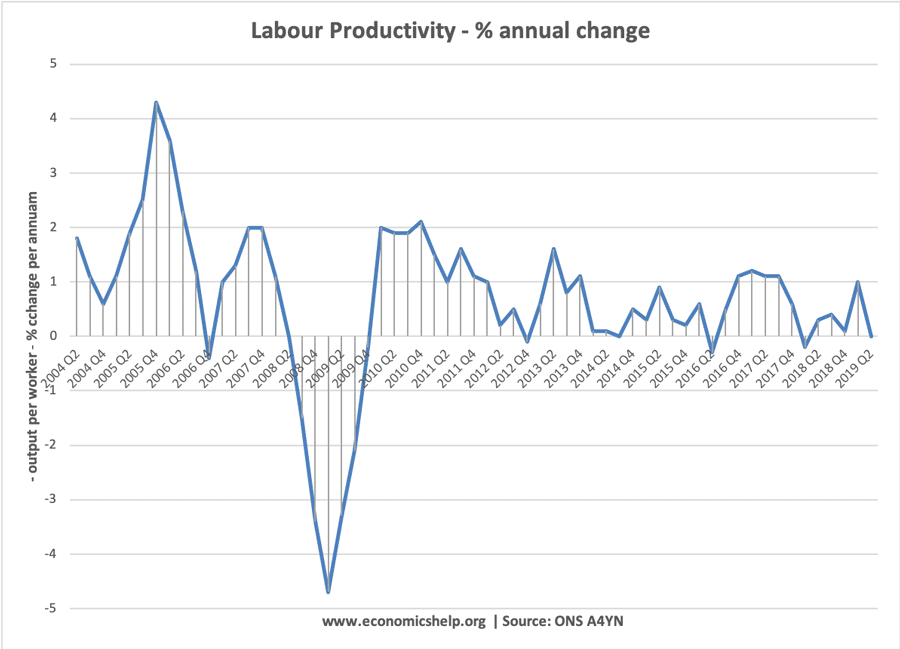

Labour Productivity since 2005

ONS – data: A4YM

Looking at the past 12 years in more detail. UK labour productivity has only marginally improved on the pre-crisis peak.

Factors affecting labour productivity

- Skills and qualifications of workers. If workers become more skilled with relevant training, then this can increase labour productivity.

- Nature of employment. Temporary/part-time jobs may be subject to lower productivity than full-time work where firms have more confidence to invest in productivity. In recent years, the UK has seen a shift to more flexible labour markets.

- Morale of workers. In a period of industrial unrest and low worker morale, productivity is likely to fall. If workers are motivated and happy, productivity is likely to be higher. The morale of workers could be affected by wages, industrial relations, whether they feel they have a stake in the company, non-monetary benefits, e.g. do they enjoy the job?

- Technological progress. The implementation of new technology is one of the biggest factors in improving productivity. For example, the assembly line introduced from the 1920s made huge strides in productivity. In recent years, the development of micro computers and the internet have also enabled improvements in productivity.

- Substitution of capital to labour. If labour becomes cheap and freely available, firms may have less incentive to spend money on capital and use labour-intensive methods rather than capital-intensive methods. Labour intensive processes are likely to have lower levels of productivity.

- Rules and regulations. If it is very hard to fire lazy workers, then productivity growth may be constrained. Though the absence of any labour market regulations could lead to high turnover and poor worker morale, which could also diminish labour productivity.

- Capacity utilisation. In a boom, firms may squeeze more output out of existing capacity by encouraging people to work overtime – this increases labour productivity. In a recession, firms may hold onto workers, rather than let them go – even if they are just working at 80% capacity – therefore labour productivity falls.

- Levels of investment. In the long-term, the level of investment in R&D, new technology and better working practices is very important for determining productivity growth.

What explains the fall in UK productivity growth?

Reasons put forward for the UK productivity puzzle include:

- Labour hoarding. (When firms hold onto workers). Unemployment has risen by a smaller amount in the ’08-’12 recession – compared to previous recessions in 1981 and 1991, and now unemployment has fallen to 6.2%. This could support the theory that firms are preferring to hang onto workers, despite lower demand. Firms may feel this prevents having to rehire and retrain workers after the recession ends. Though the length of this current recession makes this surprising, and it’s uncertain why it’s happening in 2008-12 more than previous recessions.

- Low levels of investment. The credit crunch has held back investment because firms struggle to gain finance or don’t have the confidence to invest in new capital. This could hold back labour productivity growth.

- Rising employment / dodgy data. A strange feature of the period 2008-19, despite low growth, employment levels were rising. Some query whether output figures are understated and employment figures overstated. But, this is unlikely to be happening. The downward trend in unemployment, suggests firms are keen to rehire workers.

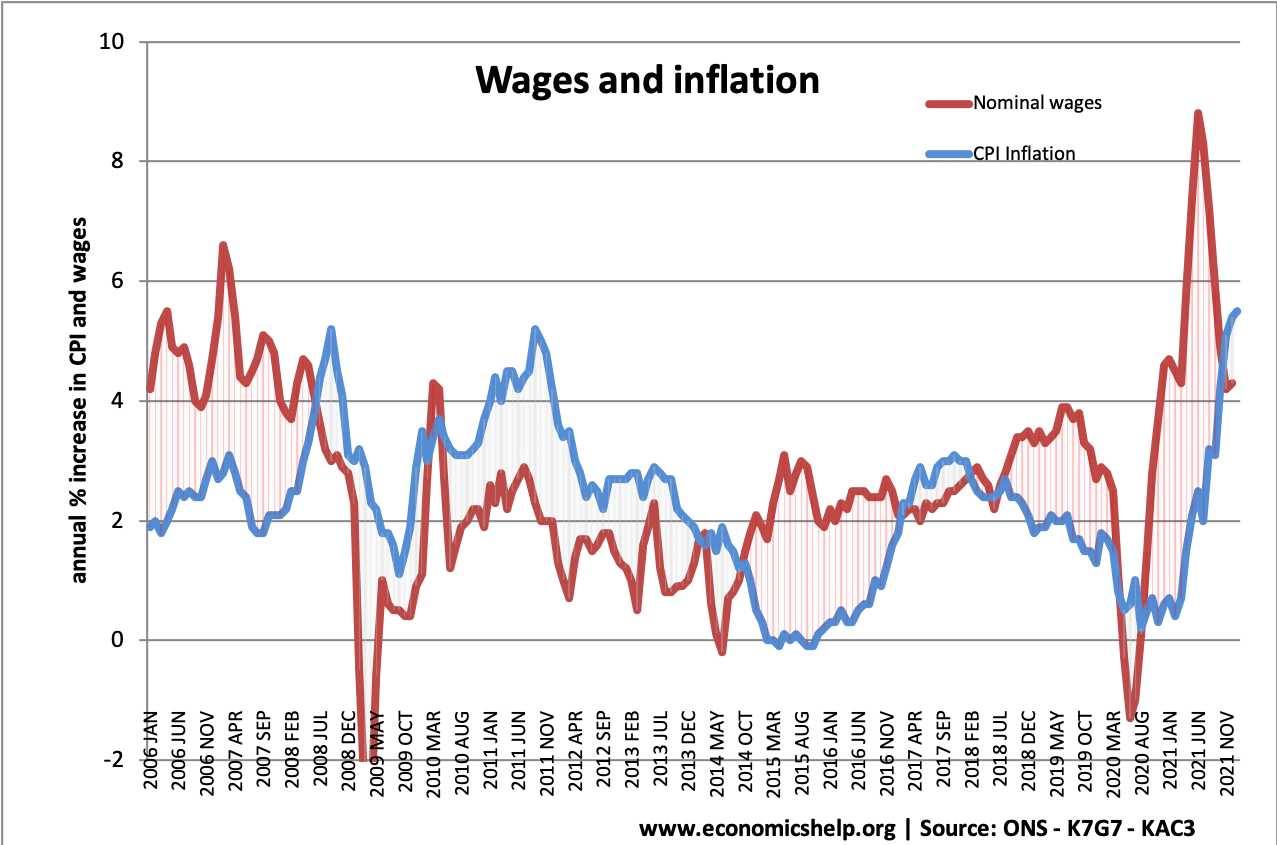

- Falling real wages. During recent years, the UK has seen falls in real wage growth. If real wages are lower (or stagnant), firms may be more willing to employ labour rather than capital. In other words, low wage growth means labour is relatively more attractive than usual. Therefore with lower labour costs, firms are willing to employ more workers and labour-intensive production methods.

- More flexible labour markets. In recent years, UK labour markets have become more flexible, with more part-time, temporary contracts (e.g. zero hour contracts) This has helped reduce the cost of labour to firms, and therefore, they are more willing to employ workers, without rising productivity.

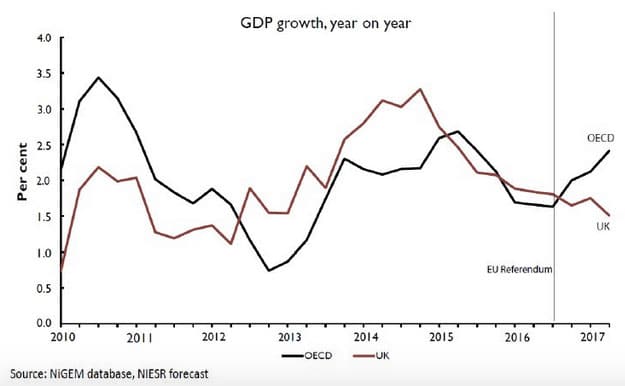

- European wide fall. The graph below shows that labour productivity growth has also fallen in other Eurozone economies, suggesting there could be global issues with the growth of productivity and new technology.

- Lack of major technological breakthrough In the past, the economy has attained major boosts to productivity through inventions such as the assembly line, electricity, containerisation, the microchip. The internet and automation has enabled some productivity gains, but the scope for big gains may prove less than less ‘glamorous’ attainments such as electricity or assembly lines. (Perhaps the internet is slowing down some labour productivity as we waste time on social media!)

- Brexit uncertainty. Since 2016, UK productivity has performed worse than the Eurozone and OECD. Some economists argue this reflects the uncertainty over Brexit is reducing investment as firms wait to see the kind of deal people get.

Implications of falling labour productivity

1. Lower output

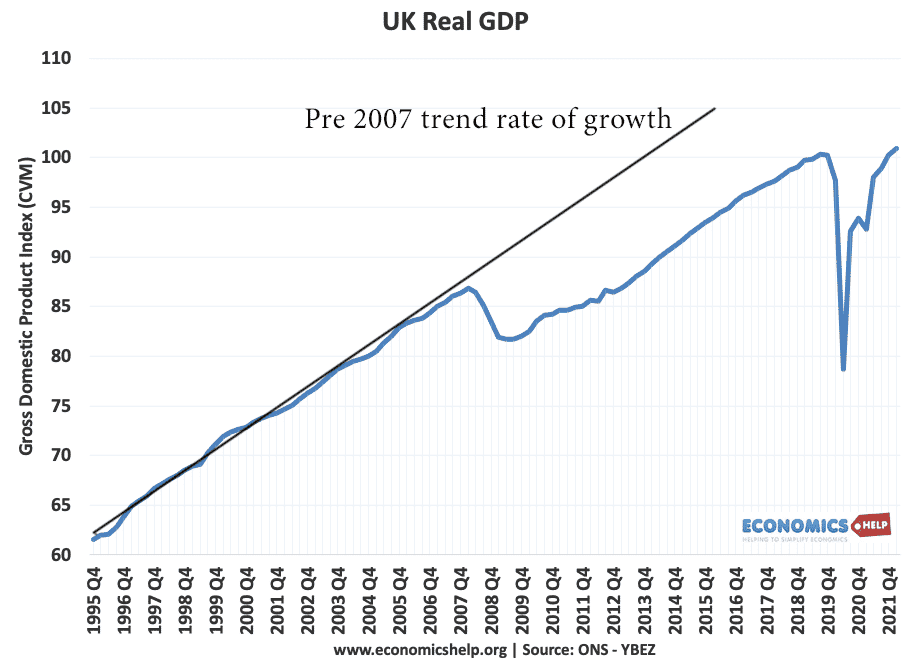

The fall in labour productivity mirrors the fall in real GDP.

2. Lower wages

With falling productivity, firms cannot afford wage increases. This is leading to depressed income tax receipts for the government.

3. Lower tax receipts. The IFS estimates the cost of falling productivity is a potential £20 billion black hole (Sky News). Lower productivity growth = Lower economic growth = lower tax receipts (VAT and income tax)

Comparative UK labour productivity

The slowdown in productivity growth is not just a UK issue. Source: ONS

Importance of Labour Productivity

- Economic growth. UK labour productivity is a key factor in determining long-run economic growth (and LRAS). Improvements in labour productivity enable firms to produce more for lower costs. Without growth in labour productivity, it would be difficult to have strong economic growth. see: causes of economic growth

- Inflation. Rising labour productivity helps to keep costs and inflation low.

- Rising real wages. Rising labour productivity is a key factor in enabling rising real wages. If workers become more productive, firms can afford to pay the wage increases.

- International competitiveness. Improvements in labour productivity can help to boost the competitiveness of UK exports. See also: Factors that determine international competitiveness.

Related

I find the explanations for the UK low productivity somewhat plausible but, from a layman’s point of view, I think that the real reason is government cutbacks. it is simply impossible for a government to reduce expenditure the way it has since 2010 without it having a severe effect and shock to the economy. It is also interesting to see the correlation between the start of low productivity and the start of austerity. It would be interesting to see studies on this as I suspect that this is the real cause.

The slowdown in productivity growth is not just a UK issue.

https://ades.vn/nen-su-dung-bep-tu-hay-bep-hong-ngoai

The key to the productivity puzzle is understanding the policy of mass immigration.

By definition – You cannot have anything *BUT* falling productivity with mass immigration due to Hardin’s tragedy of the commons. Employers simply import Labour to the level of it’s marginal productivity.