Arguments for a sugar tax

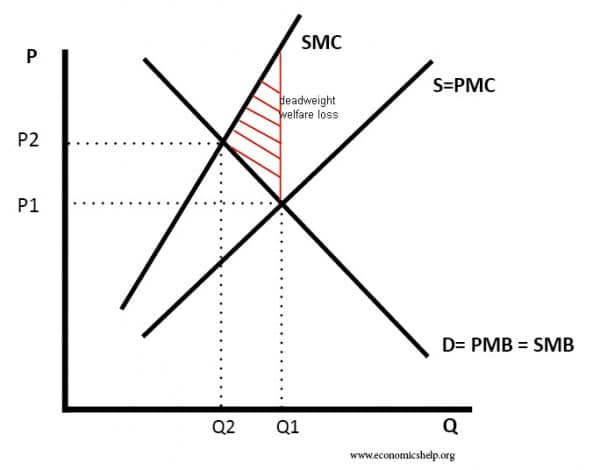

1. External costs. Sugary drinks impose high external costs on society. The overconsumption of sugar is a major cause of health problems such as

- Diabetes (in particular, type 2 diabetes)

- Obesity and obesity-related illnesses, such as back pain, heart disease,

- Tooth decay (especially amongst young people

These external costs are reflected in higher costs imposed on the national health service. Poor health also adversely affects work and productivity. Therefore, the social cost of sugar consumption is greater than the private cost of sugar.

This diagram shows the impact of a good with external costs. The free market price is Q1, Price P1. But, the socially efficient level is at Q2 (where SMB social marginal benefit = SMC social marginal cost)

The solution is to impose a tax which raises the price and reduce the quantity to Q2. (See more detail at: tax on negative externality)

2. Demerit good

In addition to the external costs, we can class sugary drinks as a demerit good. This is because people may be unaware of the personal costs involved in sugar consumption. Alternatively, people may be aware sugar is bad for you, but struggle to reduce consumption because of its addictive qualities.

Furthermore, these sugar hits can lead to mood swings. A ‘hit’ of sugar gives a high, but then as the sugar wears off and the body releases insulin to cope with the surge in sugar, it leads to a decline in energy and endurance – which can only be solved by taking more sugar.

The average UK resident consumes 238 teaspoons of sugar per week – but often without realising, because so much sugar is ‘hidden’ in soft drinks, and processed food. This lack of awareness about sugar is an example of information failure – consumers not having full information to make informed choices.

- The amount of sugar in certain foods/drinks

- The harmful effects of sugar

3. Raises revenue

It is estimated a 20% sugar tax could raise approx. £1billion (BBC) This could be used to

- Reduce over taxes (£1 billion is worth about 0.5p on basic rate of income tax) or VAT

- Fund spending on growing health problems of sugar consumption (e.g. diabetes clinics)

From a political perspective, having a tax earmarked to fund spending in a particular area, makes it more palatable for consumers. If they feel tax raised is being used to fund health care or education about healthy eating, then it feels like a good use of tax raised.

4. Shifting supply and consumption

A sugar tax creates an incentive for firms to supply alternatives which are healthier. If you go into certain fast food restaurants, sugary drinks have often been heavily promoted – e.g. free refills in McDonald’s. Here you could argue that supply creates its own demand. But, if firms have incentives to promote healthier drinks with substantially lower sugar content, then consumers will to an extent follow the supply. If you are offered a free coke with a Big Mac, you take it. But, if you are offered free water, you may take that too.

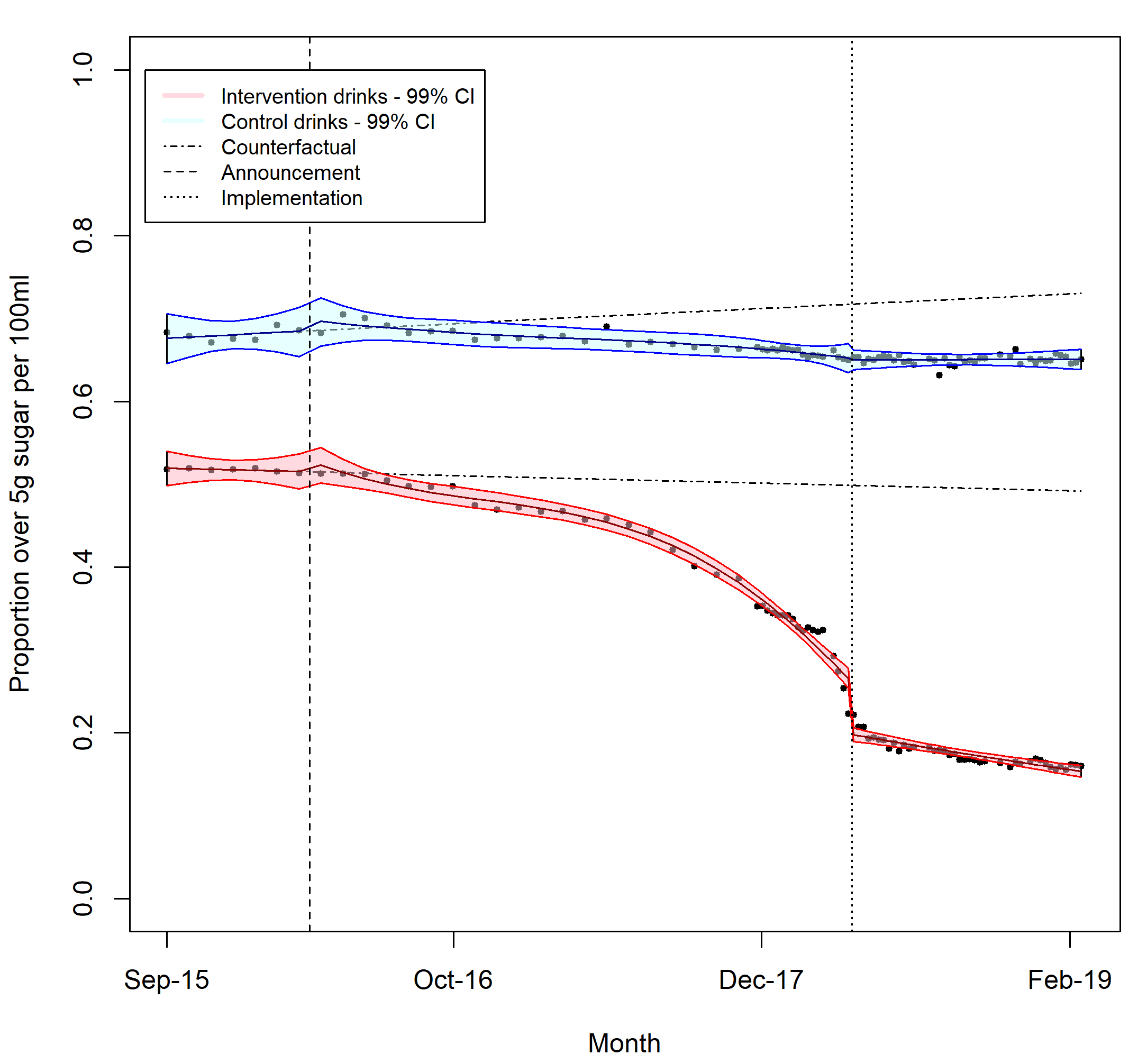

Evidence from the UK sugar tax suggests this is true. In the two years after the UK introduced a tax on sugary drinks, manufacturers responded by reducing the sugar content in their drinks to avoid the tax.

Drinks with more than 5g of sugar per 100ml fell from an expected level of 49% to just 15%.

5. Sugar tax in the UK

- £0.24 per litre for drinks with over 8 g sugar per 100 mL (high levy category),

- £0.18 per litre for drinks with 5 to 8 g sugar per 100 mL (low levy category)

- no charge for drinks with less than 5 g sugar per 100 mL (no levy category)

A study on the effect of the UK sugar tax, found prices only rose by 31% of the tax levy, suggesting manufacturers absorbed 2/3 of the tax increase themselves, suggesting demand is price sensitive for sugary drinks – with many alternatives.

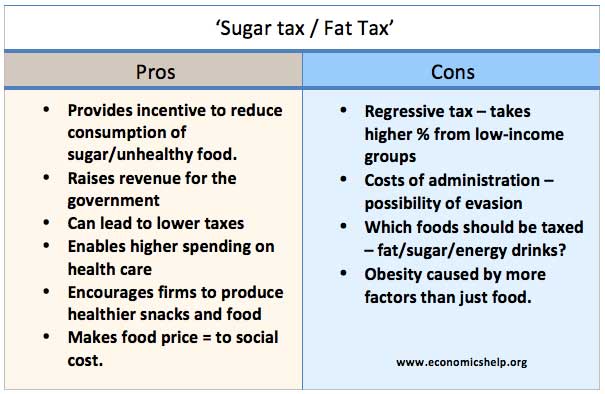

Arguments against sugar tax

1. It leads to job losses. Recently the head of Weatherspoons claimed ‘Jamie Oliver’s plans for a sugar tax would costs pubs millions of pounds and lead to job losses

“Showboating of this kind by Jamie Oliver will close pubs.” (Independent)

From an economic perspective, it is hard to give too much weighting to the idea that a sugar tax will lead to job losses.

Firstly, it will shift demand away from sugary drinks to non-sugary drinks so it will shift demand within the non-alcoholic market. Ironically, Weatherspoons also said “Sales of non-sugar drinks in the non-alcoholic category are increasing at a rapid rate and are in the great majority when you take into account coffee and tea.”

The tax will just accelerate that shift to non-sugary drinks. It’s hard to imagine people not going to a pub because full-sugar coca-cola is now 20% more expensive.

It is possible that the tax will lead to a small decline in the soft-drink market – people may drink tap water and not the non-sugary alternative. It is possible that lower spending on soft-drinks will lead to some decline in market share and job losses. But, at the same time, the sugar tax will be spending £500-£1bn on health care / education initiatives. Jobs will be created in the treatment of diabetes and education of young people about healthy diets. The tax should be employment neutral. It is simply shifting resources from sugary drinks to health care market. (Related article on Luddites and unemployment)

2. It is unfair on low-income groups

It is argued that the sugar tax is regressive because it will take a higher percentage of income from those on low-incomes. However:

- If people are price sensitive then they can switch to non-sugary drinks and avoid tax.

- Everyone will benefit from the increased health care spending and improved quality of life.

- If there were concerns about income distribution as a result of the tax, the tax revenues could be used to reduce other regressive taxes such as VAT, but spending on health care will probably be a better way to improve quality of life for those on low-incomes as they are unable to afford private health care treatment.

3. We shouldn’t make judgements about people’s lifestyle

The other argument about sugar tax is that it is wrong for the government to make judgements about people’s lifestyle and influence consumer patterns.

This is a weak argument.

- Firstly, you don’t have to pay the sugar tax, because there are many alternatives to sugary drinks.

- Secondly, if a government has a commitment to provide universal health care free at the point of use, it has also has a right to encourage healthy lifestyles which avoid placing undue strains on health care services. Good health care is not just about treating ill health; much better to prevent ill health in the first place.

4. Tax is not the best policy to reduce sugar consumption

Campaigners suggest that other policies, such as banning advertising at children, education initiatives – could be more effective in reducing excess sugar consumption.

However, this is not an argument against a sugar tax. It is merely an observation that we shouldn’t rely on tax alone. The most effective strategy is a combination of policies – education, tax and ban on advertising. The past few decades have shown that demand for cigarettes can be reduced significantly through advertising, regulation and tax. All can play a role.

Conclusion

There is a very strong economic, social and personal benefit from a sugar tax. It will play a role in encouraging a healthier diet and at the same time raise money to deal with the rapidly rising health costs associated with obesity and excess sugar consumption.

The only potential losers are the soft drink industry who will see some fall in demand. But, at the same time, there are opportunities for the soft-drink market to produce healthier options which avoid the sugar tax. It will also be good for the national health service.

Overall, there will be a net welfare gain from a sugar tax, with minimal economic disruption.

Related

Of course sugar is addictive. You only have to have some after removing it from your diet to know you immediately want more! And it’s a strong urge that’s hard to ignore even when you were fine without it before! It takes a few days or longer to get it out of your system and then not crave it at all but as soon as you reintroduce it, wow those cravings kick in. If science is behind what we already know, hurry up science!

I want reduced sugar drinks without artificial sweetener but it doesn’t seem to exist. I am being forced into a choice between having water only or consuming chemicals.

This also effects millions of people that have type 1 diabetes that rely on fast sugar intake when they have a hypo,without a fast sugar intake they could die including myself.I am a lorry driver and it is the law to carry fast acting sugar intake ” coke or jelly babies are fast acting” while you are driving incase you have a hypo Why should these people need to pay more because other people can’t control there habits,they should make people pay for treatment related to sugar and leave the people alone that rely on sugar, sweaters,diet drinks and no sugar drinks are worse for you than real sugar.