A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. In theory, the tax will reduce pollution and encourage more environmentally friendly alternatives. However, critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

The purpose of a carbon tax

The purpose of a carbon tax is to internalise this externality. What this means is that the final price of the good should include the external costs and not just the private cost. It is similar to the ‘polluter pays principle.‘ – which was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

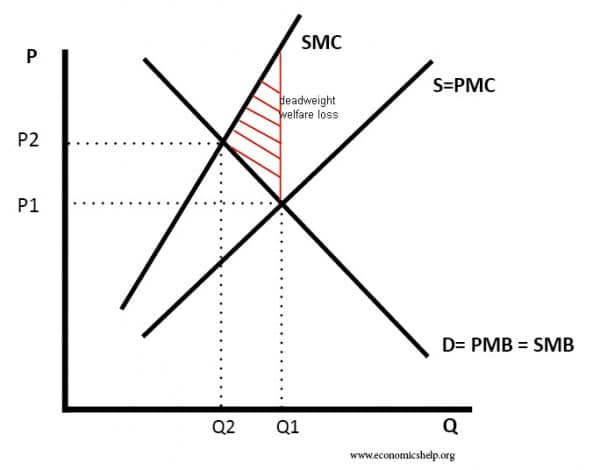

Diagram to show welfare loss of a negative externality

This diagram shows that in a free market (without any tax), we get overconsumption (Q1) of carbon, leading to a welfare loss to society.

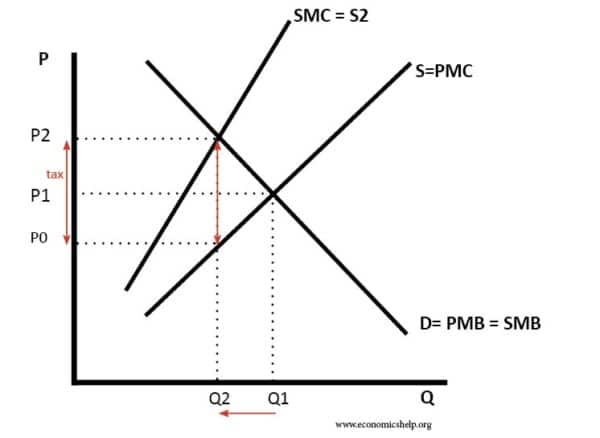

Social efficiency with Carbon Tax

The tax shifts the supply curve from S to S2. With the tax, consumers now face the full social cost (SMC). Quantity falls from Q1 to Q2. Q2 is socially efficient because social marginal cost = social marginal benefit.

Revenue neutral

In theory, a carbon tax could be revenue-neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Arguments for a Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourage firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- It might encourage more people to cycle or walk to work. This would have health benefits such as the lower risk of a heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post-oil economy easier.

2. Raises revenue. The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. Alternatively, a higher carbon tax could be used to reduce other taxes, such as VAT.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption we see in a free market.

4. Improves the environment. With higher taxes, firms will reduce pollution and look for alternatives which have a lower environmental impact. For example, it will make solar power even more competitive than traditional fossil fuels.

5. Evidence of success. Countries which have implemented carbon taxes have seen encouraging results – resulting in lower carbon emissions than would otherwise have occured, and in many cases substantial falls in CO2 emissions. For example, Sweden introduced a carbon tax of €33 per tonne in 1991. Over time, the tax was increased to €120 per tonne. (Some sectors like manufacturing, agriculture and forestry, received a discounted rate). Link – carbon price works in Sweden)

Source: Eurostat, 2018a

Since the mid-1990s emission levels in Sweden has fallen by over 20%, making it one of the more successful EU countries in reducing emissions – despite a period of strong economic growth. This shows a carbon tax can play a role in enabling lower carbon emissions, without holding back economic growth and rising living standards.

Successful implementations of carbon tax/ carbon pricing include

- UK – coal use fell sharply after introduction of a carbon tax of around $25 per ton in 2013. In the UK greenhouse gas emissions have fallen to lowest level since 1890. (NY Times)

- British Colombia (a province of Canada) introduced a scheme in 2008 to charge a levy on carbon. In the first four years of the scheme 2008 and 2012, Karen Tam Wu of the Pembina Institute said “We saw fossil fuel consumption decrease by more than 17% and in the rest of Canada fuel consumption increased by more than 1%,” (link)

- Canada has implemented an ambitious carbon pricing tax (named pollution pricing). In Canada, it has led to higher energy bills, but 90% of proceeds are given to households in the form of tax rebates. The full success of the scheme is not fully evaluated, but it retains popular support

Problems of a Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so-called ‘pollution havens’) This can give developing countries an incentive to encourage production processes which cause pollution, i.e. there is ‘outsourcing’ of pollution.

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- It is difficult to evaluate the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though, over time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be a need for a carbon tax to reflect different abilities to pay.

Evaluation

- To be successful, it depends on how the proceeds of carbon tax is distributed. In British Colombia, Canada, the main proceeds of Carbon pricing go directly to firms households – making the carbon tax quite popular amongst important political constituencies.

- By contrast, Australia’s short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it. Popularity of Carbon Pricing

Carbon Tax vs Cap and Trade

- See: Carbon Trading

Related

I would like to set this on Canada around our country

A carbon tax can only work if there are economic and viable alternatives that people can choose and use. Such alternatives are not available to the majority of people in the western world. Stop using your automobile and use ?????. Many large cities have poor public transportation except into their downtowns. Cool down your house if on natural gas, really? Canada’s proposed carbon tax is a sick joke, one that will not change most behaviors because there simply are no alternatives available.

have you heard of this neat thing called electric and hybrid cars? Chevrolet and Toyota sell them for relativity good prices. A good way to cool down your house is with a geothermal pump (look it up) and if you need transportation to go downtown then just use your bike that’s catching dust in your shed. Thanks and have a wonderful day! 🙂

Funding gathered from the carbon tax can better public transportation and other “necessities” of the developed worlds that you claim are currently unavailable. Additionally, increasing taxes on unwanted practices or pollutants (also commonly known as “sin taxes”) have historically showed change in human behaviors (i.e. increased cigarette taxes lowered consumption in the western hemisphere). I encourage you to look at other countries already implementing this tax- Sweden has successfully been implementing carbon pricing since 1990. Since the introduction of Sweden’s carbon tax consumption of fossil fuels has been decreasing by 2% per year. If you want any additional reading or have any discrepancies I would encourage you to read some of my sources: https://www.theguardian.com/environment/2012/jul/16/carbon-price-tax-cap

http://www.naturvardsverket.se/klimatutslapp

https://www.economicshelp.org/blog/2207/economics/carbon-tax-pros-and-cons/

One of your sources circles back to this page, usually they actually go to another source. You mentioned that the cigarette tax lowered consumption, you should have a source for that, otherwise its just your opinion. You also mention fossil fuels in Sweden have decreased by 2% each year. I will remind you that correlation does not equal causation. While being down by 2% is good it my also be good to look at the other statistics that could be related. Maybe the poor in Sweden have got poorer. Is this also good?

https://ecofiscal.ca/2018/04/11/carbon-pricing-works-in-sweden/

2 second google search. Many many many world economists, and I repeat “economists” support carbon tax as the best method to reduce carbon emissions and continue economic growth.

https://www.google.ca/amp/s/beta.washingtonpost.com/business/2019/01/17/this-is-not-controversial-bipartisan-group-economists-calls-carbon-tax/%3foutputType=amp

There are different ideas of what can happen with the dollars raised whether letting a government make decisions with the money or a dividend paid back out to citizens either through direct deposit or a tax break. Politics are getting in the way of educating people on the actual pros and cons of a system. For example premier Doug Ford’s radio adds and proposed gas station stickers fighting carbon tax without mentioning important elements of how it actually works, or that the numbers used to scare people, were on the absolute high scale of theoretical numbers created by the study that was trying to estimate the cost per household by province. Which is impossible.

https://youtu.be/-ROJZ1PKS-k

No one really knows the true cost of a carbon tax as everything we do is touched by the increased cost of fuel from growing to delivering to heating to cooling to everything! There are no alternatives that work all the time so why??? To collect a tax and provide support for the ipcc and their useless efforts to stop CLIMATE CHANGE! So do we all have to walk, sit in the dark and shiver so the ipcc can have meeting to approve all the raises and STUPID ideas???

Post oil economy really ? Quit counting particles in air and realize the sky isn’t falling .

Post oil is important Dan. Whether you realize it or not, climate change IS HAPPENING. What this means is that measures need to taken in order to combat this, and all of the small changes can and will make a difference. Get your head out of the ground and read the science. Stop being ignorant and take a lot. The sky might not be falling, but it isn’t looking too great for the next generations. Try looking past yourself. Thanks.

No, it really isn’t

Appreciate you assuaging my concerns, I had been worrying about the scientific consensus and its support through increasingly verified research for such a long time. Glad you were able to bat it aside with such minimal effort. Good work.

So who is going to enforce this ridiculous tax? The UN is unable to enforce their own rules. Rogue nations, of course, will not be a part of this insanity. This is another hair-brained scheme by the ultra liberal left.

“Ultra liberal left”

As it turns out, a majority of Americans:

a. understand that climate change is happening

b. understand that humans are the cause

c. are worried about climate change

d. think that clean energy should be a priority for the federal government

e. support a transition to 100% clean energy

I didn’t know that the United States was such an ultra liberal left country.

Source: http://www.theclimatechat.org/americans-on-climate-change

The problems of enforcing the carbon tax are much less complicated if it is levied on the carbon-based fuels (whether domestically extracted or imported), rather than the specific activity of the industry burning it. For example, a company that consumes coal would pay a tax when purchasing this fuel, and then recover at least part of this cost by raising the sale price of the product or energy it sells to consumers.

One other point: There is no practical way for coal-burning power plant to “outsource.”

The idea of a carbon tax will never work. I am in the middle of this debate as I believe climate change is real and even if it is only a temporary shift we can’t afford to take that chance. The carbon tax won’t work as there are no other alternatives. Electric cars make up less than 1% of cars and will be under 10% for the next 10 years. The battery technology is not there yet. But what people are very naive about is nat gas is what is used to generate electric. Nat gas is actually a much cleaner fuel but it gets categorized as a fossil fuel and all fossil fuels must be bad which isn’t true. As there are no energy alternatives to cover even 10% of what the world needs, a carbon tax will never work. The answer is Carbon Capture either through technology or the planting of trees. There are groups reforesting the tropics right now and if they planted enough, it could solve this entire problem. But its never discussed in the media.

I can’t resolve the apparent contradiction between the two goals of tax revenue neutrality and the use of carbon tax to fund the transfer to renewable energy sources.

I believe the French “gilets jaunes” movement was against a price increase designed to wean people away from fossil fuels. There was no revenue neutrality, it made the poor poorer and they rejected it.

The Green New Deal suggests giving the whole of society tangible benefits from the energy revolution in order to help them support it. It seems a cleverer way.

hi im using this for an essay

can you share your source with me maybe

sources* i need them for a debate

Most people realize that government legislation cam greatly help with the reduction of carbon emissions. Mandatory emission scrubbers for industrial operations, legislating the phasing out of the domestic sales of gasoline only personal vehicles and Geothermal energy augmentation for residential and industrial use. In many parts of urban Canada people have to commute to work farther and farther distances. A carbon tax on gasoline will not change a commuters carbon foot print. An application of a carbon tax on low polluting natural gas for home heating will not reduce furnace use in the winter. Though it was vaguely hinted upon, the flaw in carbon taxing is the failure to recognize a relation to personal income stress. Ie. The lower your income, the increase in financial stress from a carbon tax. Any alleged tax returns from carbon taxes to citizens are not comparable to the increased cost of living. Green Clean Emission Legislation I stead of taxation!

Your logic would make sense if you live in the city. most pollution comes from large factories, agriculture, transportation of products or mass amounts of people ex: planes, boats trains.