A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. In theory, the tax will reduce pollution and encourage more environmentally friendly alternatives. However, critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

The purpose of a carbon tax

The purpose of a carbon tax is to internalise this externality. What this means is that the final price of the good should include the external costs and not just the private cost. It is similar to the ‘polluter pays principle.‘ – which was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

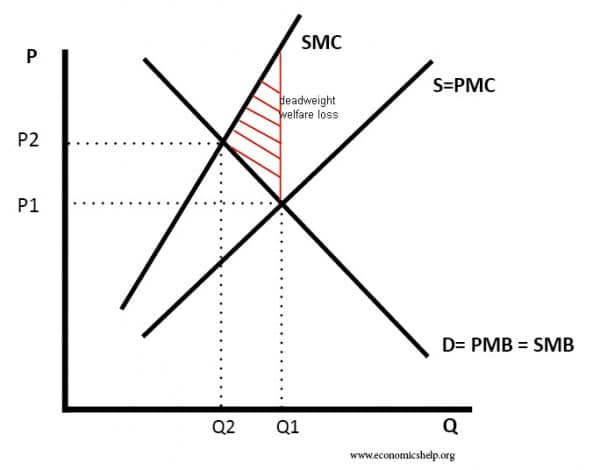

Diagram to show welfare loss of a negative externality

This diagram shows that in a free market (without any tax), we get overconsumption (Q1) of carbon, leading to a welfare loss to society.

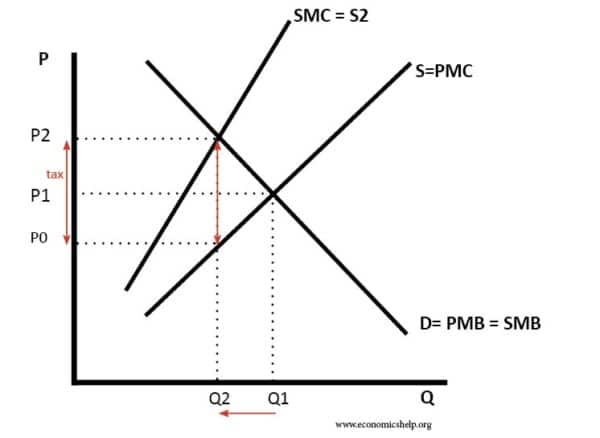

Social efficiency with Carbon Tax

The tax shifts the supply curve from S to S2. With the tax, consumers now face the full social cost (SMC). Quantity falls from Q1 to Q2. Q2 is socially efficient because social marginal cost = social marginal benefit.

Revenue neutral

In theory, a carbon tax could be revenue-neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Arguments for a Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourage firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- It might encourage more people to cycle or walk to work. This would have health benefits such as the lower risk of a heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post-oil economy easier.

2. Raises revenue. The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. Alternatively, a higher carbon tax could be used to reduce other taxes, such as VAT.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption we see in a free market.

4. Improves the environment. With higher taxes, firms will reduce pollution and look for alternatives which have a lower environmental impact. For example, it will make solar power even more competitive than traditional fossil fuels.

5. Evidence of success. Countries which have implemented carbon taxes have seen encouraging results – resulting in lower carbon emissions than would otherwise have occured, and in many cases substantial falls in CO2 emissions. For example, Sweden introduced a carbon tax of €33 per tonne in 1991. Over time, the tax was increased to €120 per tonne. (Some sectors like manufacturing, agriculture and forestry, received a discounted rate). Link – carbon price works in Sweden)

Source: Eurostat, 2018a

Since the mid-1990s emission levels in Sweden has fallen by over 20%, making it one of the more successful EU countries in reducing emissions – despite a period of strong economic growth. This shows a carbon tax can play a role in enabling lower carbon emissions, without holding back economic growth and rising living standards.

Successful implementations of carbon tax/ carbon pricing include

- UK – coal use fell sharply after introduction of a carbon tax of around $25 per ton in 2013. In the UK greenhouse gas emissions have fallen to lowest level since 1890. (NY Times)

- British Colombia (a province of Canada) introduced a scheme in 2008 to charge a levy on carbon. In the first four years of the scheme 2008 and 2012, Karen Tam Wu of the Pembina Institute said “We saw fossil fuel consumption decrease by more than 17% and in the rest of Canada fuel consumption increased by more than 1%,” (link)

- Canada has implemented an ambitious carbon pricing tax (named pollution pricing). In Canada, it has led to higher energy bills, but 90% of proceeds are given to households in the form of tax rebates. The full success of the scheme is not fully evaluated, but it retains popular support

Problems of a Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so-called ‘pollution havens’) This can give developing countries an incentive to encourage production processes which cause pollution, i.e. there is ‘outsourcing’ of pollution.

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- It is difficult to evaluate the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though, over time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be a need for a carbon tax to reflect different abilities to pay.

Evaluation

- To be successful, it depends on how the proceeds of carbon tax is distributed. In British Colombia, Canada, the main proceeds of Carbon pricing go directly to firms households – making the carbon tax quite popular amongst important political constituencies.

- By contrast, Australia’s short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it. Popularity of Carbon Pricing

Carbon Tax vs Cap and Trade

- See: Carbon Trading

Related

In 1973 I was told by lecturer at LaTrobe University that CO2 was warming up the globe. We are currently having a normal cold and wet winter. Four weeks ago Ms Gillard told Parliament that at present there is the greatest concetration of CO2 in the atmosphere for the last million years. Really, when is the globe going to start to warming up?

Hi Paul,

just because you don’t see it or actually u choose not to see it does not mean there is no change in the world’s weather patterns. The polar ice is melting, there are category 5 hurricanes one after the other, drought in a quarter of the world, people in some countries find it difficult to come out without wearing a face mask and temperature at some places has risen by a few degrees and you ask when is the globe going to start warming up? I refuse to believe that a well read person like you is so ignorant.

Who wrote this? I need to reference in an assignment. Thanks.

Tejvan Pettinger, Oxford, UK

I think everyone should stop blaming CO2 on global warming and carbon tax WON’T encourage us to walk because the tax isn’t on us!!

The tax Will be on us. Don’t you think the price of gas at the pumps will go up because it will cost the manufacturers more money to produce? And since we already pay tax on gas, we’ll be paying more tax.

After reading the article along with its many comments i conclude that no one really knows how this trial and error ‘solution’ will pan out, (assuming that there is a problem in the first place). For instance how will the consumers of Australia really react to this proposed tax if it goes ahead?… we don’t know. This is why it is of such controversial nature, people are worried about the implications it will have on them, with such high costs of living i certainly wouldn’t want to start forking out money for a questionable purpose, however this is just one of the many assumptions that we are plagued with in this time of uncertainty.

For this tax to have any credibility certain questions and statements must be answered, am i the only one that thinks this a ‘stab in the dark’ attempt of fixing the ‘problem’, i say ‘problem’ because carbon emmisions are in itself a highly debateable topic, there is yet to be factual solid evidence that co2 emmisions are a direct cause of global warming.

For the people of Australia and indeed the greater world, how will this impact you? will the tax on major producers be handed down to consumers? Will both producers and consumers change their ways in order to make room for an environmentally sustainable world…. can they? Does Australia have the proper policies and guidlines in place to support such a tax proposal?

Everyone is entitled to their own oppinion on the subject, and as such no one person is correct, all i ask is that you do your homework before making a decision, to truly solve this issue (providing there is one) we need to come together as a whole and unite to negotiate for a fairer more stable and secure outcome that will benefit everyone as well as the environment.

Thankyou for your time.

Leon.C

its really all about a changing of the guard ie., cultural & class

overturning of the paradigm so to speak.

Carbon Tax is more about politics rather than the environment ultimately.

polution has nothing or little to do with it all.

What’s all this talk on global ‘warming’? The winters are getting extremely cold too – there is no warming, the weather’s going totally extreme.

Not sure what a tax will do about that…

But thankyou for the pros and cons and other info about carbon tax. It was really helpful. Its good to be educated on these things.

It’s not global warming. Its climate change, meaning not that our globe is beginning to warm, but also that we’re experiencing extreme temperatures from cold to warm. And not only that but also that it’s causing disruptions in ocean currents, and wind currents. You may not think this is serious but it’s changing the way the world even functions. Furthermore, climate change is causing the molecular formula of the ocean to change and become more acidic which is then causing reefs and aquatic life to deteriorate. Climate change is also causing the rising sea level, and thousands of species to be lost because they have to migrate to the poles where it’s cooler. You can choose to believe that climate change isn’t happening, but it is, and faster than anyone could have ever predicted.

Greenhouse gases create a barrier around the ozone layer. Normally the the sun’s says are able to mostly bounce off the clouds and go back into space. However, these greenhouse gases create this barrier and instead of allowing the sun’s rays to escape they are bounced back into the earth once again. One of the most significant greenhouse gases is carbon dioxide because it has increased so much. Yes, the world needs carbon dioxide to function, but you don’t want too much of a good thing. Our human influence on the earth is causing the carbon dioxide amounts to increase. People who believe that most of the carbon dioxide is naturally made, you should check you stats because I’m pretty sure that’s impossible with the increase in industrial factories all around the world. Are you aware of just how much carbon dioxide is released from the industrial world? How can you say we’re not impacting our world?

Now, I’m not saying I completely agree with the carbon tax. I believe it is a good idea because big companies are moved by money. Therefore if they’re losing a lot of revenue because of this carbon tax they will find a way to produce power without producing so much carbon. However, I don’t believe this will be effective unless countries all around the world make this decisions together. It won’t be effective if Canada introduces this tax but the United States doesn’t when they’re neighboring countries. In conclusion, I believe that the carbon tax could be very impactful if many countries band together.

Grade 1…….. Nuf’ said

Carbon tax will do nothing but pass increased costs on to consumers.

This will raise prices and therefore taxes on goods.

My company will move overseas.

How about carbon reduction intensives instead??