A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. In theory, the tax will reduce pollution and encourage more environmentally friendly alternatives. However, critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

The purpose of a carbon tax

The purpose of a carbon tax is to internalise this externality. What this means is that the final price of the good should include the external costs and not just the private cost. It is similar to the ‘polluter pays principle.‘ – which was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

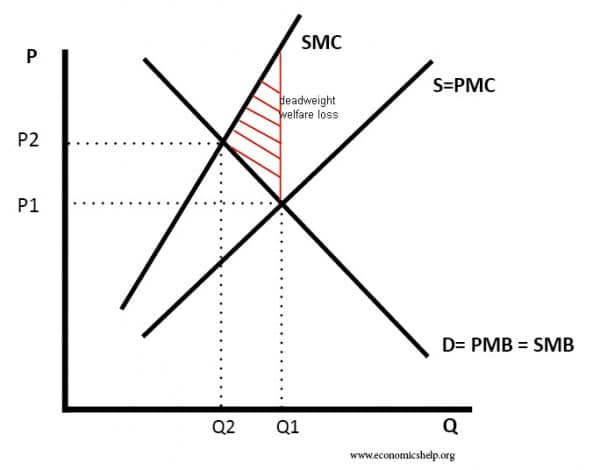

Diagram to show welfare loss of a negative externality

This diagram shows that in a free market (without any tax), we get overconsumption (Q1) of carbon, leading to a welfare loss to society.

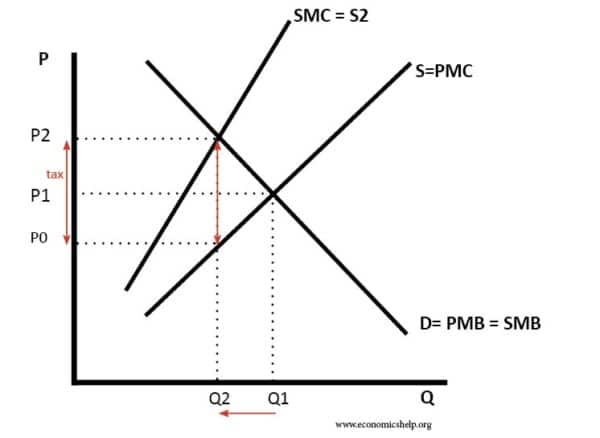

Social efficiency with Carbon Tax

The tax shifts the supply curve from S to S2. With the tax, consumers now face the full social cost (SMC). Quantity falls from Q1 to Q2. Q2 is socially efficient because social marginal cost = social marginal benefit.

Revenue neutral

In theory, a carbon tax could be revenue-neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Arguments for a Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourage firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- It might encourage more people to cycle or walk to work. This would have health benefits such as the lower risk of a heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post-oil economy easier.

2. Raises revenue. The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. Alternatively, a higher carbon tax could be used to reduce other taxes, such as VAT.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption we see in a free market.

4. Improves the environment. With higher taxes, firms will reduce pollution and look for alternatives which have a lower environmental impact. For example, it will make solar power even more competitive than traditional fossil fuels.

5. Evidence of success. Countries which have implemented carbon taxes have seen encouraging results – resulting in lower carbon emissions than would otherwise have occured, and in many cases substantial falls in CO2 emissions. For example, Sweden introduced a carbon tax of €33 per tonne in 1991. Over time, the tax was increased to €120 per tonne. (Some sectors like manufacturing, agriculture and forestry, received a discounted rate). Link – carbon price works in Sweden)

Source: Eurostat, 2018a

Since the mid-1990s emission levels in Sweden has fallen by over 20%, making it one of the more successful EU countries in reducing emissions – despite a period of strong economic growth. This shows a carbon tax can play a role in enabling lower carbon emissions, without holding back economic growth and rising living standards.

Successful implementations of carbon tax/ carbon pricing include

- UK – coal use fell sharply after introduction of a carbon tax of around $25 per ton in 2013. In the UK greenhouse gas emissions have fallen to lowest level since 1890. (NY Times)

- British Colombia (a province of Canada) introduced a scheme in 2008 to charge a levy on carbon. In the first four years of the scheme 2008 and 2012, Karen Tam Wu of the Pembina Institute said “We saw fossil fuel consumption decrease by more than 17% and in the rest of Canada fuel consumption increased by more than 1%,” (link)

- Canada has implemented an ambitious carbon pricing tax (named pollution pricing). In Canada, it has led to higher energy bills, but 90% of proceeds are given to households in the form of tax rebates. The full success of the scheme is not fully evaluated, but it retains popular support

Problems of a Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so-called ‘pollution havens’) This can give developing countries an incentive to encourage production processes which cause pollution, i.e. there is ‘outsourcing’ of pollution.

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- It is difficult to evaluate the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though, over time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be a need for a carbon tax to reflect different abilities to pay.

Evaluation

- To be successful, it depends on how the proceeds of carbon tax is distributed. In British Colombia, Canada, the main proceeds of Carbon pricing go directly to firms households – making the carbon tax quite popular amongst important political constituencies.

- By contrast, Australia’s short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it. Popularity of Carbon Pricing

Carbon Tax vs Cap and Trade

- See: Carbon Trading

Related

The Carbon tax is not fair and inefficient. The biggest polluters are the coal power stations. If you impose a carbon tax on them they will simply raise the price of electricity as them have been doing, that is pass it on to the consumers. Also compensating low income earners does nothing for people on a middle income who have a big mortgage and are battling. I wonder who favour a carbon tax if it meant price rise may lead to one losing their house or job. The solution is to go nuclear. Using Th-232 as a fuel will cause virtually no radioactive waste and these nuclear power stations cannot possibly lead to a meltdown like in Japan.

hi everyone i like to mention that if you put a carbon tax on polutors it will include coal & the steelindustry which have very high exports , which they will lose to other countries , which will mean a loss of jobs, also how are the poluters going to be able to pay to change there ways as well as the tax, lastley the world should all have a tax then it would be a even playing field. tax will not be passed

ray

the goverment dons how dare they don in my country

get a job!

all the goverment does is don how dare they don in bill sakalis’s country.

GET A JOB!

Carbon tax is not helping and there are no cons for it as far as I have seen. in the first dot point in benefits of carbon tax it is not true. there could be people who work on the other side of the city from their home and they would have to leave very early in the morning to get to work. And what about families who have to transport their kids. So we still need to be using carbon but if we have to pay tax then we’re done for anyway because we would have to be paying lots of money and with inflation prices for everything will be going up. The worlds going to heck in a hand basket

I enjoy reading your blog.Everything is perfectly explained and that’s make it very understandable.I find it interesting too so I will definitely visit here again to see more great ideas from other commentators.Thanks!

Why is it that the pro carbon tax advocates either can not or will not provide a clear simple answer as to why we need a carbon tax and how it will help the environment. I personally believe there are many more things to help the environment that are more important, are proven effective and can be willingly done by everyone. Enough of the smoke and mirrors and other BS.

You should talk bout the truth of carbon tax.

please.

There are no pros to the carbon tax. IT is negative to EVERYONE except those producing these so-called poisonous gases. (carbon of course is an essential element for life to exist on earth – ask any tree or bush what photosynthesis is all about).

The large polluters will end up profiteering from the implementation of such a tax as they will pass their costs onto the consumers down the line and we will all end up paying a lot more for EVERYTHING.

This government MUST GO

A good solution is the “carbon fee and dividend”. It has been called a tax, but that is a little misleading .

In this scenario, Carbon is assigned a fee per ton. The fee is collected and returned to the tax payer to compensate for higher energy prices. So don’t even tell me it’s going to cost the taxpayer, because, unless your are an oil hog, it won’t.

It is expected that the added costs of carbon will shift the market to renewables. So, it’s no big scheme to rip you off. The money is returned.

The fees should be there anyway. Why? Carbon’s true externalities – or hidden costs-actually are quite high, but Shell or Exxon doesn[t pay them. We do. The cost of pollution was estimated, by real economists (not Joe the Plumber), at about $.20/kwh.

BTW: I have been involved with about 5 rooftop solar projects. All involved are happy with them, and it will return about 10 x of the investment, in 25 years. It doesn’t kill people either, another difference between fossil fuels and renewables.

Good job i am a grade 5 and are copying and pasting for my Plus Minus and Interesting project thanx!!!

In the light of the fact that the volcano in Iceland put out more pollution than for the whole of time, and now the volcano in Chile not much less, saying nothing for the hundreds of other volcanoes

…

blowing their tops, Humans have a long way to go to beat mother nature.

Australias contribution [see below] is really significant!! NOT!!!

MAKES ONE ASK WHAT DO THEY REALLY WANT TO DO WITH THE EXTRA MONEY THEY WILL TAKE FROM THE TAX PAYERS .

Subject: Carbon Facts vs. Carbon Tax

Let’s put this into a bit of perspective for laymen!

ETS is another tax. It is equal to putting up the GST to 12.5% which would be unacceptable and produce an outcry.

Read the following analogy and you will realize the insignificance of carbon dioxide as a weather controller.

Pass on to all in your address book including politicians and may be they will listen to their constituents, rather than vested interests which stand to gain by the ETS.

Here’s a practical way to understand Julia Gillard Carbon Pollution Reduction Scheme.

Imagine 1 kilometre of atmosphere and we want to get rid of the carbon pollution in it created by human activity. Let’s go for a walk along it.

The first 770 metres are Nitrogen.

The next 210 metres are Oxygen.

That’s 980 metres of the 1 kilometre. 20 metres to go.

The next 10 metres are water vapour. 10 metres left.

9 metres are argon. Just 1 more metre.

A few gases make up the first bit of that last metre.

The last 38 centimetres of the kilometre – that’s carbon dioxide. A bit over one foot.

97% of that is produced by Mother Nature. It’s natural.

Out of our journey of one kilometre, there are just 12 millimetres left. Just over a centimetre – about half an inch.

That’s the amount of carbon dioxide that global human activity puts into the atmosphere.

And of those 12 millimetres Australia puts in .18 of a millimetre.

Less than the thickness of a hair. Out of a kilometre!

As a hair is to a kilometre – so is Australia ‘s contribution to what Julia Gillard calls Carbon Pollution.

Imagine Brisbane ‘s new Gateway Bridge , ready to be opened by Julia Gillard. It’s been polished, painted and scrubbed by an army of workers till its 1 kilometre length is surgically clean. Except that Julia Gillard says we have a huge problem, the bridge is polluted – there’s a human hair on the roadway. We’d laugh ourselves silly.

There are plenty of real pollution problems to worry about.

It’s hard to imagine that Australia ‘s contribution to carbon dioxide in the world’s atmosphere is one of the more pressing ones. And I can’t believe that a new tax on everything is the only way to blow that pesky hair away.

And they want you to accept this snake oil. Stand Up be counted and tell your MP its all hot air

Best analogy ever!

When are the thickheads ever going to get it through their skulls??

So if i throw a bit of oil on that 1km of road it won’t have any effect but if i constantly throw oil on it what would happen to that road and to the people who will drive on it?

Fat is natural eating a bit is no problem but what happen if you keep eating it? So is all the doctors wrong about eating to much fatty food is bad for you?

Hi, I just wanted to thank you for providing the pros and cons of carbon tax. You helped me alot for my essay (it’s being sent to a selective school I am applying for). If I got good marks, I owe you credit, but don’t worry because I didn’t copy and paste. Thank you; it was very thorough and well arranged.

Your economic theory is very simplistic and does not take into acount the variables which are part of the real world. The modelling done by evironmental scietists is just as simplistic. The carbon tax is a regressive tax. The government wants expand the tax base and, like the GST, it will fall more heavily on low income earners. Economic theory is irrelevant for MS Gillard. She needs the money to reduce the deficit, pay for the things she promised the indipendent MPs and the Greens, who are keeping her in power.