A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. In theory, the tax will reduce pollution and encourage more environmentally friendly alternatives. However, critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

The purpose of a carbon tax

The purpose of a carbon tax is to internalise this externality. What this means is that the final price of the good should include the external costs and not just the private cost. It is similar to the ‘polluter pays principle.‘ – which was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

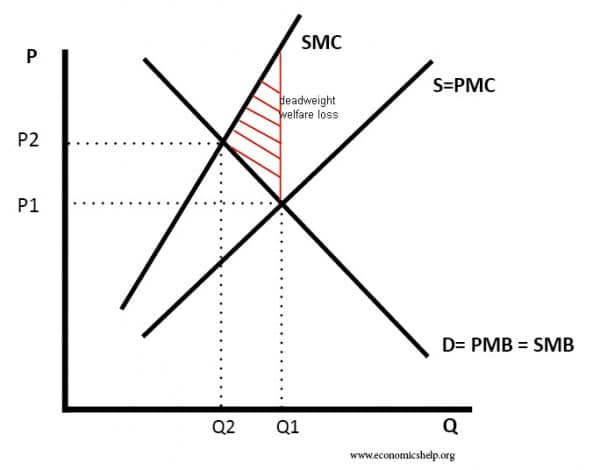

Diagram to show welfare loss of a negative externality

This diagram shows that in a free market (without any tax), we get overconsumption (Q1) of carbon, leading to a welfare loss to society.

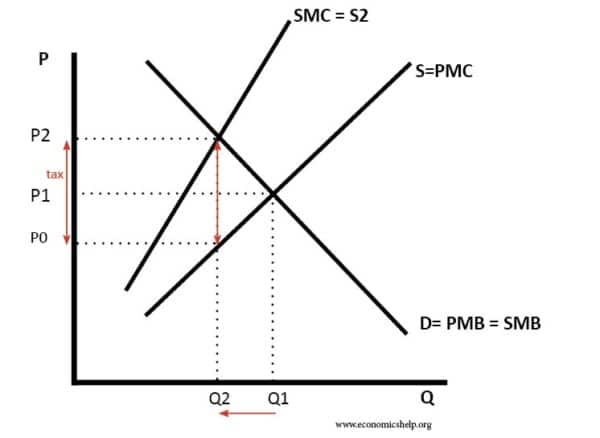

Social efficiency with Carbon Tax

The tax shifts the supply curve from S to S2. With the tax, consumers now face the full social cost (SMC). Quantity falls from Q1 to Q2. Q2 is socially efficient because social marginal cost = social marginal benefit.

Revenue neutral

In theory, a carbon tax could be revenue-neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Arguments for a Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourage firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- It might encourage more people to cycle or walk to work. This would have health benefits such as the lower risk of a heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post-oil economy easier.

2. Raises revenue. The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. Alternatively, a higher carbon tax could be used to reduce other taxes, such as VAT.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption we see in a free market.

4. Improves the environment. With higher taxes, firms will reduce pollution and look for alternatives which have a lower environmental impact. For example, it will make solar power even more competitive than traditional fossil fuels.

5. Evidence of success. Countries which have implemented carbon taxes have seen encouraging results – resulting in lower carbon emissions than would otherwise have occured, and in many cases substantial falls in CO2 emissions. For example, Sweden introduced a carbon tax of €33 per tonne in 1991. Over time, the tax was increased to €120 per tonne. (Some sectors like manufacturing, agriculture and forestry, received a discounted rate). Link – carbon price works in Sweden)

Source: Eurostat, 2018a

Since the mid-1990s emission levels in Sweden has fallen by over 20%, making it one of the more successful EU countries in reducing emissions – despite a period of strong economic growth. This shows a carbon tax can play a role in enabling lower carbon emissions, without holding back economic growth and rising living standards.

Successful implementations of carbon tax/ carbon pricing include

- UK – coal use fell sharply after introduction of a carbon tax of around $25 per ton in 2013. In the UK greenhouse gas emissions have fallen to lowest level since 1890. (NY Times)

- British Colombia (a province of Canada) introduced a scheme in 2008 to charge a levy on carbon. In the first four years of the scheme 2008 and 2012, Karen Tam Wu of the Pembina Institute said “We saw fossil fuel consumption decrease by more than 17% and in the rest of Canada fuel consumption increased by more than 1%,” (link)

- Canada has implemented an ambitious carbon pricing tax (named pollution pricing). In Canada, it has led to higher energy bills, but 90% of proceeds are given to households in the form of tax rebates. The full success of the scheme is not fully evaluated, but it retains popular support

Problems of a Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so-called ‘pollution havens’) This can give developing countries an incentive to encourage production processes which cause pollution, i.e. there is ‘outsourcing’ of pollution.

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- It is difficult to evaluate the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though, over time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be a need for a carbon tax to reflect different abilities to pay.

Evaluation

- To be successful, it depends on how the proceeds of carbon tax is distributed. In British Colombia, Canada, the main proceeds of Carbon pricing go directly to firms households – making the carbon tax quite popular amongst important political constituencies.

- By contrast, Australia’s short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it. Popularity of Carbon Pricing

Carbon Tax vs Cap and Trade

- See: Carbon Trading

Related

Can you briefly talk about how those external costs are valued? Through surveys? Standard statistical analysis? Also, can you list some of the key contributors to this field, and what they contributed?

Thanks,

Enjoying the blog…

You were rather vague in your pros of the carbon tax, if you could please add some more organized pros, as you have done for your cons. You speak of what carbon tax is and briefly touch on it’s expected efficiency, however you never actually spoke of the pros.

BC shows positive carbon tax results

The early results of BC’s carbon tax are in, and the results are promising. As Stewart Elgie, one of the founders of Sustainable Prosperity notes in an op-ed in the Ottawa Citizen, the BC carbon tax has been a success on many levels:

The BC carbon tax puts a price on carbon emissions. The price is currently $20/tonne of CO2, rising at $5 annually.

Fiscally, the tax is a success because it has remained revenue neutral – in other words, the revenue raised by the tax has not added to government tax revenues. In fact, the tax has been more than matched by tax cuts and credits – in 2008 and 2009, the tax raised $846 million, and the cuts and credits for taxpayers totaled almost $1.1 billion. Furthermore, the tax does not appear to have hurt BC’s economy – BC’s rate of economic growth post-tax is higher than Canada’s, and unemployment does not appear to have increased following the tax. From a policy perspective, unlike most other taxes, the BC carbon tax succeeds in discouraging “bads” rather than “goods”, thereby incenting behaviour that is less carbon intensive. And from an environmental perspective, the projections are that the tax will lower the province’s emissions by 5%.

Tom Heintzman

President, Bullfrog Power

——————————————————————————–

you forget – carbon dioxide is not a pollutant – there IS no Pros in regard to a carbon tax other than creating a new marketplace for a non existant “product” ie carbon credits ( ah -banks will love it!)

there are no “pros” for a carbon tax, it is simply a way to transfer wealth and slow development of the middle class.

Yes… you forgot the pros. The cons are rather minor as they can mostly be addressed through better public policy.

I support a carbon tax 100%.

That said to be effective a carbon tax must be as simple and fair as possible – avoiding a trading scheme and over genrous compensation to polluters.

It must return most of the revenue to ordinary taxpayers through credits and tax cuts and it must make sure any additional revenue is invested in the most effective measure to cut carbon pollution.

Lastly it must be sold as necessary as forward looking and as fair to all involved.

An excellent analysis, though I tend to agree with Caitlin that the Pros should be expressed as clearly as the Cons.

@Mark and dilby – please refer us to one single piece of peer-reviewed research that backs your claims. Until then you opinions are invalid.

It might also make it more accessible for non-economists if you labeled you graphs.

Carbon tax is not easily acceptable but it is one way for us to do something.

I say Gods in control of all these things, especially global warming. The world will end soon whether we have a carbon tax or not, Jesus will come and take his family home

Hilarious joke Mitchell!

I thought the blog was pretty clear, though unfortunately I’m not sure if it will make it into parliament.

But here’s hoping!!

@Mitchell – in’shalla

or summit like that

Are there any actual proof that the carbon tax has reduced the CO2 levels and of curse the climate has improved? If this tax fails the objective then it will be nothing but short of a disaster. The inflation will be rampent and the Pollies will pocket or squander the money. I prefer a more direct approach such as encouraging sustainable and renewable energy schemes such as planing trees, installing solar power etc.

In my grade 12 economics class we are doing an assignment on an event that has impacted the economy and the intervention by the Australian government in attempt to control it. Students have either chosen the 2011 Floods and the flood levy or global warming and the carbon tax. After studying so much about it, not taking into account peoples opinions and beliefs, it is amazing how many people miss the facts in this situation. Please add more pros into your research, regarding that it is based on actual facts. Great explanation though.