Originally published in March 2015. Current inflation rate (Feb 2020) is 1.3%. I was 0.7% out.

But there was no skill in predicting inflation of 2%. If Ii had to predict inflation for 2025, I would predict the same = 2%.

Reader’s Question: What will be the inflation rate in 2020?

Firstly, I can’t resist a few economics ‘jokes’

- “An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today. “

- “The First Law of Economists: For every economist, there exists an equal and opposite economist.”

- The Second Law of Economists: They’re both wrong.

- Q:Why did God create economists ?

- A: In order to make weather forecasters look good.

To be honest, it is very difficult to make inflation forecasts for more than 12-18 months time. I feel that if you make inflation forecasts for 5 years in advance, you are really just guessing.

There are so many different scenarios which could happen in the next five years, which we can’t envisage at the moment.

My Guess for inflation in 2020

After making a sufficiently long list of disclaimers, I’m happy to stick my neck out on the line and make the rather unexciting prediction that inflation will be 2%. (which happens to the government’s target for CPI inflation). The reason for this prediction is:

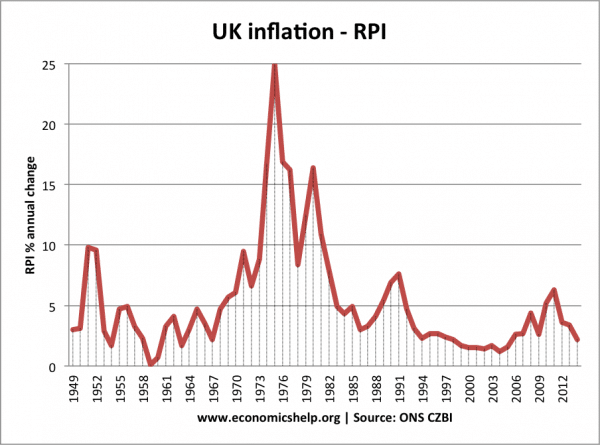

Generally, we have become quite good at keeping inflation low. The peak in inflation in 2010 to 5% is misleading, because it was just temporary cost-push inflation in the middle of a recession. Since the 1980s, we haven’t seen any significant demand-pull inflation.

Inflation is more likely to be low because:

- The Bank of England was made independent in 1997. (Previously government set interest rates). Independent Central Banks are willing to take politically unpopular decisions to raise interest rates before an election reducing chance of boom and bust. Independent Central Banks are judged on their success in keeping inflation low, so they don’t want to lose their ‘low inflation credibility’.

- Inflation expectations have fallen. It would take a big change in the economy (like the cost-push inflation of 1970s) to really shift inflation expectations upwards.

- There is a strong will to reduce inflation. For example, Europe has tolerated very high levels of unemployment and prolonged economic stagnation – but they wouldn’t tolerate high inflation. I don’t see this changing, there is a very strong consensus on keeping inflation low amongst mainstream economists and politicians.

- Continued improvements in technology and greater competitiveness of markets (e.g. see how competitive supermarkets have become in past few years.)

The greater concern is that we entering a period of disinflation – very low inflation, below the government’s target of 2%. Experience of the past few years and the experience of Japan suggests that these periods of very low inflation can be self-fulfilling and take a long time to get out of.

Long Range Inflation Forecasts may try to take these issues into account.

- Are we entering a new era of macroeconomic stability, where central banks have finally mastered the art of managing the economy? The medium-term prospects for greater economic stability are quite promising in this regard. People are already suggesting that the boom and bust economic cycle are a thing of the past in the UK

- Will a shortage of raw materials cause cost-push inflation? or will alternatives be found?

- To what extent will new technology continue to lower costs?

- Will global warming cause a shortage of food and water, therefore pushing up prices of basic necessities?

- Will overpopulation cause demand to rise faster than supply

Bank of England forecasts

This is probably not what you wanted to hear. But, the Bank of England will only publish inflation reports for up to 3 years in the future. Bank of England – inflation – As they get further in the future, they state their inflation forecasts become less reliable

The Bank of England also publishes inflation forecasts as an inflation fan. This means that over time there is a greater likelihood of their forecasts being wrong and diverging from their predictions.

Related

I feel better now 🙂 I just graduated in Economics and people stared to call me an Economist and ask for advises, like I can predict the future or something!! I was starting to freak out but I feel better after reading this…

Yes, and good economists will never forget they are fallible.

and better still new economists should know how to spell advice…

I couldn’t help but chuckle (reading in 2009), that sentence.

“People are already suggesting that the boom and bust economic cycle are a thing of the past in the UK.”

*chuckle* Thanks for the article though!

I’m starting to think that it may be a good idea politically to try and push UK inflation up to about 8% as the time lag in salaries and unemployment should allow employers to restrain pay demands and it’ll cheapen UK national debt. Hmm… now if only there was any evidence to back it up!

@pa, you may know that there is not just one way of proper spelling, I find your comment a bit out of place.

http://www.merriam-webster.com/dictionary/advise

Yes but ‘to advise’ is a verb whereas ‘advice’ is a noun.

Anyone consider that petrol prices might be a key factor in the increasing RPI and that this is likely to be a continuing upward trend as the price of fuel increases at the rapid rate is has already been.