A list of different types of economic policies.

- Monetary policy

- Fiscal policy

- Supply-side policies

- Microeconomic policies – tax, subsidies, price controls, housing market, regulation of monopolies

- Labour market policies

- Tariff/trade policies

Demand-side policies

Policies for influencing aggregate demand and expenditure in the economy. This mainly involves fiscal and monetary policy.

Fiscal policy

Government changes to taxation and spending levels to influence aggregate demand.

- Expansionary fiscal policy – higher levels of spending and/or lower tax rates. Extra spending financed by higher government borrowing. The aim is to increase aggregate demand in a depressed economy.

- Tight fiscal policy – Government spending cuts and/or tax rises. The aim is to reduce inflationary pressure or reduce the budget deficit. Could cause lower economic growth.

Monetary policy

Influencing the supply and demand for money through changing interest rates and the money supply. Monetary policy is usually managed by the Central Bank, though governments have oversight and may set an inflation target.

- Expansionary monetary policy – Cutting interest rates to make borrowing cheaper and boost spending. The aim is to increase the rate of economic growth.

- Tight monetary policy – Raising interest rates to make borrowing more expensive and reduce spending and inflationary pressures.

- Quantitative easing. A monetary policy that involves the creation of money by Central Bank and using it to buy bonds. The aim is to increase the money supply and reduce interest rates.

- Helicopter money. A monetary policy that involves the creation of money and directly injecting the money into the economy.

Exchange rate policy

If a country is in a fixed or semi-fixed exchange rate than changing the exchange rate is a policy to affect the macroeconomy. Even in a floating exchange rate system, the government may try to unofficially influence the exchange rate, e.g. changing interest rates or buying/selling currency

- Devaluation. A devaluation aims to boost export demand and higher economic growth. Devaluation may lead to inflation

- Appreciation. Raising the value of the exchange rate might be pursued in order to try and reduce the inflation rate.

Policies for Financial stability

This involves policies to manage the financial sector and avoid bank runs and liquidity shortages. It can involve

- Reserve ratios – a minimum ratio of deposits that banks should keep in cash. A higher reserve ratio provides more stability to the banking sector

- Lender of last resort. Having a central bank able to bailout out banks short of liquidity helps to maintain confidence in the banking system and avoid bank runs.

Trade policy

- A government’s trade policy may be to seek free-trade deals and the reduction of tariffs or a government may pursue a form of protectionism (e.g. higher tariffs). See Benefits and costs of tariffs

- It could also involve joining trading blocks and areas of economic unions, such as the EU. This enables not just a reduction in tariffs but non-tariff barriers too.

Supply-Side Policies

Supply-side policies are policies aimed at increasing productivity and efficiency in the economy. The can involve

Free-market policies – efforts to reduce government interference in the running of markets. For example

- Privatisation of state-owned assets

- Deregulation of monopolies

- Lower tax rates to increase incentives for workers and companies.

Interventionist supply-side policies – government intervention in the market to overcome market failure. For example

- Government spending on education and training.

- Government investment in new broadband 5G infrastructure

- Government provision of public goods, such as flood defences.

Policies for developing economies

- Structural adjustment – Policies promoted by IMF, such as privatisation, better tax collection and reduced budget deficit.

- Diversification away from primary products – May involve tariff protection whilst new industries are developed.

- Attracting investment from overseas.

- Foreign aid. Using foreign aid to increase capital investment

- See: Policies for economic development

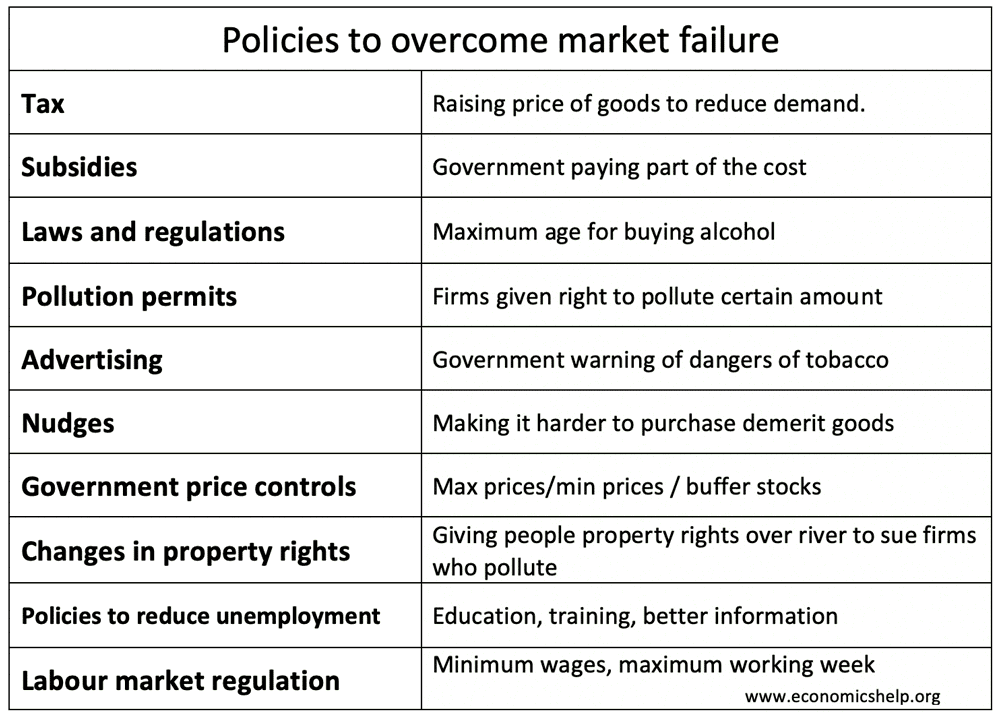

Microeconomic policies

Regulation of monopoly power

- Merger policy – government bodies (e.g. CMA in the UK) will look at proposed mergers and decide whether they are in the public interest.

- Unfair competitive practises. – a government body which can investigate potential abuses of market power (e.g. OFT in the UK) This can include

- Preventing excess prices, vertical restraints and creating artificial barriers to entry.

Taxation of negative externalities

To attain greater social efficiency the government can tax goods which have negative externalities. The aim of the policy is to make consumers and producers pay the social cost of the good. Types of tax

Subsidy of positive externalities

To attain greater social efficiency the government can subsidies goods with have positive externalities, e.g. green energy from solar power. This should reduce cost and encourage consumption. Subsidies

Government price control

Government price controls are policies to influence market prices. They can include

- Buffer stocks. Government intervention to avoid price fluctuations with the use of buying surplus to maintain a price floor and selling to prevent high prices.

- Minimum prices – legal minimum price to try and maintain certain income for farmers, e.g. CAP price support or minimum price for demerit goods like alcohol.

- Maximum prices – legal maximum price. For example to try and prevent excess prices for renting.

Behavioural economics

- Nudges – policies to subtly shift consumer behaviour, e.g. making it harder to buy cigarettes.

Labour market policies

- Minimum wages – statutory legal minimum wage

- Maximum working weeks

- Legislation to prevent zero-hour contracts

- Free child care support

- Progressive tax and benefit system to reduce poverty.

Related

- Economic stimulus packages

- Policies to reduce a current account deficit

- Policies to ease pressure on the housing market

- Policies to kickstart the economy

- Beggar my neighbour policies

- Thatcher’s economic policies of the 1980s

- Policies for dealing with economic shocks

- Policies to reduce smoking

- Policies to reduce poverty