Definition of Capital accumulation

This is the process of acquiring additional capital stock which is used in the productive process. Capital accumulation can involve

- Investment in physical fixed capital (e.g. factories, machines)

- Portfolio investment – purchase of bonds, shares and cryptocurrencies

- Investment in assets, such as housing.

Measuring capital accumulation

Capital accumulation can be calculated by measuring:

- Change in wealth/value of assets in an economy.

- Level of gross fixed capital formation – depreciation

How capital accumulation occurs

- Profit from business can be reinvested

- Foreign direct investment (important for developing economies with low capital basis)

- Technological innovation which increases the productivity of capital.

- Increase in human capital – e.g. better educated workforce enables an increase in production possibility frontier.

- Discovering new sources of raw materials, e.g. oil reserves.

- Increased level of savings. In the Harod-Domar model of economic growth, a higher proportion of income that is saved – enables more investment and higher rates of economic growth. (Though Keynesians note that higher savings are not always invested – but can be saved without investment)

Capital accumulation and inequality

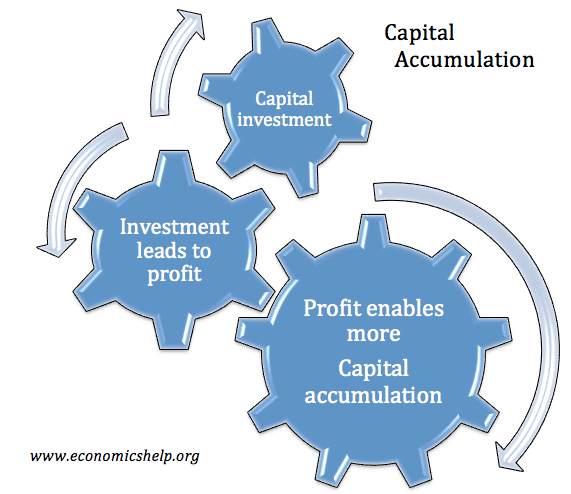

Capital accumulation often occurs from the profit or dividends from previous investment. Therefore capital accumulation can become a self-reinforcing cycle – with the wealthy able to increase their capital assets, enabling more profit/rent/dividends to finance further capital accumulation.

Notes

Capital involves man-made made equipment that is used to make other goods such as machines and factories.

Capital accumulation will need to exceed the amount of capital necessary to overcome depreciation. i.e. some capital wears out, so capital investment is necessary to overcome this. Capital accumulation involves additional purchases of capital.

Capital accumulation from owning property

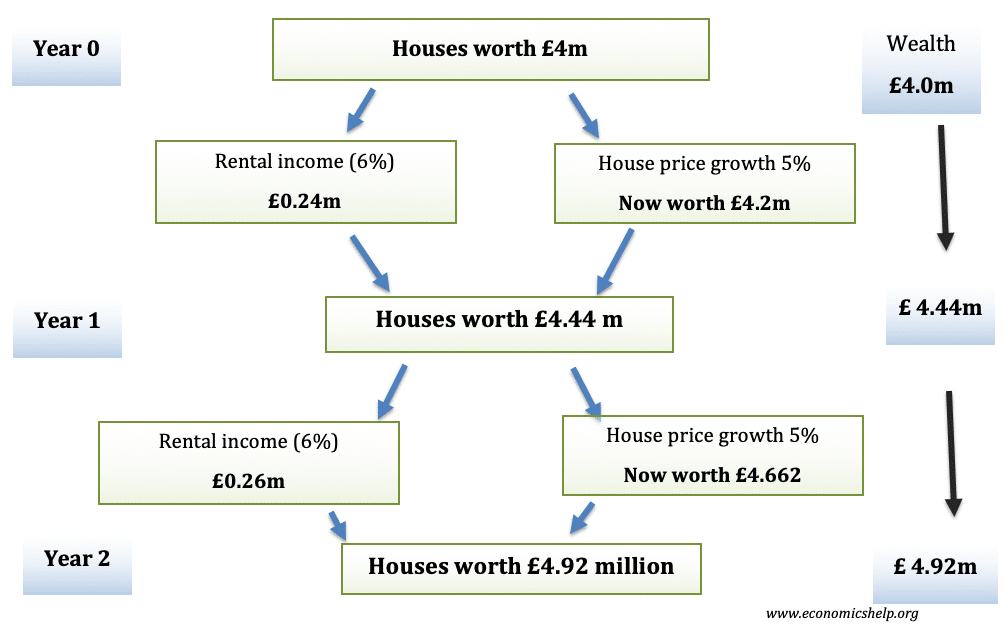

Suppose an investor owns property worth £4 million, and the owner can rent out the property for 6% of its value per year. And from this rental income, the investor reinvests in buying more property.

If there is also house price growth of 5%, then the investor will quickly be able to see an increase in wealth.

Example of wealth multiplier effect

Marxist views of capital accumulation

The Marxist view of capital accumulation concentrates on how profit from business is reinvested in more capital. This enables capitalist to increase their wealth and dominance of society. However, Marx also believed that capitalism was prone to crisis as there would be times when profit was greater than projects capitalist could invest in.

The modern-day economist Thomas Piketty argues that, unchecked, the process of capital accumulation can lead to rising inequality in society. Piketty notes capital doesn’t have to be invested in business but can be invested in other assets, such as housing, shares, bonds.

As a general rule, Picketty argues wealth grows faster than economic output. He uses expression r > g (where r is the rate of return to wealth and g is the economic growth rate. This is mainly due to the process of capital accumulation and the fact assets give a rate of return which can be re-invested.

Ricardo and capital accumulation

Ricardo’s model of economic growth placed a high value on capital accumulation. To Ricardo, capital accumulation came from profit and the willingness and ability of owners to invest in more capital.

Capital Accumulation and Diminishing Returns

Growth models based on Solow’s models argue that increasing the capital stock can soon lead to diminishing returns. They argue that economic growth is fundamentally determined by population growth and technological innovation.

Capital Accumulation and Endogenous Growth Models

Endogenous growth models hold that capital accumulation can increase the long run trend rate of economic growth. However, to permit capital accumulation it is necessary to increase the savings ratios.

Capital Accumulation Plans

Capital accumulation is often suggested as a means for developing countries to increase their long term growth rates. To increase capital accumulation it is necessary to:

- Increase savings ratios

- Maintain good banking system and system of loans.

- Avoid corruption

- Good infrastructure to make investment more worthwhile

Related