Investment is expenditure on capital goods – for example, new machines, offices, new technology. Investment is a component of Aggregate Demand (AD) and also influences the capital stock and productive capacity of the economy (long-run aggregate supply)

Summary – Investment levels are influenced by:

- Interest rates (the cost of borrowing)

- Economic growth (changes in demand)

- Confidence/expectations

- Technological developments (productivity of capital)

- Availability of finance from banks.

- Others (depreciation, wage costs, inflation, government policy)

Main factors influencing investment by firms

1. Interest rates

Investment is financed either out of current savings or by borrowing. Therefore investment is strongly influenced by interest rates. High interest rates make it more expensive to borrow. High interest rates also give a better rate of return from keeping money in the bank. With higher interest rates, investment has a higher opportunity cost because you lose out the interest payments.

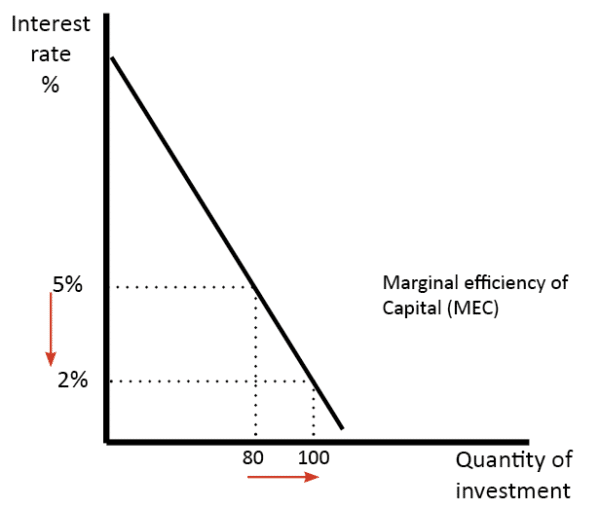

The marginal efficiency of capital states that for investment to be worthwhile, it needs to give a higher rate of return than the interest rate. If interest rates are 5%, an investment project needs to give a rate of return of at least 5% or more. As interest rates rise, fewer investment projects will be profitable. If interest rates are cut, then more investment projects will be worthwhile.

Evaluation

- Time lags. If a firm has started an investment project, a rise in interest rates will be unlikely to change the decision. The firm will continue to finish the investment. However, it will make them think twice about future investment projects. Therefore changes in interest rates can take time to have an effect.

- Other factors. Interest rates can be outweighed by economic conditions. For example, in 2009, interest rates were cut from 5% to 0.5% – but investment fell because of the deep recession and the unwillingness of the banks to lend. It was cheap to borrow, but in these circumstances, this wasn’t enough to encourage investment.

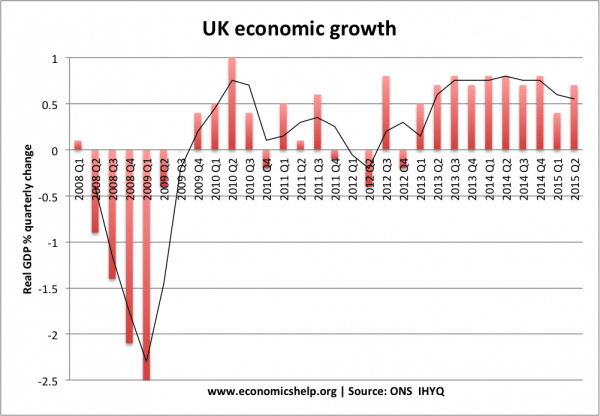

2. Economic growth

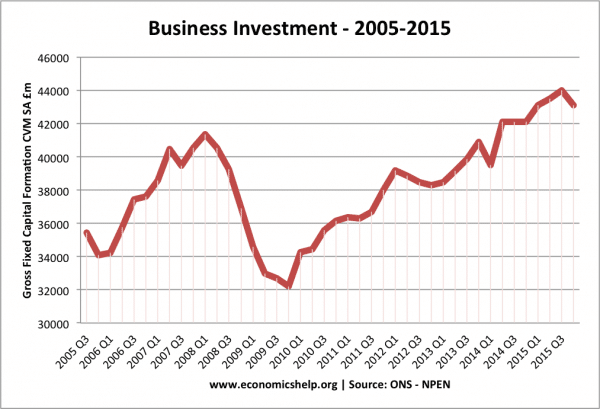

Firms invest to meet future demand. If demand is falling, then firms will cut back on investment. If economic prospects improve, then firms will increase investment as they expect future demand to rise. There is strong empirical evidence that investment is cyclical. In a recession, investment falls, and recover with economic growth.

Accelerator theory The accelerator theory states that investment depends on the rate of change of economic growth. In other words, if the rate of economic growth increases from 1.5% a year to 2.5% a year, then this increase in the growth rate will cause an increase in investment spending as the economy is on an up-turn. The accelerator theory states that investment is highly dependent on the economic cycle.

3. Confidence

Investment is riskier than saving. Firms will only invest if they are confident about future costs, demand and economic prospects. Keynes referred to the ‘animal spirits’ of businessmen as a key determinant of investment. Keynes noted that confidence wasn’t always rational. Confidence will be affected by economic growth and interest rates, but also the general economic and political climate. If there is uncertainty (e.g. political turmoil) then firms may cut back on investment decisions as they wait to see how event unfold.

- Evaluation – Confidence is often driven by economic growth and changes in the rate of economic growth. It is another factor that makes investment cyclical in nature.

4. Inflation

In the long-term, inflation rates can have an influence on investment. High and variable inflation tends to create more uncertainty and confusion, with uncertainties over the future cost of investment. If inflation is high and volatile, firms will be uncertain at the final cost of the investment, they may also fear high inflation could lead to economic uncertainty and future downturn. Countries with a prolonged period of low and stable inflation have often experienced higher rates of investment.

- Evaluation – if low inflation is caused by a fall in demand and economic growth – then this low inflation will not, of itself, be sufficient to boost investment. The ideal is low inflationary and sustainable growth.

5. Productivity of capital

Long-term changes in technology can influence the attractiveness of investment. In the late nineteenth century, new technology such as Bessemer steel and improved steam engines meant firms had a strong incentive to invest in this new technology because it was much more efficient than previous technology. If there is a slowdown in the rate of technological progress, firms will cut back investment as there are lower returns on the investment.

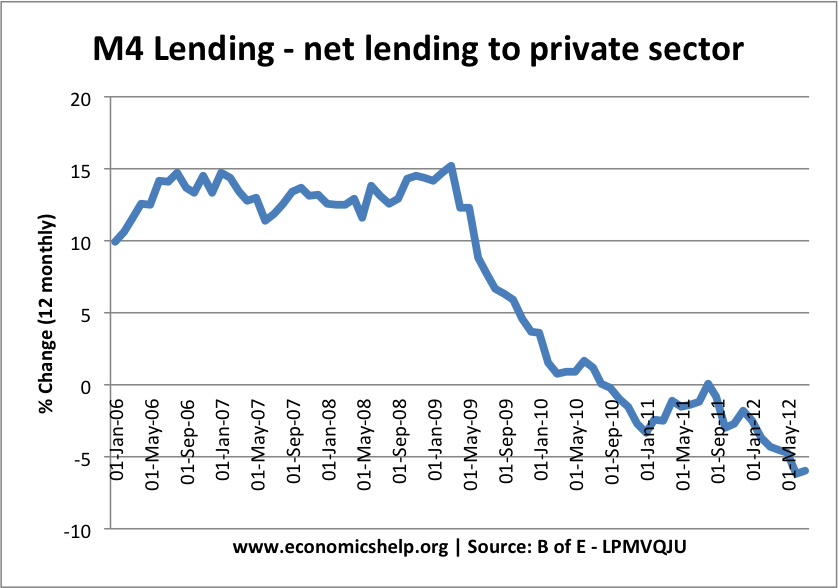

6. Availability of finance

In the credit crunch of 2008, many banks were short of liquidity so had to cut back lending. Banks were very reluctant to lend to firms for investment. Therefore despite record low-interest rates, firms were unable to borrow for investment – despite firms wishing to do that.

Another factor that can influence investment in the long-term is the level of savings. A high level of savings enables more resources to be used for investment. With high deposits – banks are able to lend more out. If the level of savings in the economy falls, then it limits the amounts of funds that can be channelled into investment.

7. Wage costs

If wage costs are rising rapidly, it may create an incentive for a firm to try and boost labour productivity, through investing in capital stock. In a period of low wage growth, firms may be more inclined to use more labour-intensive production methods.

8. Depreciation

Not all investment is driven by the economic cycle. Some investment is necessary to replace worn out or outdated equipment. Also, investment may be required for the standard growth of a firm. In a recession, investment will fall sharply, but not completely – firms may continue with projects already started, and after a time, they may have to invest in less ambitious projects. Also, even in recessions, some firms may wish to invest or startup.

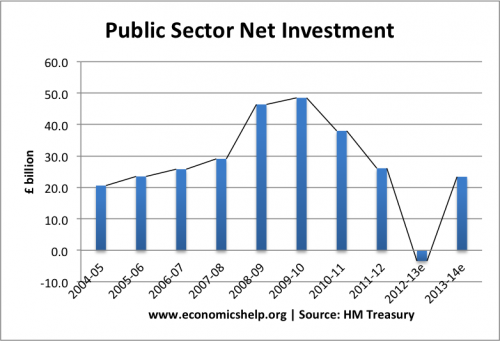

9. Public sector investment

The majority of investment is driven by the private sector. But, investment also includes public sector investment – government spending on infrastructure, schools, hospitals and transport.

10. Government policies

Some government regulations can make investment more difficult. For example, strict planning legislation can discourage investment. On the other hand, government subsidies/tax breaks can encourage investment. In China and Korea, the government has often implicitly guaranteed – supported the cost of investment. This has led to greater investment – though it can also affect the quality of investment as there is less incentive to make sure the investment has a strong rate of return.

Related

Recession is the slowing economic activity in the economy, leading to excess capacity and a higher level of unemployment and slowdown due to decrease in consumer spending caused by lower wages earnings and heightened uncertainty about the economic outlook. There are many factors that can contribute to an economy’s fall into a recession, but the major cause is inflation. Inflation refers to a general rise in the prices of goods and services over a certain period of time. The higher the rate of inflation, the smaller the percentage of goods and services that can be purchased with the same amount of money. Inflation can occur for reasons as varied as increased production costs, higher energy costs and national debt. The shift in aggregate demand can be caused in several different ways.

When they cost of goods sold are at a minimum, the net income would be higher as the cost of goods with the FIFO method is the lowest. This will not always be the case because if the cost of goods sold unit price is decreased, then. When inventory costs are increasing, an organization can limit the amount of its income tax obligation by using LIFO for its income tax return. The FIFO method can increase the amount of net income reported to investor, and LIFO can reduce the taxable income.

Hello!

what are the shift factors of IS curve and how the curve shift left and right by the factors?

What are the factors of L M curve

Is economics a science or a social science

Social science

High-interest rates also give a better rate of return from keeping money in the bank.

This economy must grow.