A look at factors affecting the demand and supply of housing.

In summary.

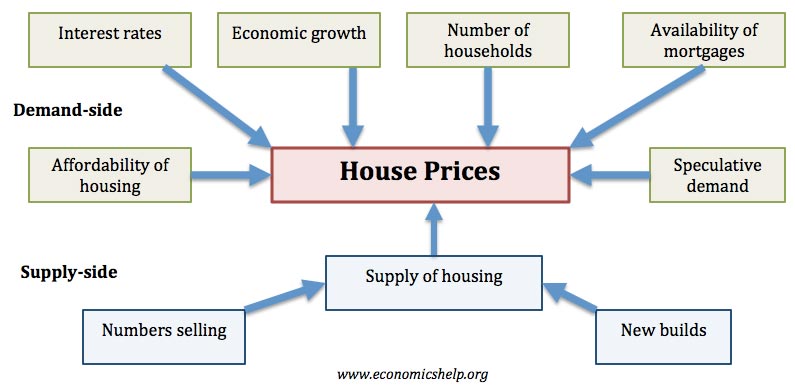

Demand-side factors

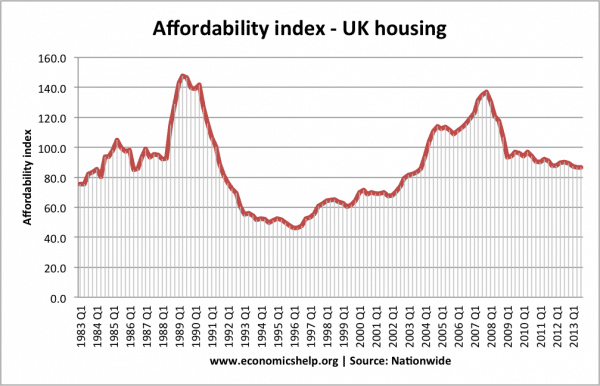

1. Affordability. Rising incomes mean that people are able to afford to spend more on housing. During periods of economic growth, demand for houses tends to rise. Also, demand for housing tends to be a luxury good. So a rise in income causes a bigger % rise in demand.

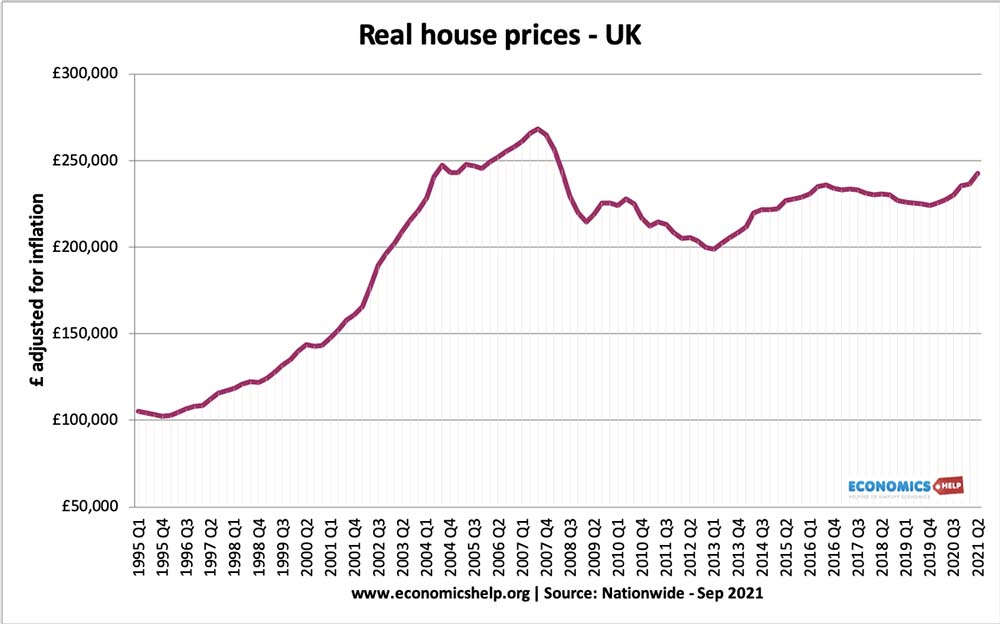

This graph shows that house prices (and therefore demand for housing can rise much faster than earnings, suggesting there are many other factors influencing demand – at least in the short run.

2. Confidence

Demand for houses depends on consumer confidence. In particular, it depends on people’s confidence about the future of the economy and housing market. If people expect prices to rise, demand will rise so people can gain from rising wealth. In a boom, demand for houses rises faster than incomes as seen in the graph above.

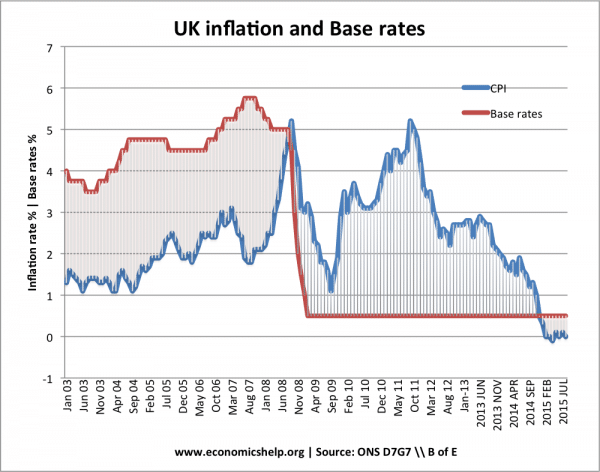

3. Interest Rates

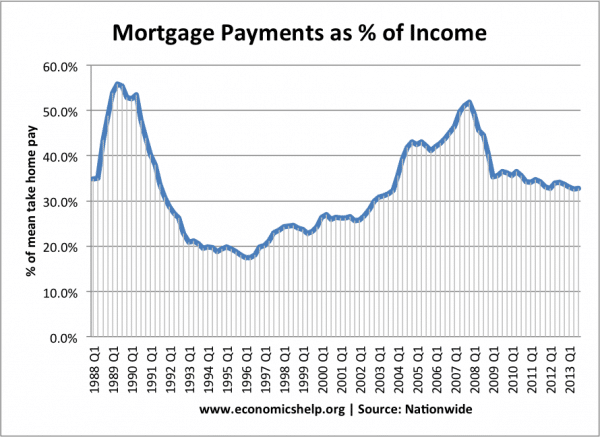

Interest rates play a big factor in determining the cost of mortgage interest repayments.

The majority of UK homeowners still prefer to take out variable mortgage rates (unlike the continent where fixed rate mortgage deals are more common). Therefore any change in the base rate by the Bank of England will immediately affect the mortgage interest payments. This is a major factor in determining the affordability of housing. Mortgage payments take a high % of people’s personal disposable income. (average is 25%, but, for some homeowners, it is higher.) If you have a £150,000 mortgage a 0.5% change in base rates will change your monthly payments by about £60 a month. Therefore, even small changes in interest rates can deter people from buying.

When interest rates reached 15% in 1992, demand for housing collapsed, causing a large fall in demand for housing. The relatively low-interest rates of the 90s and 2000s encouraged more to buy a house.

However, in 2008-09, interest rates were cut to 0.5%. Even though interest rates were very low, demand also remained low. This was because, other factors were reducing demand for housing – like the recession and prospect of rising unemployment.

4. Population

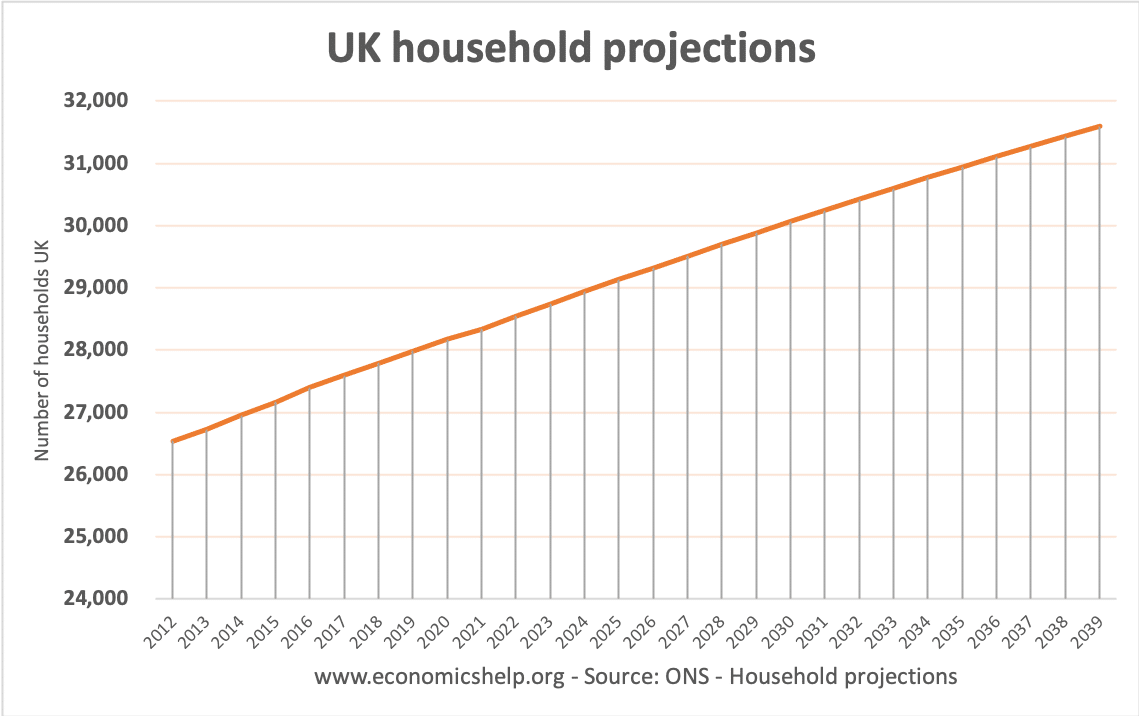

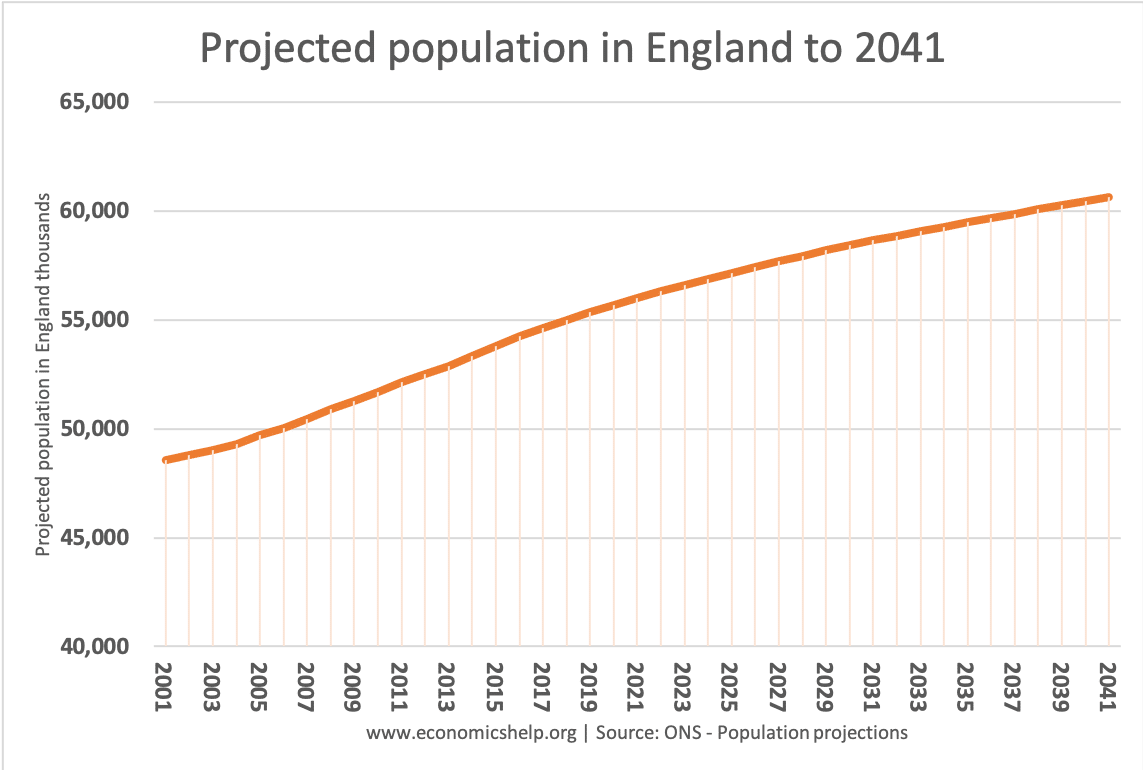

The population in England is forecast to grow to over 60 million in 2041 an increase of 6 million.

A very important factor. It is not just the number of people but demographic changes. e.g. growing number of single people living alone has led to increasing demand for houses.

The demand for housing doesn’t just depend on the population but also the average size of a household. Certain social and demographic factors are causing a rise in the number of households (faster than the population increase). These demographic changes include issues such as:

age of people leaving home

- Increased life expectancy, leading to more single old people

- Divorce rates, – increasing number of single-parent families.

5. Mortgage availability

Another factor that determines the effective demand for houses is the willingness of banks to lend mortgages. If banks give mortgages with bigger income multiples, then the effective demand for houses is greater. The willingness of banks to lend mortgage finance can vary depending on the strength of the interbank lending sector. The Credit crisis of 2008, has seen a sharp rise in the cost of interbank lending and a fall in availability of mortgage finance. Many mortgage products have been withdrawn, making it more difficult for would-be homeowners to get on the property ladder.

- For example, mortgages such as 125% and 100% mortgages have been withdrawn. Banks are increasingly demanding a higher deposit before lending mortgages.

6. Economic growth and real incomes. Rising incomes enable people to afford bigger mortgages and encourages demand for housing. In boom times, demand for housing grows rapidly suggesting demand for houses is income-elastic

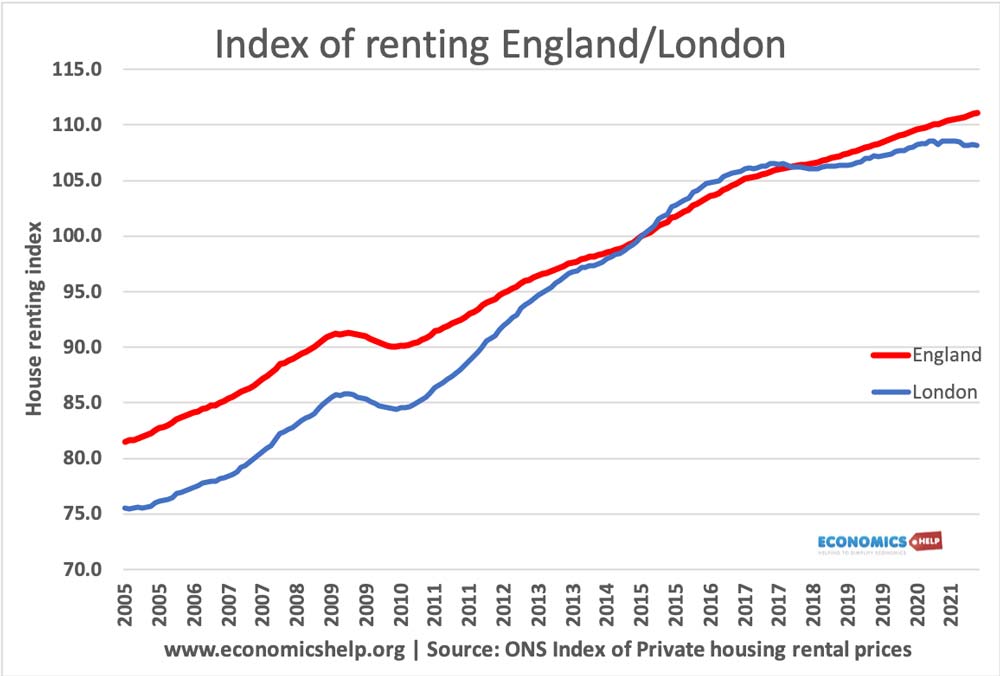

7. Cost of renting.

This shows a 30% increase in the cost of renting between 2005 and 2021 – despite the financial crisis and housing ‘crash’. In London the rise in rents was higher up until 2017. – this helped to cause UK house prices to continue rising after 2011.

If the cost of renting rises, then households will make greater efforts to try and buy a house as buying a house through mortgage becomes relatively cheaper. The UK housing market has been buoyed by expensive renting costs, which encourages buy to let lenders and encourages households to stretch their budget as much as possible to get on the housing ladder.

Factors affecting supply

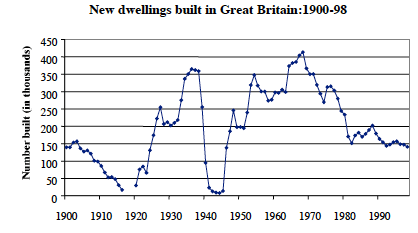

- The number of new houses being built. The graph above shows how the number of new houses built in Great Britain has varied over the past century. The peak was in the late 1960s with over 400,000 built per year, Inthe late 1990ss and early 2000s that has fallen to 150,000 (less than required)

- Planning restrictions on the use of land. A big issue in the UK is planning restrictions and limitations on building on green-belt land

- Local opposition to new home builds. There is widespread opposition to building new houses as local communities usually prefer to live in smaller villages without increased congestion.

- The profitability of building new houses. This is dependent on the demand for houses and prices. In a boom, builders are usually keener to build more. Falling house prices can lead to a restriction in supply.

- See factors that affect supply

Related

Aside from the above, there is also something to be said about the effects of central bank policies that foster a shift from more secure and dependable assets such as bonds into less-dependable and riskier assets such as stocks and real estate. Driven by a search for yield and higher returns, investor demand for housing (whether by direct ownership, such as an individual purchasing a home to let) or by a corporate mechanism (such as a Real Estate Investment Trust that purchases a large number of homes to rent) also influences supply, demand and pricing dynamics by keeping a portion of potential for-sale inventory off the market for an indeterminate period of time.

Thanks so helpful, but what about the factors which affect the supply of low income housing

how about factors affecting thr undersupply of houses?

How about factors of demand in Low income housing controlling factors affecting supply of low income housing?