Is there a link between government debt and the interest rate on government bonds?

One argument we often hear is that if government borrowing increases – we can expect higher bond yields. Investors demand higher yields to compensate for the risk of government default.

However, other economists argue this is misleading. If inflation is low, and there is surplus savings in the economy, higher debt will not cause rising bond yields. In recent years, rising government debt has led to a fall in bond yields.

Debt and yields in the great recession 2008-21

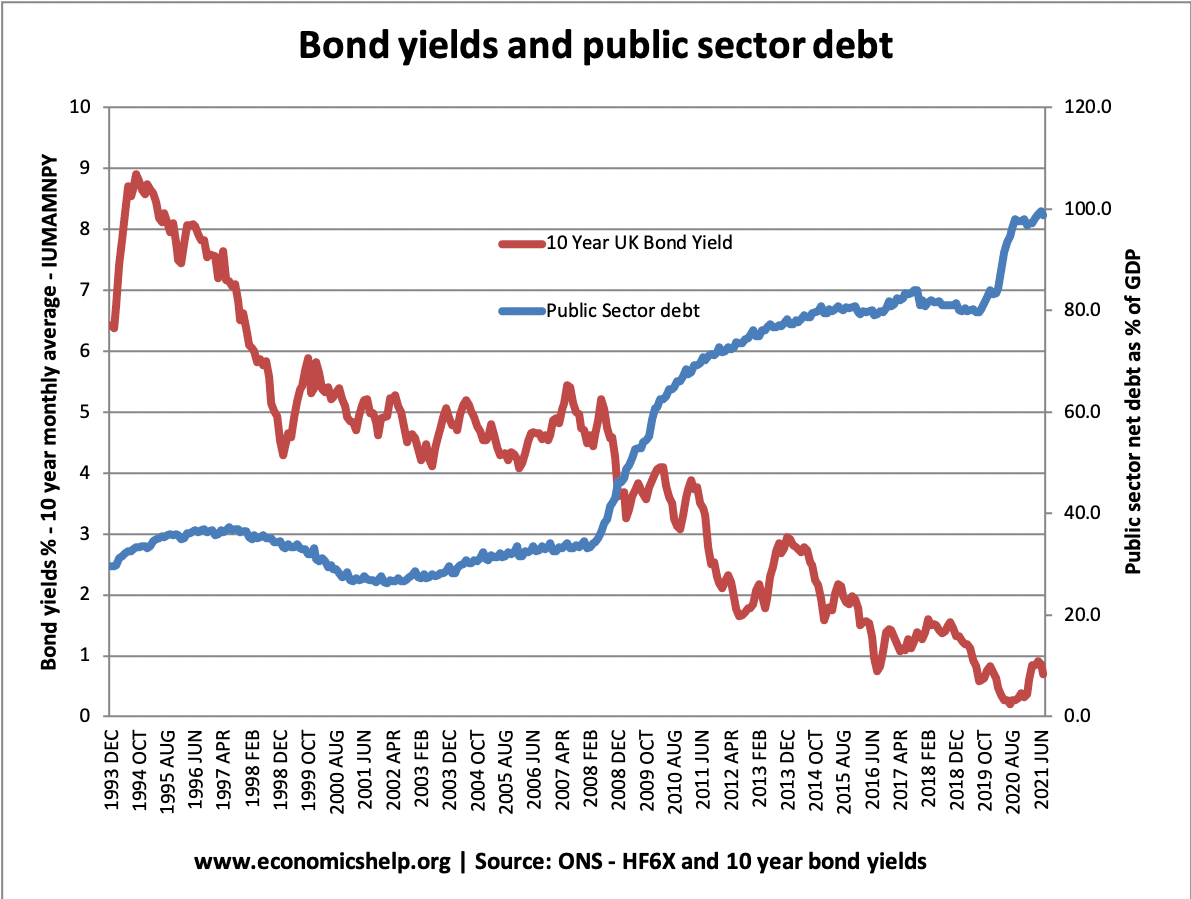

- This graph shows UK net debt levels rising from 36% of GDP in 1993 to 98% of GDP in 2021.

- During this period, bond yields on government debt fell from a peak of 9% in 1994 to 0.2% in 2021

- This shows that in a recession and a period of low inflation, we can see falling bond yields – even if debt rises.

What is a bond yield?

Government bonds are sold to private investors to finance government debt.

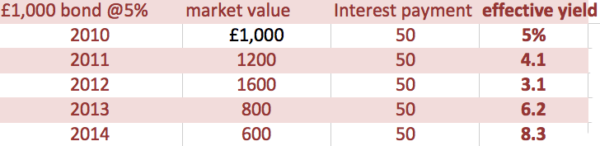

The bond yield is the effective interest rate that people who own government bonds receive.

- If there is high demand for buying government bonds, the price of bonds rises and the bond yield falls.

- If there is a fall in demand for government bonds, the price of bonds falls – and the effective bond yield rises.

To understand more on this. See: inverse relationship between the price of bonds and bond yields

Why might higher debt levels lead to higher bond yields?

1. Fear of default. If a government borrows too much, investors may fear that the government is at risk of default. If the government borrows too much, they may not be able to meet repayments in the future – meaning bonds will not be repaid by the government. If investors fear this is a possibility they will not want to buy bonds but sell.

- Therefore, as investors sell, bond yields will rise to reflect the risk of lending the government money.

- Investors demand a higher interest premium to compensate for the risk of debt default.

- This is why countries with histories of debt default are likely to have higher bond yields.

2. Inflation. If a government borrows too much, the government may be tempted to deal with the debt by increasing the money supply (printing money) and paying off the debt through inflation. But, if this happens investors will lose the real value of their bonds. The bonds will fall in value because inflation is reducing their real worth. (This is sometimes known as default through inflation). If investors fear inflation, they may sell bonds, causing interest rates to rise.

- Higher inflation will lead to higher bond yields as investors demand higher interest rates to protect against the falling value of nominal bonds.

Why higher debt levels do not lead to higher bond yields

However, although this is a possibility, it rarely occurs amongst developed Western economies.

1. Risk of default very minimal. It is rare for a developed economy to default on government debt. Countries like the UK and US have not suffered an outright debt default in their history. Japan has a public sector debt of over 230% of GDP, but bond yields remain very low. Investors don’t fear a Japanese government default and therefore are willing to keep buying Japanese bonds.

2. Lender of last resort. For countries with their own currency (let us ignore Eurozone economies for the moment), the Central Bank can always step in and purchase government debt. If necessary the Central Bank could create money in order to purchase government bonds. This helps avoid any liquidity fears markets may have.

3. Debt and economic cycle. During a recession, government debt tends to rise. This is due to cyclical factors, such as a fall in income tax revenue and higher welfare spending. This leads to higher debt, but in a recession, the private saving ratio tends to rise. There is greater demand for buying government bonds in a recession because people are looking for a safe haven for their excess savings. Therefore, bond yields tend to fall during a recession – because there is greater demand for buying bonds.

When the economy recovers, savers start to look for more profitable uses for their savings (e.g. stock market, private investment), therefore as the economy recovers bonds become less attractive and interest rates start to rise.

Furthermore, in a recession, the base rate will be cut. This tends to reduce all interest rates in the economy, including bond yields.

4. Budget deficit

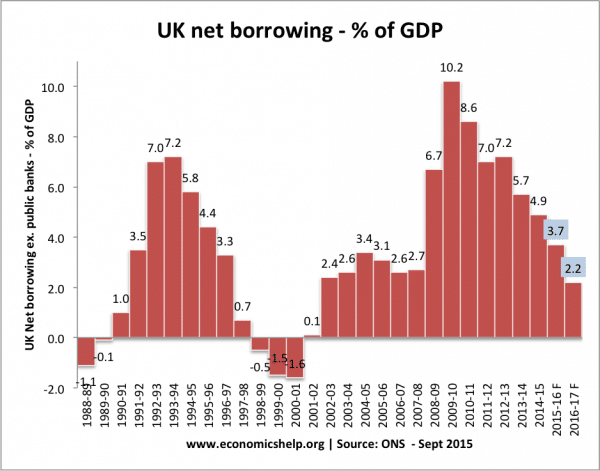

From 2011-15 – net debt is rising, but there is a fall in the annual borrowing requirement

In addition to net public sector debt (total debt), it is worth looking at the annual budget deficit. It could be argued that if there is a ‘credible’ plan to reduce the budget deficit this reassures markets that government debt is manageable.

For example, the UK government will claim that their austerity measures to reduce the budget deficit are responsible for the fall in UK bond yields (2012-17).

5. Many factors affect bond yields

The difficulty is that there are many factors that affect bond yields – and government debt and the budget deficit is often an unimportant factor. Only in certain circumstances will levels of government borrowing have a major impact on bond yields.

The most important factors for determining bond yields are probably inflation, interest rates and the rate of economic growth.

Further reading – to understand all the factors affecting bond yields

Bond yields and Eurozone economies

During 2011 and 2012, several Eurozone economies saw rising bond yields.

This occurred during a period of rising budget deficits and higher government borrowing.

EU policy often stated at the time, borrowing needed to be reduced in order to reduce bond yields.

However, the main problem for countries like Ireland and Italy and Spain was that there was no Central Bank willing to act as lender of last resort. Therefore, markets saw a real possibility of liquidity shortages, and this caused investors to be nervous.

When the ECB decided to effectively act as lender of last resort after 2012 and intervene in bond markets, bond yields fell.

Economic recovery and bond yields

If there is economic growth – bond yields tend to rise. Why is this?

- With economic growth, we can expect higher inflation. Therefore, investors will expect higher interest rates to compensate for the risk of inflation eroding the real value of a bond.

- More options. In a recession, investors are reluctant to invest in the stock market and corporate bonds. In a recession, the prospect of high profit and dividends is low. Therefore, investors prefer the security of government bonds. They are willing to accept low-interest rates for the certainty of not losing value on the stock market. However, with economic growth, shares and corporate bonds start to look relatively more attractive. If profits rise, investors will be keen to buy shares which offer relatively better returns than government bonds. Therefore, the demand for bonds will fall, and yields rise.

Related