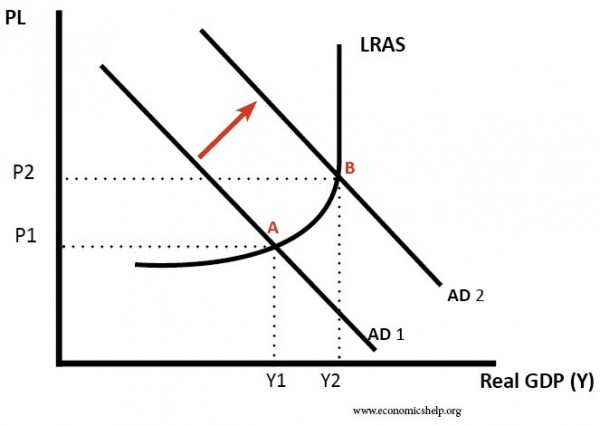

Demand-pull inflation is a period of inflation which arises from rapid growth in aggregate demand. It occurs when economic growth is too fast.

If aggregate demand (AD) rises faster than productive capacity (LRAS), then firms will respond by putting up prices, creating inflation.

- Inflation – a sustained increase in the price level.

- Demand-pull inflation – inflation caused by AD increasing faster than AS.

Demand-pull inflation means:

- Excess demand and ‘too much money chasing too few goods.’

- The economy is at (or ver close to) full employment/full capacity.

- The economy will be growing at a rate faster than the long-run trend rate.

- A falling unemployment rate.

How demand-pull inflation occurs

If aggregate demand is rising at 4%, but productive capacity is only rising at 2.5%; firms will see demand outstripping supply. Therefore, they respond by increasing prices.

Also, as firms produce more, they employ more workers, creating a rise in employment and fall in unemployment. This increased demand for workers puts upward pressure on wages, leading to wage-push inflation. Higher wages increase the disposable income of workers leading to a rise in consumer spending.

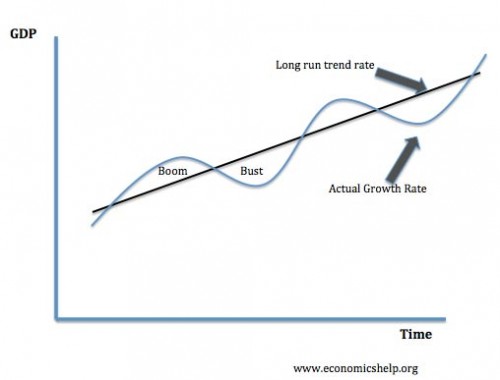

Economic growth and long-run trend rate

The long trend rate of economic is the sustainable rate of economic growth; it is the rate of economic without any demand-pull inflation. If economic growth exceeds this long-run trend rate, then it will cause inflationary pressures.

In a boom, growth is above the long-run trend rate, and it is in this situation where we will get demand-pull inflation.

Causes of demand-pull inflation

- Lower interest rates. A cut in interest rates causes a rise in consumer spending and higher investment. This boost to demand causes a rise in AD and inflationary pressures.

- The rise in house prices. Rising house prices create a positive wealth effect and boost consumer spending. This leads to a rise in economic growth.

- Rising real wages. For example, unions bargaining for higher wage rates.

- Devaluation. Devaluation in the exchange rate increases domestic demand (exports cheaper, imports more expensive). Devaluation will also cause cost-push inflation (imports more expensive)

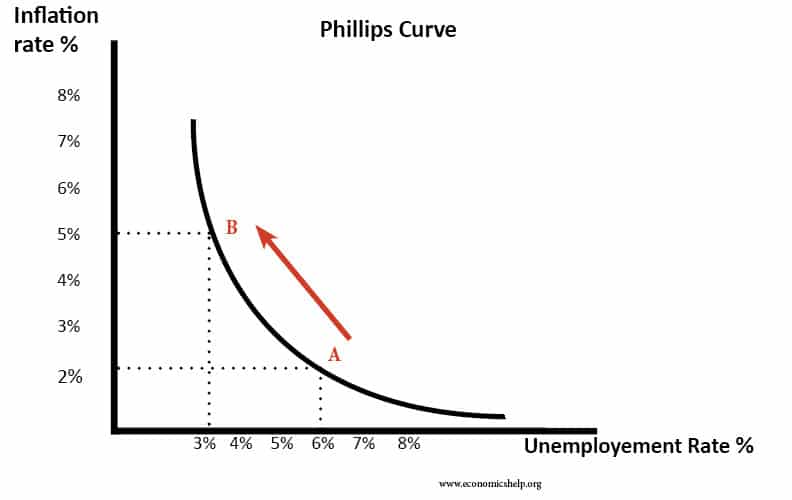

Demand pull inflation and Phillips Curve

Demand-pull inflation can also be shown on a Phillips Curve. A rise in demand causes a fall in unemployment (from 6% to 3%) but an increase in inflation from inflation of 2% to 5%.

Examples of demand pull inflation

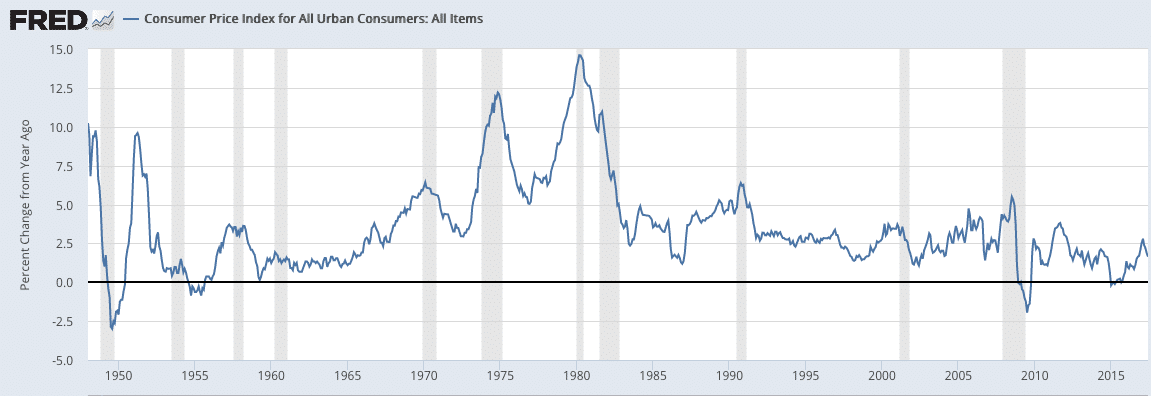

From 1986, inflation increased to 1991. This was an example of demand-pull inflation.

The inflation of the late 1970s was due primarily to cost-push factors (wages/oil prices of 1970s)

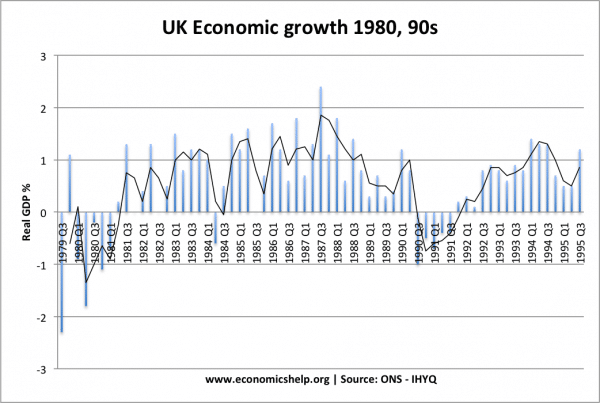

UK 1980s-91

During the late 1980s, the rate of economic growth in the UK rose to over 4%. The high rate of economic growth was caused by demand-side factors, such as:

- Rising house prices

- Cut in real interest rates

- Cut in income tax rates.

- Rise in consumer confidence

The rapid growth in demand saw inflationary pressures increase.

US late 1960s

Rapid economic growth in the mid-1960s, caused inflation to increase from 2% in 1966 to 6% by 1970.

Demand pull inflation and other types of inflation

Demand pull inflation could occur with:

- Cost-push inflation (rising costs of production). For example, in the early 1970s, economic growth and rising oil prices caused a spike in US inflation of 12% by 1974.

- Built-in inflation. Inflation has its own momentum. High inflation in previous years, makes future inflation more likely as firms put up prices in anticipation of repeated inflation.

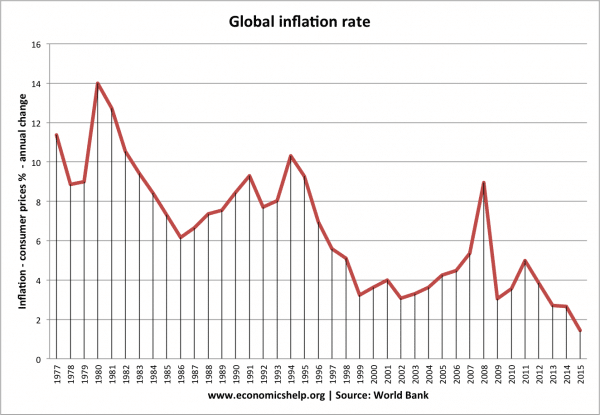

Decline of demand pull inflation

In recent years, demand-pull inflation has become quite rare. The small rises in inflation (2008/2001) were primarily due to cost-push factors. In recent decades, we have not witnessed any significant demand-pull inflation. this is due to several factors

- Independent Central Banks responsible for monetary policy and keeping inflation to a target of 2%

- Secular stagnation. Lower rates of economic growth

- Downward pressure on prices from the global economy. Deflation of manufactured goods in Asia.

- New technology leading to lower prices.

- See also: fall in global inflation

Related

Simple to understand,enjoyed reading would like to learn more from you.Simple English

This is a very important article and easy to understand.

Loved this article. It was very easy to understand. Thankyou 🙂

Now I understand what is meant by Demand -pull inflation.

Thank you 🙏

I really appreciate your help by making me understand demand-pull inflation better😊.

But does demand-pull inflation have advantages and disadvantages.

Hi what is difference between high inflation and Deflation also how many inflation their is under our money markets economy NYSE US Dollar US currency federal interest rates unemployment rate price food fuel energy all above pays A roll in the inflation rate up or down thanks 😊

Both..increase in employment rate and increase in prices.

This Whole Inflation Thing Gets Me Really Confused.

1. Why Should Increase in Workers’ Wages Increase Inflation? I Thought Disposable Income Is Supposed To Help The Economy Grow 🤷♀️

2. Why Should A Fall In Unemployment Increase Inflation? I Thought With Ppl Gainfully Employed, This Would Grow The Economy? 🤷♂️

3. When Aggregate Demand Falls Short Of Aggregate Supply, Why Should Firms Increase Prices Rather Than Increase Workers For Supply To Match Demand ???

1. Higher wages increases demand. Higher demand causes inflation

2. More employment higher demand. Upwwrd pressure on wages.