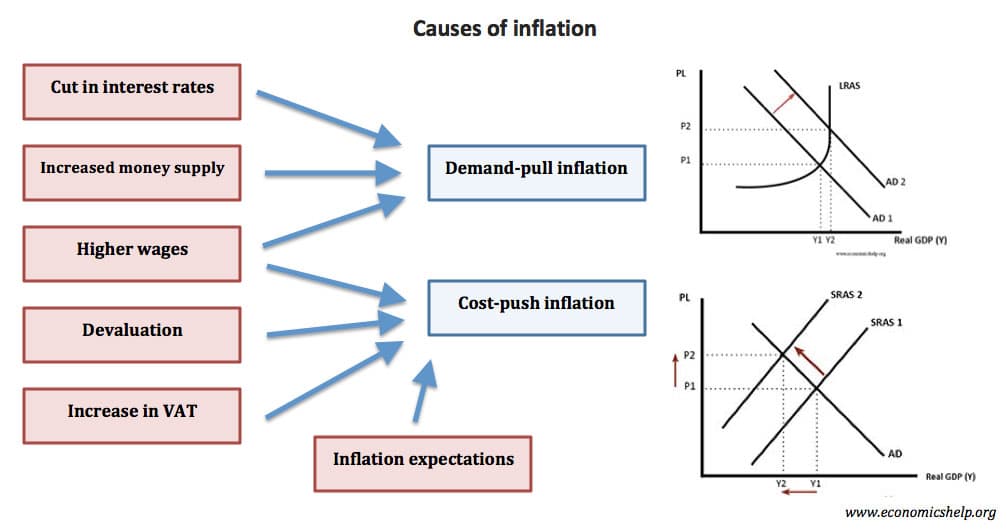

Inflation means there is a sustained increase in the price level. The main causes of inflation are either excess aggregate demand (AD) (economic growth too fast) or cost-push factors (supply-side factors).

Summary of the main causes of inflation

- Demand-pull inflation – aggregate demand growing faster than aggregate supply (growth too rapid)

- Cost-push inflation – For example, higher oil prices feeding through into higher costs.

- Devaluation – increasing cost of imported goods, and also the boost to domestic demand.

- Rising wages – higher wages increase firms costs and increase consumers’ disposable income to spend more.

- Expectations of inflation – High inflation expectations causes workers to demand wage increases and firms to push up prices.

Video summary

Factors affecting inflation

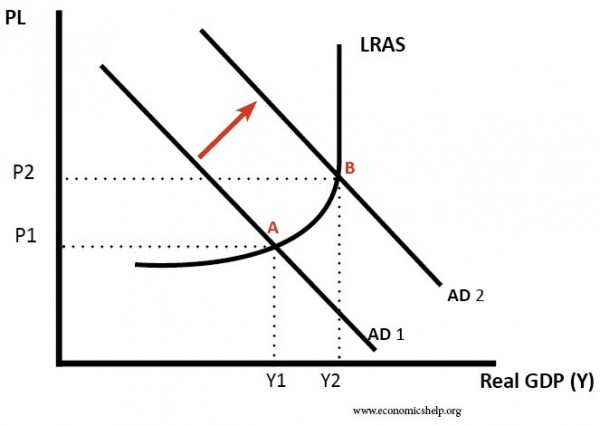

1. Demand-pull inflation

If the economy is at or close to full employment, then an increase in aggregate demand (AD) leads to an increase in the price level (PL). As firms reach full capacity, they respond by putting up prices leading to inflation. Also, near full employment with labour shortages, workers can get higher wages which increase their spending power.

AD can increase due to an increase in any of its components C+I+G+X-M

We tend to get demand-pull inflation if economic growth is above the long-run trend rate of growth. The long-run trend rate of economic growth is the average sustainable rate of growth and is determined by the growth in productivity. Demand-pull inflation can be caused by factors such as

- Higher wages.

- Increased consumer confidence.

- Rising house prices – causing positive wealth effect.

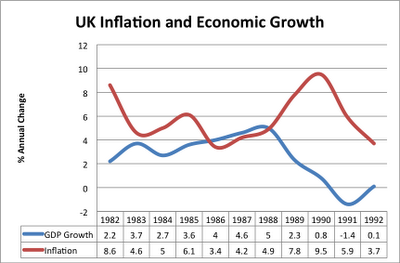

Example of demand-pull inflation in the UK

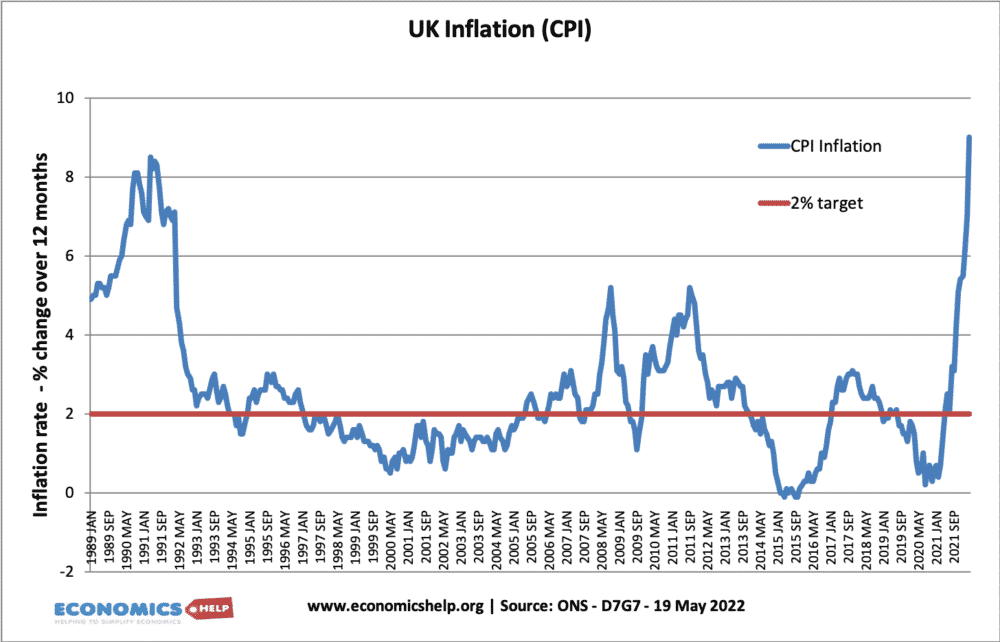

In the 1980s, the UK experienced rapid economic growth. The government cut interest rates and also cut taxes. House prices rose by up to 30% – fuelling a positive wealth effect and a rise in consumer confidence. This increased confidence led to higher spending, lower saving and an increase in borrowing. However, the rate of economic growth reached 5% a year – well above the UK’s long-run trend rate of 2.5 %. The result was a rise in inflation as firms could not meet demand. It also led to a current account deficit. You can read more about demand-pull inflation at the Lawson Boom of the 1980s.

In the 1980s, the UK experienced rapid economic growth. The government cut interest rates and also cut taxes. House prices rose by up to 30% – fuelling a positive wealth effect and a rise in consumer confidence. This increased confidence led to higher spending, lower saving and an increase in borrowing. However, the rate of economic growth reached 5% a year – well above the UK’s long-run trend rate of 2.5 %. The result was a rise in inflation as firms could not meet demand. It also led to a current account deficit. You can read more about demand-pull inflation at the Lawson Boom of the 1980s.

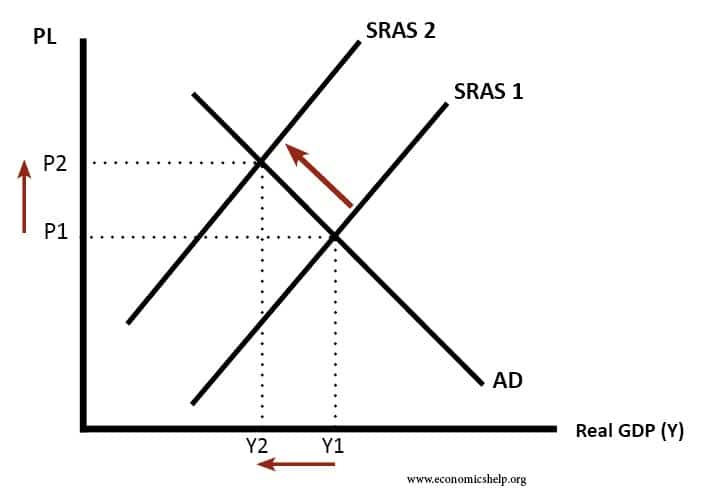

2. Cost-push inflation

If there is an increase in the costs of firms, then businesses will pass this on to consumers. There will be a shift to the left in the SRAS.

Cost-push inflation can be caused by many factors

i) Rising wages If trades unions can present a united front then they can bargain for higher wages. Rising wages are a key cause of cost-push inflation because wages are the most significant cost for many firms. (higher wages may also contribute to rising demand) See also wage-push inflation.

ii) Import prices One-third of all goods are imported in the UK. If there is a devaluation, then import prices will become more expensive leading to an increase in inflation. A devaluation/depreciation means the Pound is worth less. Therefore we have to pay more to buy the same imported goods.

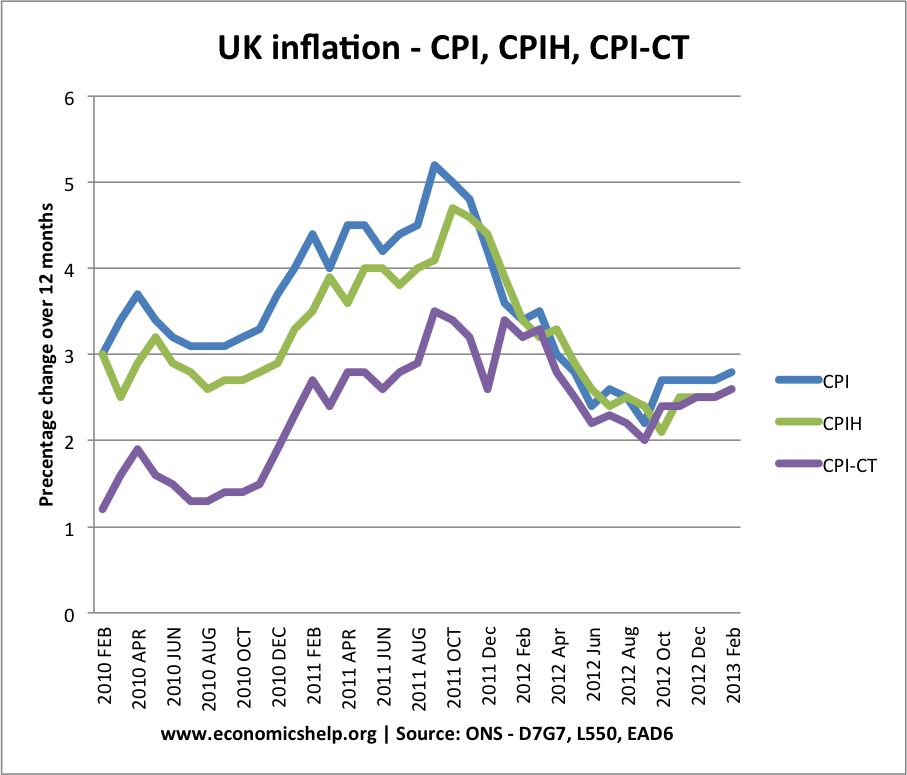

In 2011/12, the UK experienced a rise in cost-push inflation, partly due to the depreciation of the Pound against the Euro. (also due to higher taxes)

In 2022, the UK experienced more cost-push inflation due to rising oil, gas prices, Ukraine conflict, Brexit cost issues, depreciation in Pound, Covid supply constraints.

iii) Raw material prices The best example is the price of oil. If the oil price increase by 20% then this will have a significant impact on most goods in the economy and this will lead to cost-push inflation. E.g., in 1974 there was a spike in the price of oil causing a period of high inflation around the world.

4. Higher inflation expectations

Once inflation sets in, it is difficult to reduce inflation. For example, higher prices will cause workers to demand higher wages causing a wage-price spiral. Therefore, expectations of inflation are important. If people expect high inflation, it tends to be self-fulfilling. When expectations are low, temporary rise in prices tend to be short-lived and fade away.

5. Printing more money

If the Central Bank prints more money, you would expect to see a rise in inflation. This is because the money supply plays an important role in determining prices. If there is more money chasing the same amount of goods, then prices will rise. Hyperinflation is usually caused by an extreme increase in the money supply.

However, in exceptional circumstances – such as liquidity trap/recession, it is possible to increase the money supply without causing inflation. This is because, in a recession, an increase in the money supply may just be saved, e.g. banks don’t increase lending but just keep more bank reserves.

See: The link between money supply and inflation

6. Higher taxes

If the government put up taxes, such as VAT and Excise duty, this will lead to higher prices, and therefore CPI will increase. However, these tax rises are likely to be one-off increases. There is even a measure of inflation (CPI-CT) that ignores the effect of temporary tax rises/decreases.

7. Declining productivity

If firms become less productive and allow costs to rise, this invariably leads to higher prices.

8. Profit push inflation

When firms push up prices to get higher rates of inflation. This is more likely to occur during strong economic growth.

9. Monetary and fiscal policy

The attitude of the monetary authorities is important; for example, if there was an increase in AD and the monetary authorities accommodated this by increasing the money supply then there would be a rise in the price level.

Related