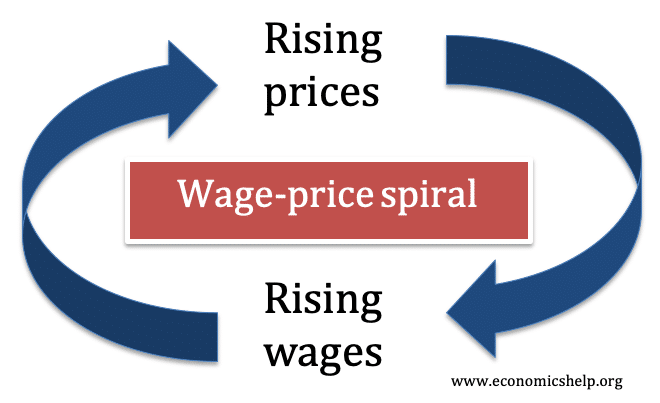

The wage-price spiral refers to the strong mutual link and between wage growth and inflation.

- Rising wages invariably put upward pressure on prices and inflation.

- High inflation creates upward pressure on wages as workers seek to gain an increase in wages to meet the rising prices and maintain living standards.

Thus a wage-price spiral can lead to a prolonged period of inflation.

Wage-price spiral explained

If workers see an increase in the inflation rate, then that means the cost of living will be rising. In order to maintain their real income, they will demand wage increases above the current rate of inflation. As wages rise, this contributes to higher inflation for two reasons:

- Firm’s costs rise and this encourages them to pass the cost increase onto consumers in the form of higher prices.

- Workers see a rise in nominal income and so have more spending power. This will lead to an increase in consumer spending and demand-pull inflation.

If the inflation rate continues to rise, workers will begin to expect ever-higher rates of inflation, and therefore, will want to negotiate a larger wage increase – because of fears over future inflation. This means each year there is an incentive to demand higher nominal wage growth. Therefore, there is a continued increase in inflationary pressure.

Factors that contribute to a wage-price spiral

- Powerful trade unions. If trade unions are in a position of strength to bargain for higher wages, then we are more likely to see real increases in wages and upward pressure on inflation

- Strong economy. If economic growth is rapid, then demand-pull factors will put upward pressure on prices and contribute to inflation.

- Low unemployment. If the economy is near full employment, then firms may have difficulty filling vacancies, this gives workers more clout to demand higher wages and cause a wage-price spiral.

What causes an end to wage-price spiral?

There are many factors affecting wages and inflation and – even if wages are rising – we don’t necessarily get inflation. The wage-price spiral could be broken if:

- Wages are linked to productivity growth. If wages rise 10%, but productivity is also 10%, then firms can afford to pay higher wages without passing the cost increases on to consumers.

- Monetary policy. The government/Central Bank can decide to tackle inflationary pressures by the use of the monetary policy. For example, an increase in interest rates increases cost of borrowing/mortgages and will reduce disposable income, causing workers to hold back from spending.

- Cost-push inflation falls. A rise in oil prices may cause a spike in inflation, but this will be temporary, if oil prices fall, then cost-push inflation will also fall, causing less pressure for wage increases.

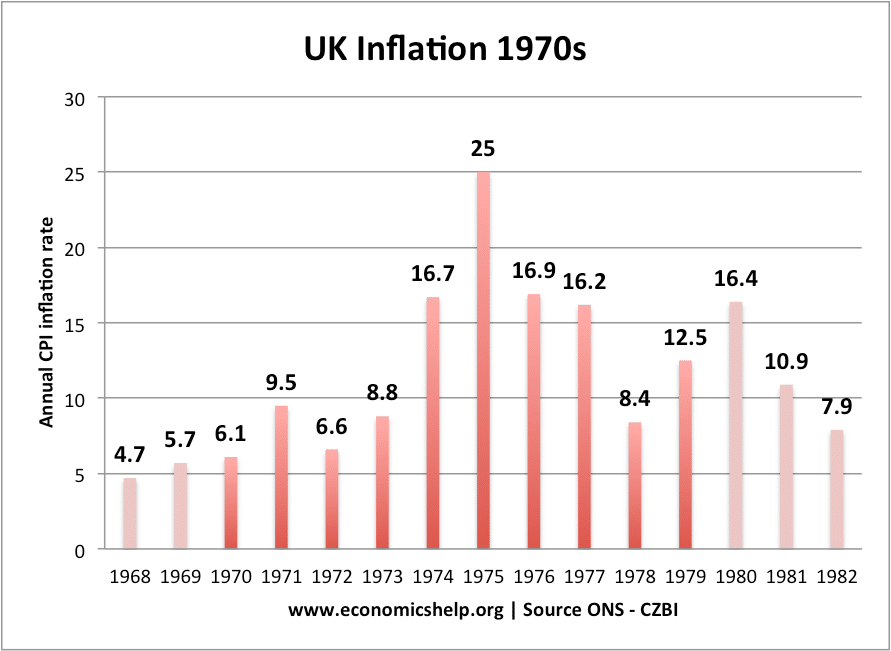

Examples of a wage-price spiral in UK 1970s

In the UK, the best example of a wage-price spiral was during the 1970s and early 1980s. In this period, trade unions had strong collective bargaining capacity. There was also a period of cost-push inflation caused by rising oil prices. Due to the inflation, unions used their collective bargaining strength to demand wages keep up with inflation and maintain real incomes. The rise in wages fuelled more inflation due to firms passing the wage increases on to consumers and increased demand for goods from workers.

The high inflation in the 1970s.

In 1975, wage inflation was 29.5% (ONS)

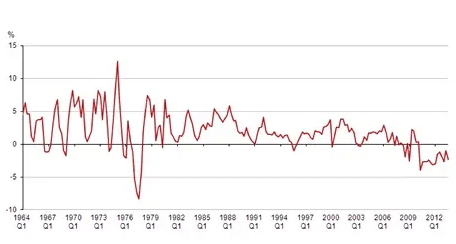

Quarterly Nominal Average earnings growth

Source: ONS

Related