Definition Wage-push inflation is the increase in general price level resulting from higher wages in an economy.

Explanation of wage-push inflation

If firms increase nominal wages by 5%, they experience higher costs of production. This is likely to cause firms to pass the cost increases onto consumers in the form of higher prices. Firms increase prices to maintain their level of profitability. Therefore, from higher wages, we see a rise in prices and hence the inflation rate.

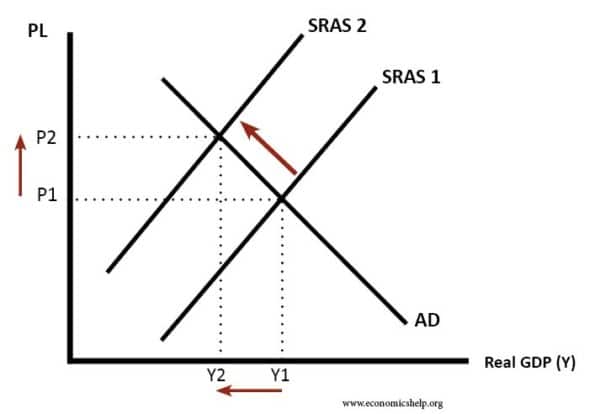

Wage inflation is an example of cost-push inflation

This diagram shows how rising costs cause the short-run aggregate supply curve (SRAS) to shift to the left, leading to a higher price level.

Evaluation

- Labour costs can account for up to 70% of a firm’s total costs, so it is a significant factor in determining prices and hence inflation.

- If there is wage inflation, then it will also contribute to higher demand in the economy – workers have more income to spend. Therefore, as well as causing cost-push inflation, higher wages can also cause demand-pull inflation, making wages an important factor in determining long-term inflation.

Causes of wage-push inflation

- Rapid economic growth and full employment. If economic growth is above the long-run trend rate of growth, the economy will soon reach full employment and firms will have difficulty filling labour vacancies. This will lead to higher wages and higher inflation.

- More powerful trade unions. If workers are well represented by unions, then they are in a better position to push for higher wages – and in particular, wages increases higher than productivity gains.

- Higher minimum wages. If there was a very significant rise in the minimum wage, it could in theory cause inflation, but generally speaking modest rises in the minimum wage have no significant impact on inflation.

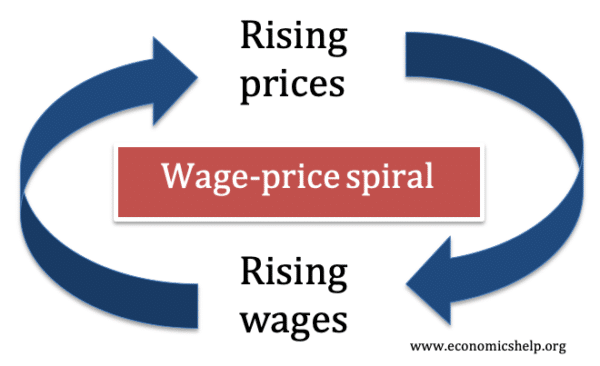

Wage price spiral

If higher wages cause higher prices. Then workers may make more efforts to increase wages in response to rising prices. This can lead to a wage-price spiral. Instances of hyperinflation often have an element of this. For example, in the 1920s, Weimar Germany saw moderate inflation, meaning workers were becoming worse off. To keep workers happy, the government printed more money so that they could increase nominal wages. But, this just fed through into higher inflation, more wage demands and hyperinflation

Do higher wages always cause inflation?

Not necessarily. There are a few cases where higher wages do not feed through to higher wages.

- Higher productivity. Suppose wages are rising by 5%, but at the same time productivity (output per worker) is increasing by 5%. This means that firms are able to pay workers higher wages without an increase in costs. To simplify they are paying 5% fewer workers 5% higher wages; therefore, the total wage bill is the same. In this case, there is not the same pressure to increase prices.

- Lower profit margins. A firm may face a significant increase in costs, but because of the economic climate may not feel able to put up prices. For example, if product markets are very competitive (e.g. cheap imports), then they may struggle to raise prices because they will lose market share. Also in an economic downturn consumers may have very elastic demand so firms are not willing to increase prices but make lower profits instead.

- Wage adjustment. It is also important to distinguish between micro wage rises and macro wage rises. For example, if certain industries have labour shortages then this will lead to higher wages in this particular industry. But, on its own will not cause economy-wide inflation to increase. Wage inflation stems from an economy-wide wage rise.

Examples of wage push inflation

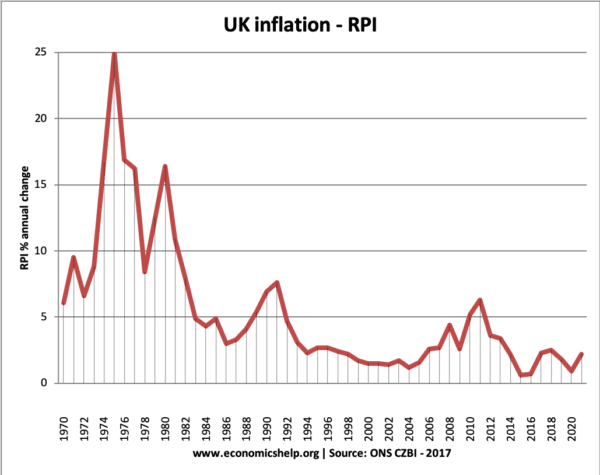

In the 1970s, nominal wages were rising rapidly in the UK, EU and US. This contributed to the high rates of inflation we saw in the 1970s. Inflation was also caused by rising oil prices.

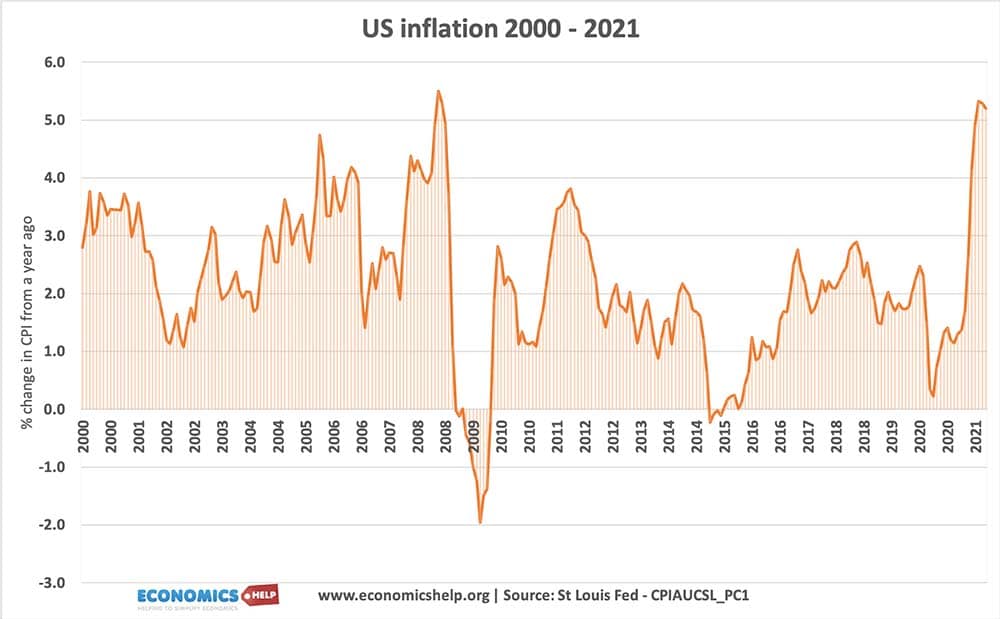

In 2021, we see a rare example of wage-push inflation. Since the credit crunch in 2008, wage growth has remained muted and this is a factor in keeping long-term inflation low. However, 2021 has seen wage growth and is a factor in the inflation that we see.

Related

Thank you! Cost-push (including wage-push) inflation fascinates me. I remember the 1970s.

In terms of relative payoffs, which of the two is preferable for economic growth? Lower profits or higher wages.