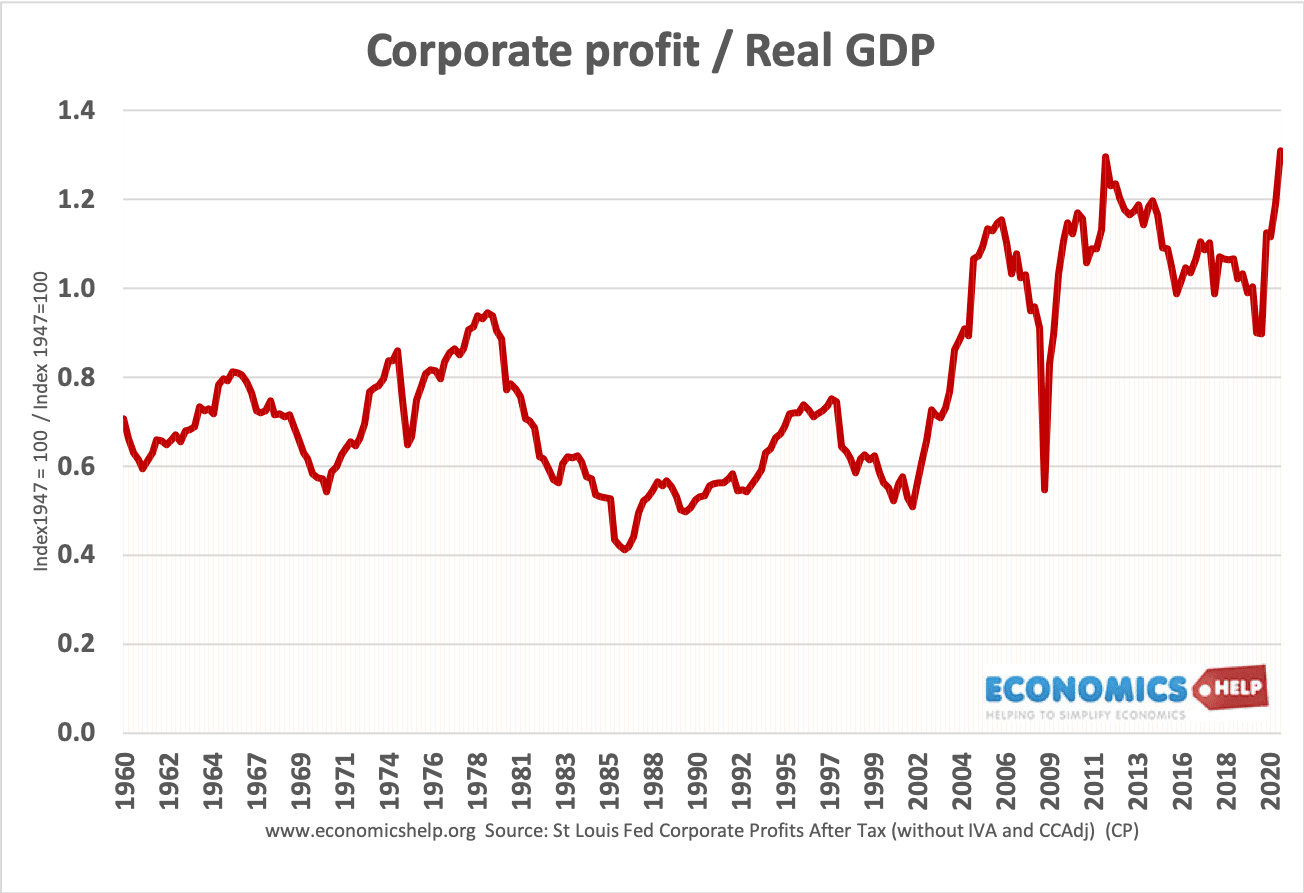

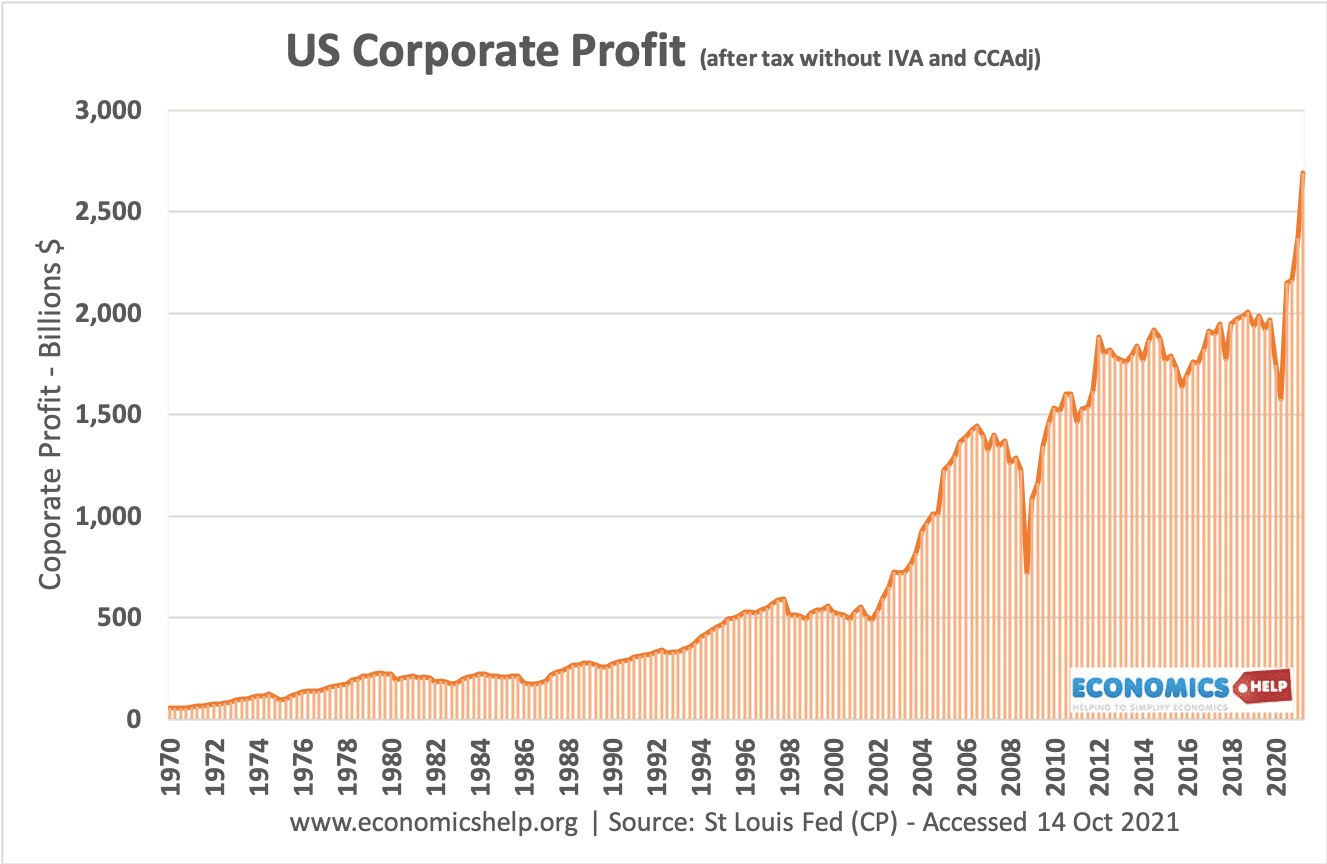

By different measures, US corporate profit has increased significantly in the past two decades. It stands at 10.5% of GDP. What is behind the large rises in profit?

In 2021, US corporate profit after tax stands at 2,700 billion (or $2.7 trillion) This is the nominal figure, but even as a percentage of GDP, corporate profit has been rising.

Corporate profit has been rising at a time of fairly stagnant median wage growth.

Globalisation (profit made abroad)

One factor for the rise in corporate profit/GDP is globalisation. GDP measures income owned by US residents. So when Apple (US-owned company) makes profit from producing iPhones in China, part of this profit comes back to the US. Therefore, US corporate profit is magnified by their operations overseas. Therefore, with multinational operations, US companies are not making a profit out of the US economy directly but overseas too.

Note the rise in after-tax corporate profit would be higher if US multinationals repatriated more of the profit back to the US. Instead many of the big multinationals are keeping profit offshore in tax havens to avoid paying US corporate profit which is nominally 35%.

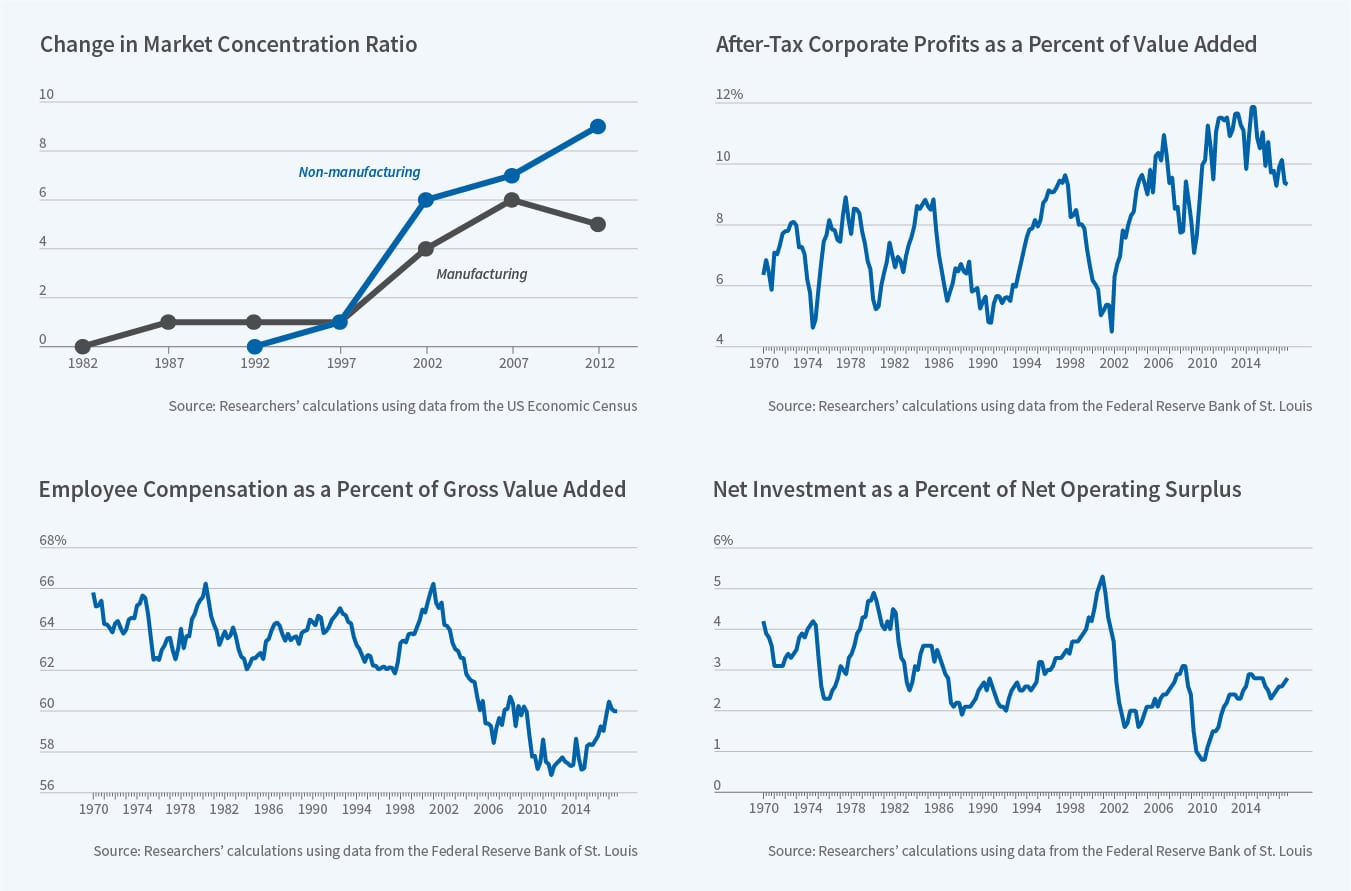

Monopoly power

Several studies have shown a rise in market concentration with the growth of ‘superstar’ firms who are in a position to dominate their market through economies of scale, brand loyalty and barriers to entry. These include firms such as Apple, Amazon, Walmart, Microsoft, Google, Facebook. This enables the firms to increase prices and set a monopolist maximising price without losing their dominant position. In 2020, Facebook made revenue of $85 billion. In Q2 2021, Facebook made profit of $9 billion (an annualised rate of $36 billion)

When measuring market concentration it is important to include the market share of foreign companies for example, car manufacturing has few US companies, but if you include foreign companies selling in the US, the market is much more competitive. However, in the realm of tech, the markets have increasingly moved to large monopolies.

Monopsony Power

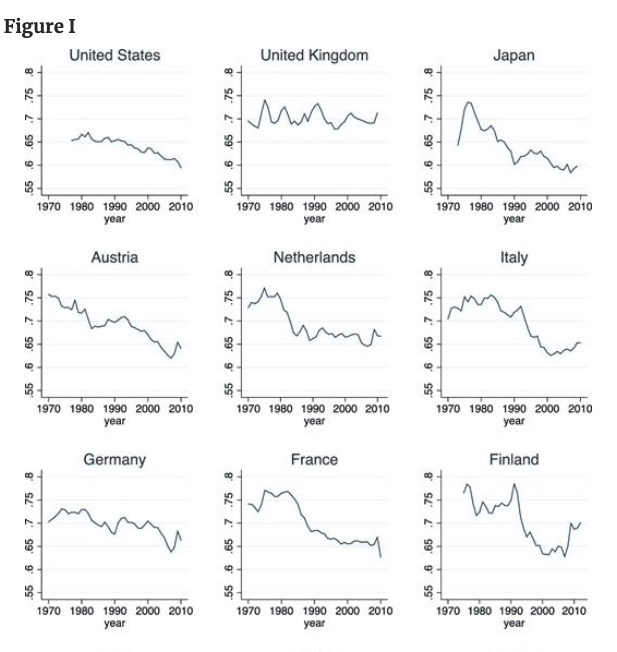

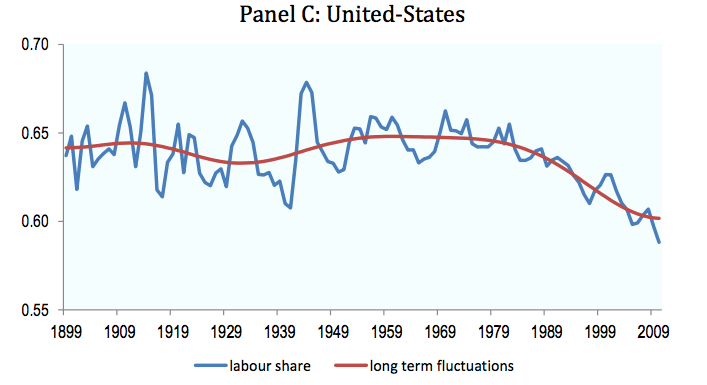

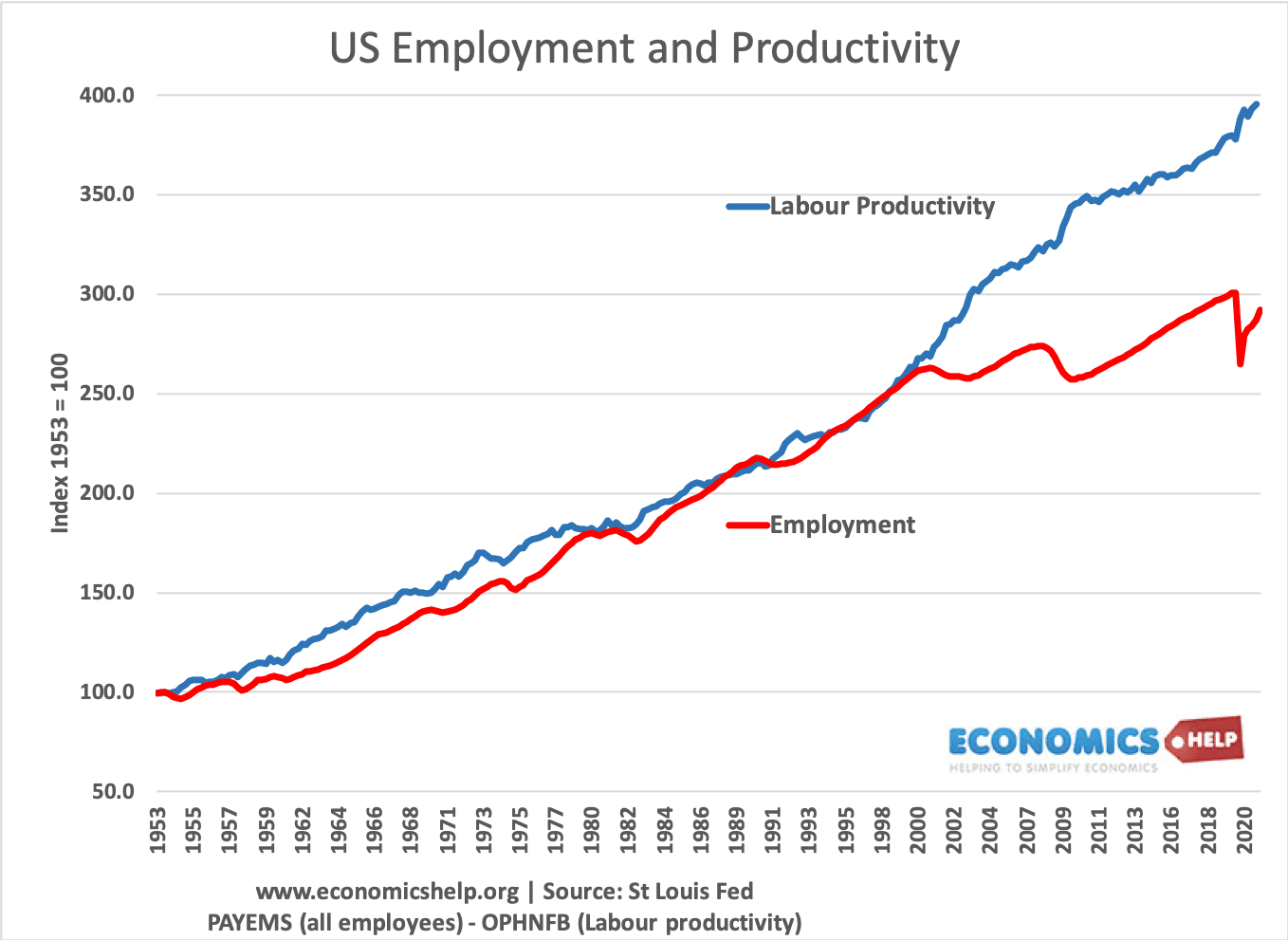

In recent decades there has also been a fall in the labour share of GDP.

Plots the ratio of labor compensation to gross value added for all industries. Source EU KLEMS July 2012 release.

One factor in the decline share of labour income is a decline in the power of trade unions and a weak minimum wage. In the US membership of trade unions fell from 20.1% in 1983 to 10.3% in 2019 (BLS) This means workers are in a weaker position to demand wage increases and a share of productivity growth.

Low Costs

Up until 2020, firms had benefited from falling costs of production, low inflation and cheap energy. Oil prices were low and we saw gluts in key commodities like steel. Firms have also been able to move manufacturing off-shore to take account of lower labour costs in Asia. These continued low costs is a key part of the equation which enables higher profit.

Interestingly 2021, has seen a reversal in this trend as firms face higher energy costs, disrupted supply chains and higher prices of raw materials. This is eating into firms’ profit margins as they have only been able to pass on a certain fraction of their costs in higher prices.

Brand loyalty

Highly profitable firms usually are able to make themselves indispensable to consumers. By offering next day delivery on a variety of goods, Amazon has been able to carve out a niche almost on par with the post office. For many years, Amazon aimed at market penetration but now it is influenced shoppers spending habits, the firm is in a position to remain very profitable for years to come. Competitors will find it very difficult to take consumers away from the ease of using Amazon and compete with Amazon’s huge economies of scale, such as an extensive delivery network. Apple is another very profitable firm, whose main selling point is the strong brand loyalty of its Apple products. Given strong brand loyalty, they are able to keep increasing the price of its mobile phones with every release because consumers are interested in the quality of the phone more than buying the cheapest.

Related