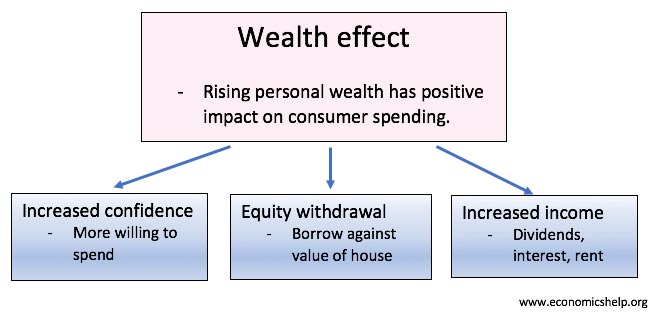

The wealth effect examines how a change in personal wealth influences consumer spending and economic growth. Rising wealth has a positive impact on consumer spending.

Wealth is a stock concept. At a particular time, your wealth is fixed. Wealth is comprised of savings, bonds, property and assets.

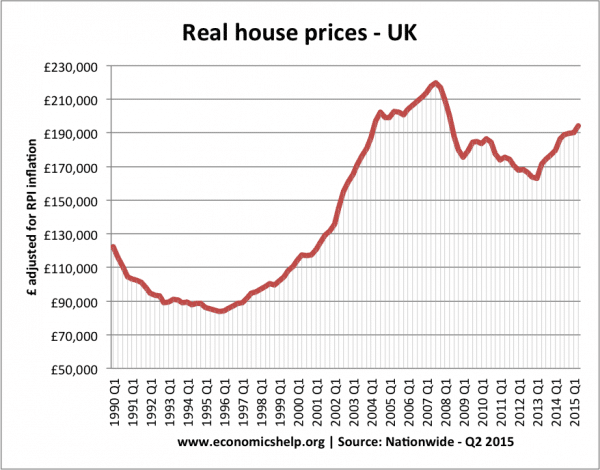

A major form of wealth in the UK is the value of your house. If house prices, increase, then it tends to cause a positive wealth effect. Similarly, a fall in the value of wealth can have a negative impact on consumer spending and economic growth.

The impact of a change in wealth

If households see an increase in their personal wealth, it will have the following effects:

- Increase in confidence to spend, borrow and take risks. During a period of rising wealth, we may see a fall in the savings ratio.

- Increased ability to re-mortgage and take equity withdrawal. Suppose you take out a mortgage for £100,000 on a house valued £120,000. If house prices double to £240,000. A bank is maybe willing to give you a bigger mortgage. This means you can gain a lump sum to spend on buying a car, school fees, a gap year.

- Increased wealth can lead to higher income. Higher wealth may enable higher income from dividends, rent or interest. A householder seeing a rise in house prices may not see much increase in income, but they could always sell the house to finance retirement home.

Other impacts of rising wealth

- In addition, rising house prices will have influence on banks. With rising house prices, they may be more willing to lend mortgages

- Governments will see rising tax revenue – if they have taxes on wealth, such as stamp duty.

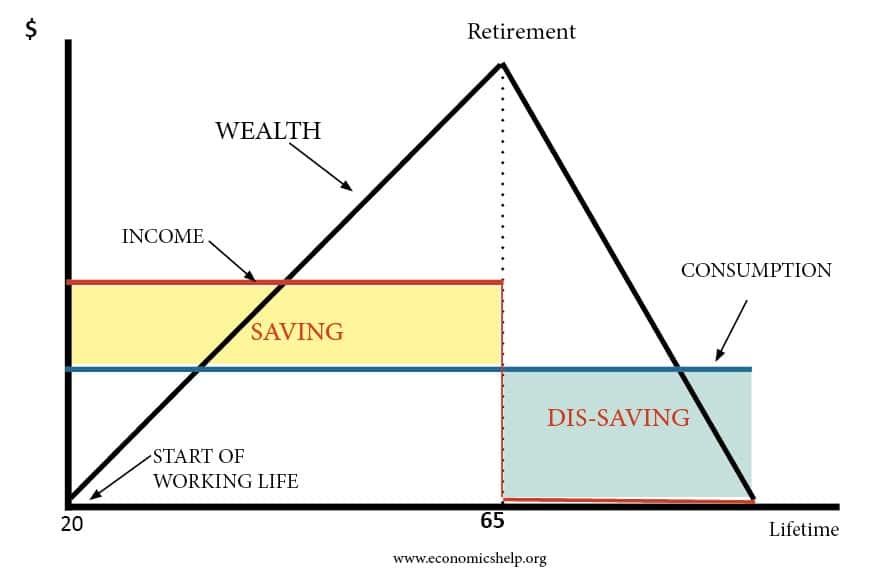

Life cycle theories

Some life-cycle theories of consumer spending state that wealth is an important factor in determining spending – with households using wealth to smooth consumption over a life-cycle. Therefore, changes in wealth will influence this average spending level.

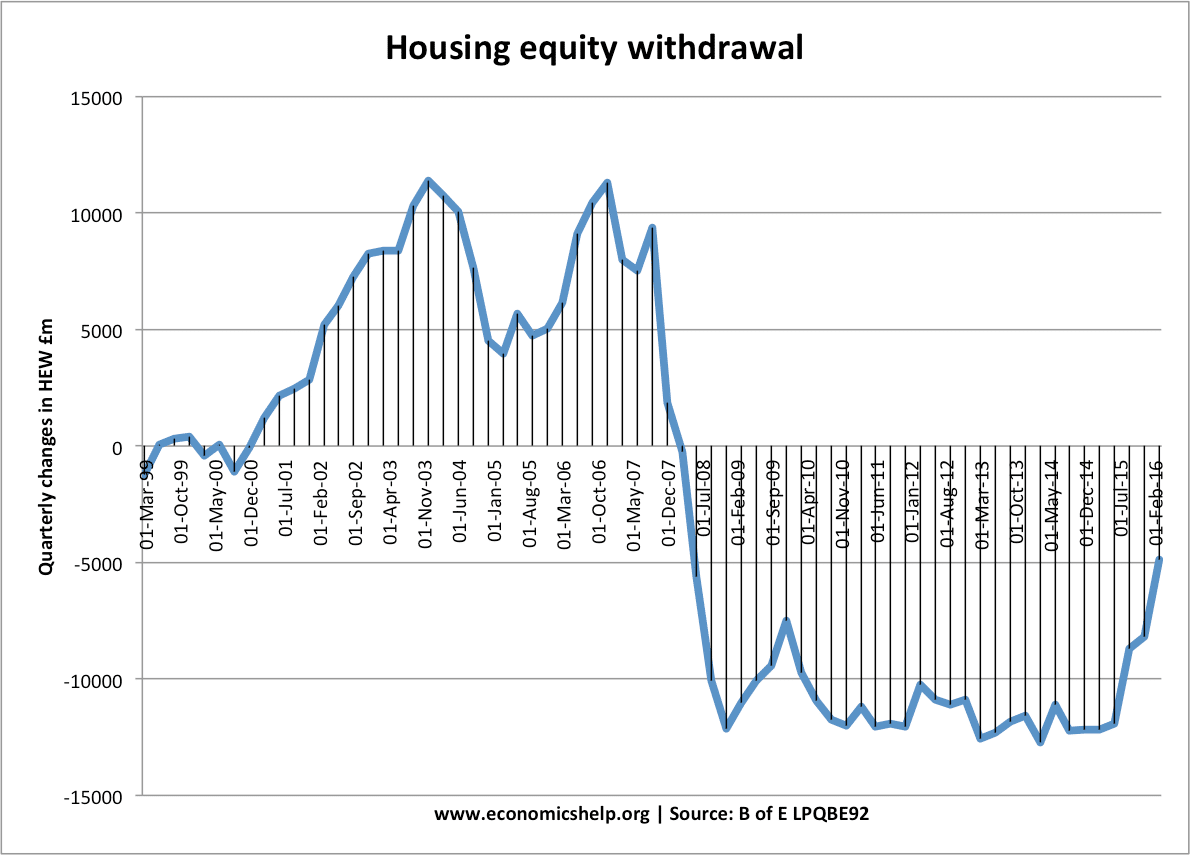

Impact of rising house prices on housing equity withdrawal

In the UK house prices were rising substantially from 2000 to 2007. From 2008, house prices fell leading to a decline in housing equity withdrawal.

Housing equity withdrawal (used to be called mortgage equity withdrawal) occurs when homeowners remortgage house – to get a bigger mortgage loan and use the advance to spend.

UK house prices

Evaluation of wealth effect

- The link between wealth and spending is smaller than the link between income and wealth.

- It is harder to translate wealth into money which can be spent. For example, banks may not be willing to give a bigger mortgage – despite the rise in house prices.

- Rising house prices will not make everyone feel better off. If house prices rise, then it is not much as people may feel if they sell house, they will just have to spend more moving elsewhere.

- It depends on the wealth bracket. If wealth increases for the very wealthy – they may have a lower marginal propensity to consume from increased wealth as they don’t have any pressing spending needs. However, for those on relatively low incomes, a rise in wealth – may be the only way they can afford one off expenditures such as home extension or several years of school feeds.

- It depends whether an increase in wealth is volatile or permanent. A rise in share prices can be quite volatile. Most people don’t see share equity as sources of spending. If share prices rise or fall – it has little effect on spending in the short-term.

- Housing wealth in the UK has often had a significant effect on the economy. This is because many households own a house and it is by far the biggest forms of wealth. In Germany, there is a lower percentage of the population who own a house, changes in house prices have a smaller impact on the economy.

- It is hard to separate cause and effect. Falling house prices cause lower spending and lower growth. But, lower spending and recession – cause falling house prices.

- Rising house prices can reduce the spending power of renters. If house prices rise, homeowners (around 65% of households) will see a rise in wealth. However, for those who do not own their own house, they may need to save more for a deposit and actually reduce spending.

Conclusion

The UK housing market can play a significant role in the economy. Rising house prices in the late 1980s and early 2000s were a factor in supporting rising consumer spending. Similarly the fall in house prices 1990-92 and 2008-10 were periods of economic recession. Falling house prices definitely reduce household wealth and reduce the ability to take equity withdrawal.

Related