The gig economy refers to the segment of the labour market which concentrates on short-term / temporary jobs and contracts. Often these workers can have more than one job, e.g taxi driver who works both for a traditional taxi company and Uber.

Like a musician who goes from one gig to the next, the gig economy refers to a growing range of workers who don’t have typical stable employment but work as self-employed and temporary contractors.

The number of people who work for themselves has increased significantly in recent decades. Nearly five million UK workers are now classified as self-employed. A 45% rise since 2000.

Features of the gig economy

- Workers on zero hour contracts

- People self-employed.

- Workers paid for limited contracts

- People having more than one source of income.

Cambridge University dictionary definition

A way of working that is based on people having temporary jobs or doing separate pieces of work, each paid separately, rather than working for an employer: (link)

Different types of workers

The gig economy is by definition not linear, but with many different types of gig workers. We could segment the gig economy into different sub-groups.

- Free agents – People who choose jobs and derive their primary income from their work. For example, web designers who work by contract.

- Casual earners – people who use independent work for supplementary income. They may have part-time/full time jobs or even be in semi-retirement. For example, teachers working as examiners.

- Reluctants – people who are classed as self-employed, but who would prefer to do the same (or similar) job reclassified as employed. Examples could include delivery drivers (Hermes, Deliveroo, Amazon) Workers who feel self-employment status is a way for a company to pay less than minimum wage, avoid sickness benefits and greater job insecurity. In theory, they are being paid for separate contracts, but in reality, it is the continuation of the same job – picking up passengers.

- Financially strapped – people who do extra work out of necessity.

- (see also: BBC article on Gig economy)

Factors behind the growth of gig economy

Decline in traditional manufacturing jobs. Heavy industry with large factories/mines was more conducive to stable, full-time work. The service sector, by contrast, is more conducive to flexible part-time work and short-term contracts.

Technology. The internet enables many people to work from home and set up as self-employed. For example, there is a rise in the number of people working as online project managers. Websites such as Upwork (formerly Elance), eBay, Etsy (peer to peer selling) have facilitated this economic diversity.

Shift in economy. The rise in online shopping, has seen a rise in growth for home deliveries, which is a big growth area of the gig economy. Though the status of delivery drivers is often a grey area.

Tax / payment issues. In the UK, there is a tax advantage for setting up as a self-employed worker as opposed to the traditional employed worker. There are lower rates of National Insurance contributions for the self-employed. If a firm is able to reclassify employees as self-employed contractors, then the firm can avoid National insurance contributions. At present, a company pays 13.8% NI contributions on an employees wage, but none on self-employed contractors.

If the government cut corporation tax rates to 17% – then there will be a bigger incentive for the employed to switch to self-employment and start mini-companies. Companies avoid NI because income paid as dividends does not attract any NI.

If an employed worker (earning £30,000) switches to owning his own company and paying dividends, he could save £3,200 on a salary. After the proposed corporation tax cut to 17%, the tax dividend of incorporation would rise to £4,200. This tax advantage could encourage a faster rate of shift in employment classification.

Implications of the growth of the Gig economy

Lost tax revenue. The divergence between tax rates for traditional employed and self-employed is leading to lost tax revenues as more move out of traditional employment.

The OBR predicts by 2021/22, growth in incorporation (of 5% a year) could lead to a loss of tax revenue £3.5bn. (See: article at FT)

It is a similar situation in the US, where Gig economy has negatively impacted tax revenue (Fortune.com)

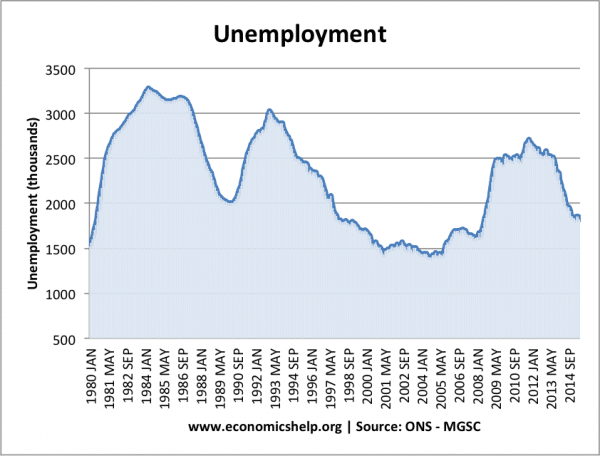

Growth in employment. It is suggested the increased flexibility of the gig economy has been a significant factor in the rapid decline in UK unemployment since 2012. Compared to previous recessions, unemployment has fallen much quicker. With greater flexibility and lower costs, it has been easier for workers to find some kind of work – even if lacking in permanence.

Growth in self-employment

UK unemployment

Winners and losers of the gig economy

There are some winners from a gig economy – especially high skilled workers; for example, IT experts, computer programmers. The gig economy enables workers an enviable opportunity to work from home, choose jobs and earn relatively high wages.

At the other end of the scale, other workers feel loose labour market regulations have enabled their jobs to be reclassified as self-employed, primarily to enable worse working conditions and pay.

Personal note

Since leaving university in 1991, I never had a proper job. When I taught at a tutorial college, I was classed as self-employed. I had no guarantee of hours, but was able to find supplementary jobs, such as marking exam papers, giving lectures and then increasingly earning money through websites, such as economicshelp.org.

On the other hand, my lodger works as self-employed teacher at an English school on a zero hour contract. He has occasional other work, but the labour market flexibility has seen a squeeze on his wages and employment prospects.

Related

Great! a study by Intuit predicts that by 2020, 40 per cent of American workers will be independent contractors. We don’t have sizeable gig economy yet in East Africa, but it is imminent.

There are more and more people willing to work from home. Internet access is available everywhere. These pushes the growth of the gig economy.

In Germany there is a law against so-called “Scheinselbstaendigkeit’ which translates as “fictitious or disguised self-employment”, under which – as one of many criteria – a sub-contractor is not allowed to have mainly one client who he works for. A similar emplyoment law in the UK would solve many of the problems associated with the gig economy, particulary the subpar position the aformentioend ‘Reluctants’ find themselves in.

the biggest problem is the banks not recognising this type of work. This means an inability to borrow