- An exchange rate index is a way of measuring the performance of a currency against a basket of other currencies.

- An exchange rate index shows the percentage change in the value of the currency against its main competitors.

- It sets the index to 100 for a particular base year. This enables users to make percentage comparisons.

- The index uses the geometric mean of the exchange rate spread between different currencies

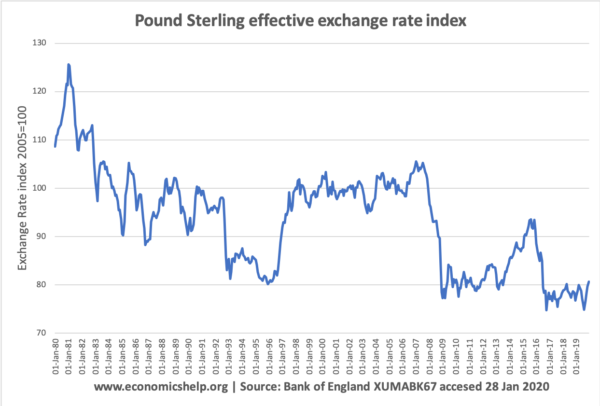

Example of Sterling Trade Weighted Index

Base index Jan 2005 = 100.

This shows that by Jan 2020, the exchange rate index has fallen over 20% from its 2005 value.

Trade weighted index

A trade-weighted index means that a currency is measured against a variety of currencies and a weight is attached to the relative importance of the currency. For example, if the Pound appreciates 10% against the Euro – this is significant as nearly 50% of UK trade is with the EU. If the Pound appreciates 10% against the Australian Dollar, this is not so significant as trade with Australia only accounts for a small percentage of UK trade

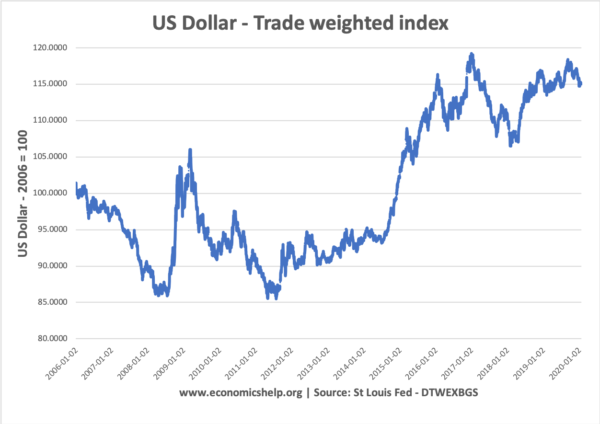

US Dollar Trade weighted index

St Louis Fed – Trade weighted index (Broad)

In this case, the base year is 2006. By 2020, the US dollar trade-weighted index has appreciated by 15%.

The most recent US dollar index measures the US dollar against 25 main currencies including:

- Euro (EUR) –

- Japanese Yen (JPY)

- Pound Sterling (GBP)

- Loonie (CAD) – Canada

- Peso – Mexico

- Yuan – China

- Kronas (SEK) – Sweden

- Francs (CHF) – Switzerland

These are weighted. This means the exchange rate movements also depend on the relative importance of trade with these currencies. Therefore an appreciation against the Swedish Krona only accounts for a small % of US trade. A devaluation against the Euro will have much more impact and weighting.

Each year the index is updated to reflect changes in the pattern of trade. In recent years, the Chinese currency (Yuan) has gained a bigger impact on the dollar index reflecting the importance of US-China trade.

Related