The long-run trend rate of growth is the average sustainable rate of economic growth over a period of time. It could also be termed as the ‘underlying trend rate of economic growth’ The long-run trend rate is determined by growth in productive capacity (AS). It is the rate of growth which is consistent with low inflation.

Actual growth can be quite volatile with booms and busts taking the growth rate away from this underlying trend rate. In the UK, in the post-war period, the long-run trend rate is approximately 2.5% – but we had many periods of boom and bust.

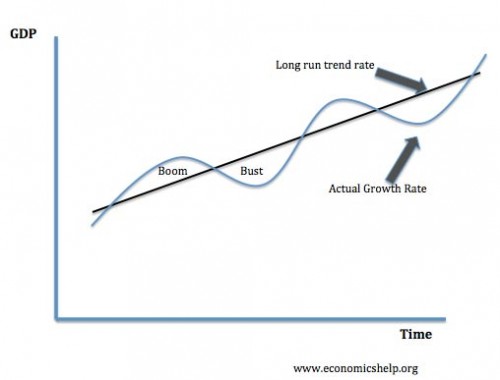

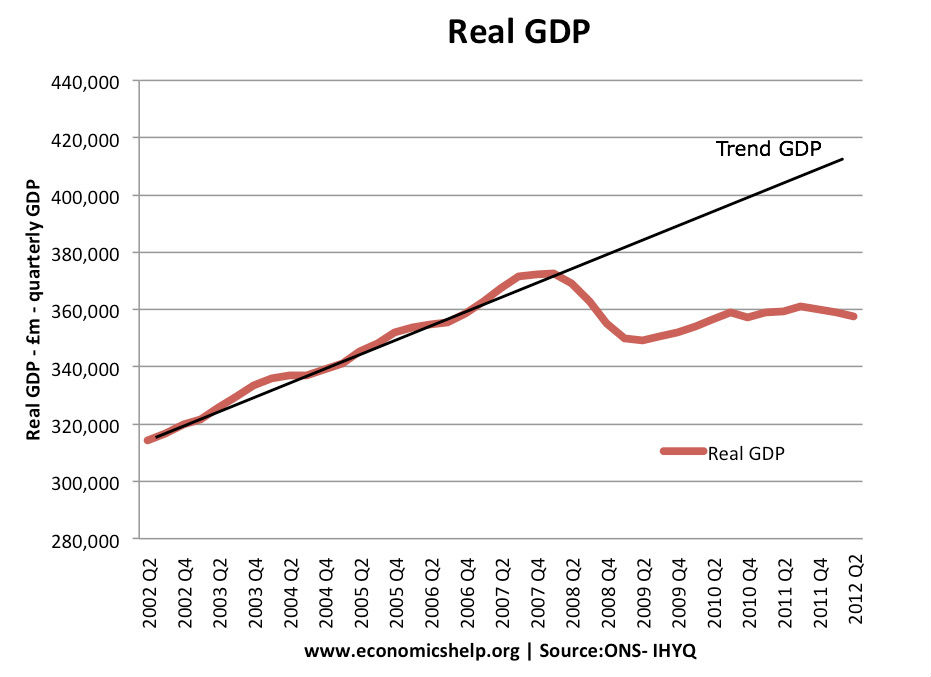

Graph Showing Long Run Trend Rate

This graph shows the actual growth rate is fluctuating above and below the long-run trend rate.

- If growth is above the long-run trend rate we say there is a positive output gap (inflationary pressures – boom)

- If growth is below the long-run trend rate, this creates a negative output gap (spare capacity or bust)

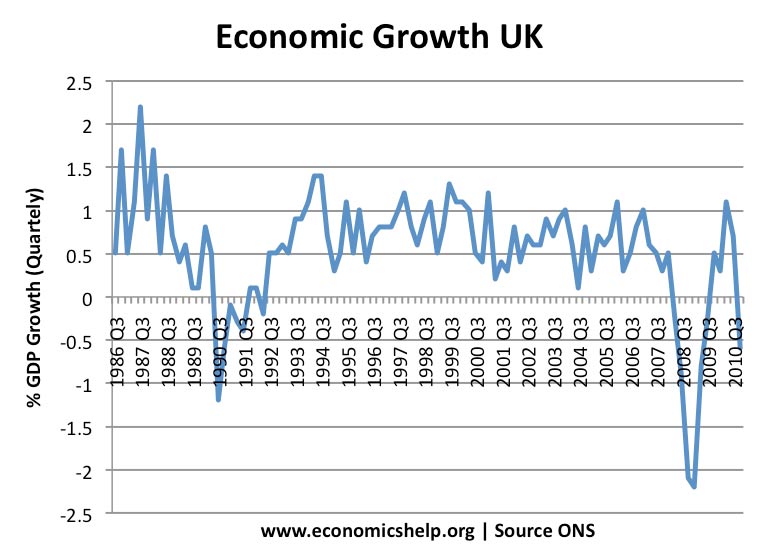

Economic Growth Rates and Long-Run Trend Rate

This graph also gives an indication of the underlying trend rate. The average quarterly growth rate is around 0.6 – 0.7%. (annual growth rate of 2.5%) In the late 1980s, we had growth well above the underlying trend, rate – but this led to recession of 1990-1991

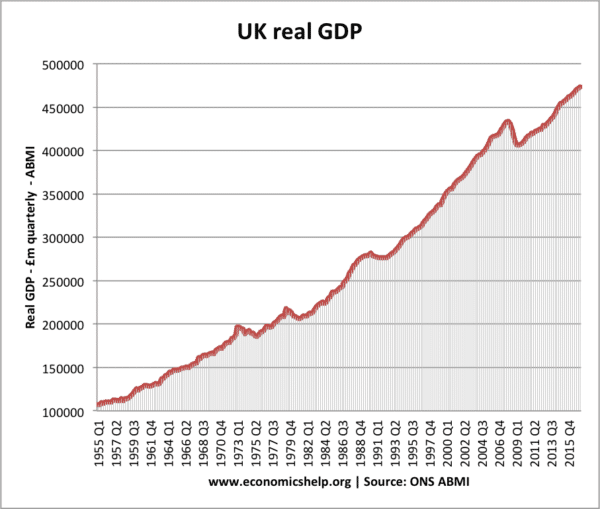

This shows a steady increase in real GDP in the post-war period.

What determines the Long Run Trend Rate of Growth?

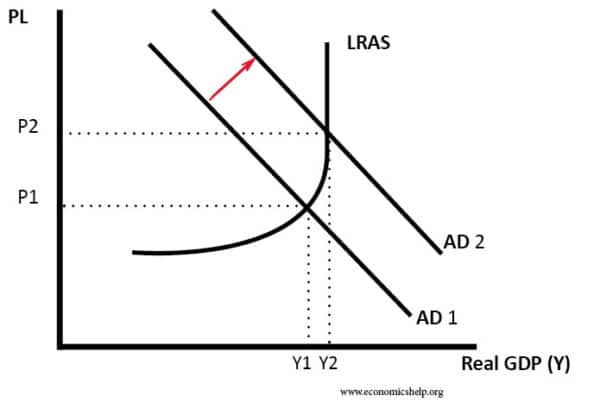

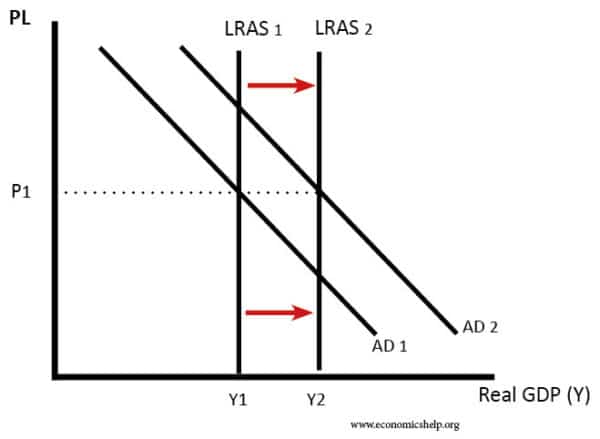

Graph showing increase in LRAS and AD.

The long-run trend rate of growth is essentially determined by the growth in productive capacity – the growth in Long-Run Aggregate Supply. The long-run trend rate will be determined by factors such as:

- Technological improvements and technological sophistication. For example are firms investing in new technology such as Artificial Intelligence and automation?

- Labour productivity – output per worker – which depends on education, training and skill levels.

- Availability of resources – easy access to power and natural resources can provide stimulus to economic growth.

- Investment levels and efficiency of investment

- Scope for productivity gains from privatisation

- Labour market flexibility.

- Levels and quality of infrastructure – communication/transport.

- Entrepreneurial spirit – Are people willing to set up and develop new business? This may depend on the confidence of people in the long-run performance of the economy.

Some countries like China may have a high long-run trend rate because their productive capacity is increasing at a faster rate than in UK.

Boom and Bust Cycles

If the actual growth is above the long-run trend rate, then it implies that demand is exceeding the growth of productive capacity. In this case, we tend to get inflation and a worsening of the current account. This inflationary growth tends to be unsustainable and is often followed by an economic downturn.

inflation from an increase in AD.

Economic Growth below the Long Run Trend Rate

In 2008-12, we have had an experience of economic growth being persistently below the long-run trend rate. In other words, actual growth hasn’t caught up with the trend rate.

The prolonged recession of 2008-12 caused GDP growth to fall well below the long-run trend rate. (What is the UK’s output gap?)

If growth is consistently below the long-run trend rate, it may cause the long-run trend rate to decrease. In other words, in a serious recession, demand-side conditions can have an effect on the average growth and lead to a persistent decline in productivity growth.

Related

thanks alot, you are of help

other determinants of the long run trend of rate of growth are ; capital accumulation; growth-compartible institutions; resources availability ; technological sophistication and entrepreneural capacity.

You are the best!

I think it would be great if the difference between Actual Growth and Long-Run trend rate of growth was more simply explained at the top, through making a comparison between the two. One is the productive potential for an economy (IF they were at full capacity, it would operate on that point) and the other is the actual growth an economy (how much they are actually growing).

I mean you do explain it very well, but making it a comparison between the two will mean that it will come up on more search engines as well as providing a quicker answer to those doubtful ones like myself.