The output gap is a measure of the difference between actual output (Y) and potential output (Yf).

Output gap = Y- Yf

A Negative Output Gap occurs when actual output is less than potential output gap. In a recession, a fall in Real GDP causes a negative output gap. However, it can become difficult to know what potential output should actually be. Therefore, there can be different opinions about how the size of the output gap.

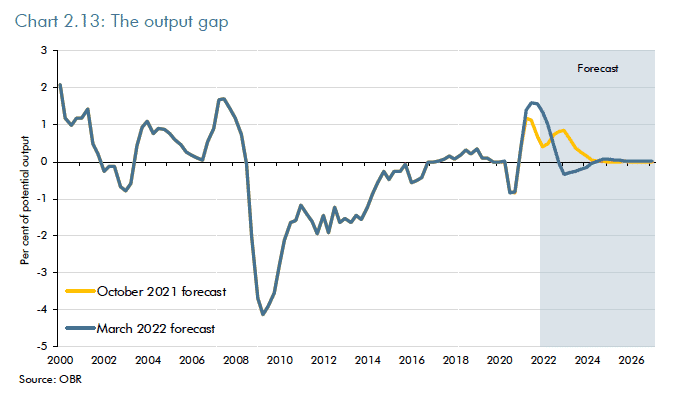

Output Gap 2022

In 2020, there was a modest output gap due to contraction due to Covid. However, this output gap was relatively limited because although demand fell, so did supply.

In 2021/22 as Covid restrictions were loosened, there was a surge in demand from pent up savings, leading to excess demand and supply bottlenecks. This led to a positive output gap and inflation

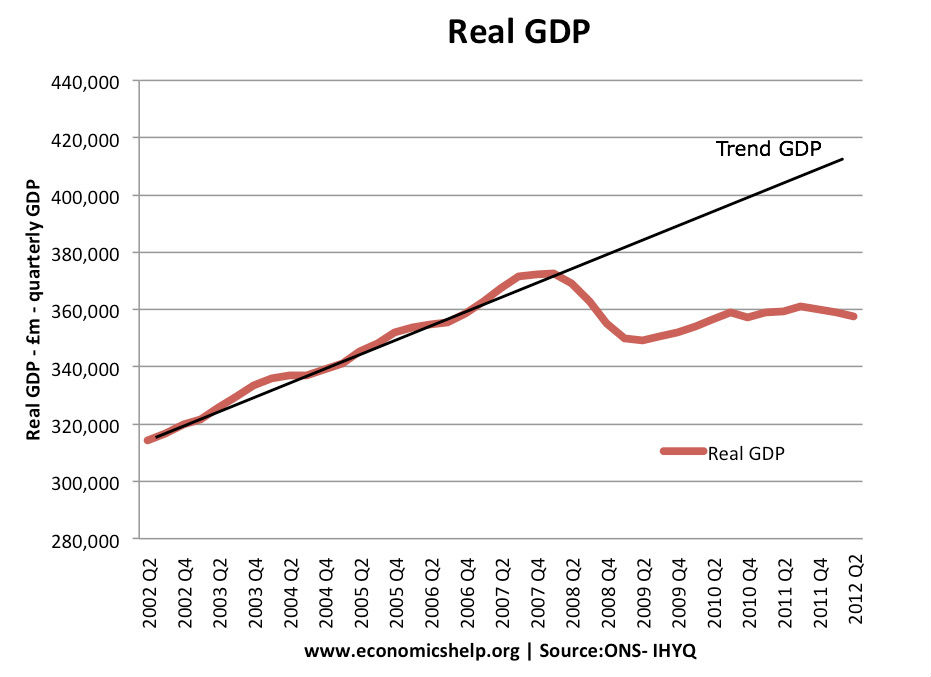

Lost Output from 2008-10 Recession

Note: This shows quarterly GDP statistics. To get annual real GDP *4

The 2008/09 UK recession led to the longest decline in GDP on record. Even in the great depression, GDP didn’t remain below the pre-crisis peak for so long – (see: great recession v great depression)

Looking at the graph above, there appears to be a very large loss of potential output. If GDP had continued to increase at the pre-crisis long-run trend rate of 2.5% real GDP could be approximately 16% higher. This is very significant. For example, imagine what would happen to tax revenues if real GDP was 16% higher.

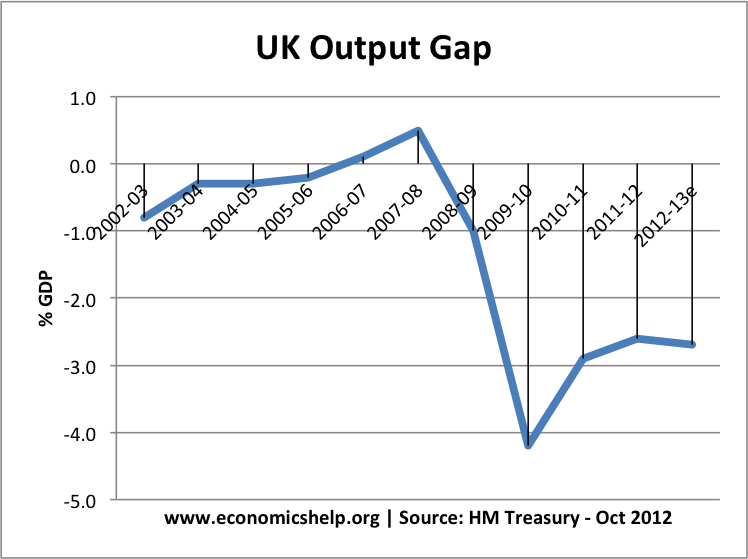

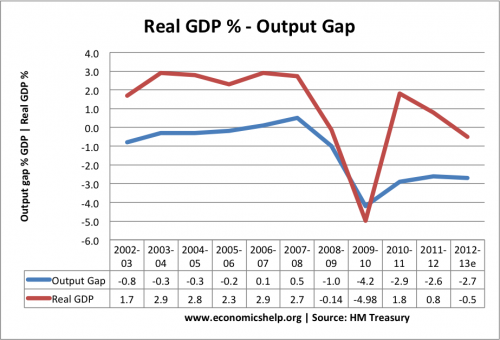

Output gap 2012

HM treasury forecast an output gap of -2.7% for 2012/13. However, others think this under-estimates the amount of spare capacity in the UK economy. Bill Martin, professor of the Centre for Business Research at Cambridge, argues the UK’s spare capacity is closer to 10% Pdf Is the British economy supply constrained? – a critique of productivity pessimism.

If the output gap really is only – 2.7% – it shows that the recession has seen a significant loss of productive capacity.

If the output gap is closer to -10% – it makes a much stronger case for more accommodative monetary and fiscal policy.

Factors that influence the output gap.

- Unemployment. Unemployed workers indicate lost potential output. Since unemployment is lower than expected at 7.9% – this gives some credence to the HM treasury view of a lower negative output gap.

- However, others, such as Bill Martin, argue that the fall in real wages has helped to contain the rise in unemployment. But, this fall in real wages has led to demand deficiency in the economy. Furthermore, there may have been a rise in hidden and cyclical unemployment during the recession.

- Spare capacity. The ONS do surveys into levels of spare capacity. There are also business surveys trying to find how much spare capacity have. These surveys have limitations as it can be hard to precisely define spare capacity. But, again it suggests less spare capacity than you might expect.

- Inflation. With a negative output gap, you would expect inflation to be below target. However, inflation has been complicated. Inflation has often been high in the UK during the recession because of cost-push factors. There is also evidence that the spare capacity has had less downward pressure on prices than usual.

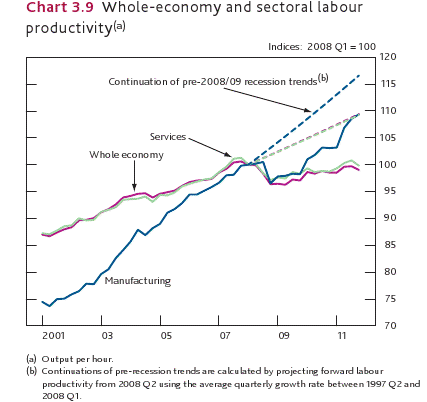

- Labour productivity. The poor growth in UK labour productivity suggests there has been little supply side growth. This means long run aggregate supply has increased at a slower rate than usual.

source: Bank of England inflation report May 2012

This graph from the Bank of England shows that productivity growth has matched the poor performance in GDP.

Summary

- Since the recession of 2008, the UK has lost a significant amount of potential GDP due to the prolonged nature of the recession. This leaves a negative output gap. But, the amount of the negative output gap is difficult to assess.

- If the UK’s output gap is close to -2%, this suggests we need only moderate monetary expansion. However, if the output gap is closer to -10%, this suggests that insufficient aggregate demand is holding back the UK economy and that the prolonged nature of the recession is unnecessary.

Related

Hello

Good article! may I ask you for help?

Can you explain me what are these formulas:

P = ∆W = Fv

∆ t

Pv = 1 Nm (crms)2

r

W= Fs cosθ

I have no clue!

Many thanks in advance!

Zrinka