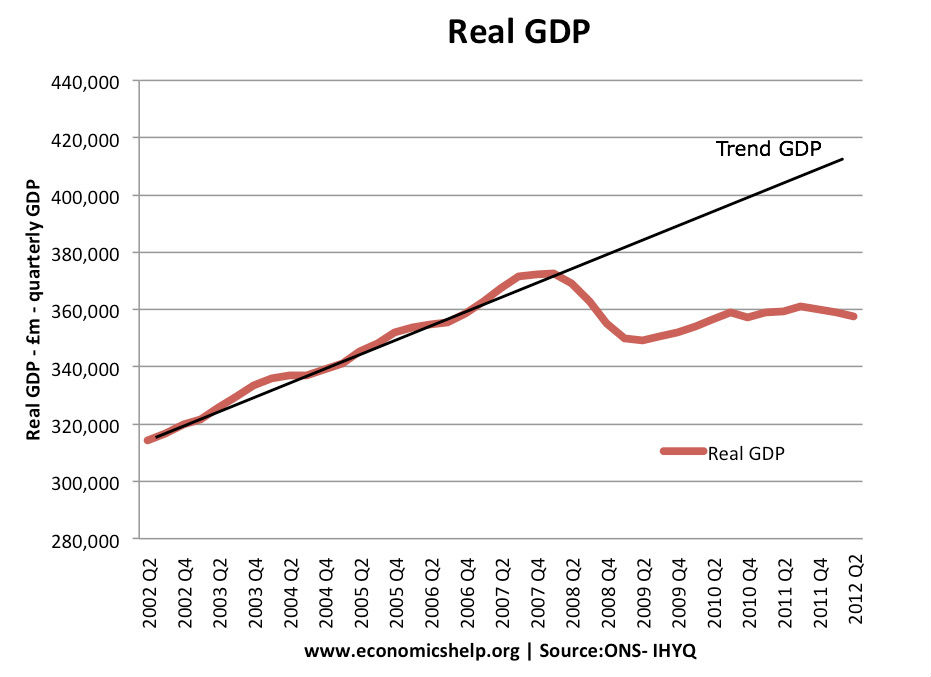

There is hope that the UK may officially be leaving the current recession (for the second time). However, this recovery needs to be put into perspective in to what kind of recovery should we have been expecting?

Interesting research by Moritz Schularick, Alan Taylor, 24 October 2012 on this post- “What should we have expected in terms of economic recovery?

They look at the nature of the recession and examine what kind of recovery might have been expected. Also, they compare the UK recovery to the US. A few notes:

- Both economies experienced a deep financial crisis. With excess credit overhang, you would expect a longer recession than say 1981 or 1991 when the recessions were caused by monetary and or fiscal tightening.

- However, even allowing for the nature of the balance sheet recession, we should have expected to see a much quicker and stronger recovery from the UK.

- The pink lines show the area of expected economic recovery, the blue line shows actual Real GDP growth.

- The US has slightly exceeded expectations – true US unemployment is still high, but given the nature of the recession, they are perhaps doing reasonably well.

- The UK by contrast has completely underperformed. In particular, the economic growth rate since 2009 is very disappointing.

- My only criticism of the research is that they set the bar fairly low. Previous financial recessions involved significant mistakes in fiscal and monetary policy. Mistakes we have tended to repeat.

UK GDP