Stop-go policies refer to macroeconomic policies which result in economic boom or recession.

To manage the economy, the government can change monetary and/or fiscal policy, but the danger is that they might over-react and the economy can go from very fast ‘unsustainable growth’ to very slow/negative growth.

Stop-go policies may be linked to the ‘political business cycle’ with politicians seeking to boost the economy before an election and then dealing with inflation after the election.

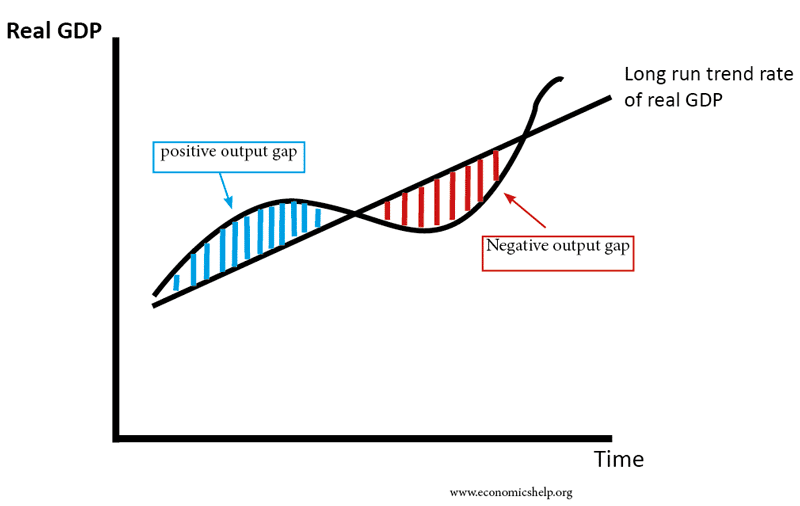

Stop-go compared to long run trend rate of growth

The long-run trend rate of growth is the average sustainable growth rate over a period of time. If growth stays close to long-run trend rate, then it will avoid ‘stop-go’ or ‘boom and bust’.

With a bust ‘stop’ we get a negative output gap – growth below long-run trend rate of negative growth.

Stop

For example, if inflation increased the government may respond by putting up interest rates. However, the rise in interest rates will lead to an economic slowdown. This is because borrowing is more expensive and it will discourage consumer spending and investment. If interest rates increased too much it can cause an economy to go into recession.

Go

On the other hand, if economic growth was below the trend rate of growth and there was unemployment, the government may respond by cutting interest rates. This provides a boost to domestic spending and could cause a rapid increase in economic growth. This will lead to an uptick in inflation and could cause an unsustainable economic boom.

Why fine-tuning doesn’t work and we end up with stop-go policies?

In theory, a government/Central Bank should be able to ‘fine-tune’ the economy making small changes to interest rates or fiscal policy and maintaining economic growth close to the long-run trend rate. If the government could maintain growth close to the long-run trend rate, then they can avoid the ‘boom and bust’ cycle and inflationary pressures. However, in practice, this can be difficult to implement.

Poor information about the state of the economy. It can be difficult to predict the future trend of the economy and even know current data. This leads to delays in making the right choices. By the time the government intervenes with higher interest rates, the economy may already be slowing down. So in this case, the higher interest rates aggravate the economic downturn.

Time lags of policy. If the government increased interest rates the effect can take up to 18 months to have an effect. If inflation was a problem, the government may raise rates, but in the short-term, inflation continues to rise. Therefore, they increase interest rates further. When the rate rises start to have an effect, there is a bigger downward pressure on the economy than expected.

Momentum effect. If the government try to change the state of the economy there might be a multiplier effect which magnifies their changes to the economy. For example, if the government increased tax, this might be expected to reduce the growth of consumer spending. However, the tax rise may harm consumer confidence and lead to a much bigger fall than expected.

Over-reaction. If inflation increases, the government may over-react in trying to control it. Increasing interest rates more than expected.

Examples of stop-go policies

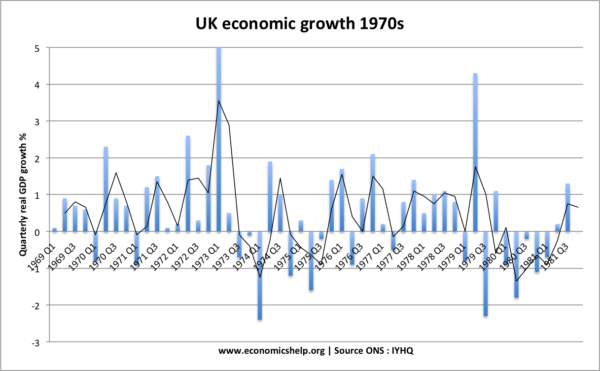

In 1973, the UK experienced a ‘boom’ -known as the barber boom. In the 1972 budget, the chancellor Anthony Barber introduced an inflationary budget – designed to boost economic growth and reduce unemployment. It was successful in causing a surge in growth, but at the expense of inflation. The oil price shock of 1973, exacerbated this problem and the economy went into recession by the end of 1973.

Lawson Boom

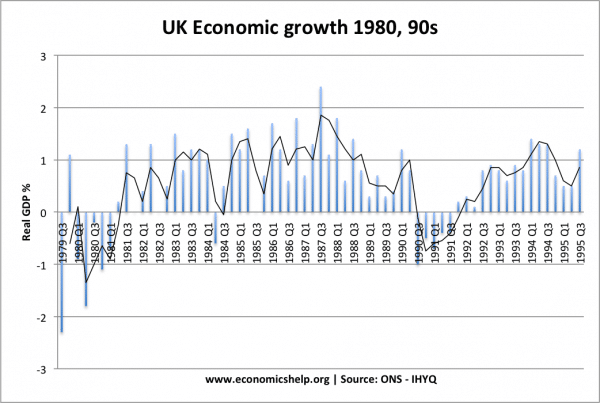

In the late 1980s, the UK economy expanded at a rapid rate – annual growth of over 4% – this led to high inflation, and in 1990/91, the policy was reversed and interest rates increased. The economy went from boom to recession in 1990/91.

Related