The Fisher effect examines the link between the inflation rate, nominal interest rates and real interest rates.

It starts with the awareness real interest rate = nominal interest rate – expected inflation.

If you put money in a bank and receive a nominal interest rate of 6%, but expected inflation is 4%, then the real purchasing power of your savings is rising by 2%.

The link between inflation and nominal interest rates

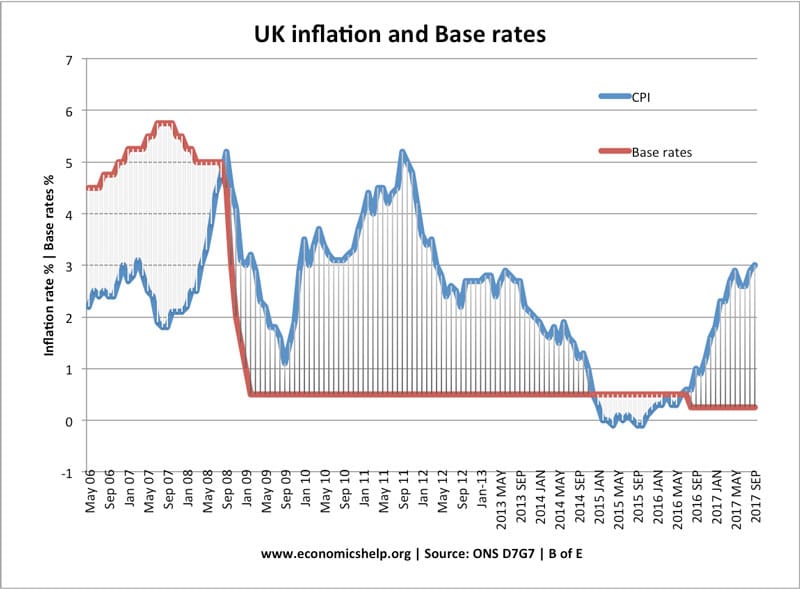

One implication of the Fisher effect is that nominal interest rates tend to mirror inflation, making monetary policy neutral.

For example, if the Central Bank increased money supply and the expected inflation rose from 4% to 7%, then to maintain a stable economy, the Central Bank would raise interest rates from 6% to 9%.

If nominal interest rates increase at the same rate as inflation the real net effect has little impact.

Limitations of the Fisher Effect

- Elasticity of demand to interest rates. In periods of confidence and rising asset prices, high real interest rates may be ineffective in reducing demand. Therefore, in some circumstances, Central Banks may need to increase the real interest rate to have an effect.

- Liquidity Trap. In a liquidity trap reducing nominal interest rates can have no effect on boosting spending. Lower interest rates don’t encourage investment because the economic climate discourages investment and spending.

- Breakdown between base rates and actual bank rates. In some circumstances, there is a breakdown between base rates set by Central Bank and the actual interest rate set by banks.

International Fisher Effect

This uses the Fisher effect to predict a link between interest rates and exchange rate movements.

The argument is that if a country has higher nominal interest rates, this will tend to cause depreciation because higher nominal rates imply that inflation is higher.

Related