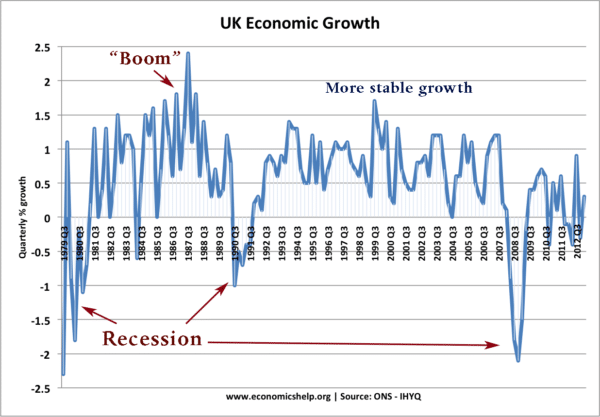

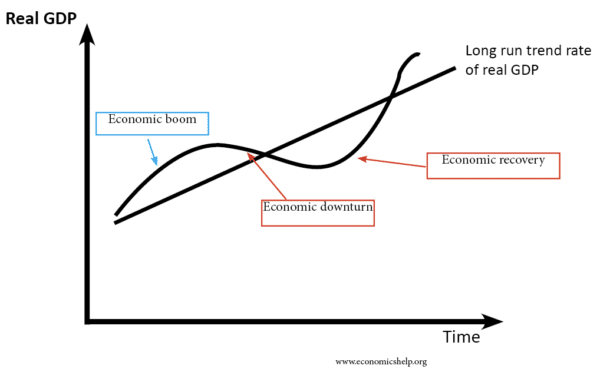

Boom and bust economic cycles involve:

- Rapid economic growth and inflation (a boom), followed by:

- A period of economic contraction / recession (falling GDP, rising unemployment)

Causes of boom and bust cycles

1. Loose Monetary Policy

If monetary policy is too loose, it means real interest rates are too low given the state of the economy, e.g. UK economy in late 1980s. Loose monetary policy reduces the cost of borrowing and mortgage payments (increasing disposable income). This will cause a rise in investment and consumer spending. This rise in aggregate demand can cause excessive growth in the money supply and cause economic growth to be above the long run trend rate.

In the post-war period, the UK has had a long run trend rate of around 2.5%. This means that typically, productive capacity (AS) increases by about 2.5% a year. If interest rates are kept low, aggregate demand (AD) will increase much faster then the rate of productive capacity and economic growth will be too high. If economic growth is substantially above the long run trend rate, we will tend to see:

- Rising inflation. Demand grows faster than supply. Therefore firms put up prices.

- Wage inflation. Due to high demand for labour, there will be labour shortages leading to wage inflation.

As inflation rises, the Central Bank/government may seek to reduce inflation by putting up interest rates, and this can turn the growth into an economic downturn.

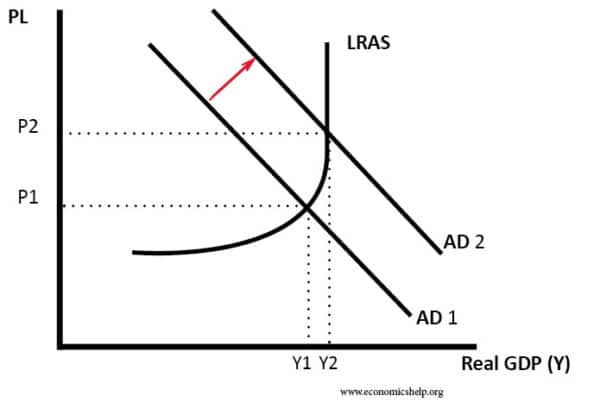

Graph showing the impact of an increase in AD on inflation.

2. Loose Fiscal Policy

Excessive economic growth could be caused by a loosening of fiscal policy, at an inappropriate time. For example, if economic growth is already 2.5%, a cut in income tax would cause higher consumer spending leading to an economic boom. A loosening of fiscal policy would also cause a rise in government borrowing. This could be inflationary if financed by an accommodation of monetary policy (allowing the money supply to rise). Also, to increase government borrowing in a boom, means the government will have fewer resources to pursue expansionary fiscal policy when the economy contracts.

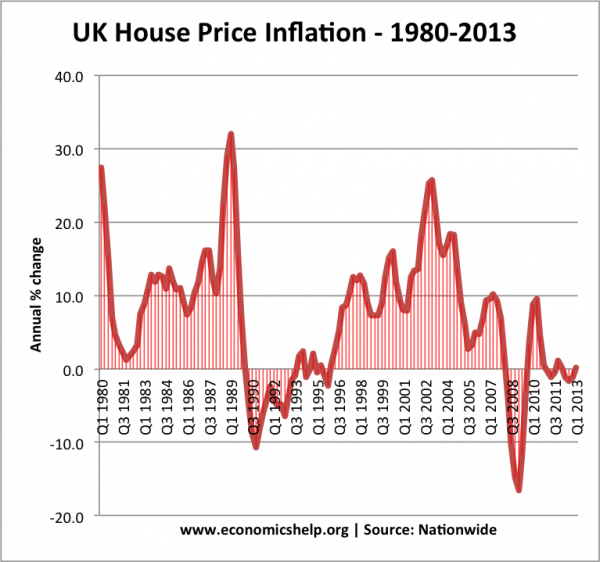

3. Boom and Bust in Asset Prices

A rise in assets such as house prices cause an increase in household wealth and also encourage bank lending. With rising house prices we tend to see a growth in equity withdrawal, a lower saving ratio and an increase in bank lending. This would cause higher consumer spending and a rise in economic growth. Rising house prices cause higher growth; however, if prices start to fall, the process starts to work in reverse. Households see a fall in wealth, reducing confidence. This will lead to a fall in consumer spending – especially if households experience negative equity. Falling house prices also will make banks more reluctant to lend.

Similar to house prices, a boom and bust in share prices could transfer to the wider economy. For example, the US stock market boom of the late 1920s encouraged a growth in consumer spending. But, the Wall Street Crash of 1929 precipitated the Great Depression. See: Impact of stock market on economy

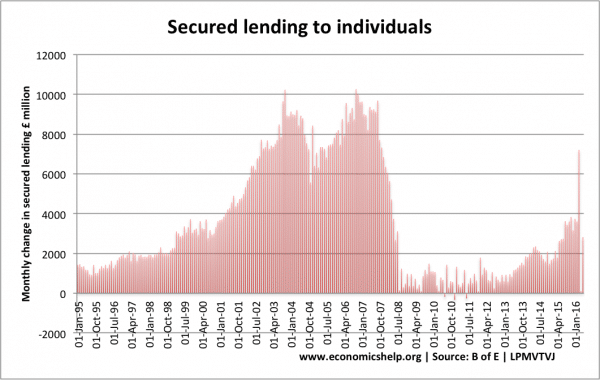

4. Bank Lending

The 2008/09 recession was not a classic boom and bust. In the lead up to 2008, headline inflation was close to the government’s target of 2.5% (apart from some cost-push inflation). However, there had been a rapid expansion in bank lending which was often based on the ability to borrow from other banks, e.g. credit default swaps. Therefore, there was a reliance on money markets to finance longer-term lending. This boom in bank lending helped sustain economic growth, but, when there was a credit crunch, bank lending fell rapidly leading to lower economic growth. Firms couldn’t get access to finance, so they had to stop investment projects.

5. Multiplier/accelerator effect

There are factors which can magnify growth, but also magnify the opposite. The accelerator theory states that investment depends on the rate of change of economic growth. A small improvement in growth can cause a bigger percentage increase in investment.

The multiplier effect states that a rise in investment can have knock-on effects causing a bigger final increase in GDP than initial injection. But, if spending falls, it causes a rise in unemployment and further falls in unemployment.

[Supply Side Shock]

A serious supply side shock can cause a recession, e.g. rising oil prices cause Aggregate Supply (AS) to shift to the left. This could cause a recession. However, this wouldn’t really be classed as a boom and bust. Though you could argue that a boom period is when raw materials are in plentiful supply, but when they run out then we have the adverse impact of that. The problem is that raw materials should run out gradually, leading to a gradual increase in prices, which markets should respond to. Boom and bust cycles tend to be triggered by shorter-term factors.

Related

This is a great help! Thanks! :))