In a recent post, we looked at food inflation and noted how prices were often volatile. Primary products like food and oil tend to be volatile because:

- Supply is inelastic in short run. (Supply is unresponsive to temporary shortages of food)

- Supply can vary due to the weather/geopolitical events.

- Demand is price inelastic – a small change in supply causes a bigger percentage change in price.

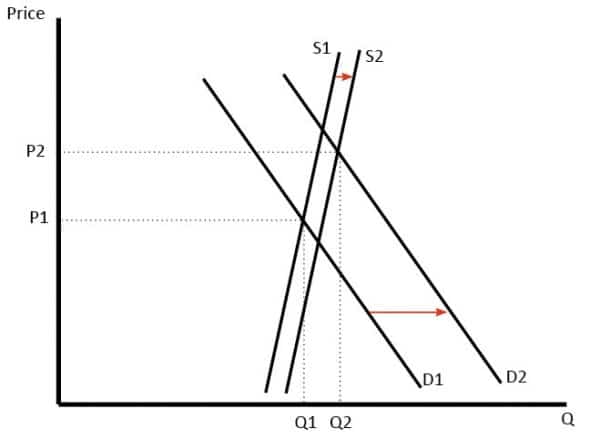

Diagram showing price volatility

This diagram shows why inelastic demand and a change in supply causes a significant change in price.

More detail on why prices are volatile

Supply is inelastic in the short run

It is not easy to increase the supply of agricultural production in the short term. You need to plant more seeds, trees, which take at least a year. Therefore, supply cannot easily respond to increases in price. A manufacturing firm can probably pay workers to do overtime and increase supply in response to rising prices. It is similar to oil – to significantly increase output a firm may need to invest in more oil exploration and drill more oil wells.

Demand is price inelastic in short-run

Because many agricultural products are basic necessities, a fall in price doesn’t tend to encourage people to buy more food. If potatoes are cheaper would you eat more potatoes? If coffee was cheaper, would you drink more coffee? – probably not very much. Therefore, an increase in supply leads to a correspondingly bigger fall in price. If demand is more price elastic, the price wouldn’t fall as much.

Supply influenced by weather/nature

Growing crops is influenced by weather and disease. A sharp frost can wipe away a crop leading to higher prices. This kind of volatility is not prevalent in manufactured goods.

Speculation

Many commodities are made more volatile by speculation (when investors buy and sell oil futures). Often this speculation is based on economic fundamentals but speculation can also exaggerate price movements. For example, if oil prices are predicted to rise, investors will buy now – causing prices to rise. It is hard to separate speculation from economic fundamentals as they are often intertwined. But speculation has a much bigger effect on the price in agriculture and oil than in manufacturing – where speculation is largely absent.

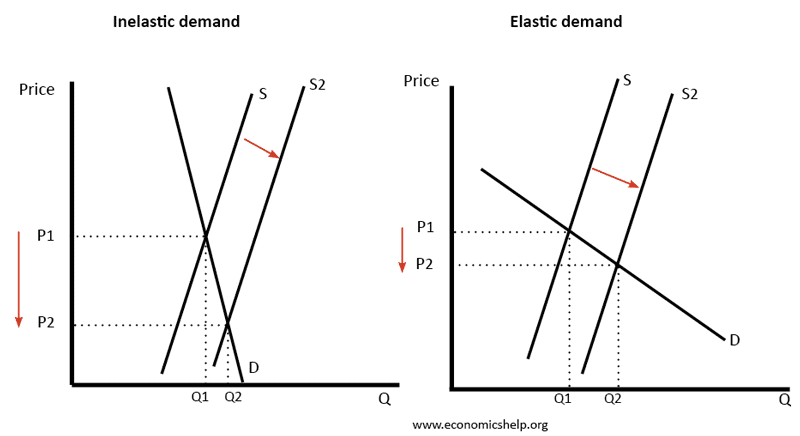

How elasticity affects the change in price

- When demand is price inelastic (on left), an increase in supply causes a correspondingly larger fall in price – Prices are more volatile.

- When demand is more price elastic (on right), an increase in supply causes a smaller percentage fall in price – Prices are less volatile.

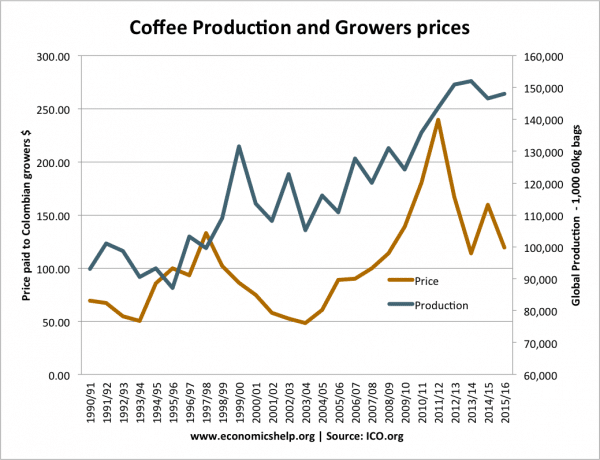

Example of volatile prices

This shows the price paid to Columbian growers of coffee. It rose from $50 in 2003/04 to approx $240 in 2011/12.

However, the link between price and output is not what you might expect. As the price rose from 2003/04 to 2011, global output actually increased

- Supply and demand analysis would suggest a rise in price is more likely to be caused by a fall in supply

How to explain this?

Perhaps there was a degree of speculation in the coffee price (buyers pushing prices higher). If there was speculation it explains why there was a sharp fall from 2010 to 2013.

Another potential reason is that the demand for coffee was growing strongly, e.g. new consumer trends and coffee becoming more fashionable than alcohol.

Related

Sir my question is why speculation is largely absent in manufacturing sector?

it doesnt take time to manufacture those type of goods but with agricultural goods it takes a while to produce