Capital to Labour ratio measures the ratio of capital employed to labour employed.

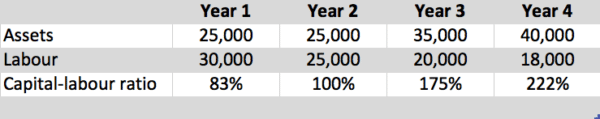

The capital-labour ratio (K/L) can measure the capital intensity of a firm.

Typically, over time, firms tend to have a higher capital-labour ratio as they seek to gain productivity improvements from investment in capital and automating the production process.

High Capital to Labour Ratio

If labour costs are high, firms will look to substitute labour for capital. For example, in Europe, waiters are equipped with mobile devices to send the order directly to the kitchen. This is a more efficient use of labour and so less is required. In countries with lower labour costs, it may not be necessary or advisable to invest in the mobile order equipment, therefore, they will have a lower capital to labour ratio

In the short term, it is easier to vary labour than the capital stock. In recessions capital to labour ratios tend to be higher as firms get rid of workers.

Capital-labour ratio and migration

Areas with a high capital-labour ratio will tend to have higher real wages.

- This will encourage workers to migrate from a low capital-labour ratio (low wage areas) to those with higher real wages.

- This will tend to reduce real wage disparity and reduce the gap of capital-labour ratio.

- For example, workers in north China have moved to south-east China where wages are higher

‘One-sector regional growth model’ (McCombie (1998) Urb. Studs 25)

Related