Speculation occurs when individuals make decisions about buying or selling depending on expectations of future price changes.

For example, if prices are rising speculators may take this as a sign that prices will continue to rise, and therefore, they buy more. This speculation causes prices to continue to rise. An example is house prices, where rising house prices often encourage investors to keep buying. This can lead to destabilising speculation

However, if prices are rising, speculators may also feel that they will soon reach their peak and it is better to sell – before prices fall.

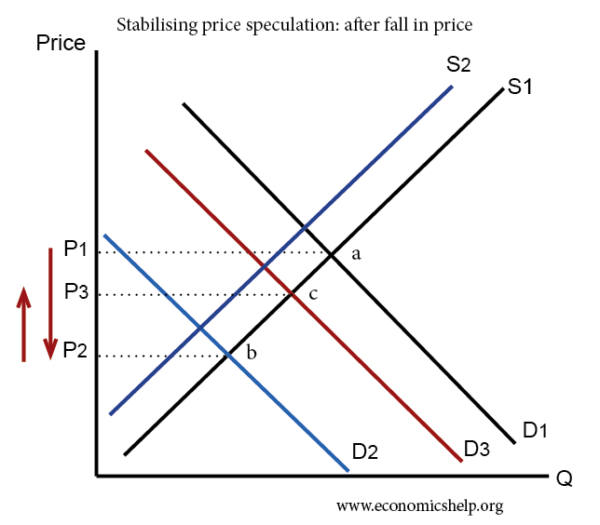

Stabilising speculation

Stabilising speculation occurs when changes in prices are modified by the role of speculators and the magnitude of price change is limited. For example, if prices fall, then firms will respond to this price fall, by cutting back on supply (the firm does not want to sell at low prices and hopes that prices will rise.) This cut back in supply raises prices.

Also, in response to cheaper prices, buyers respond by buying more – thinking the lower price represents better value.

Therefore, the initial price fall from P1 to P2 is only temporary and prices rise back to P3.

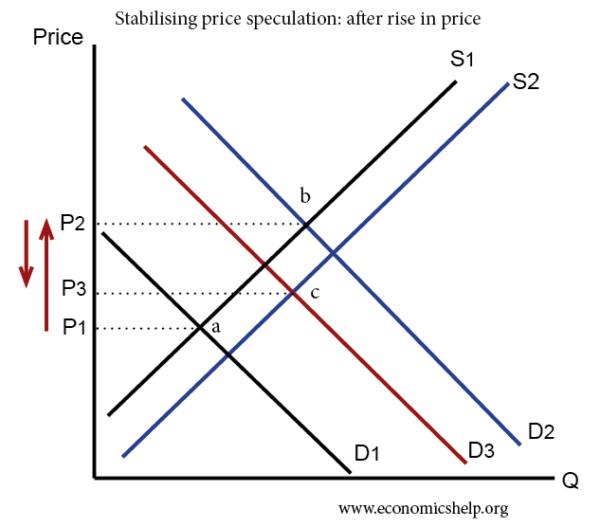

Stabilising price speculation after a rise in price

Suppose, there was a sudden rise in demand causing the price to increase.

Firms would respond to the higher price by increasing supply (it is now more profitable to sell)

The higher price will also over time reduce demand. Some consumers don’t want to buy when the good is so expensive and will look for alternatives.

Examples of stabilising speculation

- Wheat

- Potatoes

- Apples

- Corn

- Seasonal items like umbrellas, sun creams

In winter there would be a big fall in demand for suncream, causing price to potentially fall, but firms cut back on supply to keep prices from falling

During the harvest months, there will be a plentiful supply of agricultural produce causing prices to rise. Farmers will try to store the good for later when they can take advantage of higher prices. When the price of seasonal fruit like strawberries falls in June, consumers also buy more, meaning that the increase in supply is offset by an increase in demand.

When the strawberry season ends and supply is more limited, demand will fall.

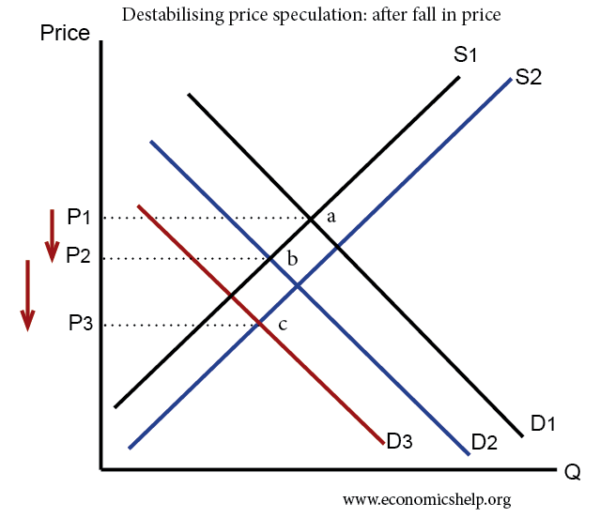

Destabilising speculation

With destabilising speculation, we get a different outcome. In this case, speculators respond to the change in price by feeling this reflects a long-term trend. An initial fall in the price of a commodity causes more firms to sell the good and demand falls further. With destabilising speculation, price swings are exaggerated.

Demand falls from D1 to D2 causing the price to fall.

Demand falls from D1 to D2 causing the price to fall.

- However, this fall in price causes firms to respond by increasing supply (trying to sell the good before the price falls further)

- Consumers/speculators also respond to falling price by reducing demand and the demand curve shifts to the left.

- After an initial fall in price to P2, the final price falls to P3.

- The expectation of falling prices becomes self-fulfilling.

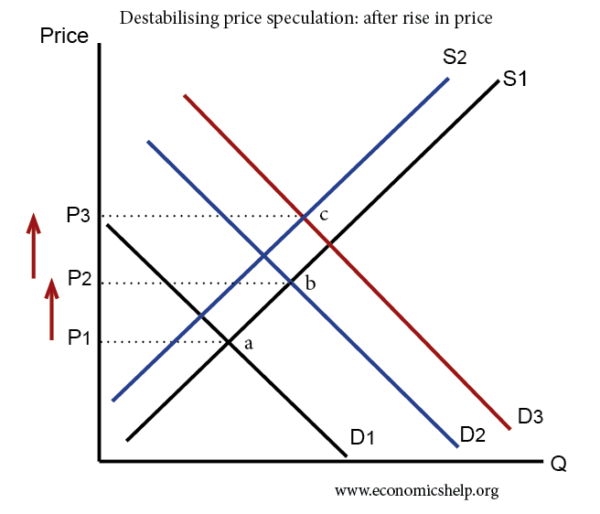

After a rise in demand, the price rises to P2.

After a rise in demand, the price rises to P2.

- Suppliers hold back on supply waiting for prices to rise further.

- Speculators increase their demand trying to buy before prices rise further.

- The initial increase in price is magnified.

- The expectation of rising prices becomes self-fulfilling.

Examples of destabilising speculation

- House prices. House prices may seem a stable good, but investors often get caught up in market trends, rising house prices attract more people to buy.

- Oil prices. Oil is an easily traded commodity and investors may try to predict market trends. When oil prices fell in 2020, it encouraged investors to sell oil future contracts. This caused the price of West Texas oil to become negative because investors were so reluctant to be lumbered with the costs of receiving oil when demand wasn’t there.

When will speculation be stabilising or destabilising?

- It depends on the good. Agricultural goods are more predictable. With investors knowing seasonal influences of supply, therefore, there is an expectation price will try to be smoothed over the year.

- Irrational exuberance. Psychology plays a role in speculation, people can get attracted to the behaviour of crowds. If a majority are optimistic about an asset, then it encourages others to join the bandwagon and get caught up in the ‘irrational exuberance’ of the investors.

- Efficient market hypothesis. This states that investors will be rational and will have access to good information about commodities. If these hypotheses are true it will encourage prices to lead to their real market value. This should cause stabilising speculation.

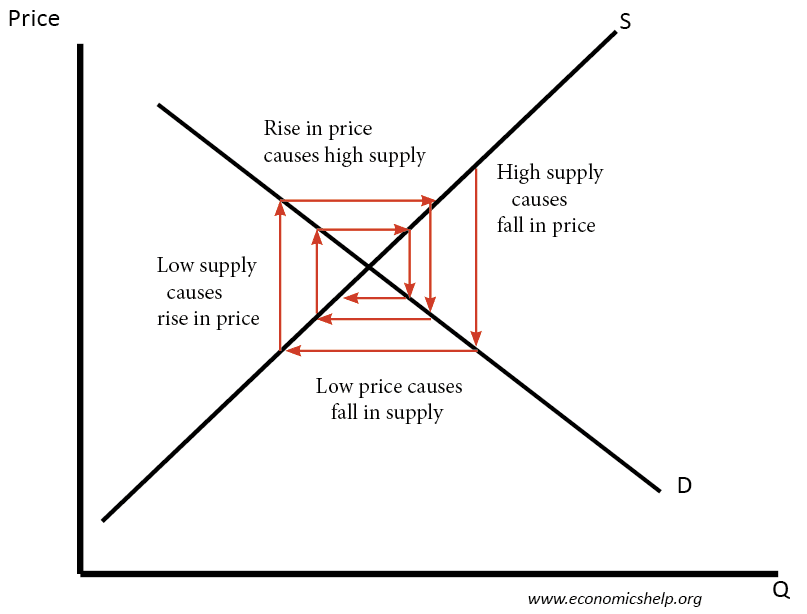

- Cobweb theory on elasticity of supply and demand

The cobweb theory states that price changes can be exaggerated depending on elasticity of supply

Cobweb theory and price convergence

At the equilibrium point, if the demand curve is more elastic than the supply curve, we get the price volatility falling, and the price will converge on the equilibrium.

Related