Readers Question: Hi! Can you explain why floating exchange rates reduce the risks of currency speculation? What are those risks? Thank you very much!

Currency speculation is when investors feel the exchange rate is wrongly valued and so buy/sell currency in the hope of making a profit. For example, if a currency is pegged at a certain level, if investors believed the currency was overvalued, they would start selling their reserves – putting downward pressure on the price.

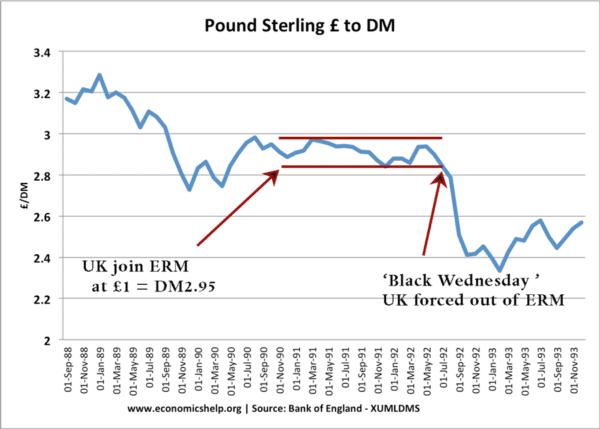

A fixed exchange rate means the government try to keep the value of an exchange rate within certain bands e.g. fixing the £ between DM 2.85 and $2.95

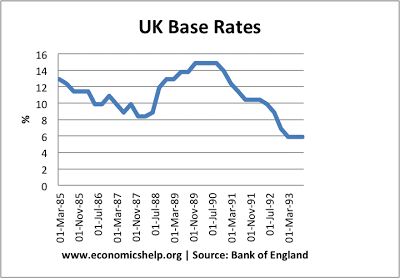

If the currency started to go below this ‘target value’, the UK government would intervene to protect the falling value of the Pound Sterling. They could increase interest rates and/or buy sterling with foreign currency reserves.

The idea is that by guaranteeing a certain exchange rate, people won’t speculate on the currency because people will expect the currency to remain at a certain value.

However, being in a fixed exchange rate doesn’t give you immunity from speculation, especially if the market feels the fixed exchange rate doesn’t reflect underlying market conditions.

In 1992, the UK was in the ERM, but speculators thought the £ was too strong as the UK was in recession. Therefore, speculators aggressively sold and eventually the UK was forced to leave the Exchange rate mechanism and the Pound was forced to devalue.

A fixed exchange rate will be the victim of speculation if:

- The currency is at the wrong market value. e.g. in 1990, the UK arguably joined at a rate that was too high. (The economy was experiencing high inflation and an economic slowdown, meaning the value of the currency was too high)

- The Government doesn’t have sufficient reserves to protect the currency. In practice, government reserves are only a fraction of the value traded on foreign exchange markets. The old saying is ‘you can’t buck the market’ If a country can rely on other Central Banks to intervene they have more potential.

- People have no confidence in the government intervention. For example, the day before the UK left the ERM, the government increased interest rates to 15% in a desperate attempt to prevent the value of the currency falling. Usually, high-interest rates increase the value of the exchange rate. However, they were unsuccessful. Speculators correctly predicted that these high-interest rates just couldn’t be maintained when the economy was in recession. Therefore it was an empty move.

A floating exchange rate, means the government allow the value of the currency to be determined by market forces. It could depreciate or appreciate depending on market sentiment. The argument is that the market will correctly value the exchange rate so there is no speculative attack because the currency is correctly valued.

A floating exchange rate can still have rapid appreciation and depreciation because the situation of an economy can change frequently.

Suppose investors thought an economy like Iceland was weak (large current account deficit, high inflation and external debt). Then speculators would sell the currency, in anticipation of its fall. This speculation would cause the currency to fall.

Related

You’ve got it all backwards. Floating exchange rates reduce the risk of speculative attacks as currencies are allowed to be correctly priced by the market. Fixed exchange rates represent an arbitrary price that has to be backed up with international reserves whenever it is out of line with its true (fundamentals-based) value. These reserves are the bounty the speculators are after.

Thanks for comment. I take your point fixed exchange rates can be subject to speculative attacks. Though there are examples, where it does lead to periods of greater exchange rate stability than floating exchange rates.

Japanese economy will crush and we should sell YEN ASAP.

1. speculation especially in currencies force lazy and corruptible countries to correct their mistakes which will lead to healthy economy in the world

2. in the past, politics is the major determinant of global economy but now, real economics concern are the drivers of those decisions. However, since anything that involve politics has allot of lies , no lies in the current system and all faults must be must be faced and deal by the affected country or else their economy being devalued in the basket of world economies.

3. The current system and development in the financial market is the major cause of the major developments in international trade and development of major companies such as amazon, GooGle, Apple etc. and many other related development in the 21st century.

my only object to speculation will be on retail banks who engage in such a risky business as speculation with their clients money while infact they are no meant for that………