Definition of a Fixed Exchange Rate: This occurs when the government seeks to keep the value of a currency fixed against another currency. e.g. the value of the Pound Sterling fixed against the Euro at £1 = €1.1

Semi-Fixed Exchange Rate. This occurs when the government seeks to keep the value of a currency between a band of the exchange rate. In other words, the exchange rate can fluctuate within a narrow band. For, example the Exchange rate mechanism. For example, the Pound Sterling could fluctuate between a target exchange rate of £1 = €1.05 and £1 = €1.15

UK in Exchange Rate Mechanism

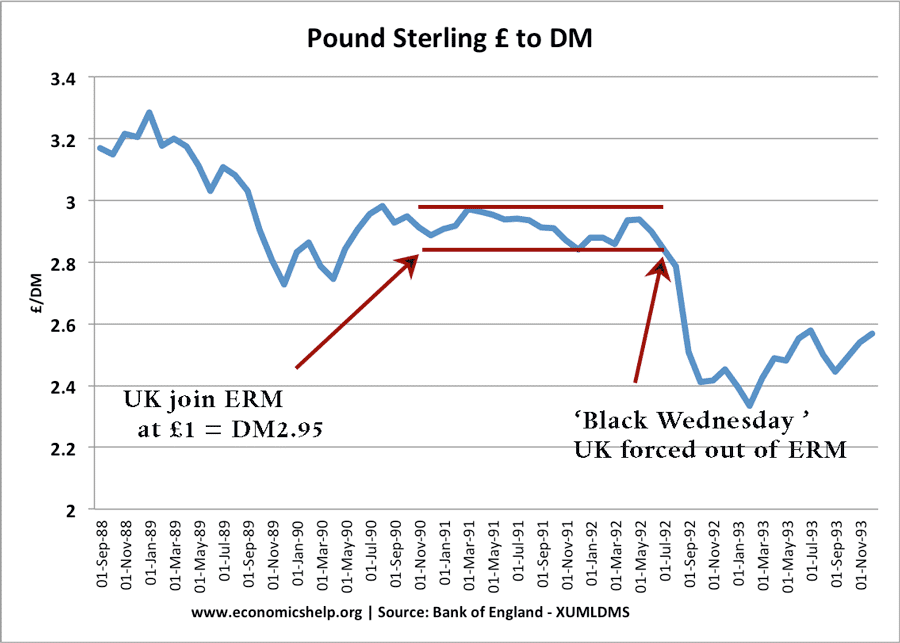

The UK joined the fixed exchange rate mechanism from Oct 1990 to 16 September 1992

The Pound joined at a rate of £1 = DM2.95. But, was allowed a small percentage fluctuations. There was a lower limit of DM 2.773. If the Pound fell below the lower limit, the government would be forced to intervene – raising interest rates and selling foreign currency to buy Pound Sterling.

Definition of a Floating Exchange Rate: this is when the government does not intervene in the foreign exchange market but allows market forces to determine the level of a currency.

Exchange Rate Mechanism ERM

This was a semi-fixed exchange rate where EU countries sought to keep their currencies fixed within certain bands against the D-Mark. The ERM was the forerunner of the Euro

In 1998, the ERM was dissolved as countries prepared to join the Euro. It was replaced with ERM 2 – and countries wishing to join the Euro are required to be part of this for a while.

In 2016, only the Danish krone participates in ERM II.

See also:

- Advantages and disadvantages of Fixed Exchange Rates

- Benefits of the Euro

- Costs of the Euro

- Policy Trilemma – why fixed exchange rates are one out of possible three targets of monetary policy.