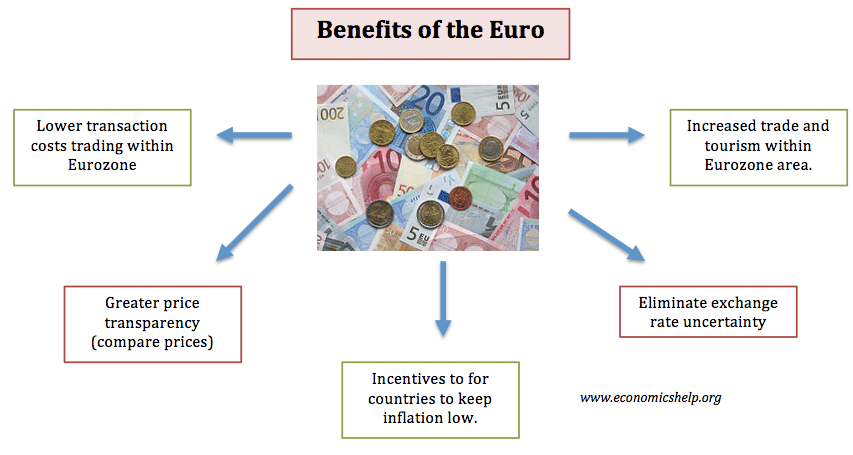

The Euro is the single European countries adopted by 18/28 EU countries. (though not the UK). It is the second-largest reserve currency in the world after the US Dollar. Euro notes and coins came into circulation on January 1st, 2002. It was hoped that the Euro would confer many benefits on member countries.

1. Lower transaction costs

With a single currency, there will be no longer a cost involved in changing currencies; this will benefit tourists and firms who trade within the Euro area. It has been estimated that this benefit will be equal to 1% of GDP so will be quite significant. (this is sometimes known as frictional costs) Some studies have suggested that the Euro has led to a 6% increase in tourism, (though many other factors may be at work.)

2. Price transparency

With a common currency, it will be easier to compare prices in different European countries because they would all be in Euros. This enables firms to source cheaper raw material and consumers to buy cheaper goods, For example, arguably new car prices are higher in the UK than elsewhere, a single currency could help reduce these price differentials or make it easier for UK consumers to buy from the Eurozone. Within the Eurozone, there has been a degree of convergence in car prices since the Euro was introduced.

3. Eliminating exchange rate uncertainty

Volatile swings in the exchange rate can destroy the profitability of exports (e.g. a rapid appreciation). This exchange rate uncertainty undermines business confidence in investing. Therefore with a single currency business confidence should improve leading to greater trade and economic growth.

4. Improved trade

Supporters of the Euro argue that greater price and cost transparency/no exchange rates encourages intra Eurozone trade. The ECB state exports and imports of goods within the euro area rose from about 27% of GDP in 1999 to around 32% in 2006

4. Improvement in inflation performance

The ECB which sets interest rates for the whole Eurozone area will be committed to keeping inflation low; countries with traditionally high inflation should benefit from this greater inflationary discipline. EU inflation has been low.

- However this point is debatable as countries outside the Euro have maintained low inflation, and arguably the ECB have concentrated too much on low inflation to the detriment of growth and unemployment.

5. Low-interest rates

It was hoped membership of the Euro would help reduce bond yields as there was greater security belonging to a stronger currency. Initially, this occurred with bond yields in Greece, Spain and Ireland converging on German bond yields.

- But the credit crisis of 2008-12, saw Euro bond yield rise to record levels, suggesting that the Euro could be very destabilising for interest rates. (EU bond yields)

6. Inward investment

Inward investment may increase from outside the EU as firms take advantage of lower transaction costs within the EU area. Some firms have said they prefer to invest within the Eurozone area.

7. Benefits to the financial sector

The introduction of the Euro appears to have reduced the cost of trading in bonds, equity, and banking assets within the eurozone.

8. Protection for smaller countries against international financial crisis which often adverself affect small countries with limited reserves.

Related

1 thought on “Benefits of the Euro”