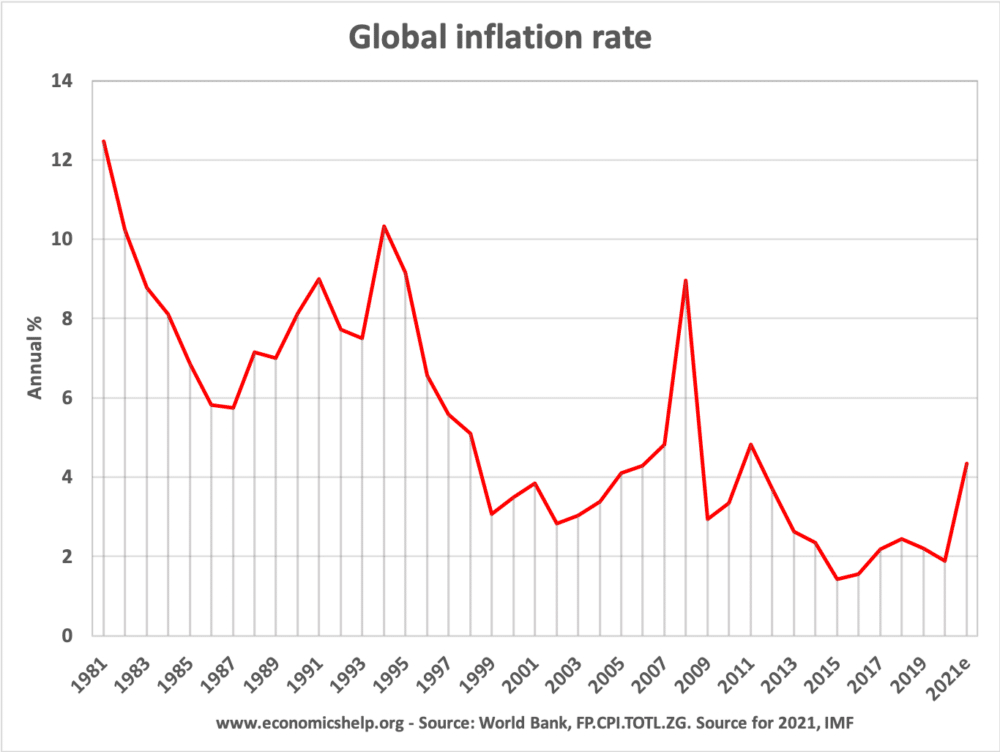

Since the 1970s, we have seen a fall in average global inflation rates. There have been periods of inflation (often due to rise in oil prices), but the overall trend has seen much lower inflation rates. In the 1970s, inflation was seen as one of the main macro-economic challenges, but now many feel the challenge is that inflation has become too low risking deflation.

Global inflation shows a marked fall since 1977.

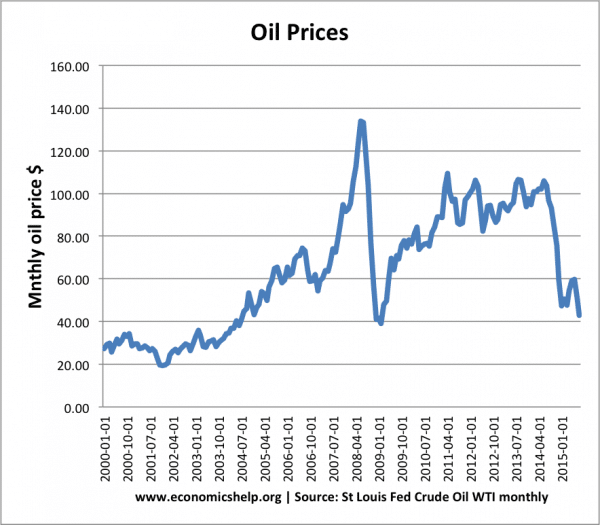

The spike in inflation in 2008, was mostly due to cost-push factors; in particular a rise in oil prices. There has been a recent rise in 2021 due to supply constraints as the economy recovers from Covid shut down.

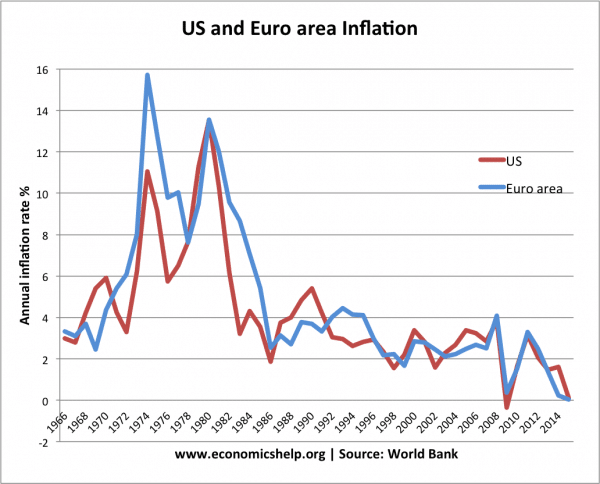

Inflation has fallen in both the US and Eurozone area. The Eurozone has been struggling to reach the inflation target of 2%, with current inflation rates hovering just above 0%, and the threat of deflation looming.

This graph also shows the close connection between global inflation rates.

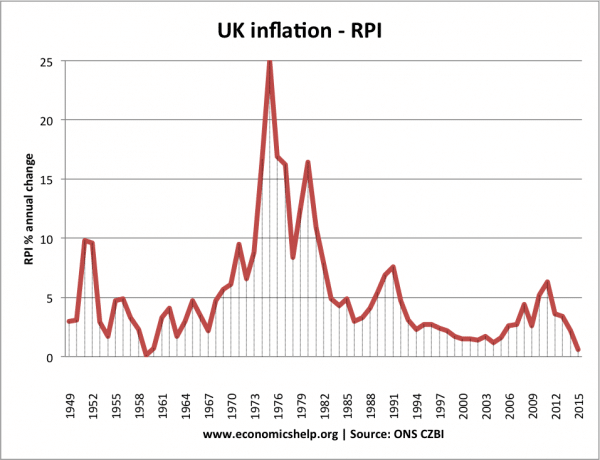

UK inflation

Why has global inflation fallen?

- Secular stagnation – demand and supply side factors are contributing to lower rates of economic growth. There is little, if any, demand pull pressures.

- Technological changes are helping to reduce costs, especially in electronics and computing.

- Globalisation increasing competitiveness of world economy. Growth of low cost Chinese manufacturing, which is exporting low inflation across the world.

- Glut (excess supply) in many markets, e.g. steel, automobiles, oil. This has put downward pressure on prices.

- Low wage growth. In many developed economies we have seen stagnant wage growth – especially for lower skilled workers. This low wage growth is due to many factors, such as globalisation, monopsony power.

- Inflation targeting by Central banks have helped to avoid boom and bust cycles, more common in the 1970s and 1980s. For example, UK made Central Bank independent in 1997.

- Fall in commodity prices since 2010. Oil and other commodities have fallen since 2010.

- Deflationary pressures of the Eurozone. See: Deflationary pressures in Eurozone

Related

Thanks for sharing. I hope it will be helpful for too many people that are searching for this topic.

Technological changes are helping to reduce costs, especially in electronics and computing.

Demand and supply lateral issues are funding to lower charges of economic growth. There is little if some demand-pull pressures.

Inflation rates are falling because society is collapsing. The elites are hoarding their wealth as economic stagnation is occurring from resource depletion.

The poor are buying second hand stuff and are not interested in new inventions made by incompetent elites, which is contributing to this economic slowdown.

The poor are too busy buying necessities to survive and are shunning overpriced crap. Nobody wants a new iPhone and people are sick of going to the movies where incompetent Plutocrats are making crappy films.

Wages have been stagnant because society is collapsing. The wealthy are desperate to maintain their current levels of wealth, so the more money they hoard, and the more crap they make, it’s worsening the economy.

This is really good