Readers Question: Is there an inbuilt deflationary bias in the Eurozone?

Note: I originally wrote this post in 2010. Unfortunately, every year there is a reason to update the post and suggest the deflationary bias in the Eurozone keeps getting stronger.

Deflationary bias means that there is a tendency for economic policy to promote lower growth and lower inflation. It means there are pressures which keep demand subdued leading to lower inflation, higher unemployment and lower growth. Now, we are seeing outright deflation (fall in prices)

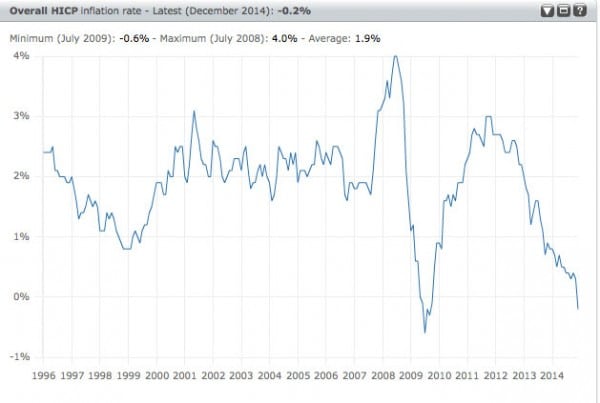

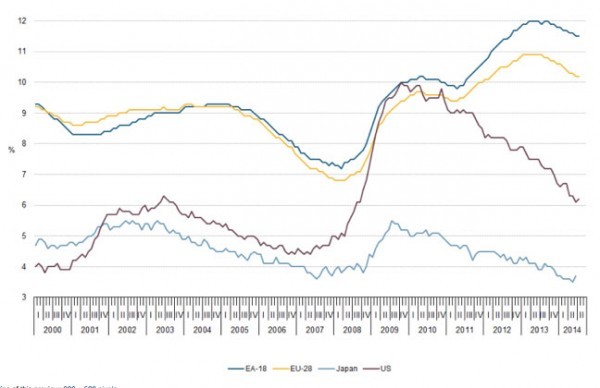

I agree that there is a deflationary bias in the Eurozone. This is proved by the long period of low economic growth (2007-15) and an inflation rate that is remaining well below target. Headline inflation in the Eurozone has fallen to -0.2% (Outright deflation, though core inflation, is still 0.7%). Growth is anaemic and unemployment well into double figures (11%) – Unemployment is higher in Europe than many other countries.

European Unemployment Eurozone vs Non-Eurozone economies

Source: Eurostat

Although core inflation is still positive. Many countries on the periphery are experiencing a real threat of prolonged deflation.

What explains the deflationary bias of the Eurozone?

Low Inflation Target

The ECB have very strong attachment to keep inflation less than the target of 2%. For example, in 2011, temporary cost-push inflation, led to an increase in the EU headline inflation rate. The ECB responded by increasing interest rates. The Bank of England responded by keeping interest rates at 0.5% (even though inflation was much higher in the UK than EU). The Bank of England argued it was important to give importance to wider economic issues of growth and unemployment. The ECB were much less willing to accept, even a temporary deviation from the inflation target over fears temporary inflation would increase inflation expectations. It showed the ECB are much more willing to risk lower growth than risk higher inflation. (see also: ECB v Bank of England)

Whilst the ECB have an inflation target, they have no explicit target for unemployment or economic growth. EU Unemployment has risen to 12%, but there has been little action to increase aggregate demand.

The ECB have worried than any unconventional monetary policy may reduce their credibility and long-term ability to tackle inflation.

Reluctance to pursue unconventional monetary policy

Despite a prolonged period of low inflation, the ECB have been very reluctant to actually implement unconventional monetary policy (e.g. Quantitative easing). It took outright deflation to finally push the ECB into proper Q.E, in Jan 2015.

The ECB is reluctant to engage in any quantitative easing because

- They are reluctant to create any possibility of future inflation, printing money is an anathema to German Central Bankers, who wield considerable influence over ECB monetary policy.

- The ECB has a reluctance to start buying bonds of different countries, deciding which to buy; and there have been constitutional excuses for not printing money.

The result is that countries with many deflationary pressures (strong exchange rate, fiscal austerity) don’t have any monetary stimulus to offset the fall in demand. (e.g. UK can pursue quantitative easing when we experienced deep recession). Countries in Eurozone can not.

Internal Devaluation

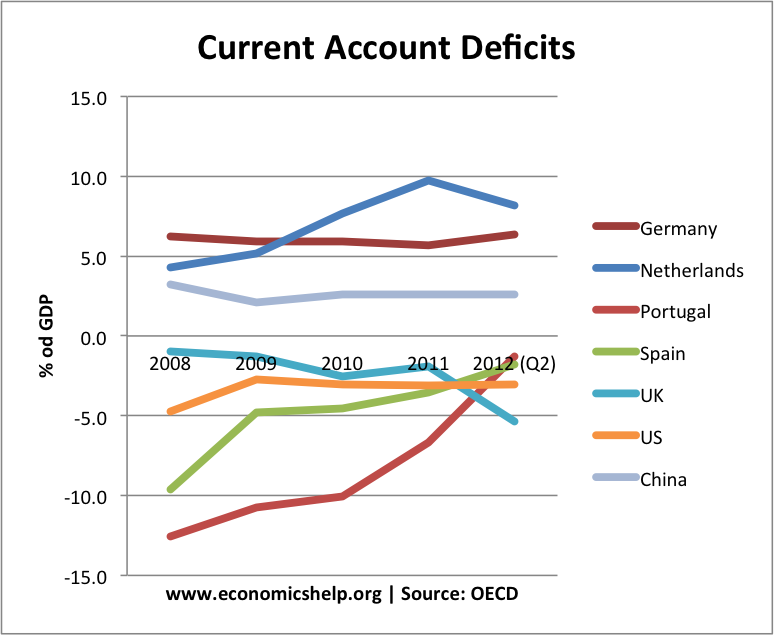

Members of the Eurozone have a common currency. Therefore, they cannot devalue their currency if they lose competitiveness. By contrast, in the recession of 2008/09, the UK experienced a sharp fall in the value of the pound to restore competitiveness and reduce the UK current account deficit with the Eurozone.

Other Eurozone countries had become relatively uncompetitive (Greece, Spain, Portugal and Ireland) This was reflected in the size of the current account deficits (up to 10% of GDP – which is very high) But, they cannot devalue the currency. To regain competitiveness, create jobs and reduce current account deficit, they need to reduce prices. (i.e. reduce wages, and other costs). However, to regain competitiveness may require very substantial reduction in wages and costs. Therefore, this may lead to a prolonged period of low inflation or deflation. This in turn leads to lower growth.

Reducing a current account deficit of 10% of GDP through internal devaluation, does create an inbuilt deflationary bias. If devaluation was an option, they could restore competitiveness quicker with less adverse impact on the rate of growth.

In 2014, four countries, Greece, Portugal, Cyprus and Slovakia were experiencing falling prices as they tried to restore competitiveness through internal devaluation.

Fiscal austerity

Because of the bond crisis, the EU has placed great stress on reducing budget deficits and running primary surpluses to reduce levels of debt. This austerity has led to lower economic growth and therefore lower inflation. Ironically, by causing deflation, the austerity is making it very hard to reduce debt to GDP ratios. Therefore, it creates a negative spiral. Austerity causes deflation. Deflation causes rising debt to GDP burdens – leading to calls for more austerity.

This is one of the fundamental problems of the Eurozone. Austerity (government spending cuts, wage cuts) are causing deflation. But, there is a fear of abandoning austerity because so much political capital has been invested in taking the ‘sensible’ option.

Other factors causing deflation

Rising real interest rates

The fall in the inflation rate, is causing a higher real interest rate – reducing demand further

Low inflation expectations

One reason why Q.E. may not work is that it will be hard to shift the very low inflation expectations in the EU.

Related

4 thoughts on “Deflationary Bias in the Eurozone”

Comments are closed.