There are a raft of different methods of calculating government debt. It can be a little bewildering (even for an economics teacher!). I have tried to define the key terms in a simple format and also a more detailed and precise way. This only focuses on the UK.

Defining Public Sector Debt

Simple Way:

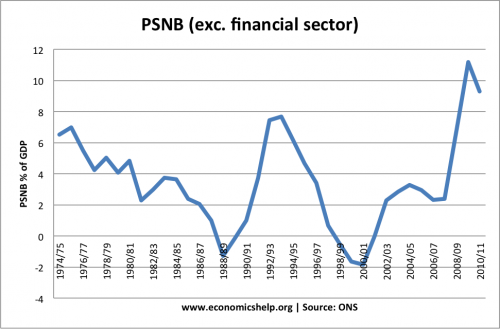

- Government Deficit – annual shortfall between spending and tax receipts. The amount the government have to borrow from private sector in a certain year. (see also: public sector net borrowing (PSNB) public sector net cash requirement (PSNCR), public sector borrowing requirement PSBR, net borrowing, cumulative public sector current budget)

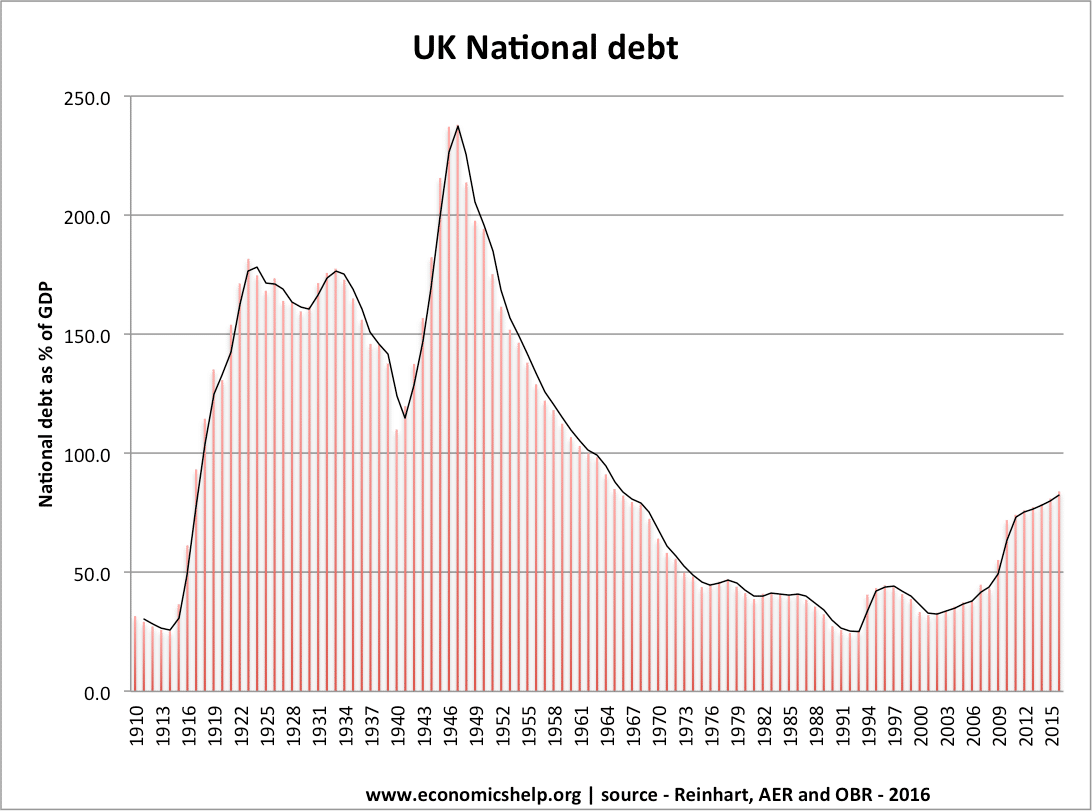

- Government Debt – The total amount the government owe to private sector (see: also, public sector net debt, national debt, GGGD). This is the accumulation of borrowing over many years.

Debt as a % of GDP

- Debt can be expressed in nominal figures or as a % of GDP.

- in Jan 2009, UK public sector debt was £697bn which = 47.5% of GDP

More Definitions

- Public Sector Net Debt – Total Amount government (central, local and corporations) have borrowed from Private sector – liquid assets. Often referred to as National debt (e.g. in 2009, Public sector net debt was £697bn or 47.5% of GDP

- Public Sector Net Cash Requirement PSNCR – The amount governments need to borrow in a year to meet its shortfall of spending and tax receipts. (e.g. in 2008-09 government has a PSNCR of about £115bn) Often referred to as annual government deficit. Used to be called PSBR (Public sector borrowing requirement).

– The PSNCR is similar to net borrowing and government borrowing

Debts Not Related to Government Debt

- Current account Balance of Payment deficit – Not related to public sector net deficit. current account deficit related to level of net imports

- External debt – Total amount that UK owes foreign countries. External debt includes government liabilities + private sector liabilities; it is not directly related to public sector debt.

More Detailed Definitions

Public Sector Net Debt – This is statistic most widely used for stating how much the public sector (central, local government and corporations) owe to the private sector.

- It is most public sector financial liabilities – liquid financial assets.

- The majority of public sector debt is financed through selling government securities and treasury bills. Most is held by UK private sector, some by foreigners)

- It is sometimes referred to as the National debt. However, strictly speaking this is not correct because National Debt was used for a much narrower definition (gross liabilities of the National Loans Fund.). Statistics for National debt are no longer produced

- Public Sector Net debt includes some imputed debt e.g. Private Finance Initiatives PFI. These are liabilities not legally held by government, but, in practise they will be liable.

- Some argue the public sector net debt should include more potential liabilities such as future pension requirements e.t.c. But, this is not counted in UK statistics or other countries.

- Public Sector Net Debt increased significantly with governments taking shares in major banks like Northern Rock and RBS. However, due to accounting rules the assets of RBS were not used to offset liabilities of RBS

- The ONS produce statistics for Public Sector Net Debt

- Current Public sector net Debt

PSNCR Public Sector Net Cash Requirement (used to be called PSBR)

The Public Sector Net Cash Requirement indicates the extent to which the public sector borrows from other sectors of the economy and overseas to finance the balance of expenditure and receipts arising from its various activities. The flows which count towards the PSNCR are measured on a cash basis (with a minor exception of interest on National Savings instruments).

source: statistics.gov.uk

Public Sector Net Borrowing

This is similar to public sector net debt but also takes into account capital expenditure. Public sector net cash requirement is particular to UK. Net borrowing is used internationally.

- Net borrowing refers to the countries accruing net financial indebtedness. Net cash requirement is how much the government need to raise to meet the shortfall.

- Some capital expenditure may require higher cash requirement without changing net indebtedness

General Government Gross Debt (GGGD) used by EU. is similar to Public sector net debt but excludes net debt of corporations. Also does not offset liquid assets.

see also : UK Budget deficit

—————–

Even more detail

- For public sector net debt. The public sector is defined as central government, local government and public corporations. The exception is the Bank of England, which has traditionally been excluded (either in whole or in part) from public sector finance statistics.

Definition of old National Debt statistics

- The National Debt is the most well-known and oldest measure of public debt.

The term ‘national debt’ is still commonly used today, often when reference should actually be made to the Public Sector Net Debt measure. This is because National Debt had a precise meaning, which is very different to PSND - Data for the National Debt extend back to 1691. For a large period of this time

- National Debt comprised the total gross liabilities of the Consolidated Fund.

- Since 1968 it comprises the gross liabilities of the National Loans Fund.

- National Debt has quite a narrow coverage, missing the non- central government parts of the public sector and not even being a comprehensive measure of central government debt. It also includes liabilities to other parts of government (for example the National Insurance Fund holds gilts as investments) whereas it is standard for debt measures to consolidate out intra-sector holdings.

Net Public Sector Debt (later renamed Public Sector Net debt )

- The calculation of NPSD started with the principle that this debt measure was

the approximate stock equivalent of the PSBR. - It differed from the National Accounts financial balance sheet concept of financial liabilities in that debt was measured at nominal value rather than their value in the market. This was because it is the value that government will have to pay on maturity. The market value is only important to the asset holder as a price at which they can sell the asset at that time. As the redemption date approaches the market value should converge towards the nominal value.

Move away from Cash accounting to National Accounts framework

21. The PSBR was a cash concept unique to the UK, although it had similarities to an International Monetary Fund measure. With the introduction of the new Public Finances framework in 1998, the PSBR played a less important role as the Government’s preferred measure moved away from the cash accounting basis and onto the accruals basis consistent with National Accounts framework. (net debt) The PSBR continued to be produced but was renamed the Public Sector Net Cash Requirement (PSNCR) to avoid confusion with the Public Sector Net Borrowing measure. The PSNCR definition and measurement are the joint responsibility of ONS and HM Treasury.

General Government Gross Debt (GGGD)

The 1992 Maastricht Treaty on European Union obliged EU member states to avoid excessive government debt levels. The Protocol on Excessive Deficit Procedure (EDP), an annex to the Treaty, defines this as 60 per cent of GDP.

The debt measure used is General Government Gross Debt (GGGD). This differs from the UK fiscal measure, PSND, in two important respects. The first is the sectoral boundary, being defined as General Government it excludes the net debt position of public corporations, which are included in the public sector. The second is that is measures gross liabilities and does not net off liquid assets.

Imputed debt in Public Sector Debt

- As noted earlier, PSND includes some imputed debt. This usually occurs when

government is considered the true economic owner of an asset or liability, even though it is not the legal owner of it, and an imputation is made to route the transaction via government. - In 2001 it was decided that PSND should be updated to include imputed debt, in particular those liabilities associated with finance leasing that were part of the GGGD definition. This moved the definition of PSND further away from being the stock equivalent of the PSNCR. However, problems with deriving estimates for the level of the imputed debt has delayed the inclusion of finance lease liabilities in PSND until September 2006. In August 2005 imputed debt associated with securitised bonds issued by London & Continental Railways was included in PSND.

Core Debt

– Excludes cyclical fluctuations

Source: Public sector accounting at statistics.gov.uk

17 thoughts on “Understanding Government Debt Statistics”

Comments are closed.