There are a raft of different methods of calculating government debt. It can be a little bewildering (even for an economics teacher!). I have tried to define the key terms in a simple format and also a more detailed and precise way. This only focuses on the UK.

Defining Public Sector Debt

Simple Way:

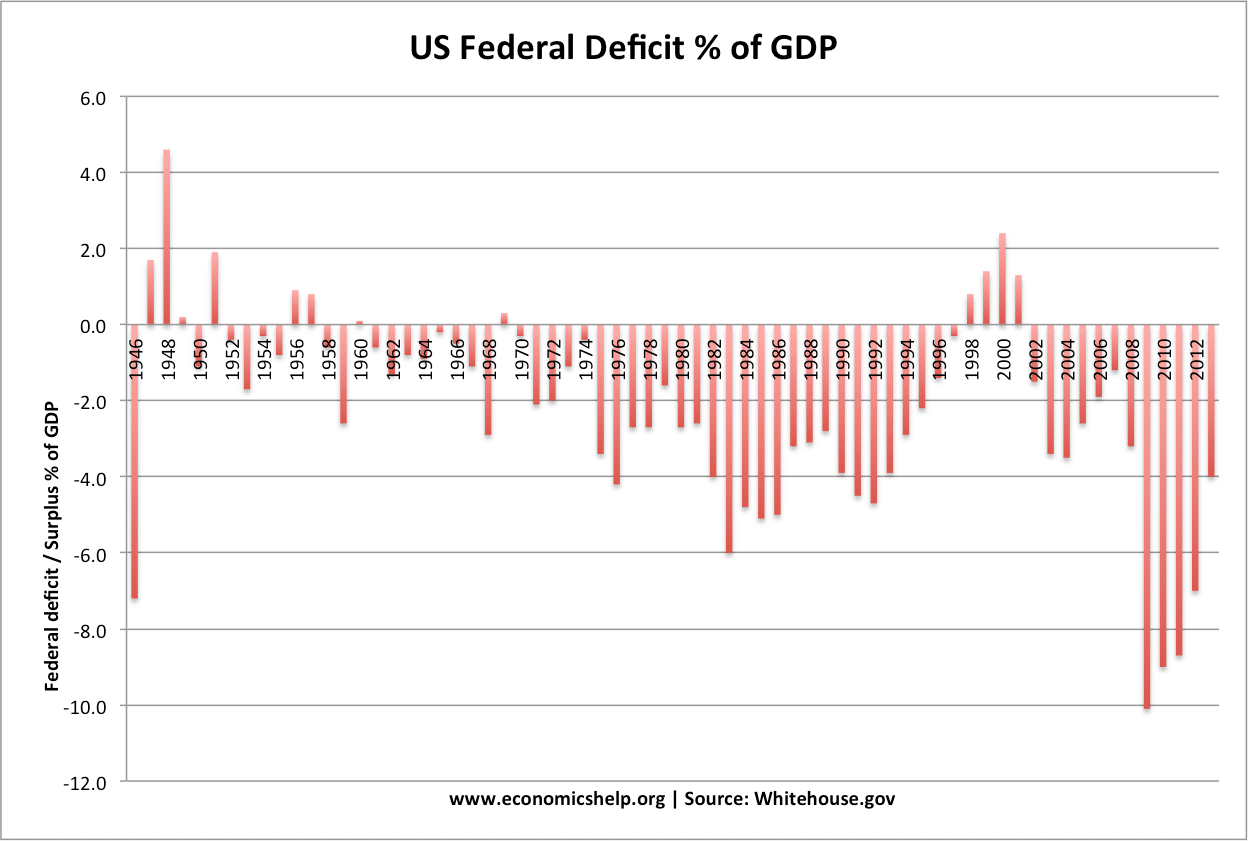

- Government Deficit – annual shortfall between spending and tax receipts. The amount the government have to borrow from private sector in a certain year. (see also: public sector net borrowing (PSNB) public sector net cash requirement (PSNCR), public sector borrowing requirement PSBR, net borrowing, cumulative public sector current budget)

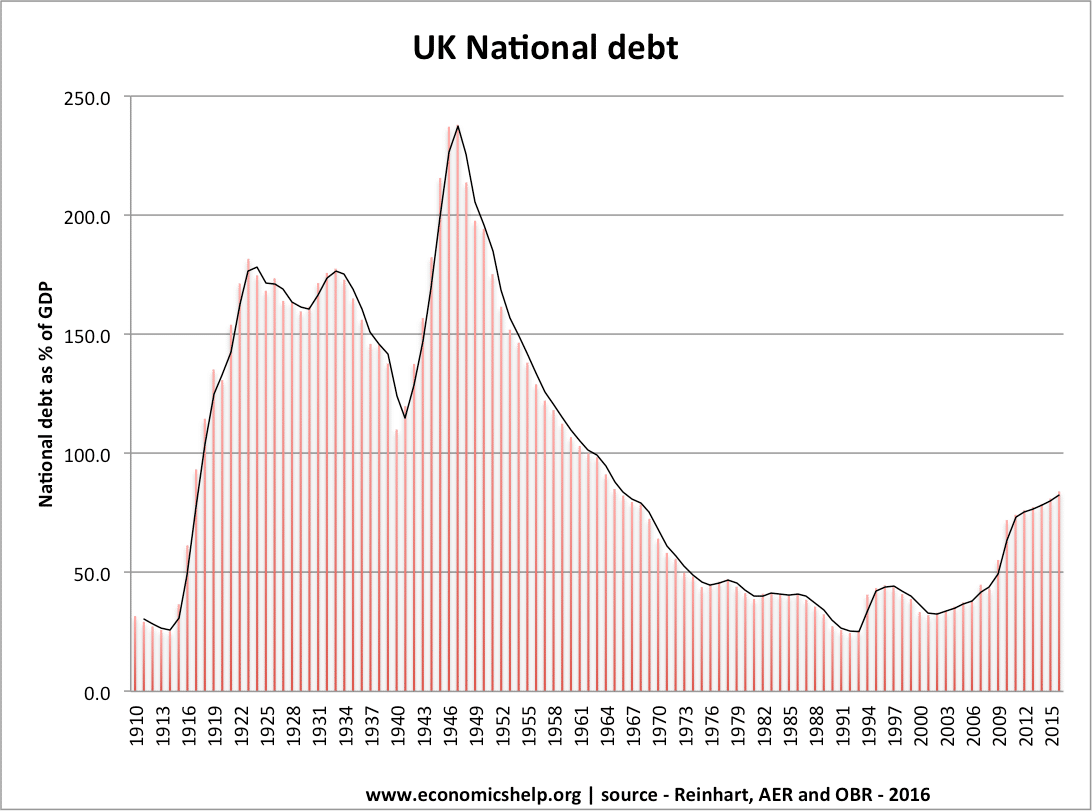

- Government Debt – The total amount the government owe to private sector (see: also, public sector net debt, national debt, GGGD). This is the accumulation of borrowing over many years.

Debt as a % of GDP

- Debt can be expressed in nominal figures or as a % of GDP.

- in Jan 2009, UK public sector debt was £697bn which = 47.5% of GDP

More Definitions

- Public Sector Net Debt – Total Amount government (central, local and corporations) have borrowed from Private sector – liquid assets. Often referred to as National debt (e.g. in 2009, Public sector net debt was £697bn or 47.5% of GDP

- Public Sector Net Cash Requirement PSNCR – The amount governments need to borrow in a year to meet its shortfall of spending and tax receipts. (e.g. in 2008-09 government has a PSNCR of about £115bn) Often referred to as annual government deficit. Used to be called PSBR (Public sector borrowing requirement).

– The PSNCR is similar to net borrowing and government borrowing

Debts Not Related to Government Debt

- Current account Balance of Payment deficit – Not related to public sector net deficit. current account deficit related to level of net imports

- External debt – Total amount that UK owes foreign countries. External debt includes government liabilities + private sector liabilities; it is not directly related to public sector debt.