A tax haven is a country where individuals and firms are able to save money on paying tax through low or zero rates of tax. Tax havens may also provide customers with the ability to hide their true identity – helping their activities to remain hidden from the government in questions

Countries considered to be tax havens include:

- Channel Islands (e.g. Jersey)

- Isle of Man

- Luxembourg

- Switzerland

- Liechtenstein

- Bahamas

- San Marino

Tax havens have been criticised because

- It means that governments find it difficult to raise revenue.

- The most profitable companies have been building cash reserves in these tax havens, leading to a loss of productive use of their profit.

- Estimates of capital held in tax havens also vary: the most credible estimates are between US$7–10 trillion (1)

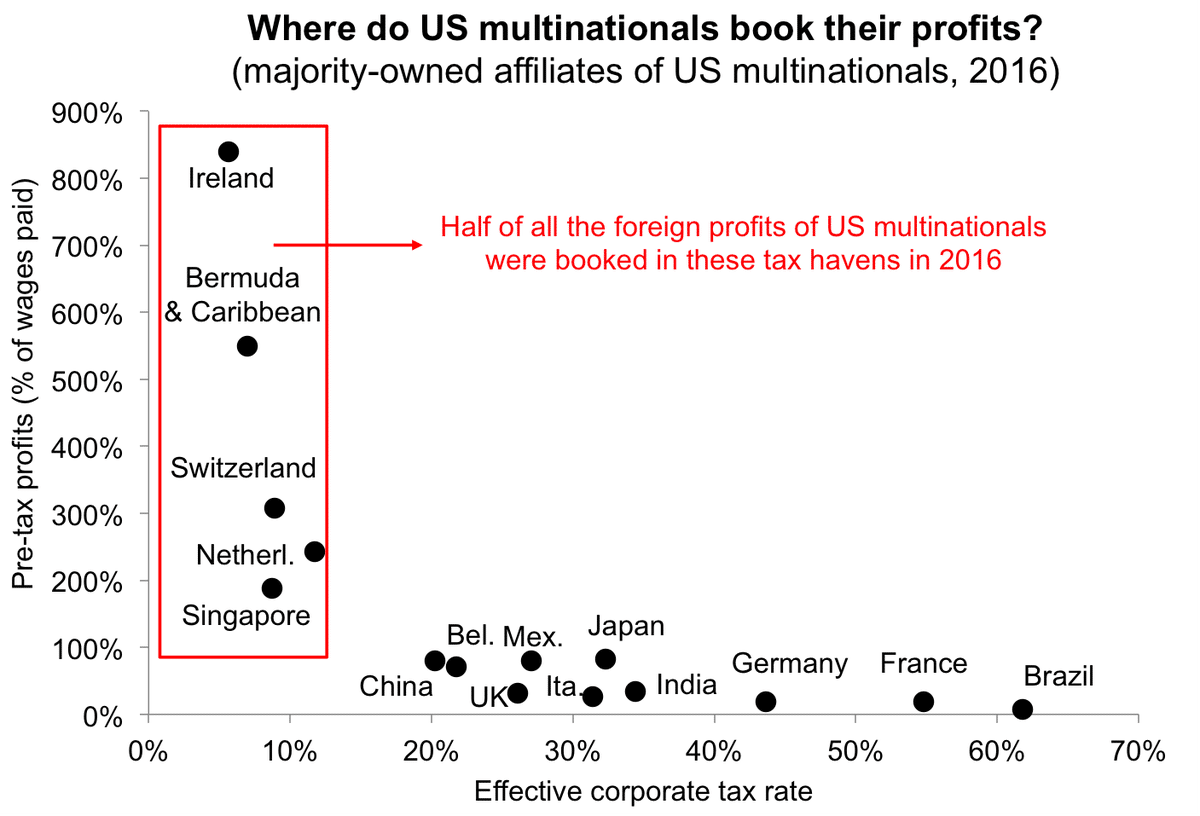

Where do multinationals keep their profit?

It encourages tax competition amongst governments as they seek to lower tax rates compared to other countries

- It is often the richest and most powerful individuals/corporations who are able to benefit the most from tax havens, increasing inequality

- Lost tax revenue means that average tax rates on people with low income have to be increased.

- Helps to facilitate financial crime and money laundering.

Related