- This is a list of the gross national debt of 178 countries, showing the variation in debt levels from Venezuela at 304% of GDP to Macau at 0% of GDP.

- National debt refers to the amount of total government debt a country has. This is also referred to as ‘public sector debt’.

- It is compiled using data from the IMF.

- Note: National debt is different to ‘External debt‘ – External debt includes all the debt a country (both private and public sector) owes to foreigners.

- Updated 1 September 2021.

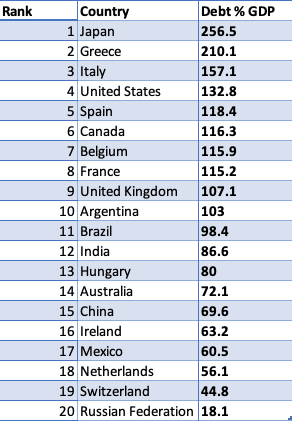

Debt of selected economies

List of National Debt by Country

Levels of general gross government debt. Debt levels as % of GDP for 2021 (² unless stated)

| Rank | Country | Debt levels as % of GDP for 2021 |

| 1 | Venezuela ² | 304 |

| 2 | Japan | 256.5 |

| 3 | Sudan | 211.7 |

| 4 | Greece | 210.1 |

| 5 | Eritrea | 175.6 |

| 6 | Suriname | 157.4 |

| 7 | Italy | 157.1 |

| 8 | Lebanon ² | 154 |

| 9 | Barbados | 143 |

| 10 | Maldives | 139.7 |

| 11 | Cabo Verde | 137.6 |

| 12 | Belize | 134.6 |

| 13 | United States | 132.8 |

| 14 | Portugal | 131.4 |

| 15 | Singapore | 129.5 |

| 16 | Bahrain | 129.4 |

| 17 | Mozambique | 125.3 |

| 18 | Bhutan | 123.4 |

| 19 | Zambia | 118.7 |

| 20 | Spain | 118.4 |

| 21 | Canada | 116.3 |

| 22 | Belgium | 115.9 |

| 23 | France | 115.2 |

| 24 | Cyprus | 113 |

| 25 | Angola | 110.7 |

| 26 | United Kingdom | 107.1 |

| 27 | Sri Lanka | 105.4 |

| 28 | Argentina (2) | 103 |

| 29 | Brazil | 98.4 |

| 30 | Jamaica | 96.5 |

| 31 | Dominica | 96.4 |

| 32 | Montenegro | 94.6 |

| 33 | Egypt | 92.9 |

| 34 | Jordan | 91.2 |

| 35 | Tunisia | 91.2 |

| 36 | Congo, Republic of | 90.5 |

| 37 | Bahamas, The | 88.6 |

| 38 | El Salvador | 88.2 |

| 39 | Mauritius | 87.7 |

| 40 | Pakistan | 87.7 |

| 41 | Austria | 87.2 |

| 42 | India | 86.6 |

| 43 | Croatia | 86.3 |

| 44 | Fiji | 83.6 |

| 45 | Iceland | 82.5 |

| 46 | Ghana | 81.5 |

| 47 | South Africa | 80.8 |

| 48 | Slovenia | 80.5 |

| 49 | Hungary | 80 |

| 50 | Israel | 78.3 |

| 51 | Guinea-Bissau | 78.1 |

| 52 | Mongolia | 77.9 |

| 53 | Morocco | 77.1 |

| 54 | Malawi | 76.8 |

| 55 | Burundi | 75.6 |

| 56 | Albania | 75.4 |

| 57 | Grenada | 74.5 |

| 58 | Gambia, The | 73.9 |

| 59 | Kyrgyz Republic | 73.4 |

| 60 | Yemen | 73 |

| 61 | Costa Rica | 72.5 |

| 62 | São Tomé and Príncipe | 72.4 |

| 63 | Australia | 72.1 |

| 64 | Kenya | 71.5 |

| 65 | Namibia | 71.4 |

| 66 | Oman | 71.3 |

| 67 | Gabon | 71.1 |

| 68 | Germany | 70.3 |

| 69 | Armenia | 69.9 |

| 70 | Iraq | 69.7 |

| 71 | China, People’s Republic of | 69.6 |

| 72 | Bolivia | 69 |

| 73 | Finland | 68.8 |

| 74 | Lao P.D.R. | 68.3 |

| 75 | Uruguay | 68 |

| 76 | Malaysia | 67 |

| 77 | Senegal | 66.8 |

| 78 | Dominican Republic | 66.6 |

| 79 | Rwanda | 66 |

| 80 | Ecuador | 65.1 |

| 81 | Puerto Rico | 64.8 |

| 82 | Colombia | 64.2 |

| 83 | Slovak Republic | 64 |

| 84 | Emerging market and developing economies | 64 |

| 85 | Georgia | 63.9 |

| 86 | Algeria | 63.3 |

| 87 | Ireland | 63.2 |

| 88 | Trinidad and Tobago | 62.1 |

| 89 | Panama | 61.4 |

| 90 | Mexico | 60.5 |

| 91 | Togo | 60 |

| 92 | Qatar | 59.8 |

| 93 | Serbia | 59 |

| 94 | Ukraine | 58.1 |

| 95 | Malta | 57.9 |

| 96 | Poland | 57.4 |

| 97 | Liberia | 57 |

| 98 | Mauritania | 56.3 |

| 99 | Netherlands | 56.1 |

| 100 | Ethiopia | 56 |

| 101 | Thailand | 55.9 |

| 102 | Honduras | 53.9 |

| 103 | North Macedonia | 53.8 |

| 104 | Korea, Republic of | 53.2 |

| 105 | Romania | 52.6 |

| 106 | Philippines | 51.9 |

| 107 | Zimbabwe | 51.4 |

| 108 | Lesotho | 49.8 |

| 109 | Tajikistan | 49.8 |

| 110 | Nepal | 49.6 |

| 111 | Papua New Guinea | 49.6 |

| 112 | Lithuania | 49.5 |

| 113 | Myanmar | 49.1 |

| 114 | Samoa | 49 |

| 115 | Uganda | 48.8 |

| 116 | Vietnam | 48 |

| 117 | West Bank and Gaza | 47.9 |

| 118 | Benin | 47.7 |

| 119 | Nicaragua | 47.6 |

| 120 | Latvia | 47.2 |

| 121 | South Sudan, Republic of | 47 |

| 122 | Madagascar | 46.9 |

| 123 | Burkina Faso | 46.8 |

| 124 | New Zealand | 46.4 |

| 125 | Côte d’Ivoire | 46.3 |

| 126 | Mali | 46.1 |

| 127 | Belarus | 45.7 |

| 128 | Switzerland | 44.8 |

| 129 | Niger | 44.5 |

| 130 | Equatorial Guinea | 44.1 |

| 131 | Czech Republic | 44 |

| 132 | Tonga | 43.7 |

| 133 | Cameroon | 42.5 |

| 134 | Guinea | 42.3 |

| 135 | Uzbekistan | 42.3 |

| 136 | Central African Republic | 42.2 |

| 137 | Chad | 41.7 |

| 138 | Denmark | 41.6 |

| 139 | Norway | 41.6 |

| 140 | Guyana | 41.4 |

| 141 | Indonesia | 41.4 |

| 142 | Sweden | 40.4 |

| 143 | Bangladesh | 40.2 |

| 144 | Djibouti | 40.2 |

| 145 | Moldova | 39.5 |

| 146 | Bosnia and Herzegovina | 38.6 |

| 147 | Tanzania | 37.9 |

| 148 | Turkey | 37.1 |

| 149 | United Arab Emirates | 37.1 |

| 150 | Iran | 36.6 |

| 151 | Paraguay | 35.7 |

| 152 | Peru | 35.4 |

| 153 | Chile | 33.6 |

| 154 | Cambodia | 33.4 |

| 155 | Guatemala | 33.1 |

| 156 | Taiwan Province of China | 32.5 |

| 157 | Nigeria | 31.9 |

| 158 | Saudi Arabia | 31 |

| 159 | Azerbaijan | 30.9 |

| 160 | Kazakhstan | 27 |

| 161 | Luxembourg | 26.8 |

| 162 | Haiti | 26 |

| 163 | Turkmenistan | 26 |

| 164 | Bulgaria | 25.5 |

| 165 | Botswana | 25.3 |

| 166 | Estonia | 25.1 |

| 167 | Marshall Islands | 23.3 |

| 168 | Kiribati | 21.4 |

| 169 | Russian Federation | 18.1 |

| 170 | Micronesia, Fed. States of | 15.3 |

| 171 | Timor-Leste | 15 |

| 172 | Kuwait | 13.7 |

| 173 | Congo, Dem. Rep. of the | 12.4 |

| 174 | Tuvalu | 11.8 |

| 175 | Afghanistan | 8.8 |

| 176 | Brunei Darussalam | 2.3 |

| 177 | Hong Kong SAR | 0.9 |

| 178 | Macao SAR | 0 |

All debt levels apply to 2021, except ² No figures for 2021. Debt given for 2020

Source: IMF DataSet, accessed 1 September 2021

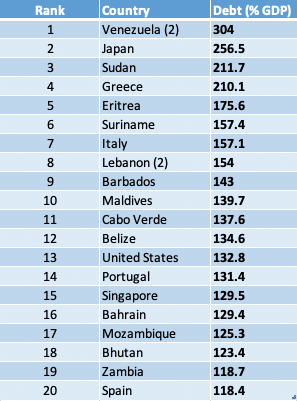

Highest levels of Government debt in the world

The country with the highest debt to GDP ratio in 2020 was Venezuela (304%) – a reflection of a collapsing economy and failure to collect tax revenues.

The second biggest debt burden is Japan with 256% – though this is very different situation with economic stability and prosperity. The Japanese government is able to borrow from private individuals in Japan. Conflict in Sudan and Eritrea have played a large role in their high debt levels.

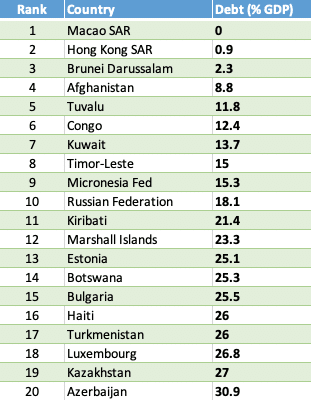

Lowest levels of government debt in the world

The country with the lowest levels of debt is Macau – an autonomous region on the south coast of China. Macau is the most densely populated region in the world, with one of highest levels of GDP per capita. Nearly 80% of the government’s revenue comes from a thriving gambling industry. Oil producing countries, like Brunei, Kuwait and Kazakhstan have low levels of debt because governments have successfully collected tax revenue from oil.

Some very poor countries like Afghanistan, Congo and Haiti have perhaps surprisingly low levels of debt. One reason is that the country does not have functioning bond markets. There is so much uncertainty that governments do not have the opportunity to borrow.

Problems of national debt

High levels of national debt can cause these potential problems

- Requirement of higher taxes and/or lower spending

- Higher debt interest payments

- Pressure to print money – causing inflation.

- Debt financed by overseas borrowing can lead to external pressure

- Crowding out of the private sector

See: more problems of government borrowing

How much can a government borrow?

- Japan’s national debt is 265% of GDP and has been high for a couple of decades. This reflects the ability of Japan to borrow from domestic citizens. Despite prolonged periods of high debt, interest rates are still low because markets feel the government is still solvent.

- A developing economy like Argentina has a track record of default on debt, therefore markets are less willing to lend money to the government. Therefore when debt levels in Argentina increase it has a greater effect on pushing up interest rates.

Factors that depend on how much a government can borrow include

- Default rates of government

- Inflationary pressures. High inflation will make investors less willing to buy government bonds because they will devalue due to inflation

- Can the government print its own money? If the government can print money it can avoid liquidity issues, though there is potential danger of inflation.

- What are the prospects for economic growth? Higher economic growth makes it easier to reduce debt to GDP ratios over time.

- How much can a government borrow?

Difference between debt and deficit

Government debt is the total amount of outstanding liabilities. The deficit is the annual amount by which spending exceeds income. The debt is the accumulation of past deficits.

For example in 2020, the US deficit was $3.13 trillion. The US total debt is $29 trillion.

Causes of national debt

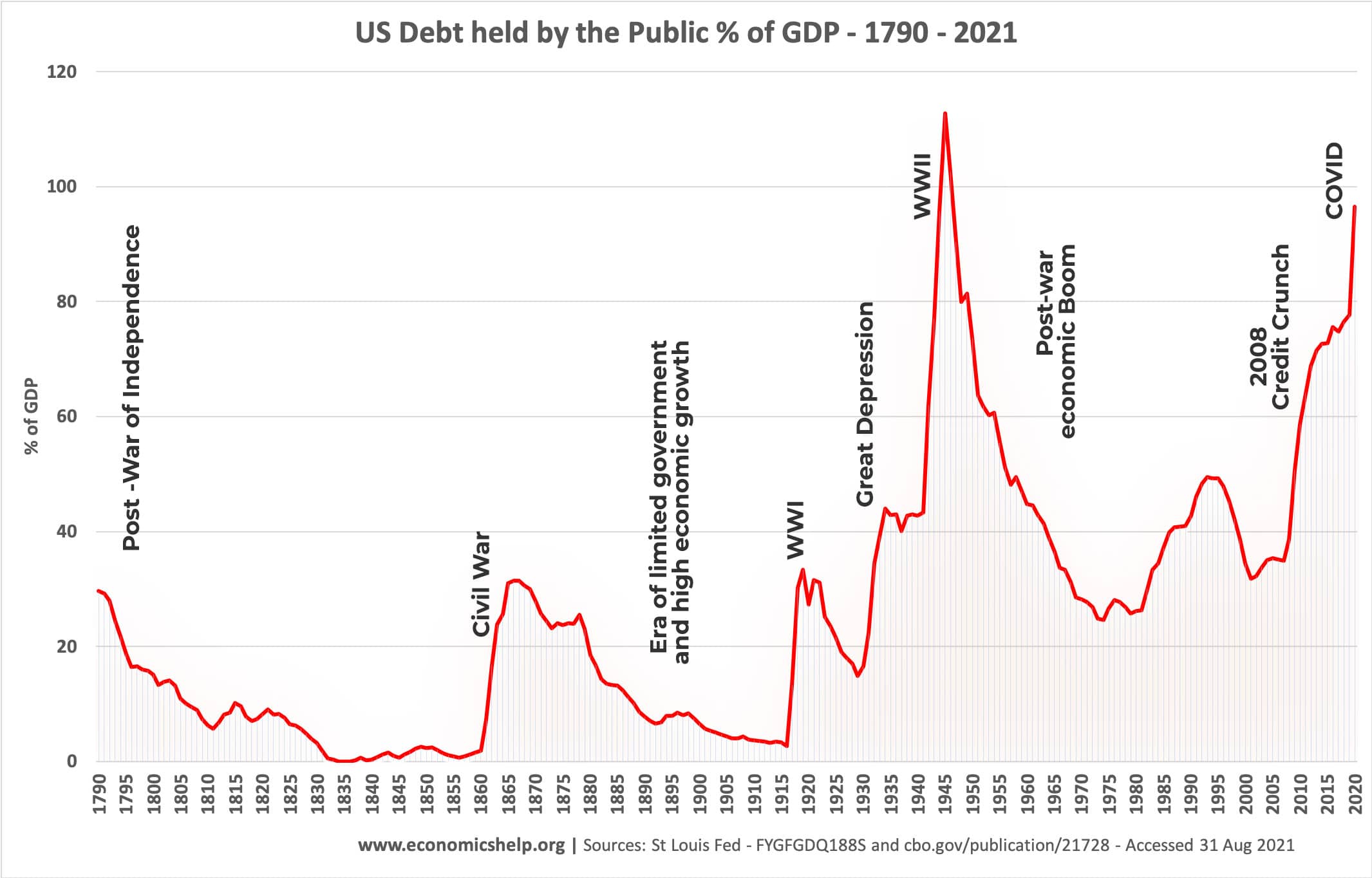

This graph for US national debt shows how national crisis leads to a rise in government borrowing. This isn’t necessarily a bad thing. Government debt enabled the US government to finance the short-term costs of the two world wars. It also enabled the government to respond to the crisis of the 2008 financial crash and the 2020 Covid crisis. Causes of national debt can include

- Recession – tax revenues fall when the economy shrinks. Also the government spend more on unemployment benefits

- Investment – Governments might borrow to build new roads, schools and hospitals.

- Finance war –

- Demographic changes and welfare spending. An ageing population tends to place more strain on government finances with older people requiring more health care spending, pensions and also they pay less income tax.

- Political decisions. Some governments may support higher spending on welfare programmes, whearas other governments may target a balanced budget.

Related

Further Reading

- Why is Japan able to borrow so much at low interest rates?

- Euro Debt crisis explained

- National Debt, printing money and inflation

Readers Question

No the numbers say the truth. Everyone cuts paper for money without giving any excuse and all the borrowers must pay their taxes. U.S Germany and U.K are the worst governments in the planet and we have to pay for their sins!!! That is the truth!!!

It sounds to me like you have an axe to grind here. Try working with facts.