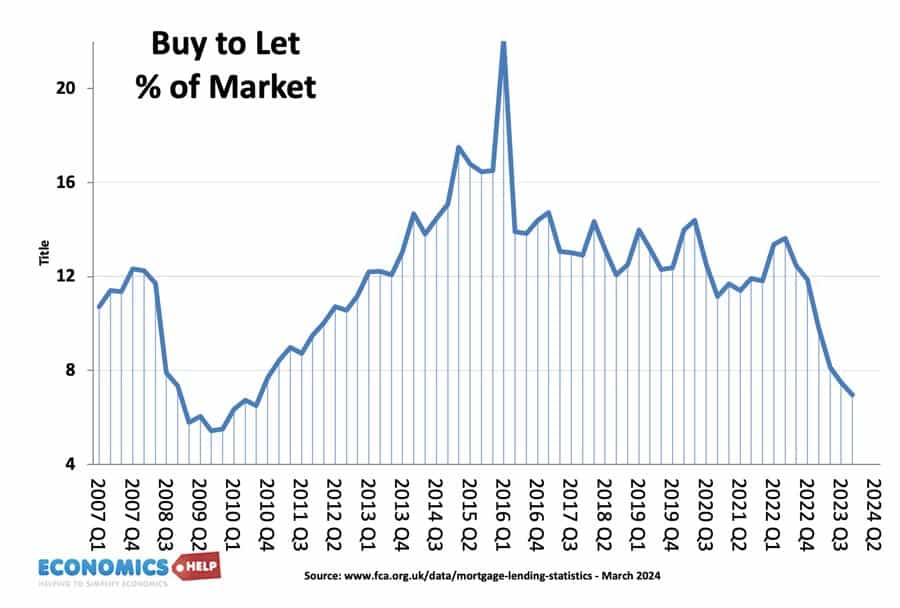

From the mid 1990s, the buy-to-let sector saw impressive growth. By 2016, 2 million individuals owned a buy to let property. But, recent events have seen a sharp decline in buy-to-let mortgage lending.

It is shrinking as a share of the market to levels last seen in the credit crunch. Recent legislation and budget changes has increased the incentive for private landlords to sell rather than buy. But with the private rented sector expected to see rapid growth in the coming years, why are many individual landlords planning to leave the sector, just as we could do with more rented housing?

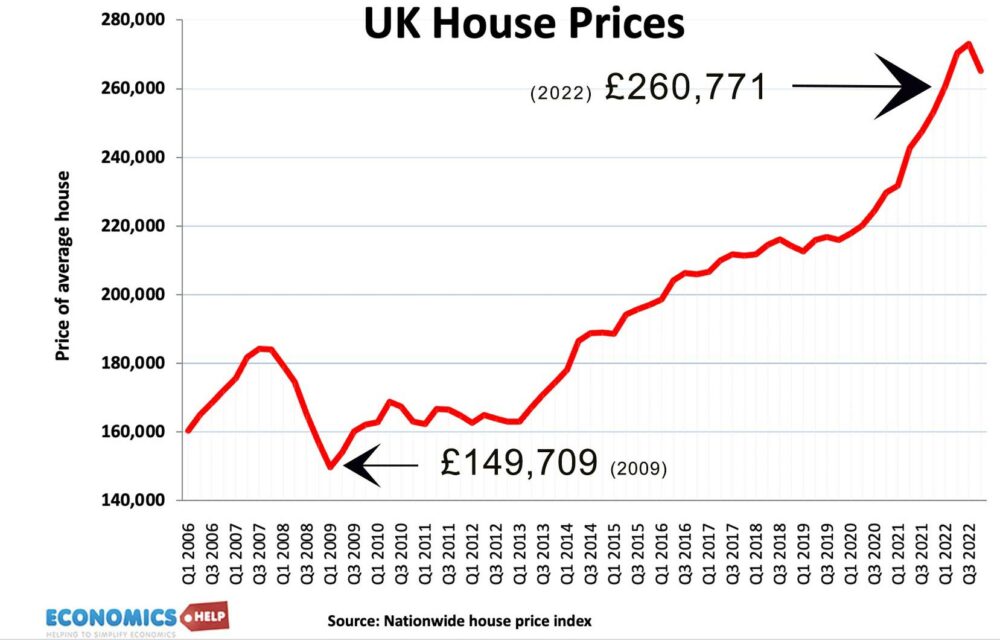

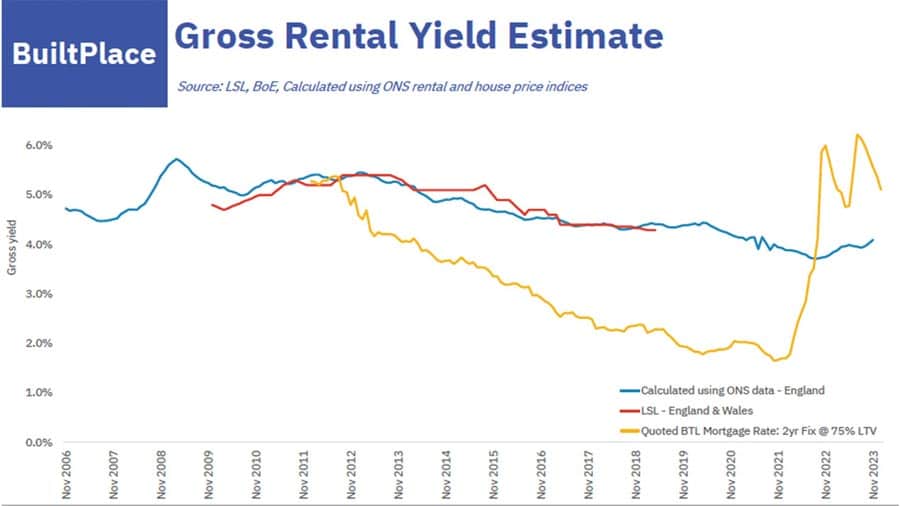

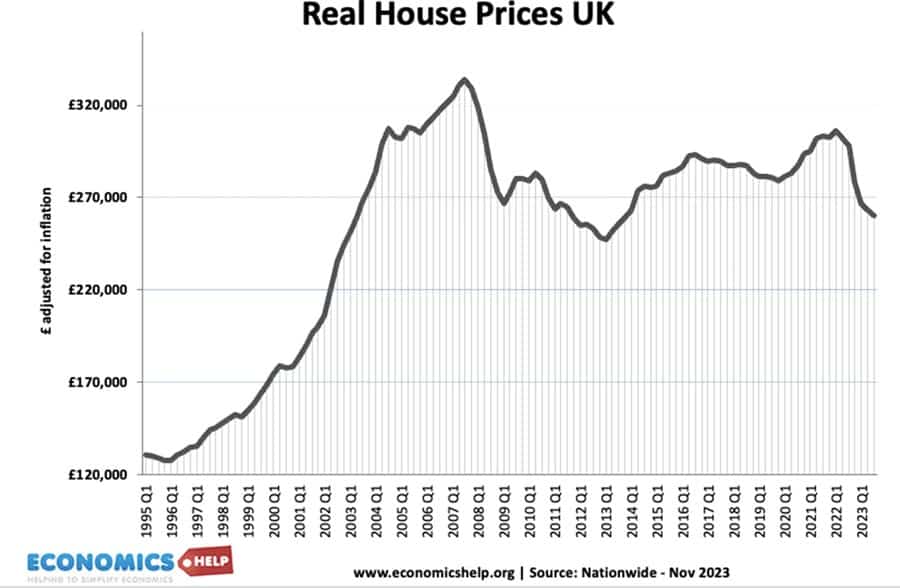

Those who bought a buy-to-let mortgage in the mid 1990s, have experienced impressive capital gains. House prices rose faster than inflation, making it one of the best investments. Those who sold a house in 2023 made an average profit of £100,000. On top of equity gains, very low mortgage costs in the 2010s meant that letting houses gave a relatively good return of yield-mortgage cost. But, the past two years has seen an abrupt change in fortunes.

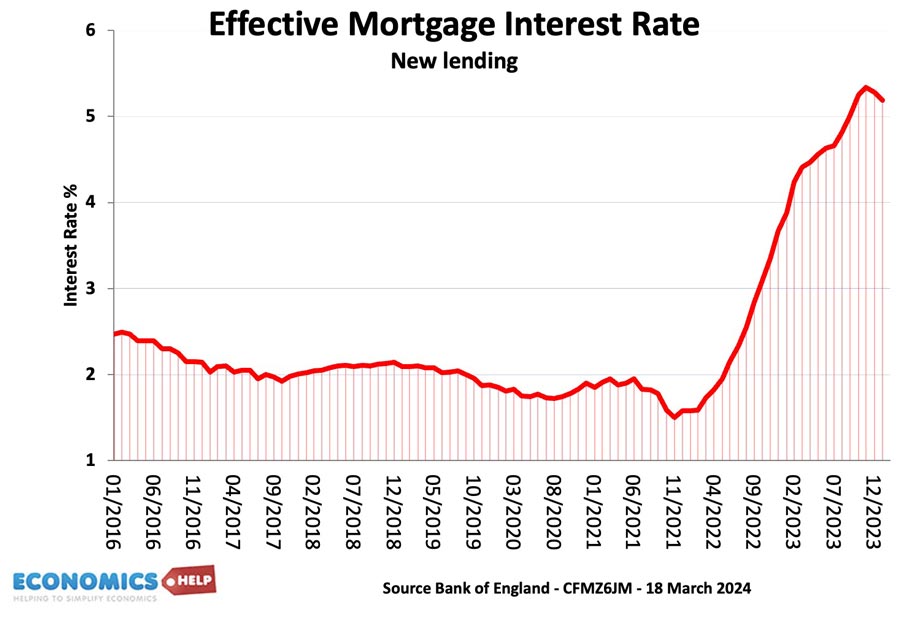

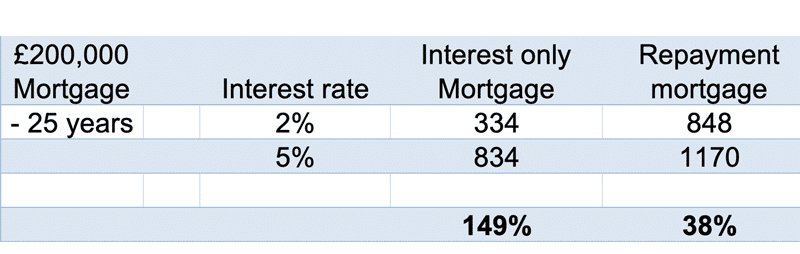

Firstly, interest rates have risen rapidly. It means that new buy-to-let mortgage rates are now higher than typical rental yields. If we look at effective mortgage rates, we see that the interest rate people are actually paying is continuing to rise. Many buy to let investors who face remortgaging to higher fixed deals this year will be asking themselves if is it worth holding on, rather than selling up.

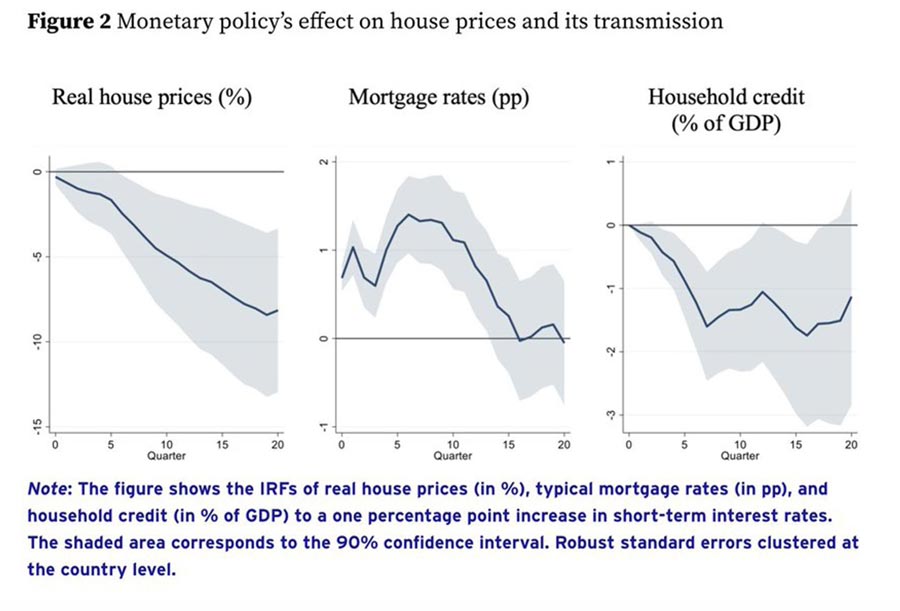

There was an interesting report at Vox, which looked at empirical data in the OECD and found that for every 1% increase in Central Bank base rates, real house prices tend to fall 8%.

Therefore, in theory, with a 4% rise in base rates, we could see real interest rates fall 32%. The negative impact is greater when the economy is doing badly and credit conditions are tight. Now, we have already seen real house price falls of 14%, so we are already halfway there.

Most of the past falls have been hidden by inflation. But, with inflation falling to 2%, this model suggests nominal house price falls are still to come. Now recent trends in house prices suggest a modest stabilisation in prices, with Righmove reporting a rise in asking prices rising this spring. But, even if you doubt the more pessimistic house price forecasts, it is hard to see any kind of capital gains of the late 90s or mid-00s. It is also worth bearing in mind that buy to let investors who take out an interest-only mortgage face a bigger % rise in costs.

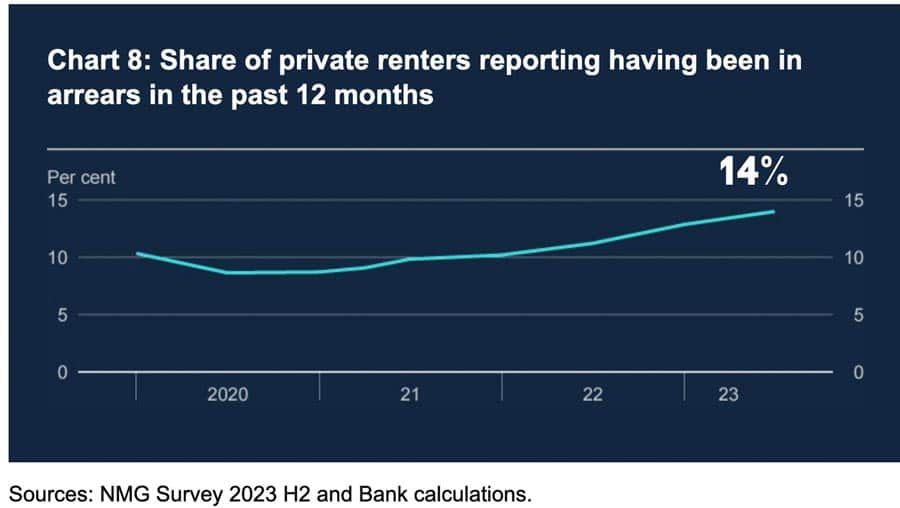

An interest-only mortgage sees a 149% increase compared to 38% for repayment mortgage. In the financial crisis of 2009, it was buy-to-let mortgages which saw the highest rises in defaults. Although nothing like past crashes, arrears are starting to rise – a sign of distress in the housing market.

Even the chancellor admitted he was reluctant to offer a budget boost for homebuyers because he felt there was the risk of negative equity. 99% mortgage loans with a prospect of falling house prices is not such a good idea.

Budget Effect

But, talking of the budget, there were a number of changes which actually increased the incentive for private landlords to sell. Firstly, capital gains tax has been cut from 28% to 24%. This means landlords who do decide to sell will be subject to lower taxes. The aim is to increase transactions and liquidity of the housing market. But, in the short-term could increase supply more than demand. Secondly, tax breaks for holiday lets has been removed. Thirdly, there was a scrapping of multiple dwellings relief. This reduced stamp duty for those buying multiple properties. At the same time, the budget was notable for failing to give any expected support to buyers.

There was no change in stamp duty or policies to boost buying power. A landlord buying a second home for £250,000 faces a stamp duty of 8% or £20,000. That’s a significant cost, even before you start paying mortgage costs.

In the late 2010s, help to buy was significant for boosting demand. Its removal, means first time buyers have that extra struggle to raise a deposit and get mortgage approval. At least in the short-term, it means the housing market faces more headwinds than might be expected.

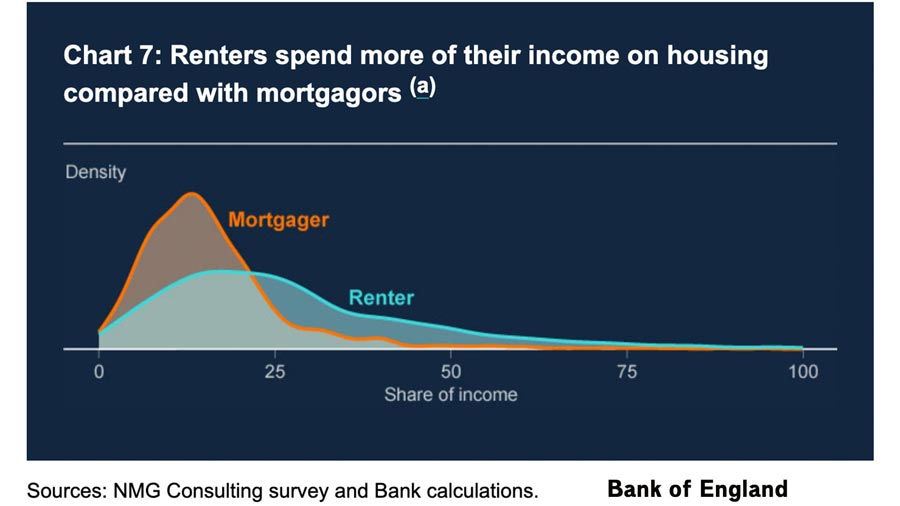

The difficulties in the housing market have been exacerbated by the gloom surrounding the economy. The economy slipped into recession, and even if we exit next month, the cost of living crisis has taken a toll on many renters.

Renters can easily pay over 25% of their income on rent. It can rise to over 50% in extreme cases. Combined with low real wage growth, renters have been struggling to pay rent. Renters reporting arrears has risen from 8% to 14%.

This is a worry for landlords, who feel that the new landlord bill which includes outlawing ‘no fault’ evictions will make it harder for them to evict non-paying tenants. The bill is still going through the Commons and it is possible that it will be watered down, but even if it is delayed, we could expect a new Labour government to re-implement measures which favour renters over landlords. A key constituent of the Labour core vote is the growing number of private-sector renters. It doesn’t help that landlords fairly or unfairly have become a scapegoat for the UK’s wider housing crisis and shortage of available properties. Rules to ensure all rental properties are energy efficient, getting an energy performance certificate rating of ‘C’ or better, have also been delayed, after protests, but they are still set to be implemented by 2030, probably earlier under a Labour government.

Rents?

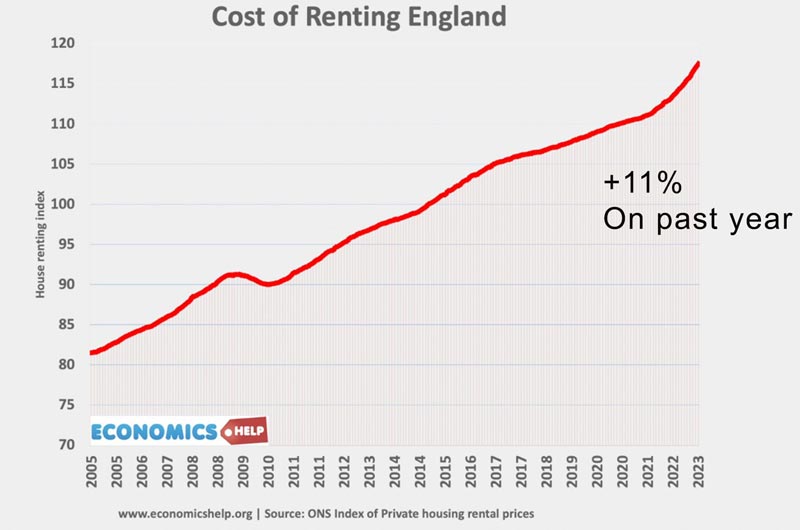

Another factor is that after years of rapidly rising rents, there are finally signs that rents may be starting to fall, with letting agents reporting the first falls for years. Flatshare website SpareRoom say Average rental prices in February 2024 fell from £1,024 to £1,009 for the first time since July 2023. Rents are very expensive, yet, compared to house prices, they still give a low yield. It’s a tough climate for new landlords to enter the market. Rents are determined by supply and demand, but also by real wages. For many rents are reaching the limit of what people can afford.

Growing Population

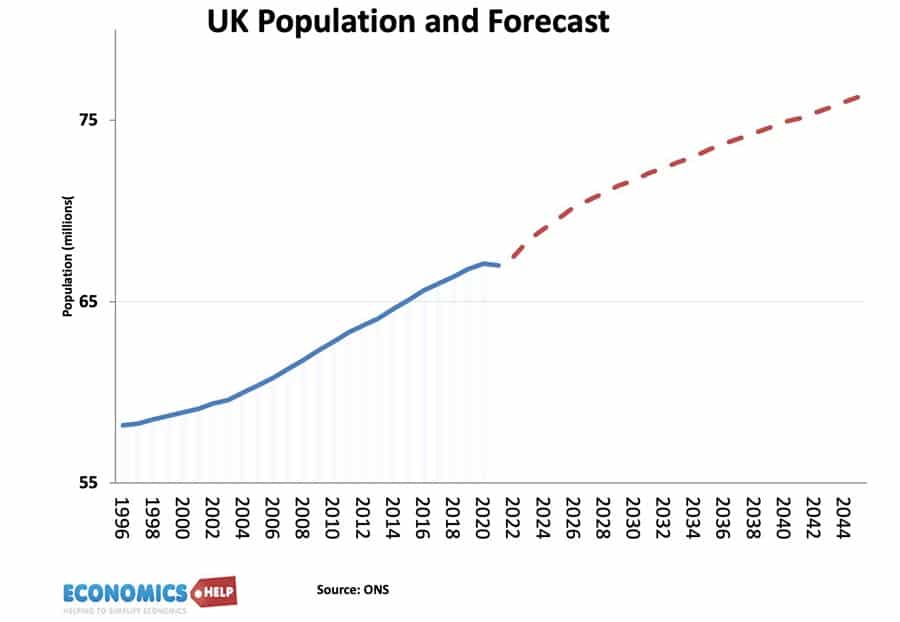

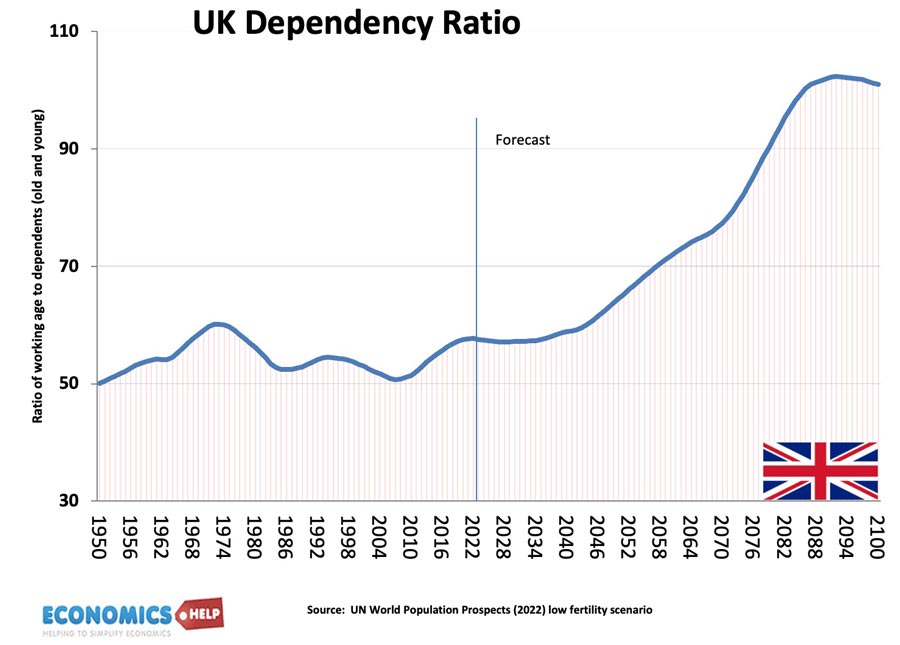

Despite all these headwinds for buy to let, the private rented sector is forecast to grow rapidly in the coming years. The UK population is forecast to grow, and the ageing population means there is a trend towards smaller households, as we see more single older people living alone.

At the same time, the amount of social housing has fallen 11% since 2010. Therefore, in theory, there will be strong growth for the private rented sector. According to statista, the expected rise in demand could push up rents by 18% by 2028. Whilst private landlords consider selling, there is evidence that there is new growth from corporate landlords. There has been a trend towards corporate ownership of the private rented sector. Recent tax changes have reduced tax advantages for private landlords who buy in their name, this will only increase demand for the corporate route. Also, bigger property companies are increasingly buying direct with cash and avoiding the more traditional large interest-only mortgage, typical of a private buy to let investor.

A 2023 Bank of England report on the buy to let sector found that buy to let constitutes a fifth of the total mortgage market in the UK and is home to around 45% of private renters. It’s a very significant part of the housing market, yet given increasing costs and reduced expectations there could be a shortage of rented properties come onto the market.

On the positive side, interest rates have likely peaked, and falling inflation should enable interest rates to come down later in the year. So far the housing market has proved more resilient to interest rates than some feared. But, there has been a change in the private rented sector with growth of bigger corporations with more cash buying power replacing the more traditional individual taking out mortgage.

Related