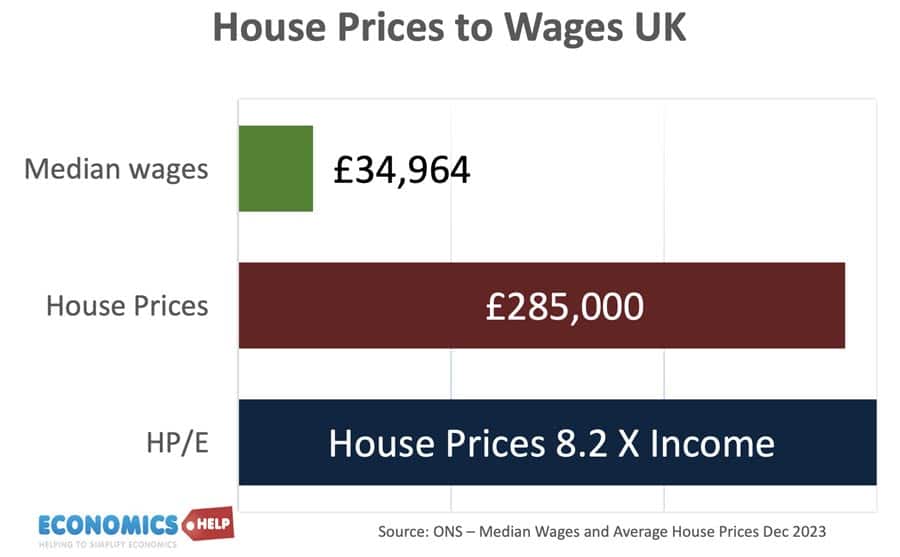

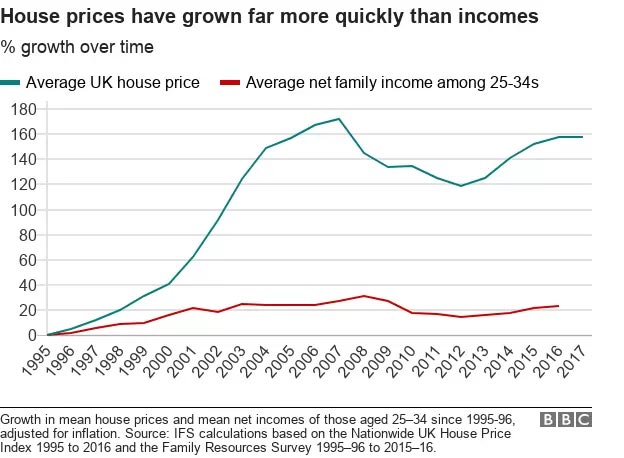

The UK housing market is in crisis, with prices eight times median incomes.

The latest idea to be floated is the return of government-backed 99% mortgages. The logic is that since house prices are out of reach for many, a 99% mortgage would enable more to be able to buy without waiting the 19 years it currently takes to get a deposit. But, like many other sticking plaster policies, it dabbles at the edge exacerbating the underlying problem. We’ll look at 10 examples of why government policy is failing, and also what could be done differently.

1. 99% Mortgage – Help to Buy “Help to Borrow”

The 99% mortgage idea is in a very similar category as the government’s help to buy. The basic premise is that houses are unaffordable, so the government needs to help first-time borrowers to borrow more. Far from fixing the underlying situation, it adds fuel to the fire. A Parliament committee found the billions spent on help to buy, were a poor use of public money which helped fuel house prices higher. Some who received government support may feel like they benefited, but the net effect is to push up prices, making it harder for everyone to buy. The other problem is that 99% of mortgages offer real problems. It only requires house prices to fall 2% for new homeowners to end up with negative equity. Also, the interest rate cost for 99% mortgages is likely to be significantly higher. 6% rather than 5% making it more expensive as well as more risky. The government will be offering guarantees to the bank, not the homeowners. Also, we have tried all this before. A reason for the disastrous credit crunch was the proliferation of risky mortgages. Remember the 125% mortgage from credit crunch times? It didn’t end well.

2. Sell off council houses and stop building

Perhaps the biggest failure in UK housing policy was the decision to sell off council houses, just about the time, the government decided to stop building. This cut off a supply of low-cost renting, pushing people into the more expensive private rented sector. 75% of council houses sold under the right to buy are now let out. And the government is spending £25bn a year on housing benefits to subsidise low-income households so they can pay private landlords. At least with this problem, there is an easy solution, return to building social housing. Most people agree this would be desirable, the only problem is that it would be quite expensive. The cost of building houses has surged in recent years, and if the government is letting at below-market rents, it will be expensive. Persimmon claims the average cost to build is over £201,000. Local councils are facing near bankruptcy, so any major homebuilding would need to come from the Central government. The Labour Party have indicated a willingness to build, and their voters are more pro-building than the typical Conservative voter coalition, but it will still be a mammoth task. There is no quick fix.

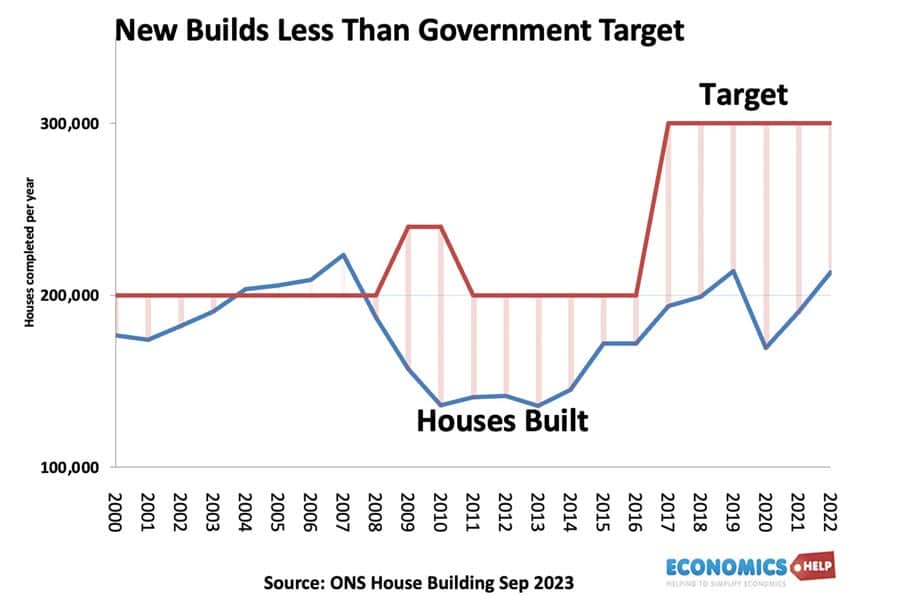

The truth is that it is easy to promise to build more houses, but governments are pulled between the desire to build and the strong opposition to building. The result is predictably, that government targets are rarely met. Planning permissions have fallen recently

3. Planning restrictions too strict?

Another controversial policy is planning regulations and the ever-expanding green-belt land. 26% of England’s land mass is protected. When asked what percentage of land in England is developed, people said 47%, in fact, the figure is just 9%.

The fear of losing Britain’s green and pleasant land is understandable, but 65% of the green-belt is unremarkable farmland, not rich in biodiversity. Less than 7% of the green-belt is actually open for recreation. The green-belt is a very powerful brand, but a large proportion of the green belt is nothing like the myth of rolling green fields. The economist reports 43,000 hectares of undeveloped land within 800 metres of a train station, which could provide housing where it is needed. The green-belt is forcing people to live further from their place of work and commute longer distances. Building near train stations could increase housing supply without putting the same pressure on road congestion, often a fear of new building. Now opponents of relaxing planning restrictions might point to the one million plots of land with permission, but remaining unbuilt. But, housing companies argue it is so hard to get permission, they need to save up plots. But, also, what counts is building houses where they are needed, for example, those cities where prices exceed 10 times median incomes.

4. Lack of incentives

Another issue is that at the moment, local councils gain little financial benefit from approving new buildings, e.g. government get stamp duty. But, at the same time, councils need to fund more services for the expanding population. To make councils and local people more supportive of new building, there needs to be better incentives to ensure that more homes also equals more funding for related services.

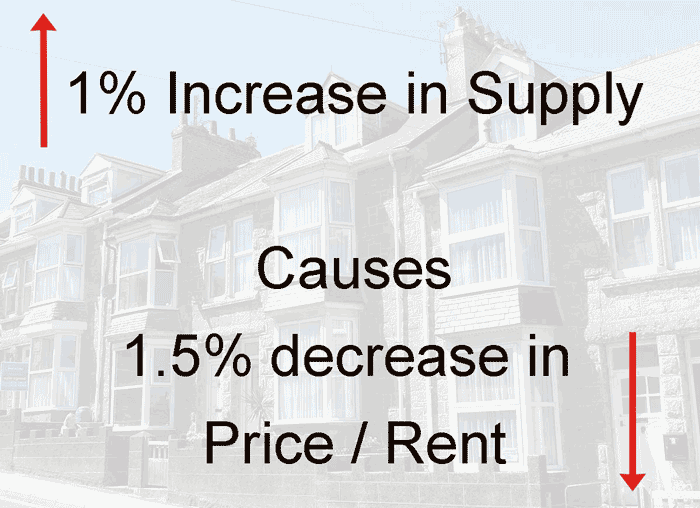

A final point worth emphasising is that building more housing is not the magic bullet for improving affordability. Increasing supply by 1 million would have a net effect of reducing prices by 10%.

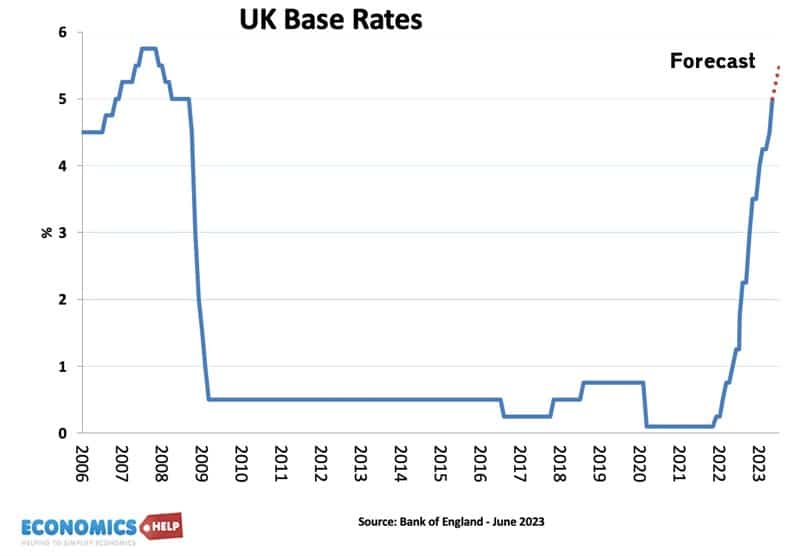

5. Monetary Policy

One indirect housing policy failure was 13 years of zero interest rates, combined with quantitative easing which inflated demand beyond what you would usually expect. It was more ultra cheap mortgages which caused house prices to rise faster than incomes. Now this is more a reflection of Bank of England and monetary policy. But, the difficulty is it would be a mistake to ask Bank of England to use interest rates to control house prices – their primary goals should be inflation and full employment. Also, a big issue is that median wages have stopped growing.

The best solution for UK housing market would be to return to post-war trend rate of growth, easier said than done.

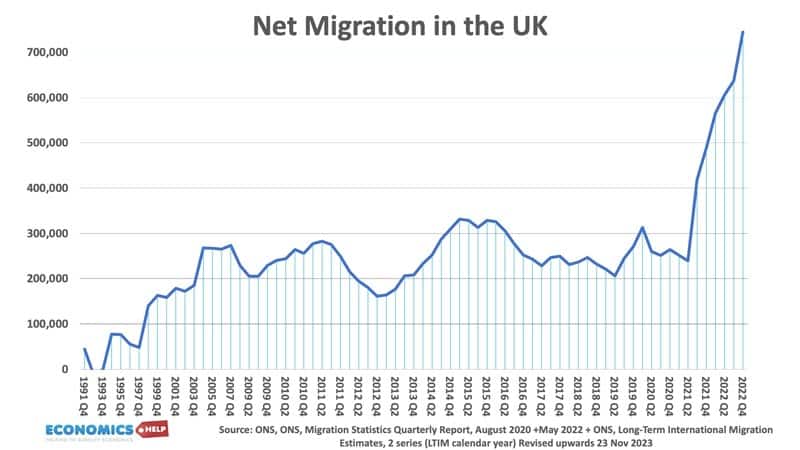

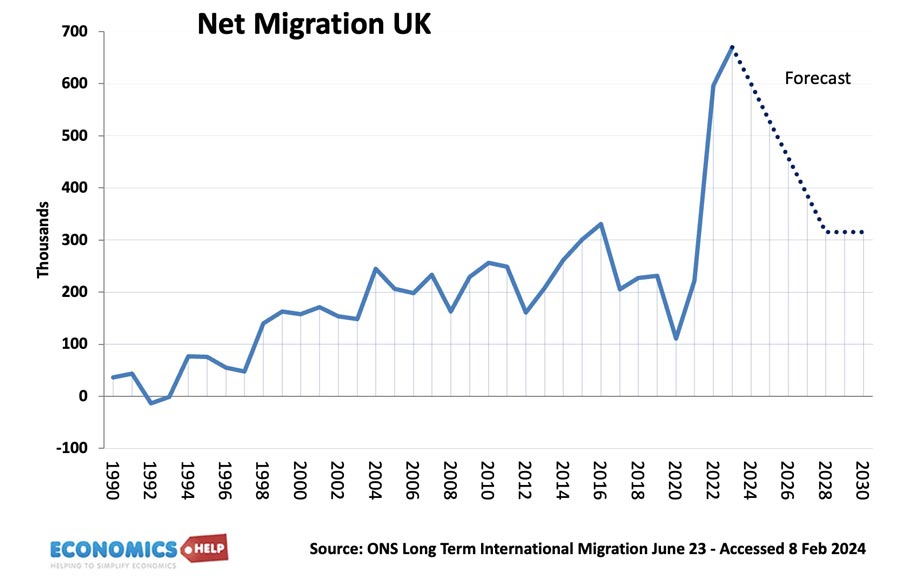

6. Immigration

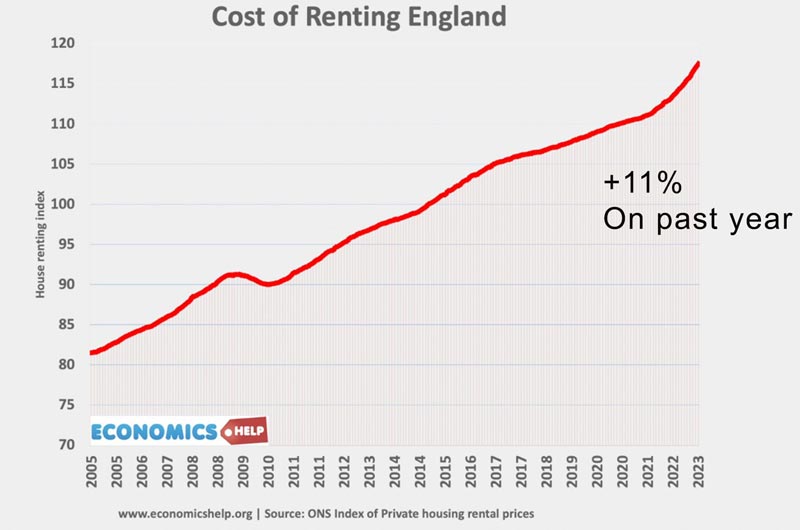

Immigration is often cited as having a big effect on housing. In the past decades, the UK has seen high levels of net migration, which have increased the number of households, putting pressure on prices and rents in particular. Despite promises to cut migration levels, the ONS forecast a continued rise in the population and therefore housing demand. Government promises over building houses and restricting immigration both seem to suffer the same fate.

It would be a mistake to say immigration is the root cause of housing crisis, but it has magnified demand, especially last year when private rents soared.

The problem is the economy needs migrants to fill vacancies in health care, agriculture and ironically building. The home building sector reports a shortage of skilled labour. Greater emphasis on vocational skills might go someway to reducing need for migration. But, if high migration levels are maintained it becomes more important to increase supply.

7. Empty and Second Homes

Another problem in housing is the number of second and empty homes, this is particular a problem for locals priced out of touristy areas. Brighton Council have announced a doubling of council tax on empty and second homes. It is not a panacea, but it has a strong logic, and it wouldn’t be a surprise to see more councils take this approach.

8. Stamp Duty

Another problem in the housing market is the huge difficulties and costs in moving house. It has led to a turgid market where people stay in inappropriate homes. For example, older people living in oversized houses, when they might prefer smaller, age specific housing. Stamp duty is a major cost of moving. For primary residencies, there is a case to abolish stamp duty completely. Stamp duty on property raised £14 billion in 2023, so it would need an alternative. I would suggest expanding inheritance tax or capital gains tax. If your parents don’t pay stamp duty, they will leave more. I don’t understand the dislike of inheritance tax, which only 4% of estates are currently liable for. But, it would be better to pay tax through inheritance than making it expensive to move. Making it easier to move, would help adjust demand, Retired could downsize freeing up spare bedrooms for young families.

9. Maximum Rents

Another failed policy I will quickly mention is maximum rents. The logic is that if rents are too high, and governments should make them cheaper. The problem is that invariably a maximum rent reduces supply. Landlords are already complaining about declining yields and lack of profitability. Max prices will only encourage more landlords to leave, exacerbating the shortage of supply. It will invariably lead to queues of renters fighting over limited supply. If landlords are exploiting monopoly power it would be better to find a way to tax landlords and use funds to increase supply.

10. Freezing of benefits

We often focus on the challenges of first time buyers, but it is worth bearing in mind, the freeze in housing benefits introduced since 2020 means that local housing allowance rates (LHA) do not cover rising private rents Fewer than one in five private rents in England were within LHA rates. It is has led to a growth in homeless families living in temporary accommodation, which is expensive for councils.

Related

External Link

- How to solve Britain’s housing crisis – Economist

https://www.gov.uk/government/statistics/uk-stamp-tax-statistics/uk-stamp-tax-statistics-2021-to-2022-commentary

With Respect

Why does the chart shown in the blog blurb, of Council builds, disappear on clicking “See More” and getting the full article?

Yours Sincerely

Landlords are leaving the market because it is simply too much hassle and too little reward added to which they feel they have become national pariahs.

There need to be incentives to be both good landlords and good tenants and to disincentivise bad landlords and bad tenants.

My latest peer reviewed research publication synthesized my work and rewrote the literature on the rapid increase in home prices, policy failure in the housing market, the Global Financial Crisis, subprime mortgage lending and the false real estate bubbles narrative.

The 3 Decades Global Financial Policy Failure in Housing

Market, Runaway Home Prices, Today’s Growing Homeless

Crisis: Eddison Walters Real Estate Housing Technology

Structural Change Transformational Theory

European Journal of Accounting, Auditing and Finance Research

Vol.12, No. 5, pp.,62-81, 2024

Print ISSN: 2053-4086(Print),

Online ISSN: 2053-4094(Online)

doi: https://doi.org/10.37745/ej…

Published May 12, 2024