Q. Is there hope for the UK economy?

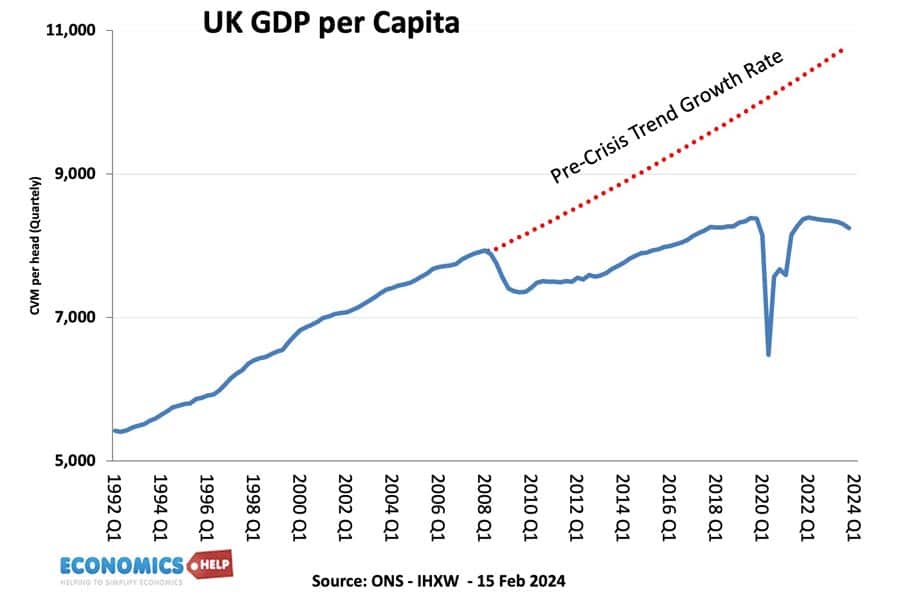

There is hope for the UK, despite very poor past 15 years, it is still a moderately wealthy country, with reasonably basic economic institutions. We are not in the same league as Latin American countries with chronic bouts of hyperinflation. Economies are also more resilient than we tend to give credit. One argument is that if you fall behind, it should be easier to catch up because there is more growth potential.

The UK certainly has lost a lot of potential Having said that 10 years ago, I had a similar optimism that the UK economy would soon improve and return to higher growth and improved public services, but it hasn’t happened yet. Italy kind of stopped growing in 2000, and the worry is that we allow problems to feed on each other. But, even Italy’s example is interesting as in recent years, Italy has had some of the best per capita growth in the OECD.

Another factor, Last year, I made a video about how youtube algorithm encourages negativity. It’s not just YT, it’s all media. If you make a thumbnail, that things are very bad, it gets more clicks and views than if you make a thumbnail, UK economy is unsatisfactory, but might do slightly better in the future. I wouldn’t judge the UK economy, by headlines and clickbait thumbnails – you can say I’m a culprit.

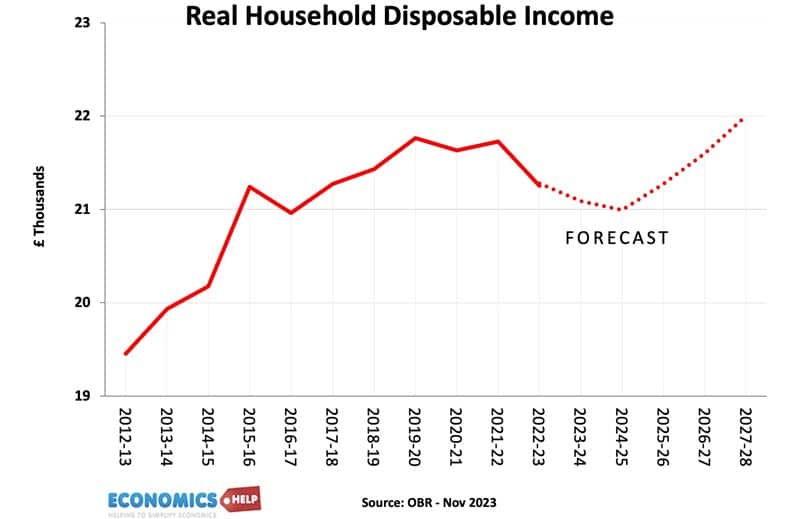

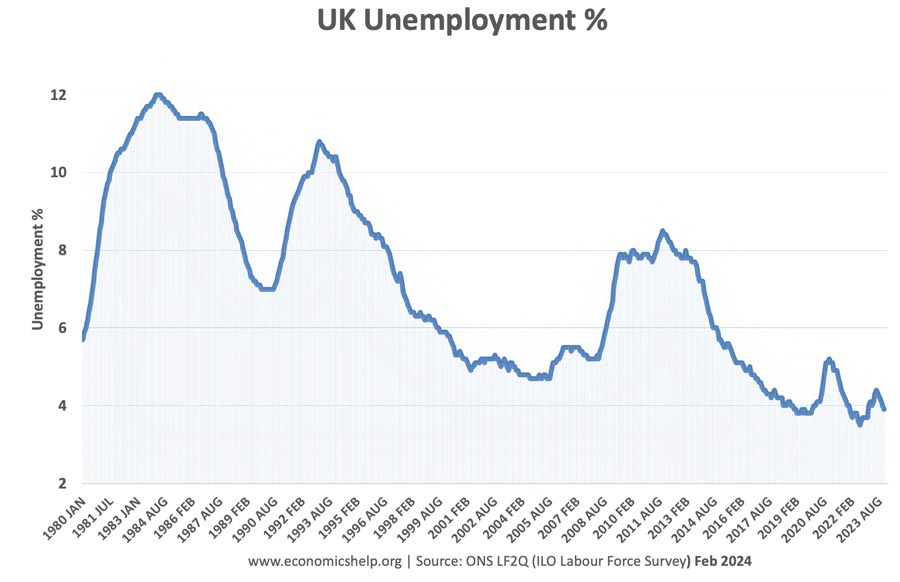

At the same time, even allowing for a negativity bias, the raw data doesn’t lie. There has been an increase in wealth inequality and households have seen little income growth in the past 15 years, and this has led to a real decline in public services, e.g. higher waiting lists. But, whilst many metrics are genuinely bad. It is not all bad. The national living wage has been successful in improving wages of the lowest paid. Unemployment is better than in the 1980s and 90s. We are also entering an era of greater uncertainty. The economy can be affected by unexpected shocks. These may be bad global warming, geopolitical crisis, but they could be also beneficial, such as AI and the falling price of energy and batteries.

Q. Privatised services appear to be failing in the UK but they were IMF mandatory conditions for bailouts in decades gone by. Is privatisation good or is it just ideological?

On privatisation, the academic literature is mixed. It’s neither very good or very bad. It depends on many other factors like quality of management and regulation. Generally, firms which offer public goods are much less suitable for privatisation. For example, under IMF pressure Latin American countries privatised industries, the biggest problems came with water privatisation where poor people lost coverage, e.g. in Bolivia. If you have a car industry, privatisation will invariably increase efficiency. In the UK it was last privatisation water, and rail, which were most problematic and highest costs.

Q. If the UK economy is doing so badly (Low growth, low productivity, low real wage growth), how can unemployment be so low? Seem like a bit of a paradox

In recent decades there has been a trend towards more flexible labour markets. More short-term, part-time jobs, where firms have monopsony power to pay relatively low-wage jobs. Therefore, firms have been providing more low wage jobs, reducing their investment in capital and improving labour productivity. Another factor, there has been a rise in long-term sickness and disability. This is not counted as unemployment, but they are not working. The loss of elder workers has definitely hit economic growth and productivity.

Q. Are you a heterodox or neo-classical economist?

I prefer to avoid labels, and ideologies because there is a danger of starting to see what you want to see. Of course, as my viewers will observe I have my own preferences and biases, but I try to avoid committing to a certain ideology. For example, Milton Friedman was a great economist but towards the end of his life he became a propagandist for free markets. He started being very selective in his arguments and data. For example, Friedman claimed the minimum wage was racist and would destroy jobs. But, he used very limited economic models that any good a-level student could have explained better. In the UK the minimum wage has increased low wages without unemployment. The increase in the minimum wage, I would rate it as one of the successful Conservative policies of the past 15 years, which is ironic as they opposed it when it was introduced in 1997 saying like Friedman it would cause unemployment.

I teach neo-classical economics, but also teach its many limitations. A great moment in economics was the early 1930s, classical economics was failing so badly, that democracies were becoming autocracies. Keynes said, throw your economic textbooks out of the window and do something completely different. Keynes policies would definitely have lowered the negative impact of the great depression, but there was too much timidity to throw off economic orthodoxy.

Q. Could we live in a happy, stable society without economic growth?

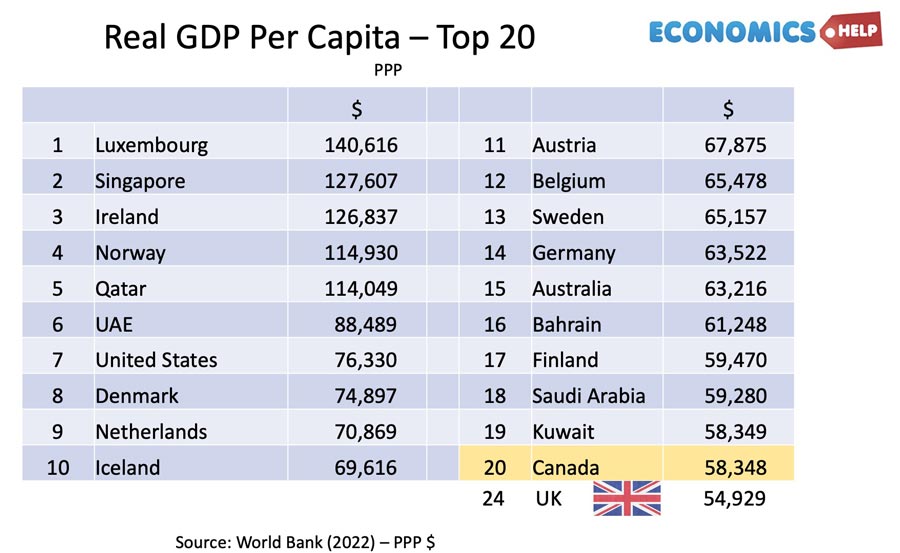

It’s a good question. I talk a lot about economic growth because in the current climate, a lack of growth is causing a worsening of poverty and public services. But, at the same time, it is worth being aware of the limitation of GDP and maximising income and output. I do believe we should target living standards and this may involve lower rates of economic growth. For example, the US has a higher GDP per capita, but they work much longer hours. The problem is that with really high living costs, freezing economic growth would exacerbate many problems. But, I do hope that future economics will be more concerned with quality of life and less about the treadmill of economic growth.

Q .Please explain the Laffer Curve?

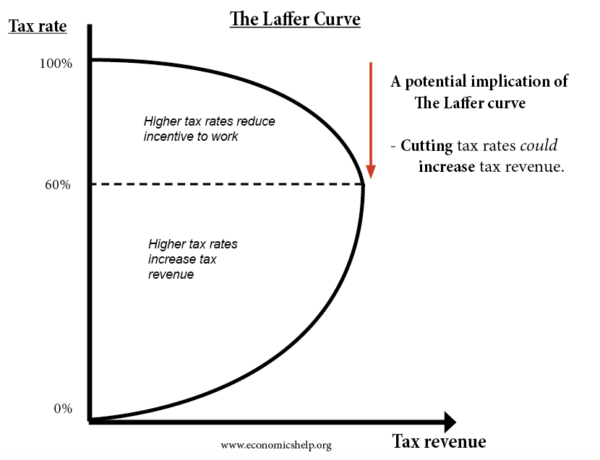

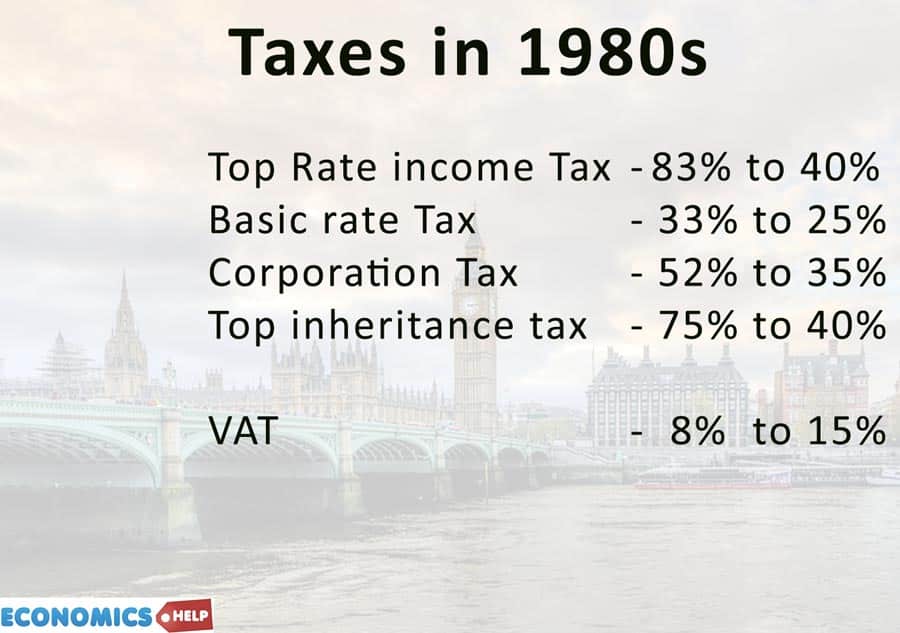

The Laffer curve states that if you tax the rich at 100% income tax, they won’t work, and the government will get zero revenue. Therefore, if you cut tax rates, the government can get more money. Unsurprisingly politicians jumped at this theory. What’s not to like tax cuts and get more revenue? The problem is where is that maximum income tax rate? Probably in the 80s. In the Truss budget, they cut a higher rate of income tax from 50% to 40%. But, there is no Laffer curve effect at that level. People don’t stop working because tax rates are 50%.

In 1979, the highest marginal rate of tax was 83%, so there were probably considerable disincentives to work, at that rate, especially in a globalised world where it is easy to live abroad or set up a company in Luxembourg.

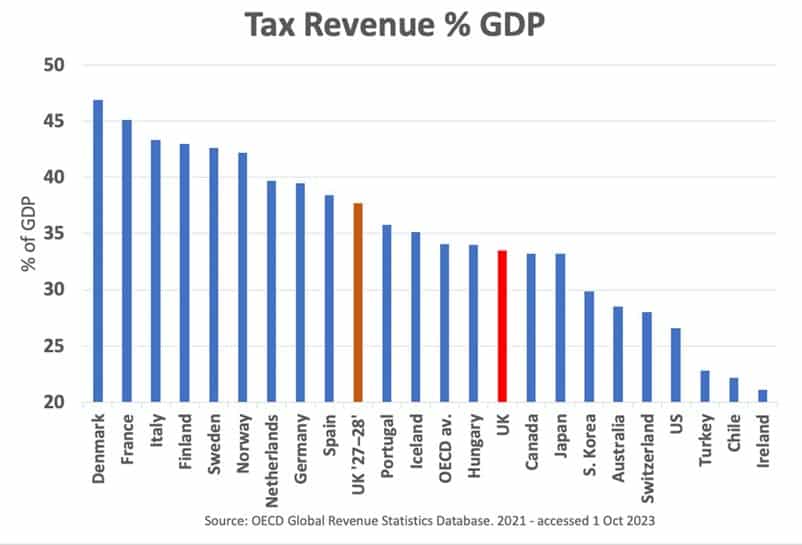

Q. Do countries with high taxation, such as Scandanavian countries, experience high exodus of ‘the rich’?

That’s a good follow-up. In the Second World War, personal tax rates were high, there was a patriotic sense to pay taxes. It was part of the social contract. 50 years later and that has been lost, especially in the UK and US. But, certainly in Scandinavia there is a greater tolerance of higher taxes, because there is a greater awareness, that there are benefits in public services. The US has never cared for a welfare state preferring a more rugged individualism, so the Laffer curve peak may be different in the US to Scandinavia

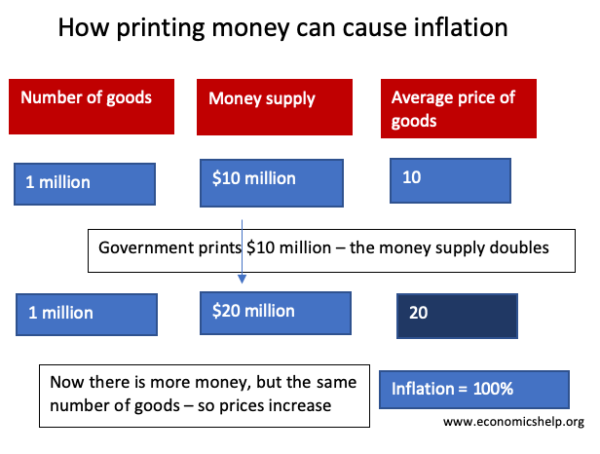

Q. Why doesn’t the UK government secretly print a lot of money and pay the whole debt in one go?

If you double the amount of money, and the amount of goods stays the same, the price would increase, causing inflation. People who own bonds would see a fall in the real value. Therefore, in future, the government would struggle to borrow, and people wouldn’t want to buy bonds if they thought the government would print money to inflate away day. In the 1970s, UK and US did reduce their real debt through inflation.

What do you think of MMT?

MMT is the theory governments with their own currency are not constrained by government borrowing but can increase the money supply to pay for government spending. I’m not particularly an adherent of MMT. In the 2010s, we had low-interest rates and low inflation, therefore, the theory of increasing the money supply to increase growth has some merit. Not through the QE we used which increased asset prices, but a people’s QE. However, as MMT admits, increasing money supply is constrained by inflation, so after 2020, with inflation, it’s not much use. There’s much more to the economy than the money supply

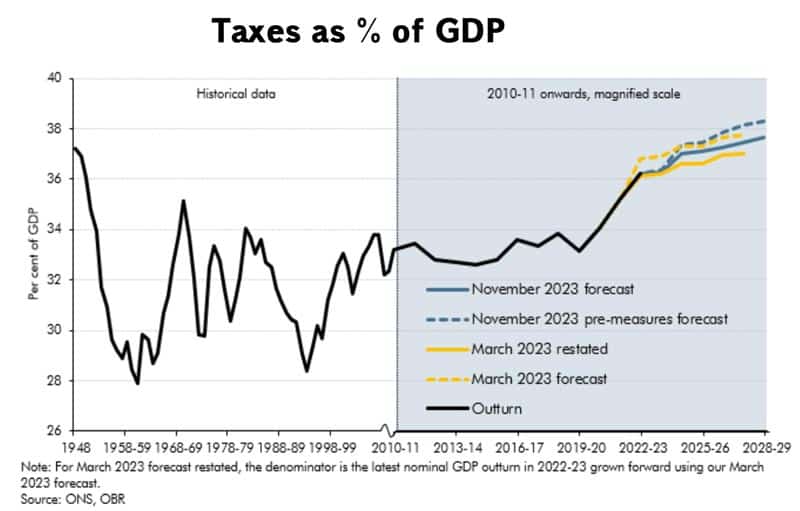

Why do we have the highest tax burden since WW2 but also have the worst public services in recent memory? Where is all the money going?

- We have less money because the economy is not growing.

- We have an ageing population so more spending on pensions.

- We have a rising number long-term sick.

- Because of new medical treatments and people living longer, health care demand is rising faster than economic growth.

Further reading