Iss the UK broke? How much can the government borrow? Has the government run out of money?

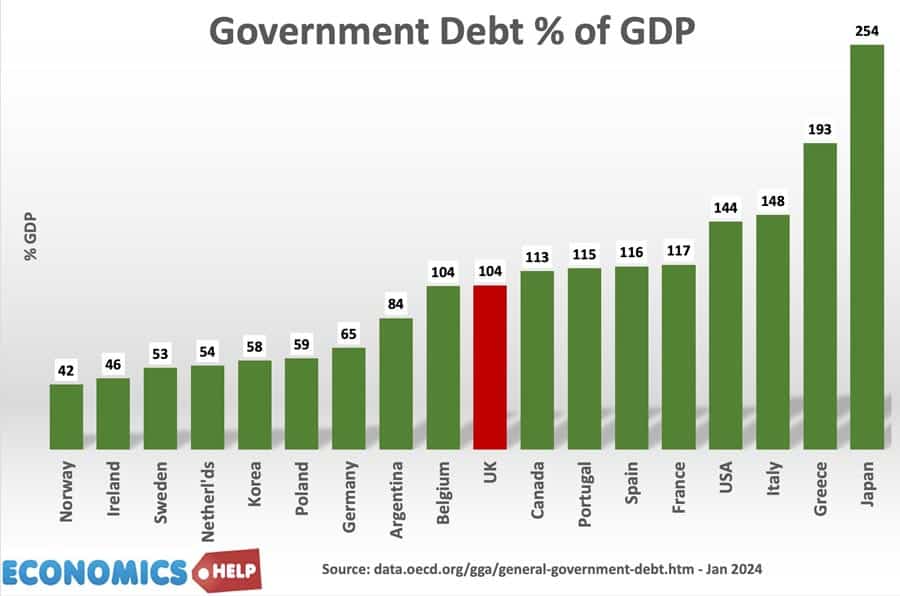

Firstly, how does the UK compare to other countries? The UK is not alone in running government debt close to 100% of GDP. But, it is still nearly double European countries like Norway and Ireland. But, this graph also raises the question – how come Japanese debt is 250% of GDP, but interest ratres are close to zero. But Argentina at 89% of GDP have defaulted five times in the past sixty years. The truth is the amount you can sustainably borrow depends on many factors we will explain soon.

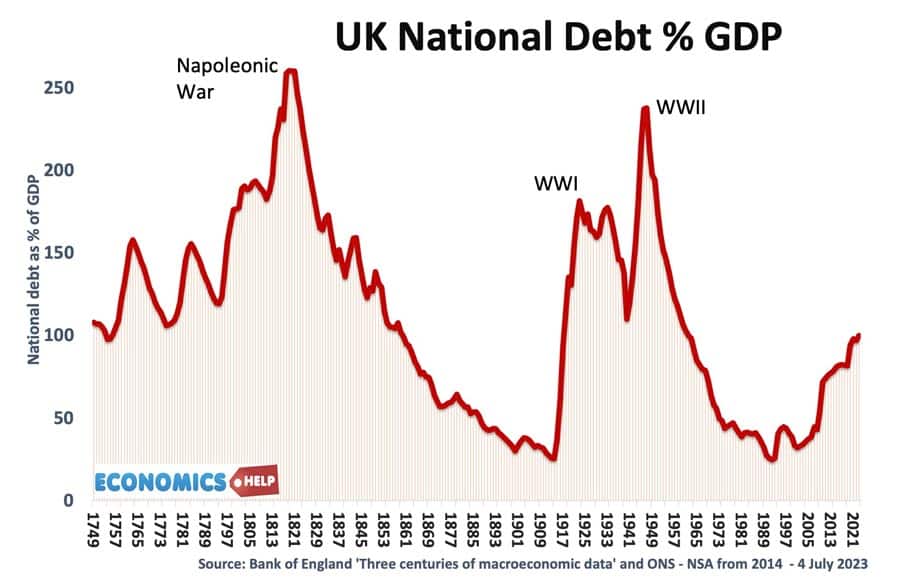

But also, to place UK debt in historical context, it is actually quite normal to have debt of over 100% of GDP. The mid 2000s was a period of uniquely low government debt.

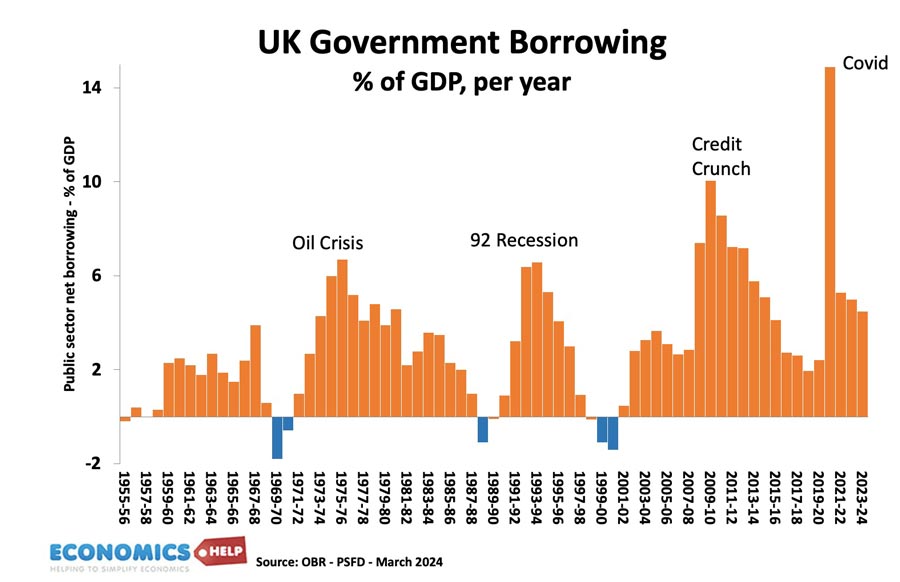

But then in the great financial crisis of 2009, the UK government ran a record peace-time budget deficit – 10% GDP. This was for two reasons, in a recession, tax receipts fall and spending on benefits rises.

But, also the government of Gordon Brown tried to reduce the impact of recession by cutting VAT rates. The idea is that if the private sector spends less then the government can maintain demand in the economy and prevent unemployment rising too much. Even if you are concerned about government debt, promoting economic recovery and higher economic growth will help improve tax revenues and reduce benefit spending. The worst outcome is getting stuck with a stagnant economy – rising debt and no growth.

Who buys UK debt?

In the past 10 years, a third of government debt has been bought by Bank of England as part of QE, this is actually unusual and they are planning to try and sell it off. But about 75% of new UK debt is bought by domestic savers and domestic banks. If you have a private pension, you will indirectly be buying government bonds. Now we tend to think of debt like a household getting a loan from a bank and politicians often use the phrase ‘Maxing out the nation’s credit card’. But, another way to think of government debt is more like borrowing within an extended family. Suppose a young adult needs to go to university he can’t afford it so he borrows from a rich uncle. The uncle has spare savings so he gives the adult a loan at a relatively low interest rate. Your debt is a way to get your rich uncle to pay for your education. Debt is a way to transfer money from those with excess wealth to those without. You could have a similar outcome by taxing your uncle.

In addition around 25% of UK debt is bought by overseas investors, such as China. They see UK debt as a relatively safe investment. The UK has never actually defaulted on debt, unlike say Argentina. Now in theory, China could suddenly sell on its UK debt and bring money back to China. That would be awkward for UK, but it would also raise value of Chinese currency and make their exports more expensive. They don’t buy UK debt out of charity.

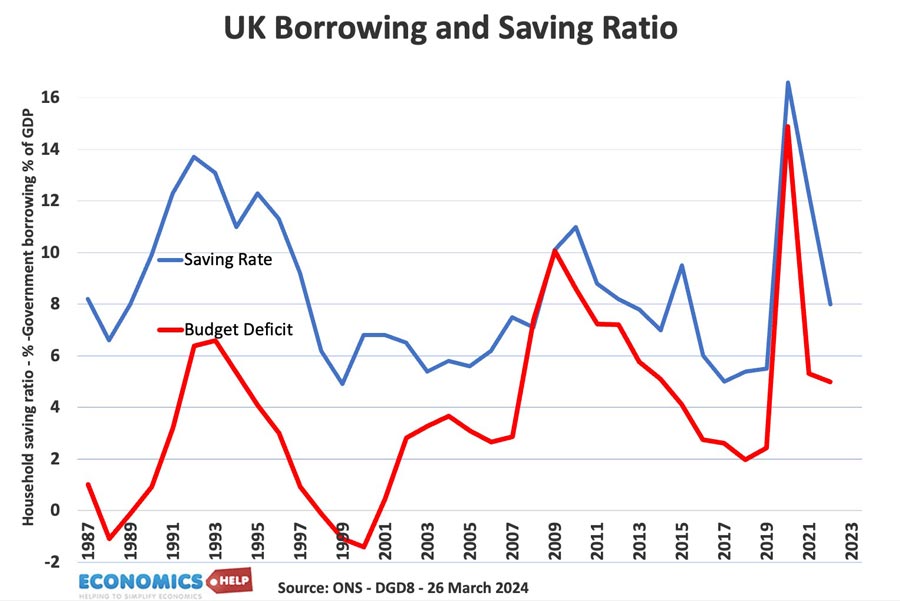

Debt Rises when saving Rises

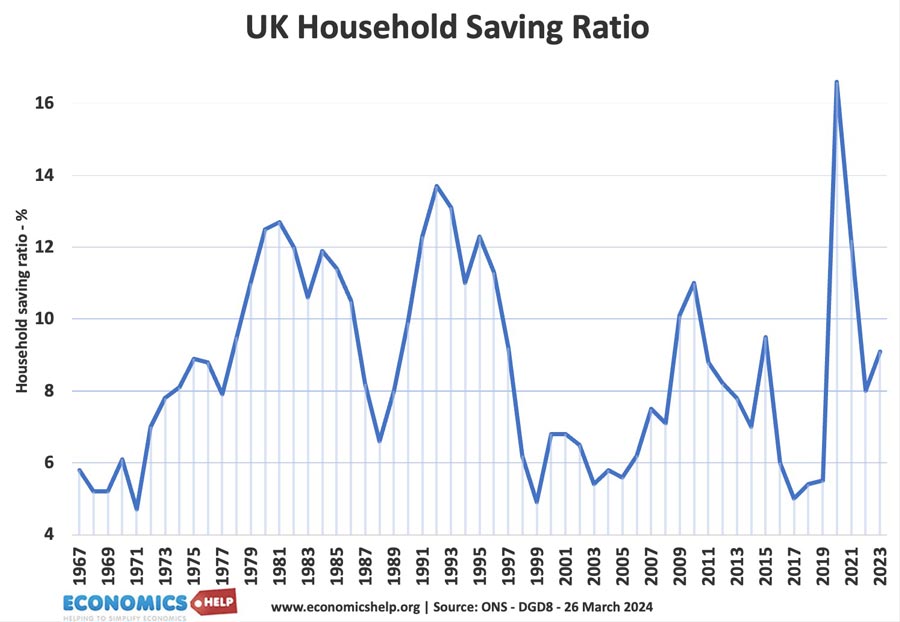

In a recession what happens? People spend less and try and increase their savings. Keynes called this the paradox of thrift. As an individual it makes sense to save more because we fear being made unemployed. But, when everyone saves more, it leads to lower spending and a deeper recession. In a recession, what the government is doing is trying to make use of these extra savings, by selling bonds and maintaining investment.

This graph shows the household savings ratio and government borrowing. There is a very clear link between the two. When households save more, the government borrow more. So when private spending collapsed in Covid, overall demand was maintained by the government borrowing from domestic savers. This prevented the economy from completely drying up. By the way in the Great Depression, the Treasury was fixated on balancing the budget, so in response to the Depression, they cut unemployment benefits and increased taxes, which made the depression worse.

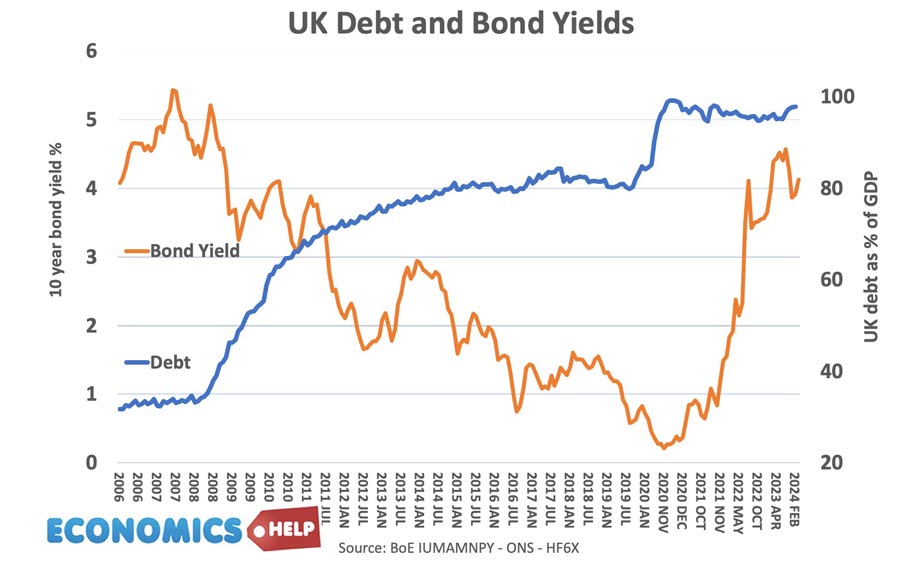

If government borrowing rises does the bond yield go up?

We will come on the Truss mini-budget shortly. But, when inflation and economic growth is low, then if government borrowing rises, there are usually enough savings in the economy to keep buying debt. From 2009 to 2021, UK debt rose, but at the same time bond yields came down. Now there was a complication of quantitative easing. The Central Bank created money to buy bonds, and this contributed to lower bond yields. But, basically in the 2010s, the economy was stuck with low growth, low inflation and low private investment. There was very strong demand for buying government bonds because the private sector was reluctant to invest. This explains why Japan has a government debt of 250%, but bond yields are only slightly above zero. Due to demographics, there is high level of savings and willingness to buy government bonds. Japan doesn’t borrow from abroad, it finances its whole debt itself.

Now, if it was cheap to borrow in the 2010s and economic growth was weak, why did the government pursue austerity? George Osborne would argue we needed to reduce deficits and bring debt under control. However, other economists argue that austerity was to a degree self-defeating. Because the private sector wasn’t investing, a cut in and public spending contributed to low growth and falling investment as a share of GDP. This is one of the reasons for poor economic growth since 2009. It is one reason why austerity had a limited impact in preventing debt as a share of GDP continues to rise.

But, why did markets turn on Truss?

So if higher borrowing led to lower bond yields in the 2010s, how come the Truss and Kwarteng budget caused bond yields to do the opposite and soar? Was it really a deep-state conspiracy to undermine free market economics? The short answer is that the Truss budget was spectacularly badly timed. In September 2022, we had a resurgence of inflation. When inflation is 10%, people don’t want to buy bonds that give a low interest, because effectively you will see the real value of your bond decline. If inflation is 10%, you need a bond yield of 10% to protect against inflation. Also In 2022, the economy was close to full capacity, so the private sector didn’t have the same amount of surplus savings as in the 2010s. Remember the relationship between higher saving and higher borrowing. Truss wanted to borrow more just as savings were falling.

When Truss and Kwarteng increased the deficit by £90bn, markets knew this would worsen UK inflation and require even higher interest rates so bond yields soared. Also, not only that but after a decade of quantitative easing and the Bank of England buying bonds, the Bank had recently decided to reverse this policy and pursue quantitative tightening. The government announced a big increase in borrowing at the same time as the Bank of England was selling bonds back onto the market. Whatever you think of the Truss budget, it is worth bearing in mind, that if they had been implemented in say 2015 or 2020, you wouldn’t have seen the surge in bond yields we got in 2022.

This is a difference between Argentina and Japan. Japan has close to zero inflation for past few decades. Argentina has had frequent bouts of hyperinflation. If inflation is high, it’s harder to borrow.

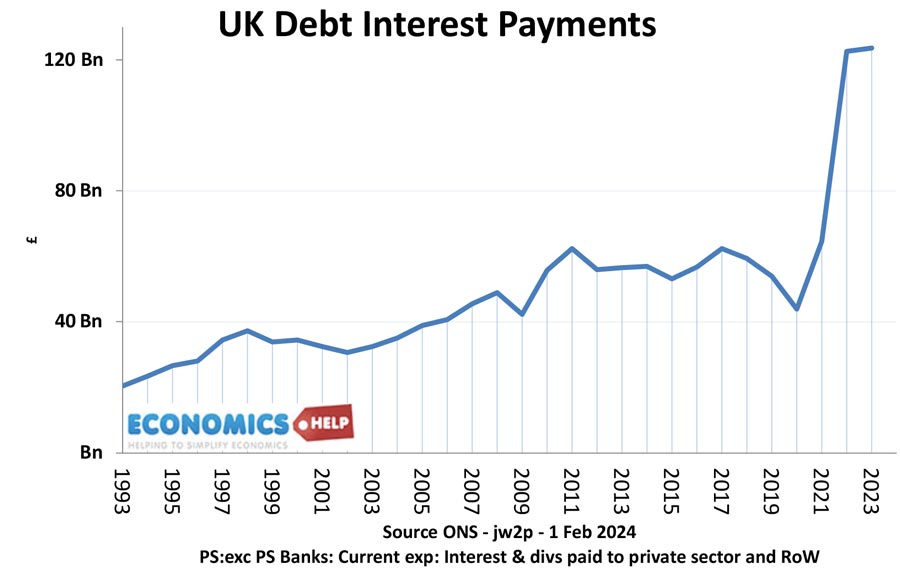

What is the cost of servicing the debt relative to GDP?

The UK government pays interest on its debt, and in the past two years this has increased sharply due to inflation and higher interest rates.

In 2022, it was close to 4% of GDP. This will fall back as inflation falls. But, notice how in 2021, it was closer to 2% because of low interest rates. £122bn a year on debt interest payments is a sizeable chunk of government spending, equivalent to the entire education budget.

When is government borrowing dangerous?

So far, I’ve suggested worries over government debt tend to be overblown and you would be better off being more relaxed about debt. However, debt does matter. If the economy is not growing like the UK but you have an ageing population and high interest rates, there is a danger debt to GDP can continue to grow, leading to ever higher debt interest payments. This is a kind of negative debt spiral. It also depends on why you borrow. If you borrow to fund investment, this will help long-term growth, but if you borrow to pay debt interest payments and pensions, you’re not helping economic growth. Also if you borrow more during a period of high economic growth, you can crowd out the private sector. Keynes advocated more borrowing in a recession, but in an economic boom, you should do the opposite and reduce debt. The problem is politicians like to cut tax in a recession, but then become reluctant to increase them later.

Is the UK broke?

No, the UK is still a moderately wealthy country, debt to GDP is not quite as bad as it looks at first glance. If we look at the history of UK debt, we can see much higher levels after the three major wars. In 1945, debt was around 180% of GDP, yet, the new government set up a welfare state, NHS and building houses. A policy that continued in the 1950s. Debt peaked at 235% of GDP in the early 1950s. But, here’s the remarkable thing, the UK didn’t implode but saw the best four decades of economic growth on record. And as the economy continued to grow, debt to GDP steadily fell all the way to 25% of GDP in the mid-1990s. It is worth bearing in mind, we had a big loan from the US and those decades of high growth may not be repeated.

What about the UK fiscal rule?

The primary target is for government debt to be falling as a percentage of GDP in the final year of a five-year forecast.

I don’t think it is helping. Firstly, it is too easy to fudge. For example, the government say they are going to raise petrol tax, which they then cancel. They have earmarked drastic cuts in government spending, which are unattainable without even worse public services. Secondly, the easiest way to meet a target is to cut investment spending. Because in five years you get all the cost, but no benefit of infrastructure investment. Thirdly, no one believes these government budget forecasts.